Decoding the Concept of Selling Bonds Short

Shorting bonds is a sophisticated strategy employed to capitalize on an anticipated decline in bond prices. In essence, what does shorting bonds mean is betting against the future value of a bond. To grasp this concept, it’s helpful to draw a parallel with shorting stocks. Just as a stock short seller anticipates a stock’s price to fall, a bond short seller believes the value of a bond will decrease. This decrease in value typically happens when interest rates are expected to increase.

The mechanics of what does shorting bonds mean involve borrowing bonds from a broker, selling those borrowed bonds on the open market, and then, at a later date, buying back the same bonds to return them to the broker. The short seller profits if the price at which they buy back the bonds is lower than the price at which they initially sold them. The difference represents the profit, minus any fees or interest paid on the borrowed bonds.

However, what does shorting bonds mean also comes with significant risk. If the bond’s price rises instead of falling, the short seller will incur a loss. This is because they will have to buy back the bonds at a higher price than they initially sold them for. Understanding these mechanics and associated risks is crucial before engaging in bond shorting. Many investors use shorting bond strategies to protect their portfolios from downturns, especially when the economic outlook is uncertain. Properly executing what does shorting bonds mean can offer substantial rewards, but it requires careful analysis and risk management.

Why Investors Choose to Wager Against Fixed Income Securities

Investors might short bonds for several reasons. Understanding what does shorting bonds mean is crucial. One primary motivation is rising interest rate expectations. When interest rates increase, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. This decrease in demand leads to lower prices for existing bonds, creating an opportunity for short sellers to profit. Concerns about the creditworthiness of a bond issuer also drive shorting activity. If an issuer’s financial health deteriorates, investors may fear default, leading them to sell the bonds short, anticipating a price decline. Broader macroeconomic factors, such as recessionary fears or inflationary pressures, can also influence the decision to short bonds. For example, during periods of high inflation, investors may anticipate that central banks will raise interest rates aggressively, negatively impacting bond prices. What does shorting bonds mean in this context? It means betting against the bond market’s overall performance due to economic uncertainty.

Real-world examples illustrate these motivations. Consider a situation where a company announces unexpectedly weak earnings. This news could trigger concerns about its ability to repay its debt, thus leading investors to short its bonds. Alternatively, if a central bank signals an imminent increase in interest rates, investors might short government bonds anticipating a price drop. Understanding what does shorting bonds mean in these specific scenarios helps clarify the strategic motivations. This proactive approach allows investors to capitalize on anticipated price movements in the bond market. Investors carefully analyze economic indicators, interest rate forecasts, and credit ratings to inform their shorting decisions. What does shorting bonds mean in the context of risk management? It can be a hedging strategy against potential losses in other parts of a portfolio.

Another compelling reason for shorting bonds relates to relative value plays. Investors may identify specific bonds that are overvalued compared to others within the same sector or with similar risk profiles. By shorting the overvalued bonds and simultaneously going long on undervalued ones, investors aim to profit from the convergence of prices. This strategy requires a deep understanding of the bond market, including factors that drive valuations and the ability to identify mispricings. What does shorting bonds mean in this arbitrage context? It represents a calculated attempt to profit from market inefficiencies. In essence, shorting bonds, when done strategically, can be a powerful tool for sophisticated investors seeking to profit from anticipated price declines or relative value discrepancies in the fixed-income market.

A Step-by-Step Guide: How to Short Bonds Effectively

Shorting bonds, a strategy to profit from anticipated price declines, involves borrowing bonds and immediately selling them. Understanding what does shorting bonds mean is crucial before proceeding. The goal is to repurchase the bonds later at a lower price, returning them to the lender and pocketing the difference. This mirrors shorting stocks, a familiar concept to many investors. However, bond shorting has unique complexities and risks. To initiate this strategy, investors first need a brokerage account with margin privileges. Margin allows borrowing funds to amplify returns—but also losses. Finding bonds available to short (locatable bonds) is the next step. Not all bonds are readily available for borrowing. The broker facilitates the borrowing process. After securing the borrowed bonds, investors sell them on the market. This generates the capital needed to eventually buy back the bonds and cover the short position.

Monitoring the position is paramount. Bond prices fluctuate based on various market factors. Investors must regularly track their position’s performance. A key aspect of what does shorting bonds mean is understanding margin requirements and the potential for margin calls. A margin call occurs when the value of the short position falls below the broker’s minimum requirement. Investors are then obligated to deposit additional funds to maintain the position. Failure to meet a margin call can lead to the broker forcibly closing the position, resulting in potential losses. Therefore, rigorous risk management is essential. This includes setting stop-loss orders, which automatically close the position when the bond price reaches a predetermined level, limiting potential losses. Investors should meticulously track market movements and adjust their strategy based on changing conditions. Understanding the mechanics behind what does shorting bonds mean requires diligent monitoring and proactive management.

The process of covering the short position involves buying back the bonds at the prevailing market price. These are then returned to the broker, completing the transaction. Profits are realized if the repurchase price is lower than the initial sale price. The profit, less commissions and borrowing fees, represents the gain from the short position. However, if the bond price rises unexpectedly, substantial losses can accumulate. What does shorting bonds mean in terms of risk? It means accepting the potential for unlimited losses, as bond prices can theoretically rise indefinitely. Short squeezes, where a rapid price increase forces short sellers to cover their positions quickly, can exacerbate losses. Therefore, careful consideration of risk tolerance and a well-defined risk management plan are crucial before embarking on this strategy. Thoroughly understanding what does shorting bonds mean includes a realistic assessment of these significant risks. This is not an investment strategy suitable for every investor.

Navigating the Risks Associated with Shorting Fixed Income

Shorting bonds, while potentially lucrative, presents significant risks. Understanding what does shorting bonds mean is crucial before engaging in this strategy. Unlike long positions where losses are limited to the initial investment, short positions theoretically carry unlimited risk. Bond prices can rise indefinitely, leading to substantial losses for the short seller. This is because the short seller is obligated to buy back the bonds at the prevailing market price, no matter how high it climbs. This risk is magnified if interest rates unexpectedly fall, pushing bond prices upward.

Another critical risk is the potential for margin calls. Shorting bonds typically requires a margin account, meaning investors borrow money from their broker to execute the trade. If the bond price rises, the broker may issue a margin call, demanding additional funds to cover potential losses. Failure to meet a margin call can lead to the forced liquidation of the position at an unfavorable price, further amplifying losses. Short squeezes represent another significant danger. A short squeeze happens when a large number of investors simultaneously decide to cover their short positions, driving up demand and prices rapidly. This can force short sellers to buy back bonds at inflated prices, resulting in substantial losses. What does shorting bonds mean in the context of these risks? It means exposure to substantial financial losses if market conditions turn against the investor’s prediction.

Effective risk management is paramount when shorting bonds. Setting stop-loss orders can help limit potential losses by automatically closing the short position when the bond price reaches a predetermined level. Diversification across different bond issuers and maturities can mitigate the impact of individual bond defaults or unexpected interest rate movements. Thorough due diligence, including a comprehensive understanding of the issuer’s creditworthiness and the broader macroeconomic environment, is essential before initiating any short position. Remember, what does shorting bonds mean ultimately boils down to a calculated bet on declining prices; a bet that requires careful planning and a strong risk tolerance. Ignoring these risks can lead to significant financial setbacks.

Exploring Different Ways to Short Bonds: Strategies and Instruments

Shorting bonds, a strategy answering the question “what does shorting bonds mean?”, offers several approaches. Investors can short individual bonds directly. This provides targeted exposure to specific issuers and maturities. However, it requires significant capital and access to a brokerage account with margin privileges. Liquidity can also be a concern, especially for less-traded bonds. Understanding the nuances of what does shorting bonds mean is crucial for success in this approach.

Alternatively, exchange-traded funds (ETFs) tracking bond indices provide a diversified way to short the bond market. Inverse bond ETFs offer leveraged exposure to declining bond prices. These instruments simplify the process, requiring less market knowledge than shorting individual bonds. However, they may not precisely mirror the performance of specific bonds. The leveraged nature also magnifies both gains and losses. Consider that what does shorting bonds mean in this context is effectively betting against the overall bond market direction. Bond futures contracts represent another option. These contracts allow investors to speculate on future bond price movements, offering leverage and liquidity. However, understanding futures trading requires a high level of market expertise due to their inherent complexity. They are not ideal for beginners asking “what does shorting bonds mean?”

The choice between these methods depends on the investor’s risk tolerance, investment goals, and level of market expertise. For instance, someone with limited capital and a desire for broad market exposure might favor inverse bond ETFs. Conversely, an experienced trader looking for targeted exposure and greater leverage might opt for shorting individual bonds or utilizing bond futures contracts. Understanding what does shorting bonds mean, in the context of these diverse instruments, is vital for making informed decisions. Each approach presents unique risks and rewards, emphasizing the importance of thorough due diligence before implementing any shorting strategy. The complexities of “what does shorting bonds mean” necessitate careful consideration of these factors.

The Impact of Interest Rates on Short Bond Positions

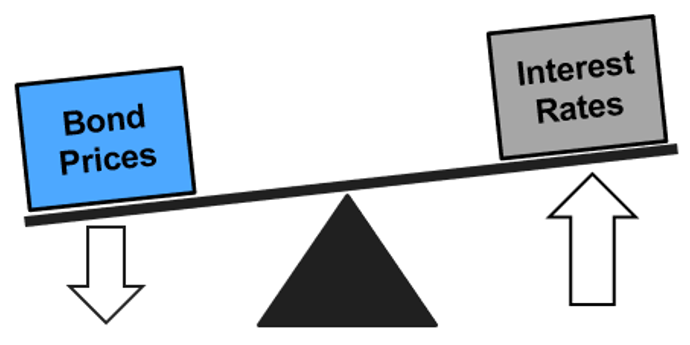

Understanding the intricate relationship between interest rates and bond prices is crucial for anyone considering what does shorting bonds mean. Bond prices and interest rates move inversely. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. This decrease in demand leads to a fall in the price of existing bonds. Conversely, when interest rates fall, older bonds with higher yields become more desirable, causing their prices to rise. For a short seller, rising interest rates are beneficial, as they lead to falling bond prices, allowing for a profitable closing of the short position. However, falling interest rates pose a significant risk, potentially leading to substantial losses as bond prices climb.

The yield curve, a graphical representation of the relationship between interest rates and the time to maturity of bonds, plays a pivotal role in influencing bond shorting strategies. A steep yield curve, where long-term interest rates are significantly higher than short-term rates, generally suggests expectations of future rate increases. This environment often presents favorable conditions for shorting long-term bonds. Conversely, a flattening or inverted yield curve, where short-term rates exceed long-term rates, signals potential future rate cuts. This scenario can be detrimental to short bond positions, as rising bond prices could lead to significant losses. Investors carefully analyze the yield curve and its potential shifts when making decisions about what does shorting bonds mean and whether to engage in such strategies. A deep understanding of this dynamic is key to effectively managing the risks associated with shorting bonds.

The impact of interest rate changes on short bond positions can be substantial. Therefore, careful consideration of interest rate forecasts and the shape of the yield curve is essential before engaging in any bond shorting activity. This includes understanding what does shorting bonds mean in the context of different interest rate scenarios, and how those scenarios can dramatically impact profitability or losses. Accurate predictions of interest rate movements are crucial for successful bond shorting, as unexpected shifts can quickly turn profits into significant losses. Sophisticated risk management techniques, including stop-loss orders, are frequently employed to mitigate these risks. Proper due diligence and a thorough understanding of the market are paramount for those considering what does shorting bonds mean and weighing the potential rewards against the considerable risks involved.

Tax Implications of Bond Shorting: Understanding Your Liabilities

Understanding the tax implications of shorting bonds is crucial for any investor considering this strategy. Profits earned from shorting bonds are generally taxed as ordinary income, similar to wages or salary. This is because the IRS typically views short-selling profits as a form of investment income rather than capital gains, especially if the bonds are held for a short period. However, if the bonds are held for longer than a year before the short position is covered, the profits may be taxed as long-term capital gains, which often have a lower tax rate than ordinary income. It’s important to carefully track the holding period of the shorted bonds to determine the applicable tax rate.

Wash sale rules can also come into play when shorting bonds. A wash sale occurs when an investor sells a security at a loss and then repurchases the same or a substantially similar security within 30 days before or after the sale. If a wash sale occurs, the loss may not be deductible for tax purposes. This rule can be particularly relevant for bond shorting strategies, especially if the investor is actively trading bonds and closing/re-opening short positions frequently. Investors need to be aware of the wash-sale implications when managing their short bond positions to avoid unexpected tax consequences. Understanding what does shorting bonds mean in the context of tax law is essential for compliant investing.

Given the complexities of tax laws and the potential for changes, it’s always advisable to consult with a qualified tax professional or financial advisor. They can provide personalized advice based on your specific financial situation and investment strategy. They can also help you navigate the intricacies of bond taxation, including the treatment of interest payments, premiums, and discounts. Failing to properly account for the tax implications of bond shorting can result in unexpected tax liabilities and penalties. Therefore, seeking professional guidance is a prudent step for any investor engaging in this strategy. Determining what does shorting bonds mean for your individual tax situation is important. The process of determining what does shorting bonds mean for your portfolio can be complex and consulting a tax professional will allow you to gain better insight. Furthermore, fully grasping what does shorting bonds mean in all its financial ramifications requires expert insight. This level of comprehension ensures well-informed investment decisions and minimizes potential tax-related issues.

Is Shorting Bonds Right for You?: Assessing Your Investment Profile

Before engaging in bond shorting, a thorough self-assessment is crucial. The strategy involves considerable risks and complexities, demanding a clear understanding of fixed income markets and macroeconomic factors. Investors must carefully weigh their risk tolerance, investment knowledge, and overall financial standing. What does shorting bonds mean in the context of your individual investment goals and capabilities? It’s essential to determine if this strategy aligns with your risk appetite.

Consider the inherent risks. Bond prices can, theoretically, rise indefinitely, leading to potentially unlimited losses for short sellers. Margin calls can unexpectedly demand additional capital. Short squeezes can amplify losses rapidly. Interest rate fluctuations significantly impact short positions. Mitigating these risks necessitates a robust risk management plan. Setting stop-loss orders is a critical step. Understanding the nuances of bond ETFs and futures contracts, as alternative shorting instruments, is also important. Carefully evaluate if you possess the expertise to navigate these complex financial instruments.

If uncertainties persist, seeking guidance from a qualified financial advisor is prudent. What does shorting bonds mean for your portfolio diversification? A financial professional can provide personalized advice, tailored to your specific circumstances and objectives. They can help you assess whether the potential rewards of shorting bonds outweigh the risks, given your financial situation. It is important to add a word of caution: shorting bonds is not a suitable strategy for every investor. A conservative investment approach might be more appropriate for individuals with a low risk tolerance or limited understanding of bond market dynamics. Before venturing into bond shorting, ensure you are fully aware of the potential downsides and equipped to manage the associated risks.