Understanding the VIX Index: The Fear Gauge of the Market

The VIX index, also known as the CBOE Volatility Index, is a widely followed metric that measures the market’s expected volatility of the S&P 500 index. It is often referred to as the “fear gauge” of the market, as it reflects the level of uncertainty and anxiety among investors. The VIX index is calculated based on the prices of options on the S&P 500 index, which provides a snapshot of the market’s expected volatility over the next 30 days.

A higher VIX reading indicates higher expected volatility, while a lower reading suggests a more stable market environment. In essence, the VIX index is a sentiment indicator that helps investors gauge the market’s mood and make informed investment decisions. By analyzing the VIX index, investors can gain insights into the market’s risk appetite, which can be useful in developing strategies to manage risk and maximize returns.

As we explore the relationship between VIX and S&P 500, it is essential to understand the intricacies of the VIX index and its role in shaping market expectations. The VIX index is often used in conjunction with the S&P 500 index to gain a more comprehensive understanding of market dynamics, particularly when it comes to vix vs s&p 500 correlation. By grasping the underlying mechanics of the VIX index, investors can better appreciate the complex relationship between VIX and S&P 500, ultimately leading to more informed investment decisions.

How to Measure Market Performance: The S&P 500 Index Explained

The S&P 500 index is a widely followed stock market index that represents the overall health of the US stock market. It is a market-capitalization-weighted index of 500 large-cap stocks, selected by a committee based on market size, liquidity, and industry representation. The S&P 500 index is often considered a benchmark for the US stock market, providing a snapshot of the market’s performance and trends.

The S&P 500 index is calculated and maintained by S&P Dow Jones Indices, a division of S&P Global. The index is designed to be a representative sample of the US stock market, with constituents selected from a range of industries, including technology, healthcare, financials, and consumer staples. The index is widely followed by investors, financial analysts, and the media, and is often used as a benchmark for investment portfolios and index funds.

In the context of vix vs s&p 500 correlation, the S&P 500 index plays a crucial role in understanding market dynamics and volatility. By analyzing the S&P 500 index in conjunction with the VIX index, investors can gain a more comprehensive understanding of market sentiment and volatility, ultimately leading to more informed investment decisions. The S&P 500 index provides a broad-based measure of market performance, while the VIX index offers a snapshot of market volatility and sentiment.

The Correlation Conundrum: Unraveling the Relationship between VIX and S&P 500

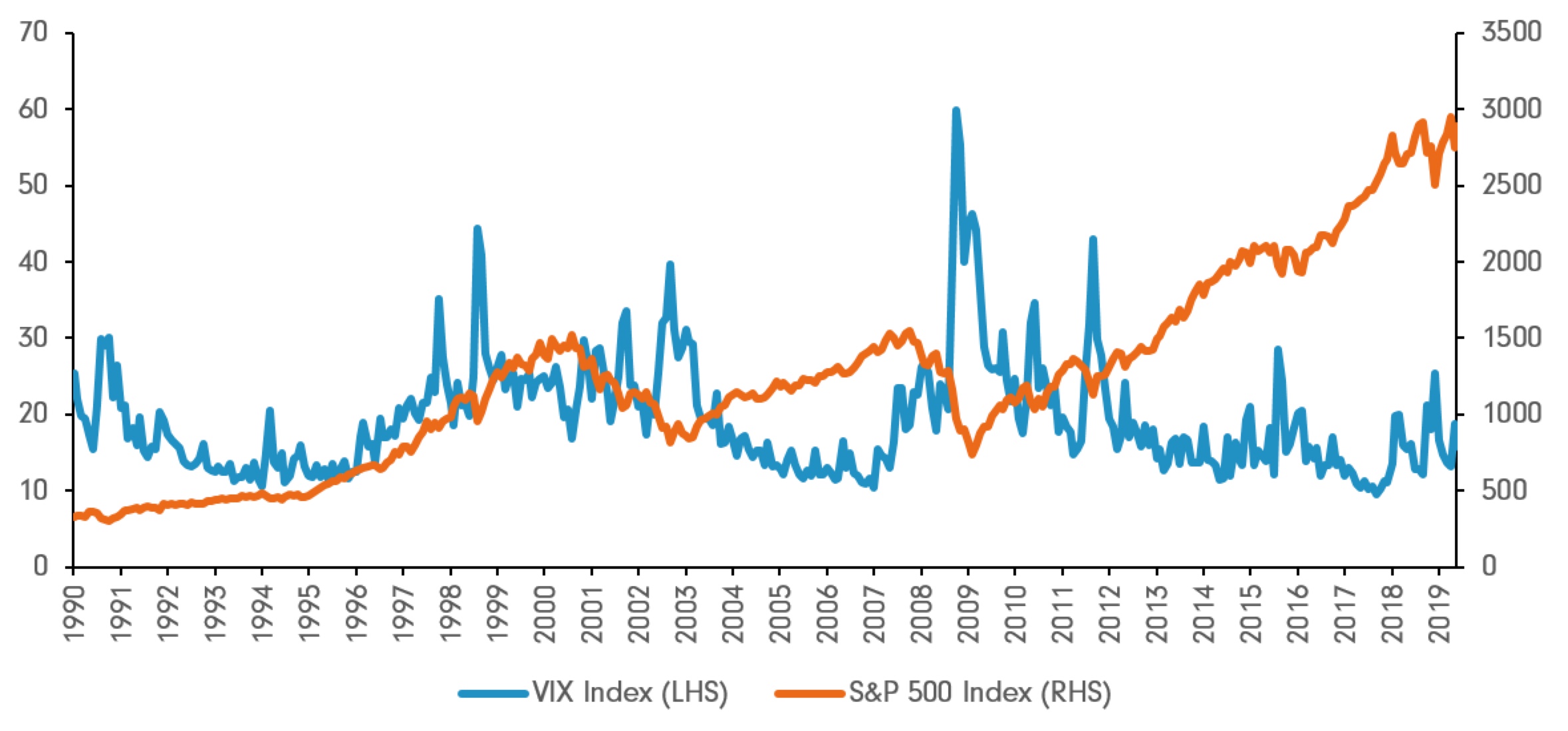

The historical correlation between VIX and S&P 500 is a fascinating phenomenon that has garnered significant attention from investors and financial analysts. At its core, the VIX index and S&P 500 index are inversely related, meaning that when the VIX index increases, the S&P 500 index tends to decrease, and vice versa. This inverse relationship is rooted in the fundamental nature of the two indices.

The VIX index, as a measure of market volatility, tends to increase during periods of market uncertainty and fear. Conversely, the S&P 500 index, as a measure of market performance, tends to decrease during these same periods. This inverse relationship is intuitive, as investors tend to become more risk-averse during periods of market turmoil, leading to increased volatility and decreased market performance.

However, the vix vs s&p 500 correlation is not always straightforward. During periods of extreme market stress, the correlation between VIX and S&P 500 can break down, leading to unexpected market behavior. For example, during the 2008 financial crisis, the VIX index surged to record highs, while the S&P 500 index plummeted. In this scenario, the inverse relationship between VIX and S&P 500 was exacerbated, leading to extreme market volatility.

Understanding the historical correlation between VIX and S&P 500 is crucial for investors seeking to navigate market volatility. By recognizing the underlying dynamics of this correlation, investors can develop strategies to mitigate risk and capitalize on market opportunities. In the next section, we will delve deeper into the key factors that drive the VIX-S&P 500 correlation, providing investors with a more comprehensive understanding of market forces.

What Drives the VIX-S&P 500 Correlation: A Closer Look at Market Forces

The correlation between VIX and S&P 500 is influenced by a complex array of market forces, including economic indicators, geopolitical events, and investor sentiment. Understanding these factors is crucial for investors seeking to leverage the vix vs s&p 500 correlation in their investment decisions.

Economic indicators, such as GDP growth, inflation rates, and unemployment rates, play a significant role in shaping the VIX-S&P 500 correlation. During periods of economic uncertainty, the VIX index tends to increase, while the S&P 500 index tends to decrease. Conversely, during periods of economic growth, the VIX index tends to decrease, while the S&P 500 index tends to increase.

Geopolitical events, such as wars, elections, and trade disputes, can also impact the VIX-S&P 500 correlation. These events can create uncertainty and volatility in the market, leading to increased VIX index values and decreased S&P 500 index values. For example, during the 2020 COVID-19 pandemic, the VIX index surged to record highs, while the S&P 500 index plummeted.

Investor sentiment is another key factor that influences the VIX-S&P 500 correlation. When investors are optimistic about the market, they tend to take on more risk, leading to decreased VIX index values and increased S&P 500 index values. Conversely, when investors are pessimistic about the market, they tend to become more risk-averse, leading to increased VIX index values and decreased S&P 500 index values.

Additionally, technical factors, such as market momentum and trend analysis, can also impact the VIX-S&P 500 correlation. For example, during periods of strong market momentum, the VIX index tends to decrease, while the S&P 500 index tends to increase.

By understanding these key factors, investors can develop a more nuanced understanding of the VIX-S&P 500 correlation and make more informed investment decisions. In the next section, we will explore how investors can leverage the correlation between VIX and S&P 500 to make informed investment decisions, including hedging strategies and risk management techniques.

How to Use VIX-S&P 500 Correlation in Your Investment Strategy

Understanding the vix vs s&p 500 correlation is crucial for investors seeking to navigate market volatility. By leveraging this correlation, investors can develop informed investment strategies that mitigate risk and capitalize on market opportunities.

One key strategy is to use the VIX index as a hedge against market downturns. When the VIX index increases, indicating increased market volatility, investors can adjust their portfolios to reduce risk. This may involve shifting assets to more conservative investments, such as bonds or money market funds, or implementing hedging strategies, such as options or futures contracts.

Conversely, when the VIX index decreases, indicating decreased market volatility, investors can take on more risk and invest in assets with higher potential returns, such as stocks or real estate. By adjusting their portfolios in response to changes in the VIX index, investors can optimize their returns and minimize losses.

Another strategy is to use the S&P 500 index as a benchmark for market performance. By comparing the performance of their portfolios to the S&P 500 index, investors can gauge their investment decisions and adjust their strategies accordingly. This may involve rebalancing their portfolios to maintain an optimal asset allocation or adjusting their investment mix to better align with market trends.

In addition, investors can use the vix vs s&p 500 correlation to inform their risk management decisions. By analyzing the correlation between VIX and S&P 500, investors can identify potential risks and opportunities in the market and adjust their strategies accordingly. For example, during periods of high market volatility, investors may choose to reduce their exposure to riskier assets and focus on more conservative investments.

Ultimately, the key to successfully leveraging the vix vs s&p 500 correlation is to develop a deep understanding of the underlying market forces that drive this correlation. By staying informed about market trends and adjusting their strategies accordingly, investors can navigate market volatility with confidence and achieve their investment goals.

Case Studies: Examining the VIX-S&P 500 Correlation in Different Market Scenarios

The vix vs s&p 500 correlation has played a significant role in shaping market behavior during various market events. By examining these case studies, investors can gain valuable insights into how the correlation between VIX and S&P 500 can inform their investment decisions.

One notable example is the 2008 financial crisis. During this period, the VIX index surged to record highs, while the S&P 500 index plummeted. This inverse relationship was driven by investor fear and uncertainty, as the crisis unfolded. By analyzing the VIX-S&P 500 correlation during this period, investors can see how the correlation can serve as a warning sign for market downturns.

Another example is the 2020 COVID-19 pandemic. During this period, the VIX index increased significantly, while the S&P 500 index experienced high volatility. The correlation between VIX and S&P 500 during this period was driven by investor sentiment and uncertainty surrounding the pandemic’s impact on the economy. By examining this case study, investors can see how the VIX-S&P 500 correlation can inform their investment decisions during periods of high uncertainty.

In addition to these examples, the VIX-S&P 500 correlation has also played a significant role in shaping market behavior during other significant market events, such as the 2011 European sovereign debt crisis and the 2015 Chinese stock market crash. By analyzing these case studies, investors can gain a deeper understanding of how the correlation between VIX and S&P 500 can inform their investment decisions and mitigate risk.

These case studies demonstrate the importance of considering the VIX-S&P 500 correlation in investment decisions. By understanding how the correlation between VIX and S&P 500 has played out during different market scenarios, investors can develop more informed investment strategies that take into account the complex relationships between market forces.

Limitations and Biases: Understanding the Flaws in VIX-S&P 500 Correlation Analysis

While the vix vs s&p 500 correlation can provide valuable insights into market behavior, it is essential to acknowledge the potential limitations and biases of relying solely on this correlation analysis.

One significant limitation is data quality issues. The VIX index is calculated based on options prices, which can be affected by various factors, such as market liquidity and trading volumes. Similarly, the S&P 500 index is subject to biases in its composition, such as the influence of large-cap stocks. These data quality issues can lead to inaccurate or incomplete information, which can, in turn, affect the reliability of the correlation analysis.

Another limitation is the impact of external factors, such as geopolitical events or unexpected economic shocks. These events can disrupt the normal functioning of the market, leading to aberrant behavior in the VIX and S&P 500 indices. As a result, the correlation between VIX and S&P 500 may not accurately reflect market sentiment and volatility during these periods.

In addition, the vix vs s&p 500 correlation analysis can be influenced by biases in investor sentiment and market expectations. For example, during periods of high market volatility, investors may become overly cautious, leading to an exaggerated response in the VIX index. Similarly, during periods of low market volatility, investors may become complacent, leading to an underestimation of market risks.

Furthermore, the correlation analysis may not account for structural changes in the market, such as shifts in investor behavior or changes in market regulations. These changes can affect the relationships between VIX and S&P 500, leading to inaccurate or incomplete information.

By acknowledging these limitations and biases, investors can develop a more nuanced understanding of the vix vs s&p 500 correlation and its role in informing investment decisions. By combining correlation analysis with other forms of market analysis, investors can develop a more comprehensive understanding of market behavior and make more informed investment decisions.

Conclusion: Navigating Market Volatility with VIX-S&P 500 Correlation Insights

In conclusion, the vix vs s&p 500 correlation is a powerful tool for investors seeking to navigate market volatility. By understanding the historical correlation between VIX and S&P 500, investors can gain valuable insights into market sentiment and volatility. The correlation can inform investment decisions, including hedging strategies and risk management techniques, and provide a framework for analyzing market behavior during different scenarios.

However, it is essential to acknowledge the limitations and biases of relying solely on VIX-S&P 500 correlation analysis. Data quality issues, external factors, and biases in investor sentiment and market expectations can all impact the reliability of the correlation analysis. By recognizing these limitations, investors can develop a more nuanced understanding of the vix vs s&p 500 correlation and its role in informing investment decisions.

Ultimately, the vix vs s&p 500 correlation is a valuable tool for investors seeking to navigate market volatility. By combining correlation analysis with other forms of market analysis, investors can develop a more comprehensive understanding of market behavior and make more informed investment decisions. As market conditions continue to evolve, the importance of considering VIX-S&P 500 correlation in investment decisions will only continue to grow.