Unraveling the Mystery of Tightening Corporate Spreads

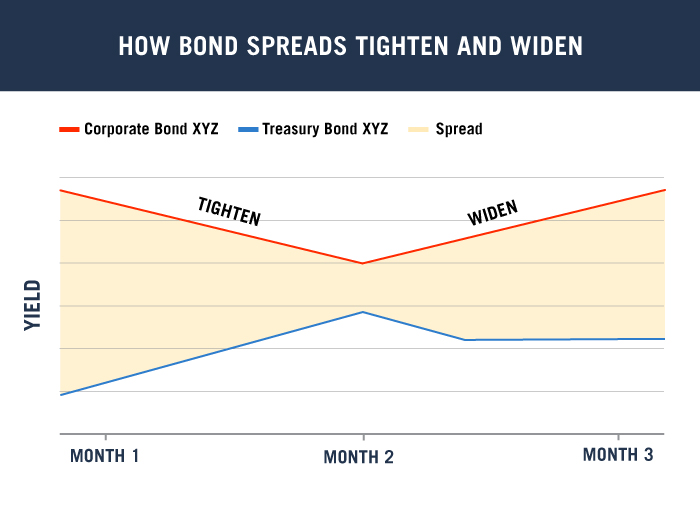

In the world of corporate finance, bond spreads play a vital role in determining the cost of borrowing for companies. A corporate bond spread refers to the difference in yield between a company’s bond and a risk-free bond, such as a U.S. Treasury bond. This spread is a key indicator of a company’s creditworthiness and is closely watched by investors. So, what does it mean when a company’s corporate spread tightens? Essentially, a tightening corporate spread indicates that the market perceives the company as a lower credit risk, leading to a decrease in the yield required by investors. This, in turn, can result in lower borrowing costs for the company, making it more attractive to investors. However, a tightening corporate spread can also have broader implications for the economy, influencing GDP growth, inflation, and monetary policy. As investors, it is essential to understand the significance of corporate bond spreads and how they can impact investment decisions.

What Drives Corporate Bond Spreads: A Deep Dive

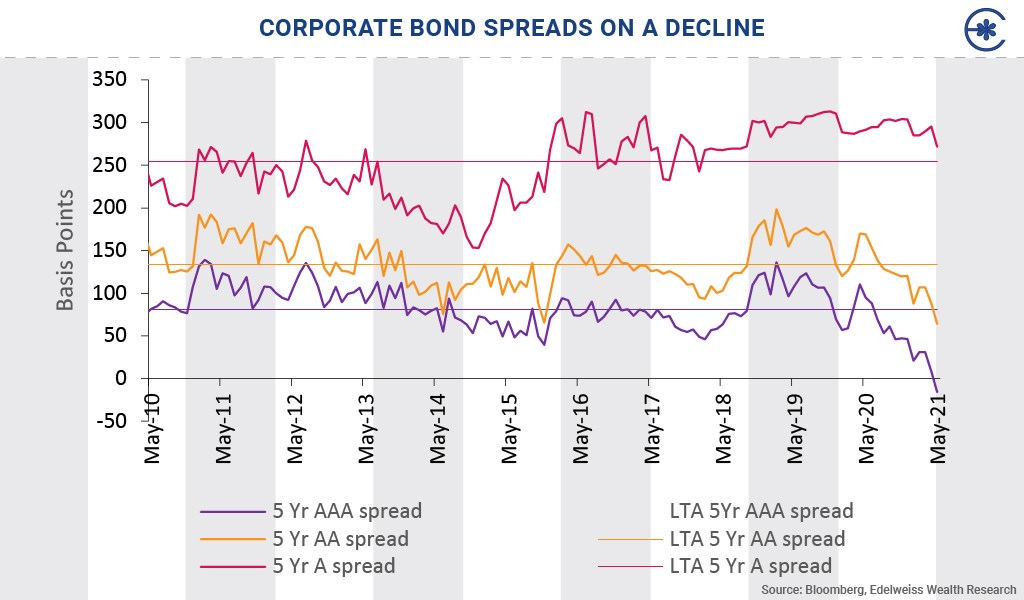

Corporate bond spreads are influenced by a complex array of factors, including credit ratings, interest rates, and market sentiment. Credit ratings, assigned by agencies such as Moody’s and Standard & Poor’s, play a significant role in determining a company’s creditworthiness and, subsequently, its bond spread. A higher credit rating typically results in a lower bond spread, as investors perceive the company as a lower credit risk. Conversely, a lower credit rating can lead to a wider bond spread, as investors demand a higher yield to compensate for the increased credit risk. Interest rates also have a profound impact on corporate bond spreads. When interest rates rise, the yield on risk-free bonds, such as U.S. Treasury bonds, increases, causing corporate bond spreads to widen. Conversely, when interest rates fall, corporate bond spreads tend to tighten. Market sentiment, driven by factors such as economic indicators and geopolitical events, can also influence corporate bond spreads. For instance, during times of economic uncertainty, investors may become risk-averse, leading to a widening of corporate bond spreads. Understanding these key factors is crucial for investors seeking to navigate the complex world of corporate bond spreads.

How to Interpret a Tightening Corporate Spread

When a company’s corporate spread tightens, it can be a significant indicator of its financial health and creditworthiness. A tightening corporate spread may suggest that the company has improved its credit profile, reduced its debt levels, or demonstrated a stronger ability to meet its financial obligations. This, in turn, can lead to a decrease in the yield required by investors, making the company’s bonds more attractive. To interpret a tightening corporate spread, investors should consider the underlying factors driving the change. For instance, has the company’s credit rating improved, or has there been a significant reduction in its debt-to-equity ratio? Understanding the reasons behind the tightening spread is crucial in making informed investment decisions. What does it mean when a company’s corporate spread tightens? It may indicate a lower credit risk, making the company’s bonds a more attractive investment opportunity. However, it is essential to consider the broader market context and the company’s overall financial health before making any investment decisions.

The Impact of Tightening Corporate Spreads on Investors

A tightening corporate spread can have significant implications for investors, offering both opportunities and challenges. On the one hand, a tightening spread can indicate a decrease in credit risk, making the company’s bonds a more attractive investment opportunity. This can lead to increased demand, driving up bond prices and providing investors with potential capital gains. What does it mean when a company’s corporate spread tightens? It may signal a lower credit risk, making the company’s bonds a more appealing investment option. However, investors must also be aware of the potential risks associated with a tightening corporate spread. For instance, a tightening spread may indicate a decrease in yield, which can negatively impact investors seeking higher returns. Furthermore, a tightening spread may also lead to increased competition for bonds, driving up prices and reducing potential returns.

To navigate these challenges, investors can adjust their portfolios in response to changes in corporate spreads. For example, investors may consider diversifying their bond holdings to minimize exposure to specific companies or industries. Additionally, investors can also consider hedging strategies to mitigate potential losses associated with a tightening corporate spread. By understanding the implications of a tightening corporate spread, investors can make informed decisions and optimize their investment portfolios.

Case Studies: Real-World Examples of Tightening Corporate Spreads

To illustrate the concept of tightening corporate spreads, let’s examine a few real-world examples. Consider the case of Johnson & Johnson, a multinational healthcare company. In 2020, Johnson & Johnson’s corporate spread tightened by 20 basis points, driven by its improved credit rating and reduced debt levels. This tightening spread led to an increase in the company’s bond prices, resulting in a 5% gain for investors. What does it mean when a company’s corporate spread tightens? In this case, it signaled a decrease in credit risk, making Johnson & Johnson’s bonds a more attractive investment opportunity.

Another example is Microsoft, a technology giant. In 2019, Microsoft’s corporate spread tightened by 15 basis points, driven by its strong financial performance and increased cash reserves. This tightening spread led to a decrease in the company’s borrowing costs, allowing it to issue debt at more favorable terms. As a result, Microsoft’s stock price increased by 10%, reflecting investor confidence in the company’s financial health.

These case studies demonstrate the impact of tightening corporate spreads on companies and investors. By analyzing these real-world examples, investors can gain a deeper understanding of the factors driving corporate spreads and make more informed investment decisions. What does it mean when a company’s corporate spread tightens? It may indicate a decrease in credit risk, making the company’s bonds a more attractive investment opportunity. By recognizing these trends, investors can capitalize on potential investment opportunities and optimize their portfolios.

What Does a Tightening Corporate Spread Mean for the Economy?

A tightening corporate spread can have significant implications for the broader economy. When a company’s corporate spread tightens, it can indicate a decrease in credit risk, making it easier for the company to access capital markets and invest in growth opportunities. This, in turn, can lead to increased economic activity, job creation, and GDP growth. What does it mean when a company’s corporate spread tightens? It may signal a more favorable business environment, encouraging companies to invest and expand their operations.

A tightening corporate spread can also influence monetary policy. When corporate spreads tighten, it can indicate a decrease in borrowing costs, making it easier for companies to issue debt. This can lead to increased borrowing and spending, which can stimulate economic growth. Central banks may respond to this trend by adjusting interest rates or implementing other monetary policies to maintain economic stability.

In addition, a tightening corporate spread can impact inflation. When companies have easier access to capital, they may be more likely to invest in new projects and increase production, leading to increased demand for goods and services. This can drive up prices and contribute to inflationary pressures. As a result, policymakers must carefully monitor corporate spreads and adjust their policies accordingly to maintain price stability.

In conclusion, a tightening corporate spread can have far-reaching implications for the economy, influencing GDP growth, monetary policy, and inflation. By understanding the significance of corporate spreads, investors and policymakers can make more informed decisions and navigate the complexities of the financial market.

Managing Risk in a Tightening Corporate Spread Environment

In a tightening corporate spread environment, investors must be proactive in managing risk to maximize returns and minimize potential losses. What does it mean when a company’s corporate spread tightens? It may indicate a decrease in credit risk, but it’s essential to remain vigilant and adapt to changing market conditions.

One strategy for managing risk is to diversify a portfolio by investing in companies with varying credit ratings and industries. This can help mitigate the impact of a widening corporate spread on a specific company or sector. Additionally, investors can consider hedging against potential losses by investing in credit default swaps or other derivatives.

Another approach is to focus on companies with strong financial fundamentals, such as low debt-to-equity ratios and high interest coverage ratios. These companies are more likely to maintain their credit ratings and benefit from a tightening corporate spread. Investors can also consider investing in companies with a history of stable or improving credit ratings, as these companies may be more likely to experience a tightening corporate spread.

In a tightening corporate spread environment, investors should also be mindful of the potential for overvaluation. As corporate spreads tighten, bond prices may increase, leading to higher valuations. Investors should be cautious of overpaying for bonds and consider the potential risks of a correction in the market.

By employing these strategies, investors can effectively manage risk in a tightening corporate spread environment and position themselves for success in the bond market. What does it mean when a company’s corporate spread tightens? It may signal a more favorable investment environment, but it’s essential to remain vigilant and adapt to changing market conditions.

Conclusion: Navigating the Complexities of Corporate Bond Spreads

In conclusion, understanding corporate bond spreads is crucial for making informed investment decisions in the bond market. What does it mean when a company’s corporate spread tightens? It can indicate a decrease in credit risk, making it easier for companies to access capital markets and invest in growth opportunities. By grasping the key factors that influence corporate bond spreads, investors can better navigate the complexities of the bond market and make informed decisions.

This article has provided a comprehensive guide to corporate bond spreads, including the significance of tightening corporate spreads, the key factors that drive spreads, and how to interpret and manage risk in a tightening corporate spread environment. By applying these insights, investors can position themselves for success in the bond market and achieve their investment goals.

Remember, what does it mean when a company’s corporate spread tightens? It may signal a more favorable investment environment, but it’s essential to remain vigilant and adapt to changing market conditions. By staying informed and up-to-date on the latest developments in corporate bond spreads, investors can stay ahead of the curve and achieve long-term success in the bond market.