Understanding the Two-Stage Dividend Discount Model

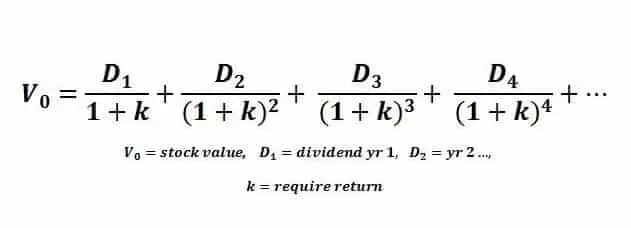

The two-stage dividend discount model is a widely used valuation technique in dividend investing, allowing investors to estimate a stock’s intrinsic value based on its dividend payments and growth rate. This model is particularly useful for investors seeking to generate passive income through dividend-paying stocks. By understanding the two-stage dividend discount model, investors can make more informed decisions about their investments and potentially achieve higher returns. The model takes into account the stock’s current dividend payment, expected growth rate, and required rate of return to estimate its intrinsic value. This approach provides a more accurate estimate of a stock’s value compared to other valuation methods, making it an essential tool for dividend investors. A reliable two-stage dividend discount model calculator can simplify the calculation process, saving investors time and reducing errors. By incorporating this model into their investment strategy, investors can gain a competitive edge in the market and achieve their long-term financial goals.

How to Choose the Right Calculator for Your Investment Needs

When selecting a two-stage dividend discount model calculator, it’s essential to consider several key features that can impact the accuracy and usability of the tool. Ease of use is a critical factor, as a complex calculator can lead to errors and frustration. Look for a calculator with an intuitive interface that allows you to easily input data and navigate the calculation process. Accuracy is also paramount, as small errors can significantly affect the estimated intrinsic value of a stock. Opt for a calculator that uses reliable data sources and has a proven track record of accuracy. Customization options are also important, as they enable you to tailor the calculator to your specific investment needs. For instance, some calculators may allow you to adjust the growth rate or required rate of return, providing a more nuanced estimate of a stock’s value. By considering these factors, investors can find a two-stage dividend discount model calculator that meets their needs and helps them make informed investment decisions.

The Benefits of Using a Two-Stage Dividend Discount Model Calculator

Utilizing a two-stage dividend discount model calculator can have a significant impact on an investor’s ability to make informed investment decisions. One of the primary advantages of using a calculator is the time it saves. By automating the complex calculation process, investors can quickly and easily estimate a stock’s intrinsic value, allowing them to focus on other aspects of their investment strategy. Additionally, a two-stage dividend discount model calculator reduces the risk of errors, which can occur when performing manual calculations. This increased accuracy enables investors to make more confident investment decisions, reducing the likelihood of costly mistakes. Furthermore, a calculator provides investors with a valuable tool for evaluating dividend stocks, identifying undervalued opportunities, and creating a diversified portfolio. By leveraging the power of a two-stage dividend discount model calculator, investors can gain a competitive edge in the market and achieve their long-term financial goals.

A Step-by-Step Guide to Using a Two-Stage Dividend Discount Model Calculator

To get the most out of a two-stage dividend discount model calculator, it’s essential to understand how to use it effectively. Here’s a step-by-step guide to help investors navigate the process:

Step 1: Gather Required Data – Collect the necessary data, including the stock’s current dividend per share, expected growth rate, and required rate of return. Ensure the data is accurate and up-to-date to ensure reliable results.

Step 2: Input Data into the Calculator – Enter the collected data into the two-stage dividend discount model calculator. Make sure to follow the calculator’s specific input guidelines to avoid errors.

Step 3: Calculate the Intrinsic Value – The calculator will generate an estimated intrinsic value of the stock based on the input data. Take note of this value, as it will serve as a basis for further analysis.

Step 4: Interpret the Results – Analyze the calculated intrinsic value in the context of the stock’s current market price. If the intrinsic value is higher than the market price, it may indicate an undervalued stock. Conversely, if the intrinsic value is lower, it may suggest an overvalued stock.

Step 5: Apply the Output to Investment Decisions – Use the calculated intrinsic value to inform investment decisions. For instance, investors may choose to buy undervalued stocks or sell overvalued ones. The two-stage dividend discount model calculator provides a valuable tool for evaluating dividend stocks and creating a diversified portfolio.

By following these steps, investors can unlock the full potential of a two-stage dividend discount model calculator and make more informed investment decisions. Remember to always use a reliable calculator and accurately input data to ensure the most accurate results.

Common Mistakes to Avoid When Using a Two-Stage Dividend Discount Model Calculator

While a two-stage dividend discount model calculator can be a powerful tool for investors, it’s essential to use it correctly to avoid common mistakes that can lead to inaccurate results. Here are some common errors to watch out for:

Incorrect Data Input – One of the most critical mistakes investors can make is inputting incorrect or outdated data into the calculator. Ensure that the data used is accurate and up-to-date to get reliable results.

Misinterpreting Results – Investors may misinterpret the calculated intrinsic value, leading to incorrect investment decisions. It’s crucial to understand the context of the results and consider other factors before making a decision.

Ignoring Assumptions – The two-stage dividend discount model calculator relies on certain assumptions, such as the expected growth rate and required rate of return. Investors should be aware of these assumptions and their limitations to avoid misusing the calculator.

Not Considering Other Factors – The calculator provides a single estimate of a stock’s intrinsic value. Investors should consider other factors, such as market trends, economic conditions, and company performance, to make a comprehensive investment decision.

Overreliance on the Calculator – While a two-stage dividend discount model calculator is a valuable tool, investors should not rely solely on its output. It’s essential to combine the calculator’s results with other forms of analysis and research to make informed investment decisions.

By being aware of these common mistakes, investors can avoid errors and get the most out of a two-stage dividend discount model calculator. Remember to always use the calculator in conjunction with other forms of analysis and research to make informed investment decisions.

Real-World Applications of the Two-Stage Dividend Discount Model Calculator

The two-stage dividend discount model calculator is a versatile tool that can be applied to various real-world scenarios, providing investors with valuable insights to make informed investment decisions. Here are some examples of how the calculator can be used:

Evaluating Dividend Stocks – The calculator can be used to estimate the intrinsic value of dividend stocks, helping investors identify undervalued or overvalued opportunities. By comparing the calculated intrinsic value with the stock’s current market price, investors can make informed decisions about whether to buy, sell, or hold the stock.

Identifying Undervalued Opportunities – The two-stage dividend discount model calculator can help investors identify undervalued dividend stocks that have the potential for long-term growth. By analyzing the calculator’s output, investors can uncover hidden gems that may not be reflected in the current market price.

Creating a Diversified Portfolio – The calculator can be used to evaluate the intrinsic value of multiple dividend stocks, enabling investors to create a diversified portfolio that aligns with their investment goals and risk tolerance. By combining the calculator’s output with other forms of analysis, investors can build a robust portfolio that minimizes risk and maximizes returns.

Comparing Investment Opportunities – The two-stage dividend discount model calculator can be used to compare the intrinsic value of different dividend stocks, enabling investors to make informed decisions about which stocks to invest in. By analyzing the calculator’s output, investors can identify the most promising opportunities and allocate their resources accordingly.

By applying the two-stage dividend discount model calculator to real-world scenarios, investors can unlock the full potential of dividend investing and achieve their long-term financial goals. Whether it’s evaluating dividend stocks, identifying undervalued opportunities, or creating a diversified portfolio, the calculator provides a valuable tool for making informed investment decisions.

Comparing Different Two-Stage Dividend Discount Model Calculators

With the increasing popularity of dividend investing, numerous two-stage dividend discount model calculators have emerged, each with its unique features, pricing, and user reviews. When selecting a calculator, it’s essential to compare and contrast different options to find the one that best suits your investment needs. Here’s a comprehensive comparison of different two-stage dividend discount model calculators:

Features – Some calculators offer advanced features, such as customizable inputs, detailed reports, and scenario analysis, while others provide a more straightforward calculation. Consider the features you need and whether the calculator can accommodate your requirements.

Pricing – Two-stage dividend discount model calculators vary in pricing, ranging from free online tools to premium software with subscription fees. Evaluate the cost-benefit ratio and determine whether the calculator’s features justify the cost.

User Reviews – Read user reviews and ratings to gauge the calculator’s accuracy, ease of use, and customer support. This will help you identify any potential issues or limitations with the calculator.

Accuracy – The accuracy of the calculator is crucial in providing reliable results. Look for calculators that have been tested and validated by financial experts or institutions.

Customization Options – A good two-stage dividend discount model calculator should offer customization options to accommodate different investment scenarios and strategies. Consider whether the calculator allows you to input specific dividend growth rates, discount rates, or other parameters.

By comparing different two-stage dividend discount model calculators, investors can make an informed decision about which calculator to use. Whether you’re a seasoned investor or just starting out, a reliable calculator can help you unlock the power of dividend investing and achieve your long-term financial goals.

Maximizing Your Investment Returns with a Two-Stage Dividend Discount Model Calculator

In today’s fast-paced investment landscape, having a reliable two-stage dividend discount model calculator is crucial for making informed investment decisions. By incorporating a calculator into a comprehensive investment strategy, investors can unlock the full potential of dividend investing and achieve their long-term financial goals.

A two-stage dividend discount model calculator provides a powerful tool for evaluating dividend stocks, identifying undervalued opportunities, and creating a diversified portfolio. By accurately estimating a stock’s intrinsic value, investors can make informed decisions about whether to buy, sell, or hold a particular stock.

Moreover, a reliable calculator can help investors avoid common pitfalls, such as incorrect data input or misinterpreting results. By following a step-by-step guide to using a two-stage dividend discount model calculator, investors can ensure that they are using the calculator effectively and making the most of its features.

In addition, a two-stage dividend discount model calculator can be applied to various real-world scenarios, providing investors with a versatile tool for navigating the complexities of dividend investing. Whether it’s evaluating dividend stocks, identifying undervalued opportunities, or creating a diversified portfolio, a reliable calculator can help investors achieve their investment objectives.

By leveraging the power of a two-stage dividend discount model calculator, investors can maximize their investment returns and achieve long-term financial success. With its ability to estimate a stock’s intrinsic value, identify undervalued opportunities, and provide a framework for making informed investment decisions, a reliable calculator is an essential tool for any serious investor.