Decoding the Two-Stage Dividend Discount Approach: A Comprehensive Guide

Stock valuation is a cornerstone of investment analysis. The Dividend Discount Model (DDM) is a method used to estimate the intrinsic value of a stock. It’s based on the principle that a stock is worth the present value of its future dividends. The basic DDM, however, assumes a constant growth rate of dividends. This single-stage approach doesn’t always reflect reality. Many companies experience different phases of growth. This is where multi-stage growth models become essential. These models allow for varying growth rates over time. The two-stage dividend discount model formula is a popular choice. It addresses the limitations of the single-stage DDM by incorporating two distinct growth phases. This provides a more realistic valuation for many companies.

The single-stage DDM provides a simplified view. It assumes a constant dividend growth rate indefinitely. This assumption is often unrealistic. Companies typically experience periods of high growth followed by periods of slower, more stable growth. The two-stage dividend discount model formula is a refinement. It accounts for these changing growth patterns. It divides the future into two distinct periods. The first stage represents a period of high growth. The second stage represents a period of stable, mature growth. By incorporating these two stages, the two-stage dividend discount model formula provides a more accurate valuation. It is particularly useful for companies expected to have significant changes in their growth trajectory.

While the single-stage DDM has its place, it’s crucial to understand its limitations. Its assumption of constant growth is a major drawback. The two-stage dividend discount model formula offers a more nuanced approach. It acknowledges the dynamic nature of company growth. By discounting dividends from both the high-growth and stable-growth phases, the two-stage dividend discount model formula arrives at a more realistic intrinsic value. Investors can use the two-stage dividend discount model formula to make more informed decisions. It helps in assessing whether a stock is undervalued or overvalued relative to its future dividend potential.

Unveiling the Two Stages: High Growth and Stable Maturity

The two-stage dividend discount model formula operates on the premise that a company’s growth trajectory evolves over time. It distinctly separates a company’s lifespan into two key phases: an initial high-growth phase and a subsequent stable-growth phase. Understanding each stage is crucial for accurate stock valuation.

The high-growth phase is characterized by rapid expansion, often fueled by innovative products, market penetration, or favorable industry dynamics. During this period, a company experiences significantly above-average growth rates. The length of this phase is influenced by factors such as competitive advantages, market saturation, and the company’s ability to sustain its innovation. Growth rates during this stage (g1) are typically higher than the overall economy’s growth rate. This initial phase reflects a period where the company reinvests heavily in itself, driving substantial increases in earnings and, consequently, dividends. A prime example is a technology company in its early years, experiencing exponential user adoption and revenue growth. It’s important to note that very high growth rates are unsustainable in the long run. The two stage dividend discount model formula helps to address this reality.

As a company matures, its growth inevitably slows down to a more sustainable rate, marking the beginning of the stable-growth phase. This phase represents a period where the company has reached a certain level of market saturation, faces increased competition, or simply experiences the natural deceleration that comes with size. The growth rate in this phase (g2) is typically aligned with the overall economic growth rate, industry average, or a conservative estimate of long-term sustainable expansion. For instance, a mature consumer goods company might experience steady, but relatively low, growth driven by population increases and incremental product improvements. This phase assumes that the company’s dividend policy becomes more predictable, and the dividend payout ratio stabilizes. The two stage dividend discount model formula considers the present value of all dividends paid in this mature stage, which is impacted greatly by the stable growth rate. Companies transition from high growth to a stable maturity phase as market opportunities evolve and competitive pressures increase. The shift highlights the relevance of using the two stage dividend discount model formula to reflect these dynamic changes.

How to Calculate Stock Value: Applying the Two-Stage Dividend Discount Model Formula

The process of calculating a stock’s value using the two stage dividend discount model formula involves a few key steps. The formula essentially calculates the present value of expected future dividends. These dividends are separated into two distinct phases: a high-growth period and a stable-growth period. Understanding the formula and its components is crucial for accurate stock valuation. The two stage dividend discount model formula helps investors determine if a stock is undervalued or overvalued.

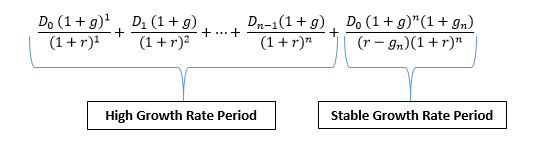

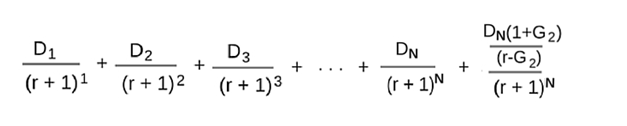

The two stage dividend discount model formula can be expressed as follows: Value = [∑(D0 * (1 + g1)^t) / (1 + r)^t] + [(D0 * (1 + g1)^n * (1 + g2)) / (r – g2)] / (1 + r)^n. Let’s break down each component of this formula. D0 represents the current dividend per share. g1 is the dividend growth rate during the initial high-growth phase. g2 is the dividend growth rate during the subsequent stable-growth phase. ‘n’ signifies the number of years in the high-growth phase. ‘r’ denotes the required rate of return, also known as the discount rate. Selecting appropriate values for g1, g2, and r is paramount for an accurate valuation. The first part of the formula calculates the present value of the dividends during the high-growth period. It sums the present values of each dividend payment expected during this phase. The second part calculates the present value of all dividends from the stable growth period. This is based on the dividend expected at the beginning of the stable growth period. This value is then discounted back to the present. Summing these two components gives the estimated intrinsic value of the stock.

Applying the two stage dividend discount model formula requires careful consideration of each input. Accurately estimating these values will significantly impact the final valuation. A small change in ‘r’, g1, or g2, can lead to a large swing in the result. The two stage dividend discount model formula is a powerful tool. But, it’s important to remember that its accuracy is dependent on the quality of the inputs. This makes understanding how to estimate these inputs critical for successful stock valuation. The two stage dividend discount model formula can be a useful tool for investors. The two stage dividend discount model formula is used to calculate the present value of future dividends.

Estimating Growth Rates and Discount Rates: Key Inputs for Accuracy

Estimating growth rates and discount rates accurately is crucial when applying the two stage dividend discount model formula. These inputs significantly influence the calculated intrinsic value. The high-growth rate (g1) estimation often involves analyzing various factors. Analyst forecasts provide valuable insights, reflecting expert opinions on a company’s future performance. Historical growth rates offer a backward-looking perspective, but should be adjusted for future expectations. A common technique involves using the retention ratio multiplied by the return on equity (ROE). This method connects earnings reinvestment with growth potential. It is important to consider the sustainability of high growth. Can the company maintain this pace over the entire high-growth phase (n)? Consider factors like competitive advantages, market size, and potential disruptions.

Determining a sustainable growth rate (g2) for the stable phase requires a different approach in the two stage dividend discount model formula. This rate should reflect long-term, achievable growth. It typically aligns with the overall economic growth rate. Gross Domestic Product (GDP) growth serves as a reasonable benchmark. Industry average growth rates provide another reference point. A company cannot sustainably grow faster than the economy indefinitely. This is because it would eventually consume the entire market. The required rate of return (r), or discount rate, reflects the risk associated with investing in the company. The Capital Asset Pricing Model (CAPM) is a widely used method for its calculation. CAPM relates a stock’s risk to its expected return. The formula is: r = Risk-Free Rate + Beta * (Market Risk Premium). The risk-free rate represents the return on a risk-free investment, such as a government bond. Beta measures the stock’s volatility relative to the market. The market risk premium reflects the additional return investors require for investing in the market over a risk-free asset. Other models, such as multifactor models, can also be used to determine ‘r’.

Selecting appropriate values for g1, g2, and r requires careful consideration. A thorough analysis enhances the accuracy of the two stage dividend discount model formula. It is also important to understand the sensitivity of the model to these inputs. Small changes can lead to significant valuation differences. Consider a sensitivity analysis to assess the impact of various assumptions. This will help to refine the valuation and understand its potential range. Remember that the two stage dividend discount model formula is a tool. Its effectiveness depends on the quality of the inputs and the understanding of its limitations.

Illustrative Examples: Bringing the Two-Phase DDM to Life

To illustrate the application of the two stage dividend discount model formula, consider two hypothetical companies: “GrowthTech Inc.” and “SteadyYield Corp.” GrowthTech Inc. is a technology company expected to experience rapid growth in its initial years, while SteadyYield Corp. is a mature utility company with stable, predictable dividends.

Example 1: GrowthTech Inc. Assume GrowthTech Inc. currently pays a dividend of $1.00 per share (D0). Analysts project a high-growth phase (g1) of 15% for the next 5 years (n). After this period, the growth rate is expected to decline to a stable 3% (g2). The required rate of return (r) is estimated at 10%. Using the two stage dividend discount model formula, the present value of dividends during the high-growth phase is calculated by discounting each year’s projected dividend back to the present. Following year 5, the terminal value, representing the present value of all future dividends growing at the stable rate, is also calculated and discounted back to the present. Summing these present values provides the estimated intrinsic value of GrowthTech Inc.’s stock. The importance of selecting the right valuation model based on GrowthTech Inc’s specific characteristics highlights the versatility of the two stage dividend discount model formula.

Example 2: SteadyYield Corp. SteadyYield Corp. currently pays a dividend of $3.00 per share (D0). Its dividends are expected to grow at a steady rate of 4% (g1) for the next 3 years (n), before stabilizing at a long-term growth rate (g2) of 2%. Given its lower risk profile, the required rate of return (r) is 7%. Applying the two stage dividend discount model formula, the present value of the dividends during the initial growth phase and the present value of the terminal value are calculated. The sum represents the intrinsic value of SteadyYield Corp.’s stock. A critical aspect of the two stage dividend discount model formula is understanding how different growth rates, tailored to different company profiles, directly impact the final stock valuation. The two stage dividend discount model formula provides a structured approach to valuation. This allows for varying growth expectations over different phases of a company’s life cycle.

Sensitivity Analysis: Understanding the Impact of Key Assumptions

Performing sensitivity analysis is a critical step when using the two stage dividend discount model formula. This process allows analysts to understand how changes in key inputs affect the calculated intrinsic value of a stock. Given the reliance of the two-stage DDM on forecasts, it’s essential to assess the impact of potential errors in these estimations. Small adjustments to growth rates or the discount rate can lead to significant variations in the final stock valuation.

The two stage dividend discount model formula heavily relies on g1 (high-growth phase growth rate), g2 (stable-growth phase growth rate), and r (required rate of return). Estimating these values involves inherent uncertainty. For example, projecting a company’s high-growth rate (g1) over several years can be challenging due to evolving market conditions and competitive landscapes. Similarly, determining the appropriate discount rate (r) is subjective and depends on assumptions about risk premiums and market conditions. The stable growth rate (g2) should reflect a rate that the company can maintain indefinitely; typically, this rate is aligned with long-term economic growth. A sensitivity analysis clarifies how the intrinsic value changes with these variables.

One effective method for conducting sensitivity analysis involves creating a table that displays the intrinsic value of the stock under different scenarios. For example, the table could show the stock’s value with g1 varying by plus or minus 1%, g2 varying by plus or minus 0.5%, and r varying by plus or minus 0.5%. Presenting the data graphically can also provide a quick visual understanding of the model’s sensitivity. Another approach is to create scenarios that reflect optimistic, pessimistic, and most likely outcomes, then evaluate the range of stock values produced. By performing a thorough sensitivity analysis, users of the two stage dividend discount model formula can gain a better understanding of its limitations and the importance of making well-informed assumptions. Recognizing the sensitivity of the two stage dividend discount model formula empowers investors to make more robust and adaptable investment decisions.

Beyond the Formula: Limitations and Considerations of the Two-Stage DDM

The two-stage Dividend Discount Model (DDM), while a valuable tool, possesses inherent limitations that should be carefully considered. Its accuracy hinges significantly on the reliability of future projections, a factor that introduces a degree of uncertainty. Accurately estimating growth rates (g1 and g2) and the discount rate (r) presents a considerable challenge, as these inputs are subject to market volatility and company-specific factors. Minute variations in these key assumptions can substantially impact the calculated intrinsic value, underscoring the importance of rigorous analysis and sensitivity testing. The two stage dividend discount model formula relies on estimations about the future, which are not always precise.

Furthermore, the two-stage DDM may exhibit insensitivity to short-term market fluctuations. It primarily focuses on long-term dividend trends, potentially overlooking the influence of immediate market sentiment or temporary economic events. Therefore, the model is best suited for valuing companies with well-defined dividend policies and relatively predictable growth patterns. Companies experiencing volatile earnings or those in rapidly changing industries may not be ideal candidates for this valuation approach. It’s also important to acknowledge that the two stage dividend discount model formula is not a one-size-fits-all solution. The appropriate application depends on the company’s specific characteristics.

It’s essential to recognize that the two-stage dividend discount model formula represents just one perspective in the broader landscape of valuation techniques. Alternative methods, such as relative valuation (using P/E ratios, price-to-book ratios, etc.), offer complementary insights and can provide a more comprehensive assessment of a stock’s worth. These methods often consider market sentiment and comparable company data, offering a different lens through which to evaluate investment opportunities. In conclusion, a holistic approach that integrates various valuation methods is crucial for making informed investment decisions, recognizing both the strengths and weaknesses of each technique, including the two stage dividend discount model formula.

Refinements and Extensions: Exploring More Complex Dividend Models

The two-stage Dividend Discount Model is a valuable tool for stock valuation, but it operates under specific assumptions about a company’s growth trajectory. Real-world companies often exhibit more nuanced growth patterns that a simple two-stage model might not fully capture. This necessitates exploring more advanced dividend discount models, such as the H-Model or three-stage DDM, to refine valuation accuracy. The two stage dividend discount model formula serves as a foundation, but these extensions address its limitations.

The H-Model, for example, assumes a linear decline in the growth rate from a high initial rate to a stable, long-term rate. This model is particularly useful for companies experiencing a gradual deceleration in growth. In contrast, a three-stage DDM incorporates an additional phase, often representing an initial period of super-normal growth, followed by a declining growth phase, and finally, a stable growth phase. This is relevant for companies with significant near-term growth catalysts. These models build upon the core principles of the two stage dividend discount model formula, offering increased flexibility. Choosing the appropriate model depends heavily on understanding the specific growth dynamics of the company under analysis.

The decision to employ a two-stage DDM, the H-Model, a three-stage DDM, or even more complex variations rests on the characteristics of the dividend stream and projected growth. While the two stage dividend discount model formula provides a strong starting point, more intricate models can offer a more precise valuation when dealing with companies exhibiting complex growth patterns. Ultimately, the key lies in selecting the valuation method that best reflects the anticipated future performance and dividend policy of the company. By carefully considering these factors, analysts can improve the reliability and relevance of their stock valuations. It is important to acknowledge that all models are simplifications of reality and come with inherent limitations.