What is the Russell 2000 Index?

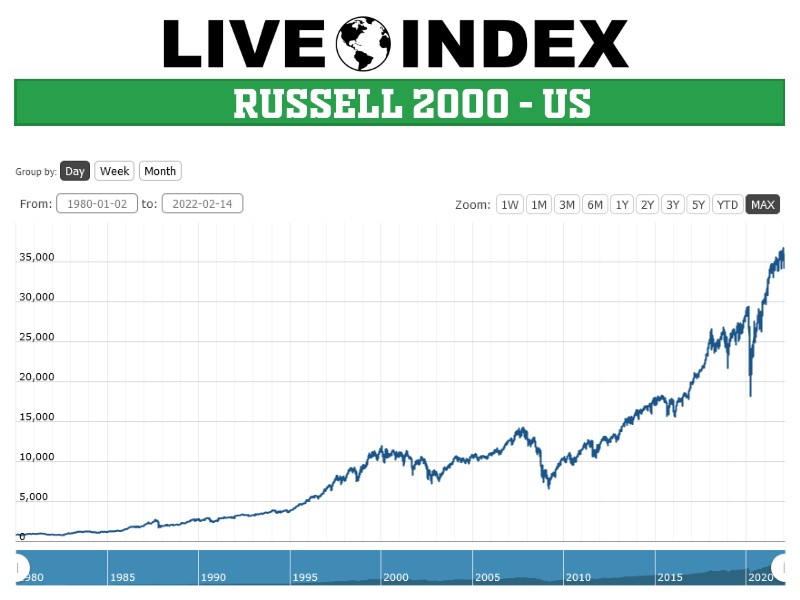

The Russell 2000 Index is a widely followed stock market index that tracks the performance of small-cap companies in the United States. It is a subset of the Russell 3000 Index, which represents approximately 98% of the investable U.S. equity market. The Russell 2000 Index is designed to provide investors with a comprehensive view of the small-cap segment of the market, which is often characterized by higher growth potential and greater volatility compared to large-cap stocks. With a diverse range of industries and sectors represented, the Russell 2000 Index is a valuable tool for investors seeking to gain exposure to the U.S. small-cap market. Many investors and financial analysts often ask, “what companies are in the Russell 2000 index?” to better understand the composition and performance of this important market segment. By understanding the Russell 2000 Index, investors can make more informed decisions about their investment portfolios and strategies.

How to Identify the Companies that Make Up the Russell 2000

Identifying the companies that make up the Russell 2000 Index is a crucial step for investors seeking to gain exposure to the U.S. small-cap market. Fortunately, there are several online resources and financial databases that provide access to the list of companies included in the Russell 2000 Index. One of the most popular resources is the FTSE Russell website, which provides a comprehensive list of constituents, including their market capitalization, industry, and sector. Additionally, financial databases such as Bloomberg, Refinitiv, and S&P Global Market Intelligence also provide access to the Russell 2000 Index constituents. Investors can also use online stock screeners and financial websites, such as Yahoo Finance or Google Finance, to find the list of companies in the Russell 2000 Index. By understanding what companies are in the Russell 2000 index, investors can make more informed decisions about their investment portfolios and strategies.

A Glimpse into the Diverse Range of Russell 2000 Companies

The Russell 2000 Index is a diverse and dynamic index, comprising a wide range of industries and sectors. The index includes companies from various sectors, such as technology, healthcare, financial services, consumer goods, and energy, among others. This diversity is one of the key benefits of investing in the Russell 2000 Index, as it provides exposure to a broad range of market segments and industries. Some well-known companies that are part of the Russell 2000 Index include Twitter, a social media giant, and Shake Shack, a popular fast-food chain. Other companies in the index operate in niche industries, such as biotechnology, renewable energy, and cybersecurity. Understanding what companies are in the Russell 2000 index can help investors appreciate the breadth and depth of the index. With over 2,000 constituents, the Russell 2000 Index offers a unique opportunity to invest in a diverse range of small-cap companies, each with its own unique characteristics and growth potential.

Understanding the Inclusion Criteria for the Russell 2000 Index

To be included in the Russell 2000 Index, companies must meet specific criteria set by FTSE Russell, the index’s administrator. The primary consideration is market capitalization, with companies ranked by their total market capitalization. The Russell 2000 Index includes the smallest 2,000 companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. In addition to market capitalization, companies must also meet liquidity and listing requirements. This includes being listed on a major U.S. exchange, such as the New York Stock Exchange (NYSE) or the NASDAQ, and having a minimum average daily trading volume of 1,500 shares. Furthermore, companies must be incorporated and headquartered in the United States, and their stock must be publicly available for trading. By understanding the inclusion criteria for the Russell 2000 Index, investors can gain insight into what companies are in the Russell 2000 index and how they are selected. This knowledge can help investors make informed decisions about their investment portfolios and strategies.

Why Invest in Russell 2000 Index Funds?

Investing in Russell 2000 Index funds can be a strategic move for investors seeking diversification, cost-effectiveness, and potential for long-term growth. By tracking the performance of the Russell 2000 Index, these funds provide exposure to a broad range of small-cap companies, which can help to reduce overall portfolio risk. One of the key benefits of investing in Russell 2000 Index funds is diversification. The index comprises over 2,000 companies across various industries and sectors, offering a unique opportunity to invest in a diverse range of small-cap stocks. This diversification can help to mitigate risk and increase potential returns over the long term. Additionally, Russell 2000 Index funds are often more cost-effective than actively managed funds, as they track a specific index rather than relying on a fund manager to pick individual stocks. This can result in lower fees and expenses for investors. Furthermore, the Russell 2000 Index has historically provided strong long-term performance, making it an attractive option for investors seeking growth over the long term. By understanding what companies are in the Russell 2000 index and how they are selected, investors can make informed decisions about their investment portfolios and strategies.

Top Performing Russell 2000 Index Companies

The Russell 2000 Index is comprised of over 2,000 small-cap companies, offering a diverse range of investment opportunities. Some of the top-performing companies in the Russell 2000 Index include those in the technology, healthcare, and financial services sectors. For example, companies like Twilio Inc. (TWLO), a cloud communication platform provider, and Teladoc Health Inc. (TDOC), a telemedicine company, have demonstrated strong performance in recent years. Other top performers include financial services companies like Stifel Financial Corp. (SF) and Piper Sandler Companies (PIPR). These companies have shown impressive growth and returns, making them attractive options for investors seeking exposure to the small-cap market. Understanding what companies are in the Russell 2000 index and their performance can help investors make informed decisions about their investment portfolios and strategies. By tracking the performance of these top-performing companies, investors can gain valuable insights into the overall health of the small-cap market and identify potential opportunities for growth.

How to Use the Russell 2000 Index as a Benchmark

Investors and financial analysts often use the Russell 2000 Index as a benchmark to evaluate the performance of their portfolios or investment strategies. By tracking the performance of the Russell 2000 Index, investors can gain a better understanding of the overall health of the small-cap market and compare the performance of their own investments to that of the broader market. This can help investors identify areas of strength and weakness in their portfolios and make informed decisions about their investment strategies. For example, if an investor’s small-cap portfolio is underperforming the Russell 2000 Index, they may need to rebalance their portfolio or adjust their investment strategy to better align with the market. By understanding what companies are in the Russell 2000 index and how they are performing, investors can use the index as a valuable tool to inform their investment decisions and optimize their portfolios. Additionally, financial analysts may use the Russell 2000 Index as a benchmark to evaluate the performance of specific industries or sectors, providing valuable insights into the market trends and opportunities.

The Role of the Russell 2000 Index in Portfolio Diversification

The Russell 2000 Index plays a crucial role in portfolio diversification, providing investors with a unique opportunity to gain exposure to small-cap stocks and reduce overall portfolio risk. By investing in a Russell 2000 Index fund, investors can tap into the growth potential of small-cap companies, which are often more agile and innovative than their larger counterparts. This can help to offset the risks associated with investing in larger, more established companies. Furthermore, the Russell 2000 Index’s diverse range of industries and sectors ensures that investors are not overly exposed to any one particular market or sector. This diversification can help to reduce volatility and increase the potential for long-term growth. Understanding what companies are in the Russell 2000 index and their role in portfolio diversification is essential for investors seeking to optimize their investment portfolios. By incorporating the Russell 2000 Index into their investment strategy, investors can create a more balanced and resilient portfolio, better equipped to weather market fluctuations and achieve their long-term investment goals.