What Drives Investment Returns: Understanding the SML

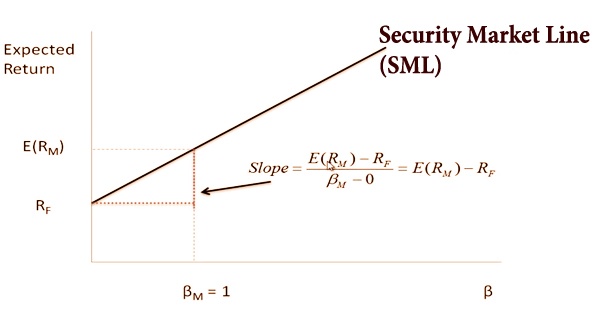

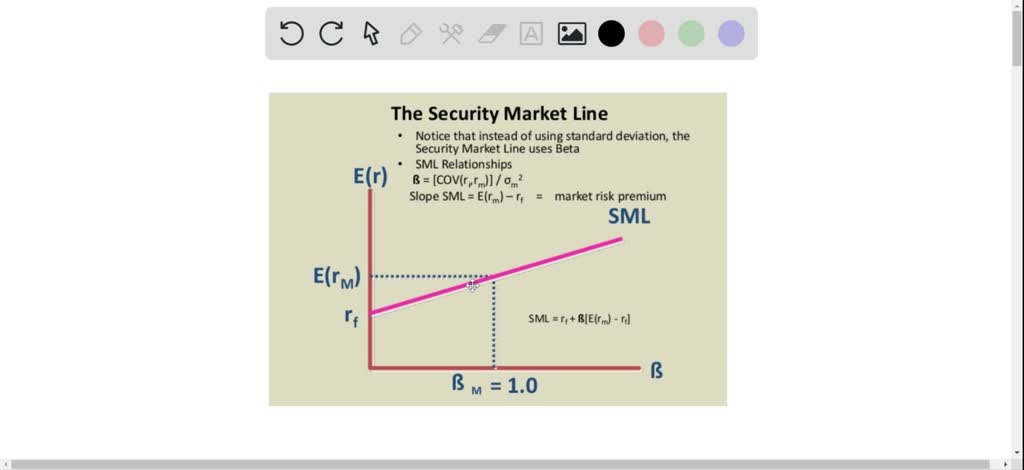

The Security Market Line (SML) is a fundamental concept in finance that helps investors understand the relationship between risk and expected returns. By plotting the expected returns of various investments against their respective levels of risk, the SML provides a visual representation of the tradeoff between risk and return. This powerful tool enables investors to make informed decisions about their portfolios, as it illustrates that investments with higher potential returns typically come with higher levels of risk. The slope of the security market line is the market risk premium, which represents the excess return required by investors for taking on additional risk. Understanding the SML is crucial for investors, as it allows them to assess the potential returns of an investment and make informed decisions about their portfolios. In essence, the SML serves as a guide for investors to navigate the complex world of finance and make more informed investment decisions.

Measuring Risk and Return: The Slope of the SML Revealed

The slope of the Security Market Line (SML) is a critical component of the SML, representing the market risk premium. This slope measures the excess return required by investors for taking on additional risk. In other words, it quantifies the tradeoff between risk and return. The slope of the security market line is the market risk premium, which is a fundamental concept in finance. To calculate the slope of the SML, investors can use the Capital Asset Pricing Model (CAPM) formula, which is: Slope = (Expected Return of the Market – Risk-Free Rate) / Market Risk. By understanding the slope of the SML, investors can make more informed decisions about their investments, as it provides a framework for evaluating the potential returns of an investment relative to its level of risk. For instance, a steeper slope indicates that investors require a higher return for taking on additional risk, while a flatter slope suggests that investors are more willing to accept lower returns for lower levels of risk.

How to Calculate the Slope of the SML: A Step-by-Step Guide

To calculate the slope of the Security Market Line (SML), investors can follow a simple step-by-step process. The slope of the security market line is the market risk premium, which represents the excess return required by investors for taking on additional risk. Here’s how to calculate it:

Step 1: Determine the Expected Return of the Market (E(Rm)) – This is the expected return of the overall market, which can be estimated using historical data or market indices.

Step 2: Determine the Risk-Free Rate (Rf) – This is the return of a risk-free investment, such as a U.S. Treasury bond.

Step 3: Determine the Market Risk (σm) – This is a measure of the overall market risk, which can be estimated using historical data or market indices.

Step 4: Calculate the Slope of the SML using the CAPM formula: Slope = (E(Rm) – Rf) / σm

For example, if the expected return of the market is 10%, the risk-free rate is 2%, and the market risk is 15%, the slope of the SML would be: Slope = (10% – 2%) / 15% = 0.53

By following these steps, investors can calculate the slope of the SML and gain a better understanding of the relationship between risk and return. This can help inform investment decisions and optimize portfolio performance.

The Impact of Market Conditions on the SML Slope

Market conditions play a significant role in shaping the slope of the Security Market Line (SML). The slope of the security market line is the market risk premium, which represents the excess return required by investors for taking on additional risk. As market conditions change, the slope of the SML adjusts accordingly, influencing investment decisions and portfolio performance.

In times of economic downturns, the slope of the SML tends to steepen, indicating that investors require a higher return for taking on additional risk. This is because investors become more risk-averse during economic downturns, demanding higher returns to compensate for the increased uncertainty. Conversely, during economic upswings, the slope of the SML tends to flatten, as investors become more willing to take on risk in pursuit of higher returns.

For example, during the 2008 financial crisis, the slope of the SML steepened significantly, as investors sought higher returns to compensate for the increased risk. In contrast, during the post-crisis period, the slope of the SML flattened, as investors became more confident in the market and willing to take on more risk.

Understanding how market conditions affect the slope of the SML is crucial for investors, as it enables them to adjust their strategies accordingly. By recognizing the impact of market conditions on the slope of the SML, investors can make more informed decisions about their investments, optimize their portfolios, and manage risk more effectively.

For instance, during times of economic uncertainty, investors may choose to diversify their portfolios, reducing their exposure to riskier assets and increasing their allocation to safer assets. Conversely, during times of economic growth, investors may choose to take on more risk, increasing their allocation to riskier assets in pursuit of higher returns.

By recognizing the dynamic relationship between market conditions and the slope of the SML, investors can stay ahead of the curve, making informed decisions that drive investment success.

Comparing the SML Slope to Other Financial Metrics

In the realm of finance, various metrics are used to measure risk and return. The slope of the Security Market Line (SML) is one such metric, but how does it compare to other financial metrics? In this section, we’ll delve into the similarities and differences between the slope of the SML and other prominent financial metrics, including the Capital Asset Pricing Model (CAPM) and the beta coefficient.

The CAPM is a theoretical framework that describes the relationship between risk and expected return. Like the SML, the CAPM is based on the idea that investors demand a higher return for taking on additional risk. However, the CAPM is more focused on individual assets, whereas the SML is a broader market-based metric. The CAPM is often used to estimate the expected return of an asset, whereas the slope of the SML is used to estimate the market risk premium.

The beta coefficient, on the other hand, is a measure of an asset’s systematic risk, or its sensitivity to market movements. A beta of 1 indicates that the asset moves in line with the market, while a beta greater than 1 indicates higher volatility. The slope of the SML is related to the beta coefficient, as it represents the market risk premium that investors demand for taking on additional risk. However, the beta coefficient is a more asset-specific metric, whereas the slope of the SML is a market-wide metric.

While these metrics share some similarities, they each have their strengths and limitations. The CAPM is a useful tool for estimating expected returns, but it relies on certain assumptions that may not always hold true. The beta coefficient is a useful measure of systematic risk, but it can be influenced by various factors, including market conditions and investor sentiment. The slope of the SML, on the other hand, provides a broader market perspective, but it can be affected by changes in market conditions and investor attitudes towards risk.

By understanding the similarities and differences between these financial metrics, investors can gain a more comprehensive understanding of risk and return. By combining these metrics, investors can develop a more nuanced approach to investment decision-making, one that takes into account the complexities of the market and the ever-changing nature of risk and return.

Real-World Applications of the SML Slope

In the world of finance, the slope of the Security Market Line (SML) is not just a theoretical concept, but a practical tool used by investors to make informed decisions. The slope of the SML has numerous real-world applications, from portfolio optimization to risk management. In this section, we’ll explore how the slope of the SML is used in real-world investment decisions.

One of the primary applications of the slope of the SML is in portfolio optimization. By understanding the slope of the SML, investors can determine the optimal mix of assets in their portfolio, balancing risk and return. For example, an investor may use the slope of the SML to determine the optimal allocation of stocks and bonds in their portfolio, taking into account their risk tolerance and investment goals.

The slope of the SML is also used in risk management. By understanding the market risk premium, investors can adjust their portfolios to manage risk more effectively. For instance, during times of economic uncertainty, an investor may use the slope of the SML to reduce their exposure to riskier assets and increase their allocation to safer assets.

In addition, the slope of the SML is used in asset pricing models, such as the Capital Asset Pricing Model (CAPM). The CAPM uses the slope of the SML to estimate the expected return of an asset, taking into account its beta coefficient and the market risk premium.

The slope of the SML is also used in performance evaluation, where it serves as a benchmark for evaluating the performance of investment managers. By comparing the returns of an investment manager to the slope of the SML, investors can determine whether the manager has generated excess returns or simply taken on additional risk.

In conclusion, the slope of the SML is a powerful tool with numerous real-world applications. By understanding the slope of the SML, investors can make more informed decisions, optimize their portfolios, and manage risk more effectively. Whether it’s portfolio optimization, risk management, asset pricing, or performance evaluation, the slope of the SML is an essential concept in the world of finance.

Common Misconceptions About the SML Slope Debunked

Despite its importance in finance, the slope of the Security Market Line (SML) is often misunderstood or misinterpreted. In this section, we’ll address common misconceptions or myths about the slope of the SML, providing evidence and explanations to set the record straight.

Misconception 1: The slope of the SML is a fixed value.

This is a common myth that can lead to poor investment decisions. The slope of the SML is not a fixed value, but rather a dynamic measure that changes over time in response to market conditions. It’s essential to regularly update and adjust the slope of the SML to reflect changing market conditions.

Misconception 2: The slope of the SML only applies to stocks.

This misconception is far from the truth. The slope of the SML applies to all types of assets, including bonds, commodities, and even real estate. It’s a universal concept that helps investors understand the relationship between risk and expected returns across different asset classes.

Misconception 3: The slope of the SML is only relevant for individual investors.

This is another myth that needs to be debunked. The slope of the SML is relevant for all types of investors, including institutional investors, portfolio managers, and even financial analysts. It’s a powerful tool that helps investors make informed decisions and optimize their portfolios.

Misconception 4: The slope of the SML is a perfect predictor of investment returns.

This misconception is a classic example of overreliance on a single metric. While the slope of the SML is a powerful tool, it’s not a perfect predictor of investment returns. Other factors, such as market sentiment, economic indicators, and company-specific factors, also play a crucial role in determining investment returns.

By understanding the slope of the SML and debunking common misconceptions, investors can make more informed decisions and avoid costly mistakes. Remember, the slope of the SML is the: a dynamic measure that changes over time, a universal concept that applies to all asset classes, a relevant tool for all types of investors, and a powerful tool that should be used in conjunction with other metrics.

Mastering the SML Slope for Investment Success

In conclusion, understanding the slope of the Security Market Line (SML) is crucial for investment success. By grasping the concept of the SML and its significance in finance, investors can make informed decisions that balance risk and expected returns. The slope of the SML is the key to unlocking the secrets of the security market line, providing valuable insights into the market risk premium and its impact on investment returns.

To master the SML slope, investors should focus on the following best practices:

Firstly, regularly update and adjust the slope of the SML to reflect changing market conditions. This ensures that investment decisions are based on the most recent and relevant data.

Secondly, use the slope of the SML in conjunction with other financial metrics, such as the Capital Asset Pricing Model (CAPM) and the beta coefficient. This provides a more comprehensive understanding of the market and investment opportunities.

Thirdly, apply the slope of the SML to real-world investment decisions, such as portfolio optimization and risk management. This helps investors to make informed decisions that balance risk and expected returns.

Finally, avoid common misconceptions about the slope of the SML, such as the myth that it’s a fixed value or only applies to stocks. By understanding the true nature of the slope of the SML, investors can avoid costly mistakes and make more informed decisions.

In summary, the slope of the SML is the key to unlocking the secrets of the security market line. By mastering the SML slope, investors can make informed decisions that drive investment success. Remember, the slope of the SML is the: a dynamic measure that changes over time, a universal concept that applies to all asset classes, a relevant tool for all types of investors, and a powerful tool that should be used in conjunction with other metrics.