Demystifying Credit Support Annexes: A Guide

In the complex realm of finance, understanding and mitigating credit risk is paramount. Financial transactions inherently carry the risk that one party may default on its obligations. To address this crucial aspect, Credit Support Arrangements (CSAs) have emerged as indispensable tools. Often implemented through legal documents known as Credit Support Annexes, these arrangements play a vital role in bolstering financial stability.

At its core, the primary goal of a CSA is to diminish counterparty credit risk. Counterparty risk refers to the risk that the other party in a transaction will not fulfill its contractual obligations. By establishing clear mechanisms for collateral exchange, CSAs provide a safety net, ensuring that losses stemming from a default are minimized. The question of “what is a csa in finance” arises frequently, and the answer lies in its function as a risk mitigation strategy.

The importance of “what is a csa in finance” cannot be overstated. Without effective risk management strategies like CSAs, the stability of financial markets would be perpetually threatened. These arrangements help create a more secure and predictable environment for financial institutions and their counterparties, fostering confidence and promoting efficient capital allocation. Understanding “what is a csa in finance” is key to grasping the broader landscape of financial risk management. The concept of “what is a csa in finance” is thus fundamental to understanding modern financial markets.

How to Navigate Collateralization Agreements

A Credit Support Annex (CSA) is a crucial component of modern financial transactions. It’s essential to understand what is a csa in finance to navigate these agreements effectively. The CSA serves as a legally binding document. This document details the terms under which collateral is exchanged between parties involved in financial deals, particularly derivatives transactions. Think of it as a detailed rulebook. This rulebook governs the collateralization process. It is not a standalone agreement. Instead, it functions as an amendment to a master agreement. A common example of such a master agreement is the ISDA Master Agreement.

The primary function of a CSA is to mitigate counterparty credit risk. This risk arises from the possibility that one party in a transaction might default on its obligations. By establishing a framework for collateral exchange, the CSA reduces the potential losses faced by the non-defaulting party. The collateral acts as a safety net. It provides a source of recovery if the other party fails to meet its financial commitments. What is a csa in finance without this protection? It would be a riskier landscape. CSAs are vital for fostering stability. They ensure confidence in the derivatives market and other financial sectors.

Understanding what is a csa in finance requires recognizing its role within a broader legal structure. The ISDA Master Agreement provides the general framework for derivatives transactions. The CSA then tailors this framework to address specific collateral requirements. This tailoring includes defining eligible collateral, setting thresholds for collateral posting, and outlining procedures for margin calls. Because financial transactions can involve substantial sums of money, it’s really important to understand what is a csa in finance. Proper adherence to a CSA’s provisions is critical for maintaining healthy financial relationships and mitigating potential disputes.

Key Components of Financial Credit Agreements

A Credit Support Annex (CSA) in finance includes several key elements. Understanding these components is crucial for managing credit risk effectively. These elements define how collateral is managed and exchanged between parties. The goal is to mitigate potential losses from counterparty default. What is a CSA in finance without understanding its core building blocks?

One vital component is the valuation method. This determines how the exposure between parties is calculated. Another key element is the threshold. The threshold defines the exposure amount allowed before collateralization becomes necessary. The Minimum Transfer Amount (MTA) dictates the minimum collateral amount that must be transferred. Rounding conventions specify how collateral values are rounded. This impacts the precision of collateralization. What is a CSA in finance when these calculations are not clearly defined? The agreement must also specify eligible collateral, which refers to the assets acceptable as collateral. Common examples include cash and government bonds. The currency in which collateral is held is another important factor. This can impact the value of the collateral due to exchange rate fluctuations.

These components are essential because they provide a framework for managing credit risk. Without a clear valuation method, exposure cannot be accurately calculated. Without a threshold, even small exposures would require collateralization, increasing costs. The MTA ensures that only material exposures trigger collateral transfers. Rounding conventions prevent disputes over minor discrepancies. Defining eligible collateral ensures that the collateral is liquid and readily available. What is a CSA in finance trying to achieve? It aims for risk reduction, and these components make that possible by creating a transparent and efficient system for collateral management. By setting these parameters, the CSA creates a clear framework, reducing ambiguity and potential disputes. This, in turn, contributes to the stability and efficiency of financial transactions. Therefore, understanding these components is fundamental to understanding what is a CSA in finance and its role in mitigating credit risk.

The Significance of Margin Calls Explained

Margin calls are a critical aspect of Credit Support Annexes (CSAs) in finance. They are directly linked to mitigating counterparty risk. A margin call is triggered when the market value of a transaction changes. Specifically, it occurs when the exposure between two parties exceeds a pre-agreed threshold. Understanding what is a csa in finance necessitates understanding margin calls.

The margin call process involves several steps. First, the party whose exposure has increased calculates the required collateral amount. This calculation considers the current exposure, the agreed-upon threshold, and the Minimum Transfer Amount (MTA). The MTA dictates the smallest increment of collateral that can be transferred. For example, if the exposure exceeds the threshold by $1,000,000 and the MTA is $500,000, the margin call will be for $1,000,000, since this amount is bigger than MTA. The party then notifies the other party of the margin call. This notification specifies the amount and type of collateral required. The CSA dictates the eligible types of collateral, like cash or government bonds. The timing of the collateral transfer is also crucial and defined in what is a csa in finance document. Typically, the collateral must be transferred within a specified timeframe, often one or two business days.

The real-world implications of margin calls are significant. Receiving a margin call means a party must quickly provide collateral. This can strain liquidity, especially during periods of market volatility. Conversely, making a margin call protects a party from increasing counterparty risk. Efficient collateral management is essential for navigating these situations. It is important to know what is a csa in finance. Failing to meet a margin call can lead to default. The use of CSAs and margin calls is a fundamental risk management tool. They ensure financial stability in derivatives and other financial transactions. Understanding margin calls is crucial for anyone involved in transactions using CSAs.

Exploring the Benefits of Collateral Management in Financial Transactions

Credit Support Arrangements (CSAs) offer significant advantages in financial dealings. One primary benefit is the reduction of counterparty credit risk. By requiring parties to post collateral, CSAs mitigate potential losses if one party defaults. This protection is fundamental to maintaining stability in financial markets. A key reason to understand what is a csa in finance is to manage the involved risks effectively.

Improved financial stability is another crucial advantage. CSAs create a safer environment for transactions. The collateral acts as a buffer, absorbing potential shocks and preventing a domino effect of defaults. Transparency in collateral management is also enhanced through CSAs. The terms of the collateral exchange are clearly defined, reducing ambiguity and disputes. Understanding what is a csa in finance can provide more transparency.

CSAs can also lead to potentially lower capital requirements for financial institutions. Because CSAs reduce credit risk, regulators may allow institutions to hold less capital against their exposures. This reduction frees up capital that can be deployed elsewhere. The effective use of CSAs contributes to a more efficient and resilient financial system. Knowing what is a csa in finance is crucial for maintaining stability, improving transparency, and reducing capital requirements, offering substantial advantages to financial institutions and market participants alike. The proper implementation of what is a csa in finance ensures risk mitigation and financial soundness.

Counterparty Risk Mitigation Strategies Explored

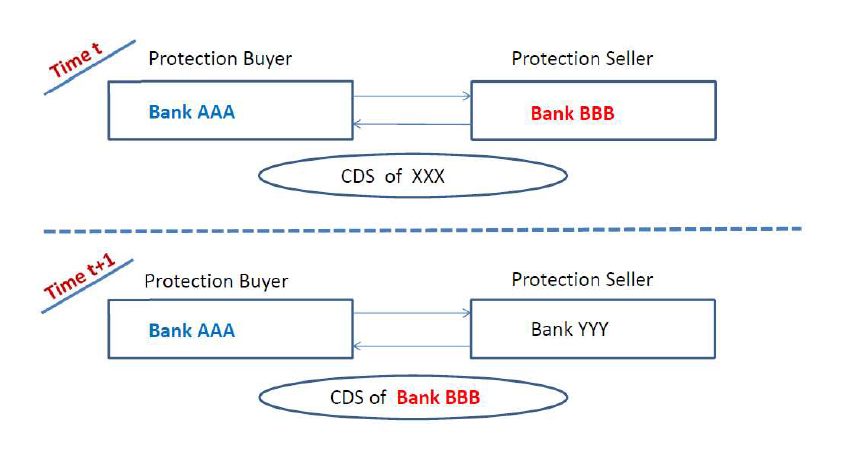

Credit Support Arrangements (CSAs) are not monolithic; they come in various forms designed to address specific needs and risk profiles in financial transactions. Understanding these different types is crucial for effective counterparty risk management. One fundamental distinction lies between one-way and two-way CSAs. In a one-way CSA, only one party is obligated to post collateral. This is typically the party perceived as having the weaker creditworthiness or the greater exposure in the transaction. Conversely, in a two-way CSA, both parties are required to post collateral, providing a more symmetrical approach to risk mitigation. This type of agreement is common between counterparties with relatively similar credit ratings and exposure profiles. Deciding what is a csa in finance and how it will work is the start of the risk mitigation.

Beyond the direction of collateral flow, CSAs can also vary based on the underlying agreements they support. For instance, there are CSAs designed specifically for cleared swaps and others for uncleared swaps. Cleared swaps, transacted through a central counterparty (CCP), benefit from the CCP’s risk management processes, which include standardized margin requirements. CSAs for uncleared swaps, on the other hand, are bilaterally negotiated and tend to be more customized to reflect the specific risks of the transaction and the counterparties involved. These variations highlight the flexibility of CSAs in adapting to different market structures and regulatory requirements. Knowing what is a csa in finance in cleared vs uncleared swaps can determine the risk exposure.

The choice of CSA type is influenced by several factors, with the creditworthiness of each party being paramount. A counterparty with a lower credit rating is more likely to be required to post collateral, potentially under a one-way CSA. Negotiation power also plays a significant role. Parties with greater bargaining power may be able to negotiate more favorable terms, such as higher thresholds or a wider range of eligible collateral. The nature of the underlying transaction, including its complexity and duration, also impacts the CSA’s design. For example, longer-dated transactions or those with complex payoff structures may necessitate more stringent collateral requirements. Ultimately, the selection of the appropriate CSA type is a critical decision that requires careful consideration of all relevant factors to ensure effective counterparty risk mitigation. What is a csa in finance must be balanced with the realities of the parties negotiating positions.

Credit Support Arrangements and Regulatory Frameworks

The regulatory landscape significantly influences Credit Support Arrangements (CSAs) in finance. Regulations like Basel III and Dodd-Frank have played a pivotal role in shaping the use and design of CSAs. These frameworks address systemic risk and aim to enhance the stability of the financial system. Consequently, understanding these regulations is crucial for grasping the modern application of what is a csa in finance.

Basel III, for example, introduced stricter capital requirements for banks, incentivizing the use of CSAs to mitigate counterparty credit risk. By requiring banks to hold more capital against exposures not covered by collateral, the regulation effectively promotes the use of CSAs. This incentivizes financial institutions to actively manage and reduce their credit risk through collateralization, highlighting the practical importance of what is a csa in finance. Similarly, Dodd-Frank mandates central clearing for many standardized derivatives, further increasing the prevalence of CSAs. Central clearing requires the posting of initial and variation margin, essentially standardizing the use of collateral to reduce risk within the clearinghouse and its members.

The impact of these regulatory changes on the efficiency and cost of collateral management is substantial. Increased demand for eligible collateral, such as cash and government bonds, can drive up the cost of these assets. Furthermore, the operational complexity of managing CSAs, including valuation, margin calls, and collateral transfers, adds to the overall cost. However, the reduced risk and improved financial stability resulting from widespread CSA adoption are considered to outweigh these costs. Therefore, regulatory frameworks are essential when considering what is a csa in finance, influencing how they are structured, used, and managed within the financial industry. The regulatory push underscores the necessity of effective collateral management and the strategic role that what is a csa in finance plays in maintaining a stable and resilient financial system.

Navigating the Complexities of Credit Support Arrangements in Finance

Understanding Credit Support Arrangements (CSAs) is crucial for navigating the complexities of modern finance. Effective management of CSAs is paramount in today’s financial landscape. This is particularly true given the increasing focus on mitigating counterparty credit risk. A firm grasp of what is a csa in finance and its intricacies is therefore essential for anyone involved in financial transactions. Credit risk mitigation relies heavily on understanding what is a csa in finance. The future of financial stability depends, in part, on how well institutions comprehend what is a csa in finance and implement these agreements.

The key takeaways emphasize the importance of thoroughly understanding and proactively managing CSAs. The trends show an increasing reliance on technology to streamline collateral management. There’s also a growing need for optimizing collateral portfolios to enhance efficiency. These developments underscore the evolving nature of what is a csa in finance and its operational implications. Exploring innovative approaches to managing what is a csa in finance will be critical for institutions seeking a competitive advantage. Understanding what is a csa in finance requires continuous learning and adaptation to new market dynamics.

Further research into CSAs is strongly encouraged. Delving deeper into their impact on the financial industry can provide valuable insights. This proactive approach will empower individuals and organizations to make informed decisions. It will also help them navigate the ever-changing financial environment. This understanding of what is a csa in finance is not merely academic. It’s a practical necessity for safeguarding financial stability and promoting responsible risk management. By embracing the importance of what is a csa in finance, the industry can foster a more resilient and transparent financial ecosystem. Understanding what is a csa in finance allows for better risk management and financial planning.