What is Portfolio Volatility and Why is it Important?

Portfolio volatility, also known as the standard deviation of portfolio returns, is a statistical measure used to quantify the dispersion of returns around an average return. In investment management, volatility is a critical factor as it helps measure the risk associated with a portfolio’s returns. A higher volatility indicates greater uncertainty in the portfolio’s returns, which may affect investment decisions and overall risk tolerance. Understanding and measuring the volatility of a portfolio calculation is essential for investors to make informed decisions and build robust investment strategies.

How to Calculate Portfolio Volatility: A Step-by-Step Guide

Calculating the volatility of a portfolio involves several steps and requires specific data, formulas, and tools. Here is a comprehensive guide on how to calculate the volatility of a portfolio:

1. Gather Historical Returns Data

To calculate portfolio volatility, you need historical returns data for each security in the portfolio. Ideally, this data should cover a complete market cycle to accurately capture the range of potential returns. Record the daily, weekly, or monthly returns for each security over the selected period.

2. Calculate Individual Security Volatility

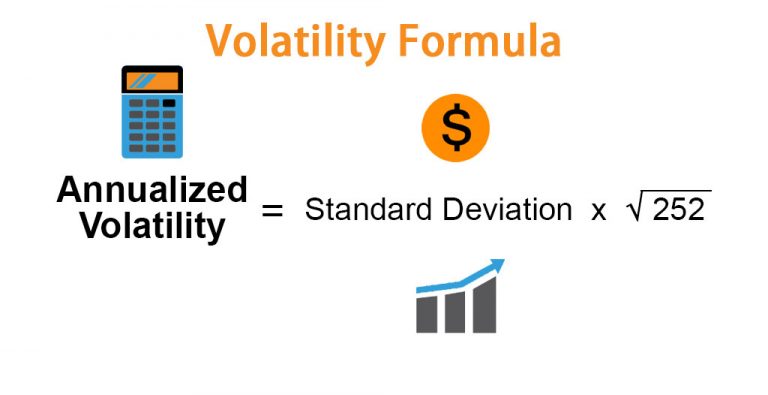

Using the historical returns data, calculate the volatility (standard deviation) for each individual security in the portfolio. This can be done using the following formula:

σi = √[(1/(n-1)) Σ(Ri – Ri,avg)^2]

where:

- σi is the volatility of security i

- n is the number of return periods

- Ri is the return of security i for a given period

- Ri,avg is the average return

Key Factors Influencing Portfolio Volatility

Portfolio volatility is influenced by several factors, including asset allocation, market conditions, and individual securities. Understanding these factors can help investors manage and reduce portfolio volatility. Here are some key factors to consider:

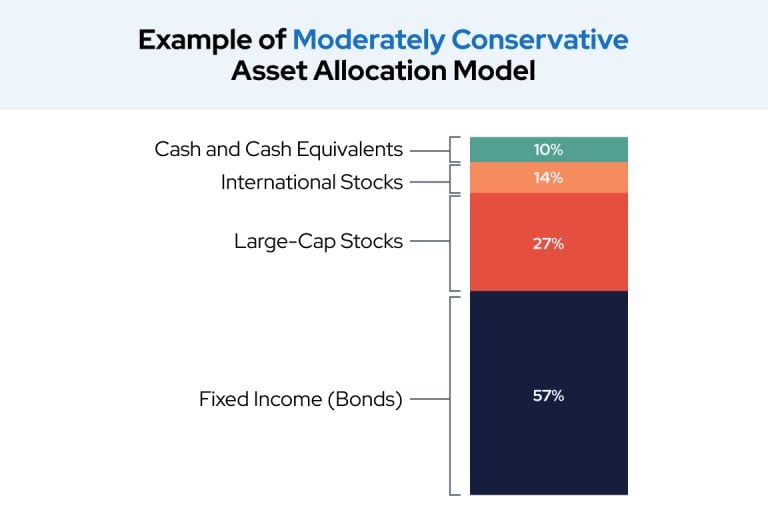

1. Asset Allocation

The way assets are allocated within a portfolio significantly impacts its overall volatility. A portfolio with a higher concentration of equities, for example, is likely to have greater volatility than one with a larger allocation to fixed-income securities. Diversifying across various asset classes can help reduce portfolio volatility.

2. Market Conditions

Market conditions, such as economic growth, inflation, and interest rates, can affect portfolio volatility. For instance, during periods of economic uncertainty or recession, market volatility tends to increase. Investors should consider the current market environment when assessing portfolio volatility and making investment decisions.

3. Individual Securities

The specific securities held within a portfolio can also contribute to its volatility. Securities with higher betas, or sensitivity to market movements, tend to be more volatile. Additionally, individual stocks with lower market capitalizations (small-cap stocks) generally exhibit greater volatility than large-cap stocks. Investors should carefully evaluate the volatility of individual securities before adding them to their portfolios.

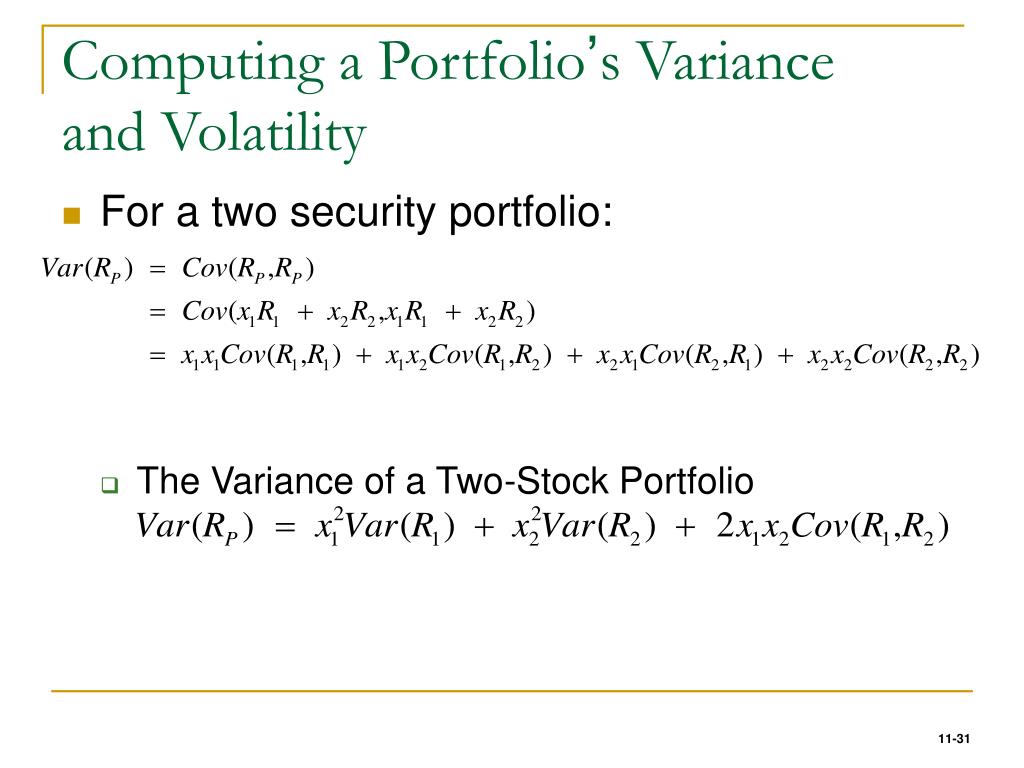

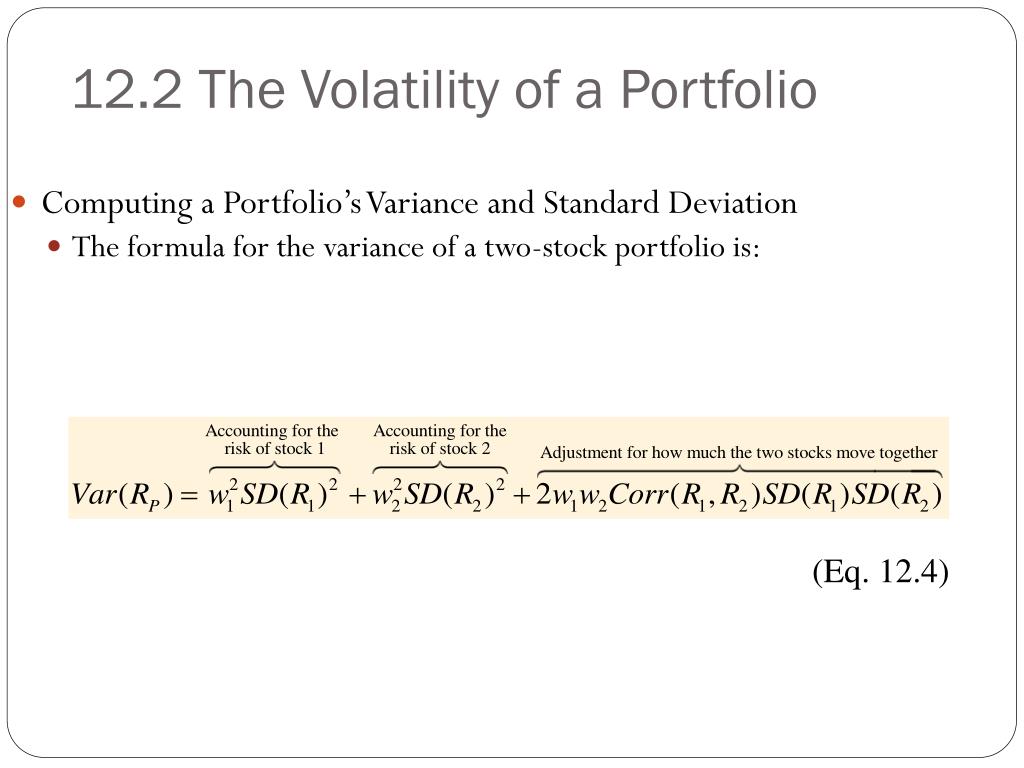

4. Correlation

The correlation between different assets within a portfolio plays a crucial role in determining its overall volatility. When assets have a low or negative correlation, their price movements are less likely to be synchronized, reducing portfolio volatility. Conversely, when assets have a high positive correlation, their price movements are more likely to be aligned, increasing portfolio volatility.

5. Diversification

Diversification is a powerful tool for managing portfolio volatility. By investing in a variety of assets with different risk profiles, investors can reduce the impact of any single investment on overall portfolio performance. This can help smooth returns and minimize the effects of market volatility.

6. Hedging Strategies

Investors can use various hedging strategies, such as options, futures, and forwards, to protect their portfolios against market volatility. These strategies can help limit losses during periods of market stress and reduce portfolio volatility.

7. Active vs. Passive Management

The choice between active and passive management can also influence portfolio volatility. Actively managed portfolios, which aim to outperform a benchmark, may have higher volatility due to the increased risk associated with stock selection and market timing. Passively managed portfolios, which track an index, generally have lower volatility due to their focus on replicating, rather than beating, the benchmark.

Volatility Measures Beyond Standard Deviation

While standard deviation is a widely used measure of portfolio volatility, other metrics can provide additional insights into the risk associated with a portfolio’s returns. Here are three alternative measures of portfolio volatility and their advantages and disadvantages:

1. Value at Risk (VaR)

Value at Risk (VaR) is a statistical measure that quantifies the potential loss in portfolio value over a specific time horizon at a given confidence level. For example, a 95% VaR of $10,000 over a one-month horizon indicates that there is a 95% probability that the portfolio will not lose more than $10,000 in value over the next month. VaR is useful for risk managers who need to set risk limits and assess the potential impact of extreme market events.

Advantages:

- Easy to interpret

- Can be calculated for various time horizons and confidence levels

- Useful for setting risk limits

Disadvantages:

- Assumes a normal distribution of returns, which may not always be accurate

- Does not provide information on the severity of losses beyond the VaR threshold

- May underestimate risk during extreme market conditions

2. Conditional Value at Risk (CVaR)

Conditional Value at Risk (CVaR), also known as Expected Shortfall (ES), is a measure of the average loss in portfolio value when portfolio returns fall below the VaR threshold. CVaR provides a more comprehensive view of risk by accounting for the severity of losses during extreme market events.

Advantages:

- Provides information on the severity of losses beyond the VaR threshold

- Less sensitive to the assumption of normal distribution

- Useful for risk managers who need to assess the potential impact of extreme market events

Disadvantages:

- More complex to calculate than VaR

- Requires more data and computational resources

- May be more difficult to interpret for non-technical audiences

3. Historical Simulation

Historical Simulation is a non-parametric method for estimating portfolio volatility that involves calculating portfolio returns based on historical data. This method does not assume a normal distribution of returns and can capture the impact of extreme market events more accurately than standard deviation.

Advantages:

- Does not assume a normal distribution of returns

- Can capture the impact of extreme market events

- Easy to implement and interpret

Disadvantages:

- Requires a large amount of historical data

- May be sensitive to the choice of historical period

- May not accurately capture future market conditions

Strategies to Manage Portfolio Volatility

Portfolio volatility can have a significant impact on investment performance, making it essential for investors to manage this risk effectively. Here are several strategies for managing portfolio volatility:

1. Diversification

Diversification is a fundamental principle of portfolio management that involves spreading investments across various asset classes, sectors, and geographic regions. By investing in a diversified portfolio, investors can reduce the impact of any single investment on overall portfolio performance and minimize volatility.

2. Hedging

Hedging involves using financial instruments, such as options and futures, to protect a portfolio against market volatility. By taking a short position in a financial instrument that is negatively correlated with the portfolio, investors can reduce the impact of market downturns and minimize volatility.

3. Use of Derivatives

Derivatives, such as options and futures, can be used to manage portfolio volatility by providing investors with the ability to take a position in an asset without actually owning it. This can help investors reduce the impact of market volatility on their portfolios and manage risk more effectively.

4. Asset Allocation

Asset allocation involves dividing a portfolio among various asset classes, such as stocks, bonds, and cash, based on an investor’s risk tolerance, investment horizon, and financial goals. By allocating assets appropriately, investors can manage portfolio volatility and achieve their desired risk-reward profile.

5. Dynamic Asset Allocation

Dynamic asset allocation involves adjusting a portfolio’s asset allocation in response to changing market conditions. By increasing the allocation to less volatile asset classes during periods of market stress, investors can reduce portfolio volatility and manage risk more effectively.

6. Risk Parity

Risk parity is an investment strategy that involves allocating assets based on risk rather than capital. By allocating an equal amount of risk to each asset class, investors can achieve a more balanced portfolio and manage volatility more effectively.

7. Volatility Targeting

Volatility targeting is an investment strategy that involves adjusting a portfolio’s exposure to risk based on the level of market volatility. By reducing exposure to risk during periods of high volatility, investors can manage portfolio volatility more effectively and achieve their desired risk-reward profile.

8. Use of Volatility Indexes

Volatility indexes, such as the CBOE Volatility Index (VIX), can be used to manage portfolio volatility by providing investors with a measure of market volatility. By monitoring volatility indexes and adjusting portfolios accordingly, investors can manage risk more effectively and achieve their desired risk-reward profile.

The Role of Volatility in Asset Allocation and Portfolio Construction

Portfolio volatility plays a critical role in asset allocation and portfolio construction. By considering volatility, investors can achieve their desired risk-reward profile and optimize their investment performance. Here’s how:

1. Risk Tolerance

Investors have different risk tolerances, which determine the level of volatility they are willing to accept in their portfolios. By considering volatility, investors can construct portfolios that align with their risk tolerance and investment objectives.

2. Diversification

Diversification is a fundamental principle of portfolio management that involves spreading investments across various asset classes, sectors, and geographic regions. By diversifying a portfolio, investors can reduce volatility and manage risk more effectively.

3. Asset Allocation

Asset allocation involves dividing a portfolio among various asset classes, such as stocks, bonds, and cash, based on an investor’s risk tolerance, investment horizon, and financial goals. By considering volatility, investors can allocate assets appropriately and achieve their desired risk-reward profile.

4. Risk Management

Volatility can have a significant impact on investment performance, making it essential for investors to manage this risk effectively. By considering volatility, investors can implement risk management strategies, such as hedging and the use of derivatives, to protect their portfolios against market downturns and minimize volatility.

5. Portfolio Optimization

Portfolio optimization involves selecting the optimal combination of assets to achieve a desired risk-reward profile. By considering volatility, investors can optimize their portfolios and achieve their investment objectives more effectively.

6. Long-Term Investment Performance

Volatility can have a significant impact on long-term investment performance. By considering volatility, investors can construct portfolios that are better positioned to withstand market downturns and achieve their long-term investment objectives.

7. Volatility as an Investment Opportunity

Volatility can also present investment opportunities. By identifying assets with high volatility, investors can potentially achieve higher returns by taking advantage of market inefficiencies and pricing discrepancies.

8. Customized Portfolio Construction

By considering volatility, investors can construct customized portfolios that are tailored to their specific needs and investment objectives. This can help investors achieve their financial goals more effectively and manage risk more effectively.

Case Studies: Real-World Examples of Portfolio Volatility Management

Understanding how to manage portfolio volatility is essential for investment success. By examining real-world examples of successful portfolio volatility management, investors can learn valuable lessons and apply them to their investment strategies. Here are a few case studies to consider:

Case Study 1: Diversification

In 2008, the financial crisis caused significant volatility in the stock market. However, investors who had diversified their portfolios across different asset classes, such as stocks, bonds, and commodities, were better able to weather the storm. By spreading their investments across various assets, these investors were able to reduce their overall portfolio volatility and achieve more stable returns.

Case Study 2: Hedging

In 2015, the Chinese stock market experienced a significant correction, causing volatility in global markets. However, investors who had hedged their portfolios using put options or other derivatives were able to protect themselves against losses. By using hedging strategies, these investors were able to reduce their portfolio volatility and achieve more stable returns.

Case Study 3: Use of Derivatives

In 2017, the cryptocurrency market experienced significant volatility, with Bitcoin prices fluctuating wildly. However, investors who had used derivatives, such as futures contracts, were able to profit from these price movements. By using derivatives, these investors were able to manage their portfolio volatility and achieve their investment objectives.

Case Study 4: Asset Allocation

In 2020, the COVID-19 pandemic caused significant volatility in global markets. However, investors who had allocated their portfolios based on their risk tolerance and investment objectives were better able to manage their portfolio volatility. By using asset allocation strategies, these investors were able to achieve their desired risk-reward profiles and achieve more stable returns.

Case Study 5: Volatility as an Investment Opportunity

In 2018, the CBOE Volatility Index (VIX) experienced a significant spike, presenting an investment opportunity for traders. By using options strategies, such as straddles and strangles, traders were able to profit from the volatility. By considering volatility as an investment opportunity, these traders were able to achieve their investment objectives and manage their portfolio risk.

Lessons Learned

These case studies illustrate the importance of managing portfolio volatility and the various strategies that can be used to achieve this objective. By diversifying their portfolios, hedging their investments, using derivatives, allocating assets based on risk tolerance and investment objectives, and considering volatility as an investment opportunity, investors can manage their portfolio volatility and achieve more stable returns. By learning from these real-world examples, investors can apply these strategies to their investment scenarios and achieve long-term investment success.

Emerging Trends and Future Developments in Portfolio Volatility Calculation and Management

In today’s rapidly changing investment landscape, new technologies and approaches are emerging to help investors better understand and manage portfolio volatility. Here are some of the most exciting trends and future developments in portfolio volatility calculation and management:

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are being increasingly used to analyze large datasets and identify patterns in portfolio volatility. By using these technologies, investors can gain deeper insights into the factors driving volatility and develop more effective risk management strategies. For example, ML algorithms can be used to analyze social media data and identify sentiment changes that may impact market volatility.

Big Data and Data Analytics

The use of big data and data analytics is becoming more prevalent in investment management, enabling investors to analyze vast amounts of data and identify trends and patterns in portfolio volatility. By using big data and data analytics, investors can gain a more comprehensive view of market conditions and make more informed investment decisions.

Advanced Volatility Models

Advanced volatility models, such as GARCH (Generalized Autoregressive Conditional Heteroskedasticity) and EGARCH (Exponential GARCH), are being used to better understand and predict portfolio volatility. These models take into account factors such as leverage, volatility clustering, and asymmetric effects, providing a more accurate picture of portfolio risk.

Integration of ESG Factors

Environmental, Social, and Governance (ESG) factors are increasingly being integrated into investment decision-making processes, providing investors with a more holistic view of portfolio risk. By considering ESG factors, investors can gain a better understanding of the potential impact of ESG risks on portfolio volatility and develop more sustainable investment strategies.

Real-Time Volatility Monitoring

Real-time volatility monitoring is becoming more prevalent, enabling investors to quickly respond to changes in market conditions and manage portfolio risk more effectively. By using real-time volatility monitoring tools, investors can gain a more accurate picture of portfolio risk and make more informed investment decisions.

Collaborative Risk Management

Collaborative risk management is an emerging trend in investment management, enabling investors to share risk management strategies and best practices. By collaborating with other investors, investors can gain access to a wider range of risk management tools and strategies, improving their ability to manage portfolio volatility.

Conclusion

The use of advanced technologies and approaches is transforming the way investors understand and manage portfolio volatility. By leveraging these trends and future developments, investors can gain a more accurate picture of portfolio risk and develop more effective risk management strategies. As the investment landscape continues to evolve, it is essential for investors to stay up-to-date with the latest developments in portfolio volatility calculation and management to achieve their investment objectives.