What Lies Behind the Bear Steepener Phenomenon

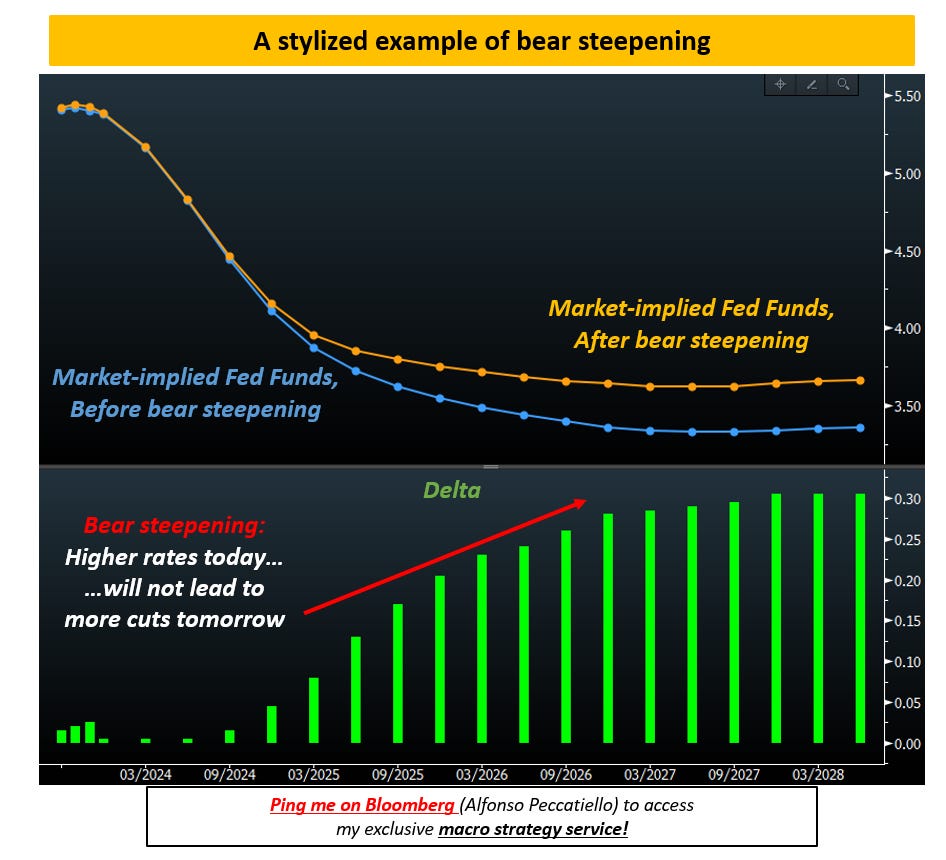

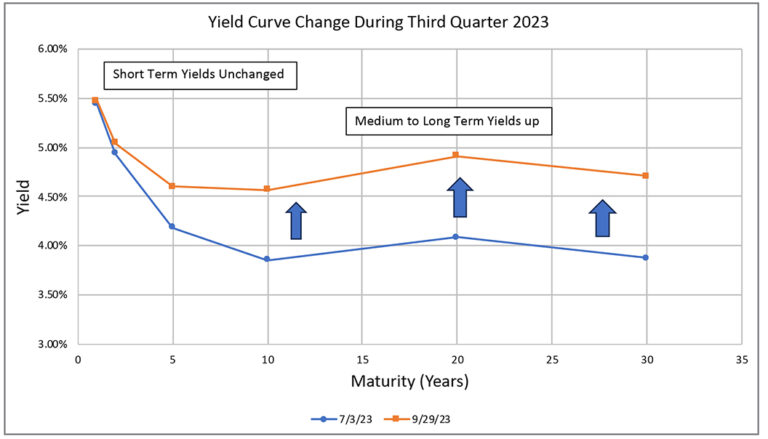

In the bond market, a bear steepener is a phenomenon that has garnered significant attention from investors and economists alike. But what is a bear steepener, and how does it impact the bond market? A bear steepener occurs when the yield curve, which plots the interest rates of bonds with different maturities, shifts upwards, resulting in higher long-term interest rates and lower short-term interest rates. This shift has significant implications for investors, as it can affect the returns on their investments and the overall health of the economy.

The yield curve is a graphical representation of the interest rates of bonds with different maturities, ranging from short-term to long-term. The shape of the yield curve can provide valuable insights into the bond market and the economy as a whole. A normal yield curve is upward-sloping, indicating that investors demand higher returns for tying up their money for longer periods. However, when the yield curve shifts upwards, it can signal a bear steepener, which has far-reaching consequences for investors and the economy. Understanding the bear steepener phenomenon is crucial for investors to make informed decisions and navigate the complexities of the bond market.

How to Identify a Bear Steepener in the Bond Market

Identifying a bear steepener in the bond market requires a combination of technical analysis and market insight. One key indicator to watch is the shift in short-term and long-term interest rates. In a bear steepener, short-term interest rates tend to decrease, while long-term interest rates increase, resulting in a steeper yield curve. This shift can be observed by tracking the changes in the yields of short-term and long-term bonds, such as the 2-year and 10-year Treasury notes.

Another important indicator is the impact on bond prices. When the yield curve steepens, the prices of long-term bonds tend to increase, while the prices of short-term bonds decrease. This is because investors demand higher returns for tying up their money for longer periods, driving up the prices of long-term bonds. Conversely, the decrease in short-term interest rates makes short-term bonds less attractive, causing their prices to fall.

In addition to these indicators, investors should also monitor the overall market sentiment and economic conditions. A bear steepener is often a response to changes in the economy, such as inflation expectations or monetary policy decisions. By staying informed about these factors, investors can better identify a bear steepener and make informed investment decisions.

The Role of Central Banks in Shaping the Yield Curve

Central banks play a crucial role in shaping the yield curve, and their monetary policy decisions can have a significant impact on the bond market. One of the primary tools used by central banks to influence the yield curve is setting short-term interest rates. By adjusting these rates, central banks can affect the entire yield curve, including long-term interest rates. For instance, when a central bank lowers short-term interest rates, it can lead to a decrease in long-term interest rates, resulting in a flatter yield curve.

In addition to setting interest rates, central banks can also use quantitative easing or forward guidance to influence the yield curve. Quantitative easing involves purchasing or selling government bonds to increase or decrease the money supply, which can impact long-term interest rates. Forward guidance, on the other hand, involves communicating the central bank’s future policy intentions to influence market expectations and shape the yield curve.

A bear steepener can be a response to central bank actions, particularly when they signal a shift towards tighter monetary policy. For example, if a central bank hints at raising short-term interest rates to combat inflation, it can lead to a increase in long-term interest rates, resulting in a steeper yield curve. This is because investors anticipate higher returns on long-term bonds to compensate for the increased risk of inflation. As a result, the yield curve steepens, and a bear steepener occurs.

Understanding the role of central banks in shaping the yield curve is essential for investors to navigate the complexities of a bear steepener. By monitoring central bank actions and communicating their intentions, investors can better anticipate changes in the yield curve and make informed investment decisions.

Implications of a Bear Steepener for Investors and the Economy

A bear steepener has significant implications for investors and the broader economy. On the one hand, a bear steepener can offer higher returns on long-term bonds, making them more attractive to investors seeking income. This is because long-term interest rates increase, resulting in higher yields on long-term bonds. However, this increased return comes with higher risks, as investors are exposed to greater volatility and potential losses if interest rates continue to rise.

For investors, a bear steepener requires a careful assessment of their investment strategies. They must weigh the potential benefits of higher returns against the risks associated with increased volatility. This may involve adjusting their portfolios to include a mix of short-term and long-term bonds, diversifying their investments to minimize risk, and regularly monitoring market conditions to respond to changes in the yield curve.

In terms of the broader economy, a bear steepener can have significant implications for inflation and economic growth. When long-term interest rates increase, it can lead to higher borrowing costs for consumers and businesses, potentially slowing down economic growth. On the other hand, a bear steepener can also be a sign of a strong economy, as investors become more optimistic about future growth and inflation prospects. Central banks must carefully balance their monetary policy decisions to ensure that the economy grows at a sustainable rate without sparking inflation.

Understanding the implications of a bear steepener is crucial for investors and policymakers alike. By recognizing the potential risks and opportunities associated with a bear steepener, they can make informed decisions that promote economic growth and stability.

Historical Examples of Bear Steepeners: Lessons Learned

Examining historical instances of bear steepeners can provide valuable insights for investors and policymakers. One notable example is the 1994 bond market crisis, which was triggered by a surprise rate hike by the Federal Reserve. This led to a sharp increase in long-term interest rates, resulting in a bear steepener. The crisis highlighted the importance of monitoring central bank actions and their impact on the yield curve.

Another example is the 2003-2004 period, when the Federal Reserve, led by Chairman Alan Greenspan, raised short-term interest rates to combat inflation concerns. This led to a bear steepener, as long-term interest rates increased more rapidly than short-term rates. The episode demonstrated the influence of central banks on the yield curve and the need for investors to adapt to changing monetary policy environments.

The 2013 “taper tantrum” is another notable example of a bear steepener. When the Federal Reserve announced its plans to scale back its quantitative easing program, long-term interest rates surged, leading to a bear steepener. The event highlighted the importance of understanding the impact of central bank actions on the bond market and the need for investors to be prepared for sudden changes in market conditions.

These historical examples offer valuable lessons for investors and policymakers. They demonstrate the importance of monitoring central bank actions, understanding the impact of monetary policy decisions on the yield curve, and adapting to changing market conditions. By learning from these examples, investors can better navigate the complexities of a bear steepener and make informed investment decisions.

The Relationship Between a Bear Steepener and Other Market Indicators

A bear steepener does not occur in isolation, but rather is connected to other market indicators. Understanding these relationships is crucial for investors seeking to inform their investment strategies. One key connection is between a bear steepener and stock prices. When long-term interest rates increase, it can lead to higher borrowing costs for companies, potentially negatively impacting stock prices. Conversely, a bear steepener can also be a sign of a strong economy, which can boost stock prices.

Another important relationship is between a bear steepener and commodity prices. As long-term interest rates rise, it can lead to a stronger US dollar, which can put downward pressure on commodity prices. This, in turn, can impact inflation expectations and economic growth. Furthermore, a bear steepener can also influence currency exchange rates, as higher long-term interest rates can attract foreign investors, leading to a stronger currency.

Investors can leverage these relationships to inform their investment strategies. For example, during a bear steepener, investors may seek to diversify their portfolios by allocating a larger proportion to stocks and commodities that are less sensitive to interest rate changes. Alternatively, they may adjust their investment horizons, focusing on shorter-term bonds to minimize exposure to rising long-term interest rates.

By recognizing the connections between a bear steepener and other market indicators, investors can develop a more nuanced understanding of the bond market and make more informed investment decisions. This requires ongoing monitoring of market trends and a willingness to adapt to changing conditions. By doing so, investors can navigate the complexities of a bear steepener and achieve their investment objectives.

Managing Risk in a Bear Steepener Environment

When navigating a bear steepener, investors must be proactive in managing risk to protect their portfolios from potential losses. One key strategy is diversification, which involves spreading investments across different asset classes, sectors, and geographic regions. This can help reduce exposure to specific market segments and minimize the impact of rising long-term interest rates.

Hedging against losses is another crucial risk management technique. Investors can use derivatives, such as options and futures, to mitigate potential losses in their bond portfolios. For example, an investor holding a long-term bond can purchase a put option to sell the bond at a predetermined price, limiting potential losses if interest rates continue to rise.

Adjusting investment horizons is also essential in a bear steepener environment. Investors with shorter investment horizons may focus on shorter-term bonds, which are less sensitive to changes in long-term interest rates. Conversely, investors with longer investment horizons may be more willing to take on additional risk, seeking higher returns on long-term bonds.

In addition, investors can consider active management strategies, such as duration management and yield curve positioning. These approaches involve actively adjusting the duration and composition of a bond portfolio in response to changes in the yield curve, seeking to maximize returns while minimizing risk.

Ultimately, managing risk in a bear steepener environment requires a deep understanding of the bond market and its dynamics. By diversifying portfolios, hedging against losses, adjusting investment horizons, and employing active management strategies, investors can navigate the complexities of a bear steepener and achieve their investment objectives.

Navigating the Complexities of a Bear Steepener

In conclusion, understanding the complexities of a bear steepener is crucial for investors seeking to navigate the bond market successfully. A bear steepener, characterized by a widening yield curve, can have significant implications for investors, including the potential for higher returns on long-term bonds and increased volatility. By recognizing the signs of a bear steepener, such as changes in short-term and long-term interest rates, investors can adjust their investment strategies to mitigate risk and capitalize on opportunities.

What is a bear steepener? It is a phenomenon that requires a deep understanding of the bond market and its dynamics. Central banks play a significant role in shaping the yield curve, and their monetary policy decisions can trigger a bear steepener. Historical examples of bear steepeners offer valuable lessons for investors, highlighting the importance of staying informed and adaptable in a rapidly changing market.

As investors navigate the complexities of a bear steepener, they must be aware of the relationships between the yield curve and other market indicators, such as stock prices, commodity prices, and currency exchange rates. By recognizing these connections, investors can develop more effective investment strategies, diversify their portfolios, and manage risk more effectively.

In today’s bond market, staying informed and adaptable is crucial. A bear steepener can emerge suddenly, catching investors off guard. By understanding the underlying dynamics of the bond market and the implications of a bear steepener, investors can position themselves for success, even in the most challenging market conditions.