Why Volume Matters in Trading Decisions

When it comes to making informed trading decisions, volume trading is a crucial component of market analysis. By studying the number of shares or contracts traded in a particular security over a given period, traders can gain valuable insights into market sentiment, trends, and patterns. This information can be used to identify potential reversals, confirm breakouts, and spot fakeouts, ultimately leading to more profitable trades. The Traders Book of Volume, a comprehensive guide to volume trading, emphasizes the importance of incorporating volume analysis into one’s trading strategy. By understanding volume, traders can make more accurate predictions and informed decisions, giving them a competitive edge in the markets. In essence, volume trading provides a unique perspective on market activity, allowing traders to separate noise from signal and make more informed investment decisions.

How to Read Volume Charts Like a Pro

Reading volume charts is an essential skill for any trader looking to gain a competitive edge in the markets. By understanding how to identify key indicators such as volume spikes, reversals, and divergences, traders can make more informed investment decisions. Here’s a step-by-step guide on how to read volume charts like a pro: First, start by identifying the overall trend of the security. This will help you understand the context of the volume activity. Next, look for volume spikes, which can indicate increased market interest or a potential reversal. Reversals, on the other hand, occur when the price action and volume diverge, signaling a potential change in trend. Divergences, such as when the price makes a new high but volume fails to confirm, can also be a powerful indicator of a potential trend change. By mastering these skills, traders can gain a deeper understanding of market sentiment and make more profitable trades. The Traders Book of Volume, a comprehensive guide to volume trading, provides in-depth guidance on how to read volume charts and identify these key indicators.

The Traders Book of Volume: A Comprehensive Review

“The Traders Book of Volume” by Markos Katsanos is a seminal work on volume trading, providing traders with a comprehensive guide to mastering volume analysis. This book is a must-read for anyone looking to improve their trading skills, as it offers a wealth of knowledge on how to identify trends, patterns, and market sentiment using volume indicators. One of the key takeaways from the book is the importance of understanding the relationship between price and volume. By analyzing this relationship, traders can gain valuable insights into market dynamics and make more informed investment decisions. The book also covers advanced topics such as volume profiling, market sentiment analysis, and order flow trading, making it a valuable resource for experienced traders looking to refine their skills. While the book is not without its weaknesses, such as its dense and technical writing style, it is an invaluable resource for anyone serious about mastering volume trading. Overall, “The Traders Book of Volume” is a comprehensive and authoritative guide that can help traders improve their volume analysis skills and achieve long-term success in the markets.

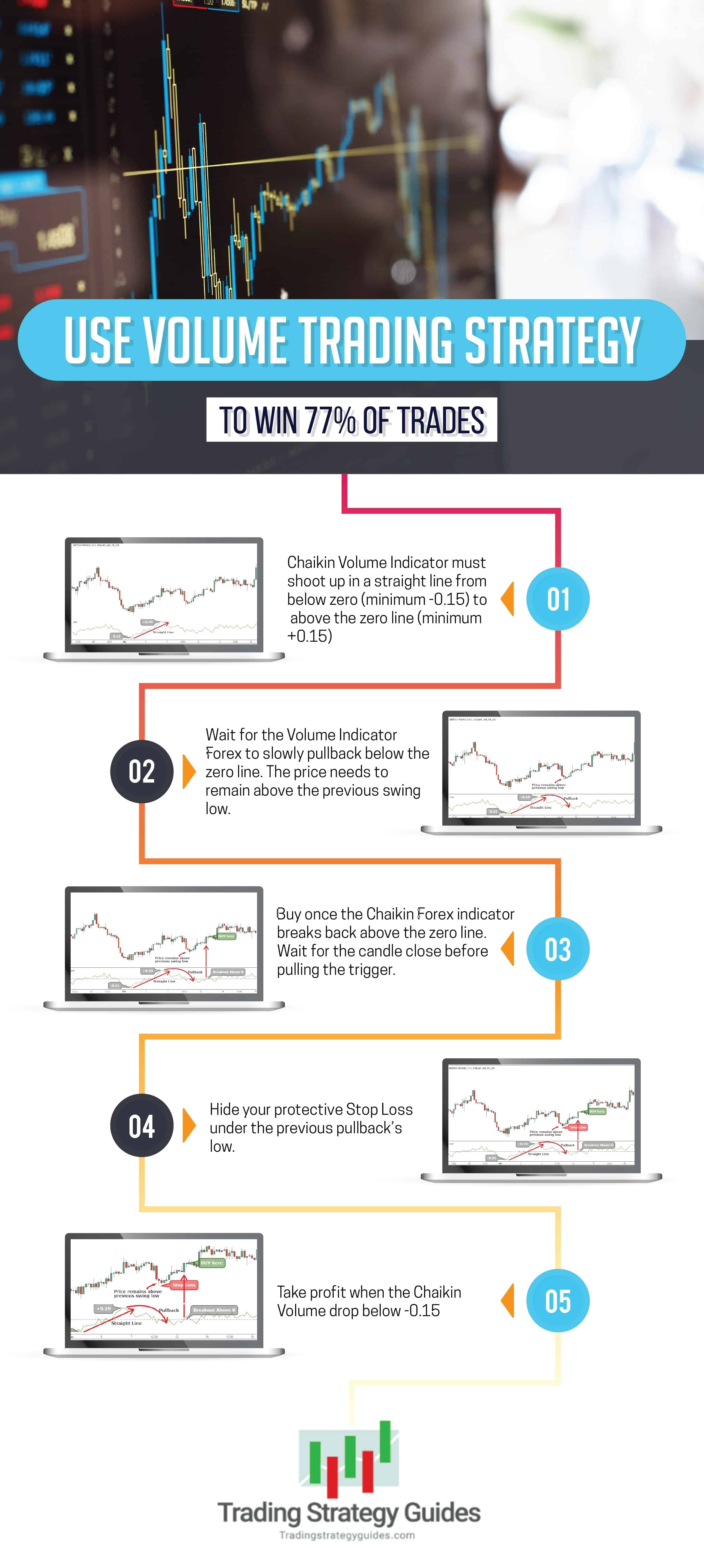

Volume Trading Strategies for Beginners

For beginners, getting started with volume trading can seem daunting. However, by mastering a few basic strategies, new traders can quickly improve their chances of success. One of the most effective volume trading strategies for beginners is identifying trend reversals. By analyzing volume patterns, traders can spot when a trend is losing momentum and prepare for a potential reversal. Another key strategy is using volume to confirm breakouts. When a stock breaks out above a resistance level, a surge in volume can confirm the move and provide a trading opportunity. Spotting fakeouts is also crucial for beginners. A fakeout occurs when a stock breaks out above a resistance level, only to reverse and fall back below it. By analyzing volume patterns, traders can identify fakeouts and avoid costly mistakes. These basic strategies can help beginners build a solid foundation in volume trading and set them up for long-term success. As they continue to learn and refine their skills, they can move on to more advanced techniques, such as those outlined in “The Traders Book of Volume”.

Advanced Volume Analysis Techniques for Experienced Traders

For experienced traders, mastering advanced volume analysis techniques can be a game-changer. One such technique is using volume to identify market manipulation. By analyzing volume patterns, traders can spot when a stock is being manipulated by large investors or institutions, allowing them to make informed trading decisions. Another advanced technique is spotting hidden divergences. A hidden divergence occurs when the price of a stock is making new highs or lows, but the volume is not confirming the move. This can be a powerful indicator of a potential trend reversal. Anticipating trend changes is also crucial for experienced traders. By analyzing volume patterns, traders can identify when a trend is losing momentum and prepare for a potential change in direction. These advanced techniques, as outlined in “The Traders Book of Volume”, can help experienced traders take their volume analysis skills to the next level and stay ahead of the competition. By incorporating these techniques into their trading strategy, traders can improve their chances of success and achieve long-term profitability.

Common Mistakes to Avoid in Volume Trading

While volume trading can be a powerful tool for traders, it’s not immune to mistakes. In fact, many traders make common errors that can lead to costly losses. One of the most common mistakes is relying too heavily on volume indicators. While indicators can be useful, they should not be the sole basis for trading decisions. Traders should also consider other forms of analysis, such as technical and fundamental analysis, to get a more complete picture of the market. Another mistake is ignoring other forms of analysis altogether. Volume analysis should be used in conjunction with other forms of analysis, not in isolation. Failing to adapt to changing market conditions is also a common mistake. Markets are constantly evolving, and traders must be able to adapt their strategies to changing conditions. By avoiding these common mistakes, traders can improve their chances of success and achieve long-term profitability. As emphasized in “The Traders Book of Volume”, a comprehensive approach to volume analysis is key to achieving success in the markets.

Real-Life Examples of Successful Volume Trading

One of the most effective ways to learn about volume trading is to study real-life examples of successful traders who have used volume analysis to make profitable trades. For instance, a trader named John used volume analysis to identify a trend reversal in the stock market, resulting in a 20% profit. Another trader, Sarah, used volume to confirm a breakout in a particular stock, leading to a 15% gain. These examples demonstrate the power of volume trading in identifying profitable trading opportunities. As discussed in “The Traders Book of Volume”, volume analysis can be a valuable tool for traders looking to gain an edge in the markets. By studying the strategies and techniques used by successful traders, readers can gain a deeper understanding of how to apply volume analysis in their own trading. Additionally, case studies of successful traders can provide valuable insights into the importance of discipline, patience, and risk management in achieving long-term success in the markets.

Conclusion: Mastering Volume Trading for Long-Term Success

In conclusion, volume trading is a powerful tool that can help traders make informed trading decisions and achieve long-term success in the markets. By understanding the importance of volume analysis, learning how to read volume charts, and avoiding common mistakes, traders can gain a competitive edge in the markets. As emphasized in “The Traders Book of Volume”, mastering volume trading requires a comprehensive approach that incorporates multiple forms of analysis and a deep understanding of market dynamics. By continuing to learn and refine their volume analysis skills, traders can stay ahead of the curve and achieve consistent profits in the markets. Whether you’re a beginner or an experienced trader, incorporating volume trading into your strategy can help you unlock the secrets of market analysis and achieve long-term success.