Understanding the Sharpe Ratio: A Quick Overview

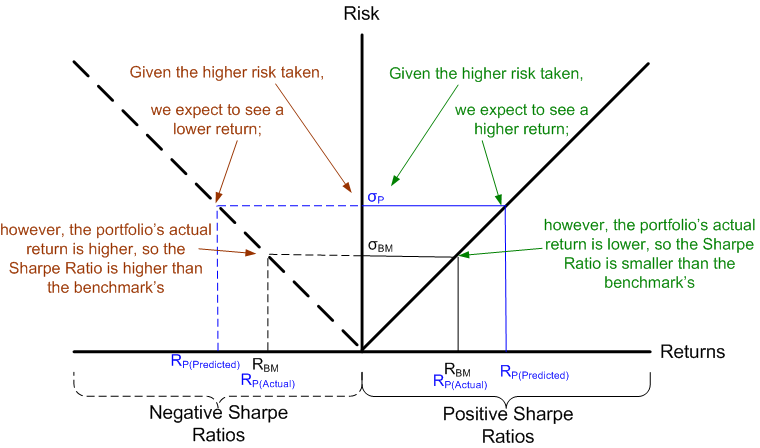

The Sharpe Ratio is a crucial metric in finance. It helps investors assess the risk-adjusted return of an investment. Essentially, it measures how much extra return an investment provides for each unit of extra risk taken. A higher Sharpe Ratio generally suggests superior risk-adjusted performance. Understanding what a negative Sharpe ratio means is key to interpreting investment results. The ratio balances the return against the risk, answering the question: “What is the return for the risk taken?” A higher ratio signifies better risk-adjusted performance. Investors use it to compare different investment options effectively.

The Sharpe Ratio calculation considers the investment’s return, the risk-free rate of return (typically a government bond yield), and the investment’s standard deviation (a measure of volatility or risk). A higher Sharpe Ratio indicates a better return for the level of risk. A Sharpe Ratio of 1.0 or higher is generally considered good. Understanding how this ratio works is crucial for making informed investment decisions. Knowing what does negative sharpe ratio mean is vital for interpreting investment performance accurately.

Many investors use the Sharpe Ratio as a key factor in their investment decisions. They compare the Sharpe Ratios of different investments to choose those that offer the best risk-adjusted returns. It’s important to remember that the Sharpe Ratio is just one factor to consider. Other factors such as diversification and investment goals also play important roles. What does negative sharpe ratio mean in the context of your portfolio? It signals that the investment’s return is not commensurate with the level of risk undertaken. Therefore, a thorough understanding of the Sharpe Ratio’s implications is essential for successful investing.

What a Negative Sharpe Ratio Signifies

A negative Sharpe ratio indicates that an investment’s return is not only low but actually underperforms a risk-free investment. What does negative Sharpe ratio mean in practical terms? It means you’re accepting substantial risk for a return that’s worse than simply leaving your money in a very safe, low-risk investment like a government bond. This is a significant red flag, suggesting the investment strategy has failed to generate sufficient returns to compensate for the risk undertaken. Understanding what a negative Sharpe ratio means requires recognizing this fundamental shortfall.

The calculation itself reveals this underperformance. The Sharpe ratio compares an investment’s excess return (return above the risk-free rate) to its volatility (standard deviation). A negative result signifies that the investment’s return has fallen below the risk-free rate. Investors should carefully consider what does negative Sharpe ratio mean in the context of their overall financial goals. It suggests that the investment strategy requires significant reevaluation. Perhaps the risk assessment was inaccurate, or unforeseen market factors negatively impacted performance. A thorough analysis is needed to understand why the return failed to surpass the benchmark of a risk-free investment.

What does negative Sharpe ratio mean for potential future performance? While a single negative Sharpe ratio doesn’t automatically condemn an investment, it highlights serious concerns. It suggests that the chosen investment strategy may be fundamentally flawed or poorly suited to the prevailing market conditions. Investors must assess whether the risk profile is justified, given the consistently underwhelming returns. Understanding what does negative Sharpe ratio mean is crucial for making informed decisions and mitigating potential losses. It’s essential to look beyond this single metric and analyze other performance indicators and market factors to get a full picture.

Why Would an Investment Have a Negative Sharpe Ratio?

A negative Sharpe ratio indicates that an investment’s return is below the risk-free rate. Understanding what does negative Sharpe ratio mean requires examining several potential causes. High volatility is a primary culprit. Investments with wildly fluctuating returns, even if they occasionally show gains, can easily generate a negative Sharpe ratio. The frequent ups and downs outweigh any positive returns, resulting in a net loss relative to a risk-free investment. Consistently poor performance is another key factor. If an investment underperforms consistently over time, regardless of its volatility, a negative Sharpe ratio is likely. This situation highlights a failure to generate sufficient returns to compensate for the inherent risk. Unexpected market downturns can also significantly impact the Sharpe ratio. A seemingly successful investment strategy could produce a negative ratio during a major market crash or economic recession. The sudden and significant losses might overwhelm previous gains, pushing the ratio below zero. What does negative Sharpe ratio mean in these contexts? It means the investment failed to provide sufficient returns to justify the risks involved.

Several investment types are more prone to negative Sharpe ratios. Highly speculative investments, such as some options trading strategies or leveraged investments, often exhibit substantial volatility. These investments can generate high returns under ideal conditions but are equally prone to massive losses during market downturns, thus increasing the likelihood of a negative Sharpe ratio. Similarly, investments in smaller, less established companies, often carry higher risks and, therefore, a higher probability of producing negative Sharpe ratios. A negative Sharpe ratio might also occur with actively managed funds that consistently underperform their benchmarks. Poor fund management decisions can lead to low returns and a negative Sharpe ratio, especially if the fund charges high fees that further erode the net return. What does negative Sharpe ratio mean for an investor in these scenarios? It signals the need for a thorough review of the investment strategy and perhaps a shift toward less risky options.

Consider a scenario where an investor chose to invest heavily in a highly volatile sector just before a significant market correction. The resulting losses, despite potentially strong returns earlier, would likely lead to a negative Sharpe ratio. This demonstrates how external market factors can drastically influence the Sharpe ratio even for well-researched investments. Another example could be an investor using a leveraged trading strategy. While this can amplify both gains and losses, a string of poor trades would rapidly push the Sharpe ratio into negative territory. Understanding what does negative Sharpe ratio mean in the context of these examples emphasizes the importance of diversification and risk management in creating a robust investment portfolio. A well-diversified portfolio reduces the impact of any single investment’s poor performance, lowering the likelihood of a negative overall Sharpe ratio. Moreover, responsible risk management includes defining acceptable levels of risk and adhering to them rigorously to avoid excessive losses that could ruin the overall investment performance.

How to Interpret a Negative Sharpe Ratio in Context

A negative Sharpe ratio doesn’t automatically signal a disastrous investment. Understanding what does negative Sharpe ratio mean requires considering several factors. The investment’s time horizon plays a crucial role. A short-term negative ratio might be less concerning than a prolonged negative trend. Similarly, an investor’s risk tolerance is key. A highly risk-averse investor would likely view a negative ratio more negatively than someone comfortable with higher volatility. Market conditions also significantly impact interpretation. A negative ratio during a broad market downturn might be less alarming than the same ratio during a period of overall market growth. What does negative Sharpe ratio mean in these varying contexts? The answer isn’t simple; it demands nuanced analysis. Investors should consider the ratio alongside other performance metrics for a complete picture.

Benchmarking is another vital element of interpreting a negative Sharpe ratio. Comparing the investment’s performance to similar assets or market indices provides context. If comparable investments also have negative or low Sharpe ratios, the negative result might be less worrisome. Conversely, if similar investments boast positive ratios, the negative result warrants closer scrutiny. Analyzing the investment’s historical performance is crucial here. Has the investment historically performed well, only recently exhibiting a negative Sharpe ratio? This suggests potential temporary setbacks. In contrast, a consistently negative ratio could indicate more substantial underlying issues. A comprehensive view considers the context, time horizon, and comparison to benchmarks.

In essence, what does negative Sharpe ratio mean? It signifies that the investment’s returns haven’t kept pace with its risk. However, the severity of this depends on several factors. Investors should avoid making quick judgments based solely on the Sharpe ratio. Instead, they should carefully analyze the ratio in conjunction with other performance indicators and within the broader context of market conditions and risk tolerance. This holistic approach helps in making well-informed investment decisions, enabling investors to fully understand the meaning and implications of a negative Sharpe ratio.

Comparing Sharpe Ratios Across Different Investments

Understanding how to use the Sharpe ratio for investment comparisons is crucial. Investors frequently encounter situations requiring a side-by-side assessment of investment options. Consider two mutual funds: Fund A shows a slightly negative Sharpe ratio of -0.1, while Fund B boasts a positive Sharpe ratio of 0.8. What does negative Sharpe ratio mean in this context? Fund B clearly demonstrates superior risk-adjusted returns. A positive Sharpe ratio indicates that the fund’s returns exceed its risk, offering better risk-adjusted performance than a risk-free investment. Fund A, however, suggests its returns fail to compensate for the risk undertaken. The investor needs to carefully consider their risk tolerance and investment goals before making a choice. What does negative Sharpe ratio mean to you? It means evaluating the context. A negative Sharpe ratio doesn’t automatically signal failure; instead, the investor should analyze if the potential upside outweighs the risk. Understanding what a negative Sharpe ratio means requires a balanced view. The time horizon for the investment significantly impacts the interpretation. A short-term negative Sharpe ratio might be acceptable if a longer-term strategy expects positive returns.

The Sharpe ratio helps investors compare diverse investment choices efficiently. For example, comparing a high-growth technology stock with a conservative bond fund necessitates considering risk. A technology stock might have a higher expected return, but its volatility could lead to a negative Sharpe ratio. Conversely, a bond fund might exhibit a positive Sharpe ratio due to its lower risk, yet its potential for high returns might be limited. This comparative analysis clarifies whether the higher risk of the technology stock is justified by its potential return compared to the lower-risk, lower-return bond fund. Understanding what does negative Sharpe ratio mean is integral to this comparison. Investors should determine whether the risk profile of each investment aligns with their individual risk tolerance and overall financial objectives. This comparative process helps investors make informed, goal-oriented investment decisions. It is critical to understand what does negative Sharpe ratio mean to avoid potentially disastrous investments.

Furthermore, the interpretation of a negative Sharpe ratio is highly dependent on the market environment. A negative Sharpe ratio during a market downturn may not be as concerning as one during a period of market growth. In a bear market, even well-managed investments might display negative Sharpe ratios temporarily, as risk-adjusted return will suffer significantly. What does negative Sharpe ratio mean in this specific scenario? It means the investor needs to consider the prevailing market conditions and forecast how the fund’s long-term outlook affects the risk-reward balance. The Sharpe ratio, when viewed alongside other metrics and market context, provides a more holistic understanding of investment performance and risk. Always remember to assess the investment’s risk-return profile before reaching a final investment decision. Understanding what does negative Sharpe ratio mean is an integral part of the overall investment strategy.

How to Improve Investment Performance and Avoid Negative Sharpe Ratios

Understanding what does negative Sharpe ratio mean is crucial for improving investment strategies. Diversification is key. Spreading investments across different asset classes (stocks, bonds, real estate) reduces the impact of any single investment’s poor performance. This lowers overall portfolio volatility, thereby increasing the likelihood of a positive Sharpe ratio. Effective diversification minimizes risk without necessarily sacrificing returns. What does negative Sharpe ratio mean in this context? It means your portfolio lacks diversification.

Portfolio optimization techniques, often employing sophisticated algorithms, can help construct a portfolio that maximizes returns for a given level of risk. These techniques analyze historical data and correlations between assets to identify optimal allocations. This ensures that investments are balanced to improve risk-adjusted returns. By carefully analyzing asset correlations and using optimization tools, investors can build portfolios less vulnerable to significant downturns. This understanding of what does negative Sharpe ratio mean informs a proactive approach to portfolio management.

Proactive risk management is paramount. Investors should establish clear risk tolerance levels before making investment decisions. Regular monitoring of portfolio performance and adjusting allocations as market conditions change are vital. This might involve rebalancing the portfolio to maintain the desired asset allocation or adjusting the overall risk exposure. By actively managing risk, investors can decrease the probability of experiencing a negative Sharpe ratio. What does negative Sharpe ratio mean in the context of risk management? It suggests a mismatch between risk tolerance and actual investment strategy. Understanding and addressing this mismatch is critical for long-term investment success.

The Limitations of the Sharpe Ratio

While the Sharpe Ratio offers valuable insights into risk-adjusted returns, it’s crucial to understand its limitations. One key assumption is that investment returns follow a normal distribution. This assumption may not hold true in reality, especially during periods of market stress or for alternative investments with skewed return distributions. A negative Sharpe ratio, therefore, might not always accurately reflect the true risk profile, especially when dealing with non-normal return patterns. What does negative Sharpe ratio mean in such situations? It might not represent the complete picture of investment performance. The calculation itself doesn’t consider the magnitude of losses. Two investments could both have negative Sharpe ratios, yet one may have experienced far greater maximum drawdowns than the other. This makes it essential to consider the Sharpe ratio alongside other risk measures.

Furthermore, the Sharpe ratio relies on the historical data used for calculation. Past performance is, of course, not indicative of future results. Market conditions, economic cycles, and investor sentiment all fluctuate, influencing both returns and risk. A negative Sharpe ratio calculated based on past data might not accurately predict future performance. What does negative Sharpe ratio mean when considering this uncertainty? It means that reliance on this metric alone can be risky for investment decisions. The risk-free rate used in the calculation is also a critical consideration. Different risk-free rates can produce varying Sharpe ratios for the same investment. The choice of a risk-free rate is subjective, and its appropriateness depends on factors like the investment’s currency and time horizon.

In summary, the Sharpe ratio is a valuable tool, but not a panacea. It should be interpreted cautiously and used in conjunction with other performance metrics to gain a more holistic understanding of an investment’s risk and return characteristics. What does negative Sharpe ratio mean in the bigger context? It highlights the need for a comprehensive investment strategy, one that goes beyond relying on a single metric to assess risk and reward. Understanding its limitations allows investors to avoid misinterpretations and make better-informed decisions, avoiding potential pitfalls associated with over-reliance on any single indicator. Investors should always conduct thorough due diligence and diversify their portfolios appropriately to manage risk effectively.

Beyond the Sharpe Ratio: Other Key Performance Indicators

While the Sharpe ratio offers valuable insights into risk-adjusted returns, understanding what does negative sharpe ratio mean requires a holistic view. It’s crucial to consider other performance metrics for a comprehensive assessment. The Sortino ratio, for example, focuses specifically on downside risk, providing a more nuanced picture than the Sharpe ratio, which treats all volatility equally. This is particularly useful when evaluating investments with asymmetrical return distributions. Investors seeking to understand what does negative sharpe ratio mean should carefully consider this metric.

The Treynor ratio, another important measure, assesses the risk-adjusted return relative to the market’s beta. It helps investors determine whether an investment’s excess return is justified by its systematic risk. Unlike the Sharpe ratio, which considers total risk, the Treynor ratio focuses only on systematic risk, making it especially useful for well-diversified portfolios. Understanding what does negative sharpe ratio mean in the context of a diversified portfolio might require looking at the Treynor ratio instead.

Maximum drawdown, a metric indicating the largest peak-to-trough decline in an investment’s value, offers critical information about potential losses. It helps investors gauge the resilience of an investment during market downturns. This measure complements the Sharpe ratio by providing insights into the potential magnitude of losses, an aspect the Sharpe ratio doesn’t directly address. Investors should integrate maximum drawdown analysis into their assessment when trying to understand what does negative sharpe ratio mean in relation to the risk of significant losses.