The Volatility Index Explained: A Comprehensive Overview

The VIX, or Volatility Index, is a real-time market index. It represents the market’s expectation of 30-day forward-looking volatility. Often referred to as the “fear gauge,” the VIX is derived from the prices of S&P 500 index options. Understanding what does the vix measure is crucial for grasping market sentiment. Its history is rooted in the need for a clear indicator of investor anxiety and potential market swings.

The Chicago Board Options Exchange (CBOE) originally introduced the VIX in 1993. It has since become a widely recognized benchmark for market risk. The VIX serves as a barometer of investor sentiment. It reflects the degree of volatility market participants anticipate in the near term. As such, it’s a valuable tool for traders, portfolio managers, and analysts. They use it to gauge market risk and make informed investment decisions. The core function of what does the vix measure revolves around quantifying this expected volatility. The index provides insights into potential market turbulence.

The significance of the VIX lies in its ability to reflect collective market expectations. It encapsulates the aggregated views of numerous options traders. These traders are actively hedging positions or speculating on future price movements. Therefore, what does the vix measure is not merely historical volatility. It represents a forward-looking projection. It is important to remember that what does the vix measure is investor sentiment regarding market volatility. A high VIX reading typically signals heightened uncertainty and potential market corrections. Conversely, a low VIX often suggests complacency and a period of relative market stability. The VIX plays a vital role in the financial landscape, offering a snapshot of market unease.

How the VIX Works: Deriving Volatility from Options Prices

The VIX calculation is based on the prices of S&P 500 index options. It considers both call and put options. A wide range of strike prices are factored into the equation. The goal is to gauge market expectations for future volatility. It’s important to note that the VIX is not a direct measure of past volatility. Instead, it’s a forward-looking estimate.

Higher option prices generally indicate greater expected volatility. This is because options become more valuable when there is more uncertainty in the market. Investors are willing to pay a premium for protection against potential losses. The VIX calculation takes these option prices and uses them to derive a single volatility number. While the exact formula is complex, the underlying principle is straightforward: option prices reflect expected market movement. Understanding what does the VIX measure involves recognizing its dependence on options market activity. This is critical for grasping how the VIX functions as a “fear gauge.” The more fear, the higher the options prices, and therefore, the higher the VIX.

It’s important not to get lost in the mathematical intricacies. The key takeaway is that the VIX is a derivative of options prices. Changes in these prices directly influence VIX values. Several platforms offer tools to track historical VIX data. This allows traders to analyze its correlation with market events. Sophisticated algorithms analyze the real-time prices of S&P 500 options. These algorithms convert the data into the VIX index value. The VIX offers a snapshot of market sentiment, indicating what does the VIX measure.

Interpreting VIX Readings: Gauging Market Sentiment

Interpreting VIX values is crucial for understanding market sentiment. The VIX, often called the “fear gauge,” provides insights into investor expectations regarding market volatility. What does the VIX measure? It essentially gauges the market’s anticipated volatility over the next 30 days. A low VIX generally indicates market complacency, while a high VIX suggests fear and uncertainty.

A VIX reading below 20 is typically considered low. This suggests that investors are relatively confident and see little risk of a significant market downturn. In such environments, caution may be warranted, as periods of low volatility can be followed by unexpected spikes. A moderate VIX, generally between 20 and 30, indicates a more neutral market sentiment. Investors are neither overly complacent nor excessively fearful. This range often reflects a market that is experiencing normal fluctuations without significant directional conviction.

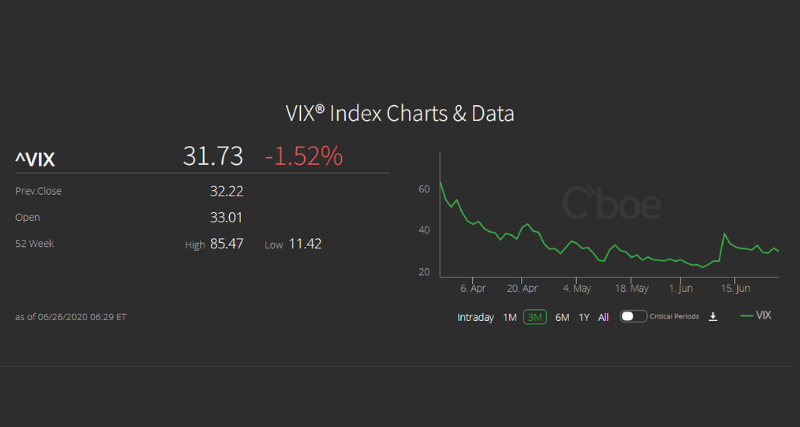

A VIX reading above 30 is generally considered high, signaling significant fear and uncertainty in the market. This often coincides with periods of market stress or economic instability. For example, during the 2008 financial crisis, the VIX surged to levels above 80, reflecting extreme panic. Similarly, at the onset of the COVID-19 pandemic in March 2020, the VIX spiked to around 85. These high VIX levels demonstrated the intense anxiety and risk aversion among investors. Monitoring what does the VIX measure allows investors to prepare for potential market corrections or capitalize on buying opportunities when fear reaches its peak. Understanding these levels helps in making informed decisions about portfolio adjustments and risk management.

What Does a Spike in the VIX Mean?: Predicting Market Reactions

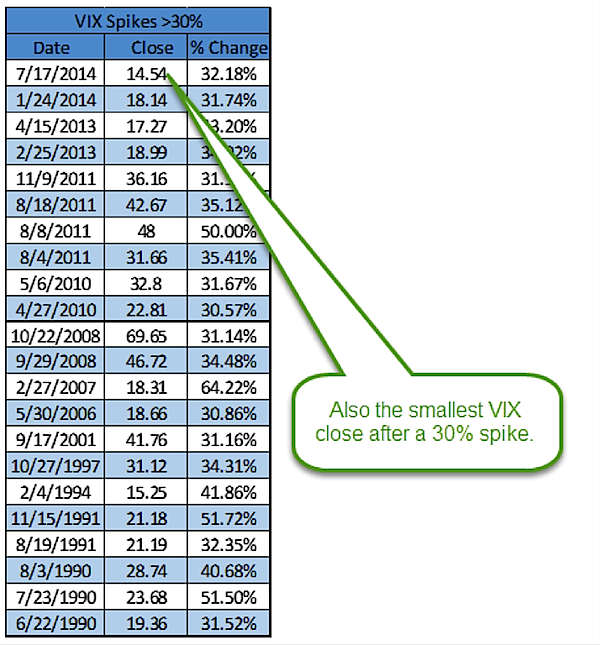

A spike in the Volatility Index (VIX) often signals turbulence ahead for the stock market. The VIX, reflecting market expectations of volatility, surges when investors become anxious. This anxiety usually stems from unforeseen events or growing economic uncertainty. Understanding what does the VIX measure during these spikes is crucial. It’s not merely a reflection of current market conditions but a prediction of potential future swings.

Typically, a VIX spike coincides with a downturn in stock prices. As fear grips the market, investors seek protection. They rush to buy put options, which increase in value when stock prices fall. This increased demand for put options drives up their prices, subsequently inflating the VIX. The relationship isn’t always immediate or perfectly correlated. Sometimes, a VIX spike precedes a market drop, acting as an early warning signal. Other times, the spike and the market decline occur simultaneously. Conversely, a declining VIX often accompanies a rising stock market. This indicates growing investor confidence and a willingness to take on more risk. It’s important to remember that what does the VIX measure is expected volatility, not necessarily a guaranteed market direction. However, its movements provide valuable insights into market sentiment.

Several factors can trigger a VIX spike. These include geopolitical events, unexpected economic data releases, and corporate earnings disappointments. Large institutional investors also contribute to VIX movement through hedging strategies. A significant portfolio adjustment by a major player can ripple through the options market, impacting VIX levels. While a VIX spike often precedes a stock market decline, it can also present buying opportunities. Savvy investors may view a spike as a sign of short-term panic. They might see it as a chance to buy fundamentally sound companies at discounted prices. However, accurately timing the market is notoriously difficult. What does the VIX measure is fear, and acting against the crowd requires a strong stomach and a well-defined investment strategy. Careful analysis and risk management are essential when navigating periods of high volatility.

Using the VIX in Your Strategy: How to Incorporate the Volatility Index in your Investment Decision-Making

The Volatility Index, or VIX, offers valuable insights for investors looking to refine their strategies. Understanding what does the VIX measure empowers informed decision-making. It allows for better management of portfolio risk and the identification of potential market opportunities. The VIX should not be the only consideration but rather a complement to research and analysis.

One way to use the VIX is in hedging strategies. Investors can use the VIX to hedge their portfolios against potential market downturns. A high VIX often signals increased market uncertainty. This might prompt investors to buy protective put options or reduce their exposure to equities. Conversely, a low VIX can indicate complacency, suggesting a potential need to rebalance portfolios or take profits. Understanding what does the VIX measure and how it relates to option prices can aid in the timing and execution of these hedging maneuvers. Another application involves identifying potential buying opportunities. A spike in the VIX, reflecting heightened fear, may present contrarian buying opportunities. When fear is high, asset prices can be temporarily depressed. Savvy investors may view this as a chance to acquire quality assets at discounted prices, betting on a future market recovery. However, it’s crucial to conduct thorough due diligence. Consider that what does the VIX measure is only one piece of the puzzle.

Asset allocation can be adjusted based on VIX levels. During periods of high VIX, investors might choose to reduce their allocation to riskier assets. Instead, increase their holdings in more conservative investments like bonds or cash. Conversely, when the VIX is low, a more aggressive asset allocation may be warranted. This involves increasing exposure to equities or other higher-yielding assets. Investors can also use VIX-related products, such as VIX futures and options, to directly express their views on market volatility. These instruments can be used for speculative purposes or to further refine hedging strategies. Keep in mind what does the VIX measure is expected volatility over the next 30 days. So strategies should be aligned with that time horizon. Ultimately, the VIX serves as a valuable tool for investors seeking to navigate market volatility. It helps them to make more informed and strategic investment decisions.

Limitations of the VIX: Understanding What It Doesn’t Measure

While the VIX provides valuable insights into short-term market volatility, understanding its limitations is crucial. What does the VIX measure? Primarily, it reflects market expectations of 30-day forward-looking volatility for the S&P 500. It does not predict long-term market direction. A high VIX doesn’t necessarily mean the market will crash, nor does a low VIX guarantee sustained gains. The index solely focuses on the S&P 500. Therefore, it might not accurately represent the volatility of other asset classes, such as bonds, commodities, or international markets. Investors need to consider this limitation when using the VIX to inform investment decisions across a diversified portfolio. What does the VIX measure in this context? It offers a snapshot of near-term equity market sentiment, not a crystal ball for future performance across all asset classes.

Another key limitation lies in its reliance on option prices. These prices are influenced by factors beyond pure volatility expectations. Supply and demand dynamics, market microstructure effects, and even the behavior of option market makers can impact VIX readings. Therefore, the VIX might overstate or understate true market volatility at times. Investors should be aware of these potential distortions. They should interpret the VIX within the broader context of market news and other indicators. What does the VIX measure when considering these influences? It reflects a complex interplay of factors influencing option pricing, not solely an objective measure of market fear.

Finally, the VIX’s focus on the near term (30 days) limits its usefulness for long-term strategic planning. Investors making long-term decisions should not solely rely on the VIX. They should incorporate other factors like fundamental analysis, economic forecasts, and long-term growth projections. What does the VIX measure in the long run? Very little, as it’s explicitly designed to gauge short-term volatility. Investors using it for long-term decisions must avoid drawing inaccurate conclusions about long-term market trends. A comprehensive investment strategy should integrate multiple indicators and perspectives, moving beyond the limitations of any single metric, including the VIX.

VIX Alternatives: Exploring Other Volatility Measures

While the VIX provides a valuable measure of equity market volatility, what does the VIX measure beyond the S&P 500? Investors often seek broader perspectives or alternative ways to gauge market sentiment. Volatility exchange-traded funds (ETFs) offer a way to directly invest in volatility, providing leveraged or inverse exposure to VIX movements. Popular examples include the VXX, which tracks the short-term VIX futures contract, and UVXY, offering amplified VIX exposure. However, using these ETFs requires understanding their inherent risks, including potential for significant losses due to the nature of leveraged products. What does the VIX measure in comparison? It focuses on the expected volatility of the S&P 500, whereas these ETFs represent a bet on the VIX itself.

Beyond ETFs, several other volatility indices exist, each catering to specific market segments or time horizons. Some indices track the volatility of other major market indexes, such as the Nasdaq 100 or international indices. Others provide longer-term or shorter-term views of volatility than the VIX’s 30-day focus. These alternatives may offer more granular insights or better align with an investor’s specific needs. Understanding the underlying methodology and characteristics of each index is crucial for making informed decisions. What does the VIX measure compared to these alternatives? It primarily measures near-term expected volatility, while other indices may provide longer-term perspectives or reflect different market sectors.

The choice between the VIX and alternative volatility measures depends on the investor’s goals and risk tolerance. For investors seeking broad exposure to S&P 500 volatility, the VIX remains a reliable benchmark. However, those looking for leveraged exposure or to gauge the volatility of other asset classes will find alternative indices and ETFs more suitable. Careful consideration of the nuances and limitations of each measure is essential before incorporating them into an investment strategy. What does the VIX measure? In essence, it measures the market’s expectation of near-term volatility in the S&P 500; understanding this is key to selecting the most appropriate volatility measure for any given situation. The availability of diverse options empowers investors to tailor their strategies to their specific circumstances and risk appetites.

Comparing VIX to MOVE Index: Contrasting Equity and Bond Market Volatility Gauges

While the VIX precisely measures equity market volatility, what does the VIX measure in relation to other asset classes? It doesn’t. To gain a more complete understanding of overall market risk, investors should consider the MOVE Index. The MOVE Index serves as a gauge for volatility within the bond market. Unlike the VIX, which focuses solely on the S&P 500, the MOVE Index reflects the implied volatility of U.S. Treasury bonds. This difference is crucial because equities and bonds often exhibit inverse relationships. When equity markets experience heightened volatility (a high VIX), investors often seek refuge in bonds, potentially driving down bond yields and thus reducing the MOVE Index. Conversely, periods of low VIX readings may see investors move funds out of bonds, increasing yields and the MOVE Index.

Analyzing both indices concurrently offers a richer picture of market sentiment than relying on the VIX alone. What does the VIX measure when considered alongside the MOVE Index? It reveals a more nuanced view of overall market risk. A high VIX coupled with a low MOVE Index might suggest flight to safety within the bond market, indicative of significant risk aversion. In contrast, a scenario with both high VIX and MOVE Index readings would point to broad-based market uncertainty across both equities and fixed income. The combination of these indices provides valuable insights into the interconnectedness of different asset classes and offers a more comprehensive perspective on overall market risk.

Understanding the interplay between the VIX and MOVE Index is especially important for diversified portfolios. Investors who hold both stocks and bonds can use these indices to adjust their asset allocation strategies. For instance, a rising VIX alongside a rising MOVE Index may signal a need for increased caution, prompting a shift toward lower-risk assets. Conversely, if the VIX declines while the MOVE Index remains stable, it might indicate a potentially favorable opportunity to increase equity exposure. The effective use of both the VIX and MOVE Index allows for a more sophisticated approach to risk management and investment decision-making. What does the VIX measure when considered in this context? It provides a critical, but incomplete, piece of the puzzle, highlighting the need for a more holistic perspective on market volatility.