What is Beta and Why Does it Matter?

In the world of finance, beta is a crucial metric that measures the systematic risk of an investment. It is a fundamental component in understanding the market portfolio, which is a hypothetical portfolio that represents the overall market. The market portfolio has a beta of 1, which signifies that it moves in tandem with the overall market. In essence, beta is a numerical value that indicates the volatility of an investment relative to the market as a whole.

Beta is calculated by analyzing the historical returns of an investment and comparing them to the returns of the overall market. A beta of 1 implies that the investment moves in line with the market, while a beta greater than 1 indicates higher volatility, and a beta less than 1 indicates lower volatility. This metric is essential for investors and portfolio managers, as it helps them assess the risk associated with a particular investment and make informed decisions about their portfolio construction.

The significance of beta lies in its ability to provide a standardized measure of risk, allowing investors to compare the risk profiles of different investments. This is particularly important when evaluating the performance of the market portfolio, which serves as a benchmark for investment performance. By understanding the beta of the market portfolio, investors can gain valuable insights into the overall market and make more informed investment decisions.

Understanding the Market Portfolio and its Beta

The market portfolio is a hypothetical portfolio that represents the overall market, comprising a diversified mix of assets that mirrors the market’s composition. It is a crucial concept in finance, serving as a benchmark for investment performance and providing a framework for understanding the behavior of individual investments. The market portfolio has a beta of 1, which signifies that it moves in tandem with the overall market.

The composition of the market portfolio is a critical factor in determining its beta. It is typically constructed by combining a broad range of assets, including stocks, bonds, and other securities, in proportion to their market capitalization. This diversified approach helps to minimize risk and maximize returns, making the market portfolio an attractive benchmark for investors. The characteristics of the market portfolio that influence its beta include its diversification, market capitalization, and the correlation between its constituent assets.

As a benchmark, the market portfolio provides a standardized measure of investment performance, allowing investors to evaluate the success of their portfolios relative to the overall market. By understanding the beta of the market portfolio, investors can gain valuable insights into the risk profile of their investments and make more informed decisions about their portfolio construction. The market portfolio’s beta of 1 serves as a reference point, enabling investors to assess the relative risk of their investments and adjust their portfolios accordingly.

How to Calculate the Beta of the Market Portfolio

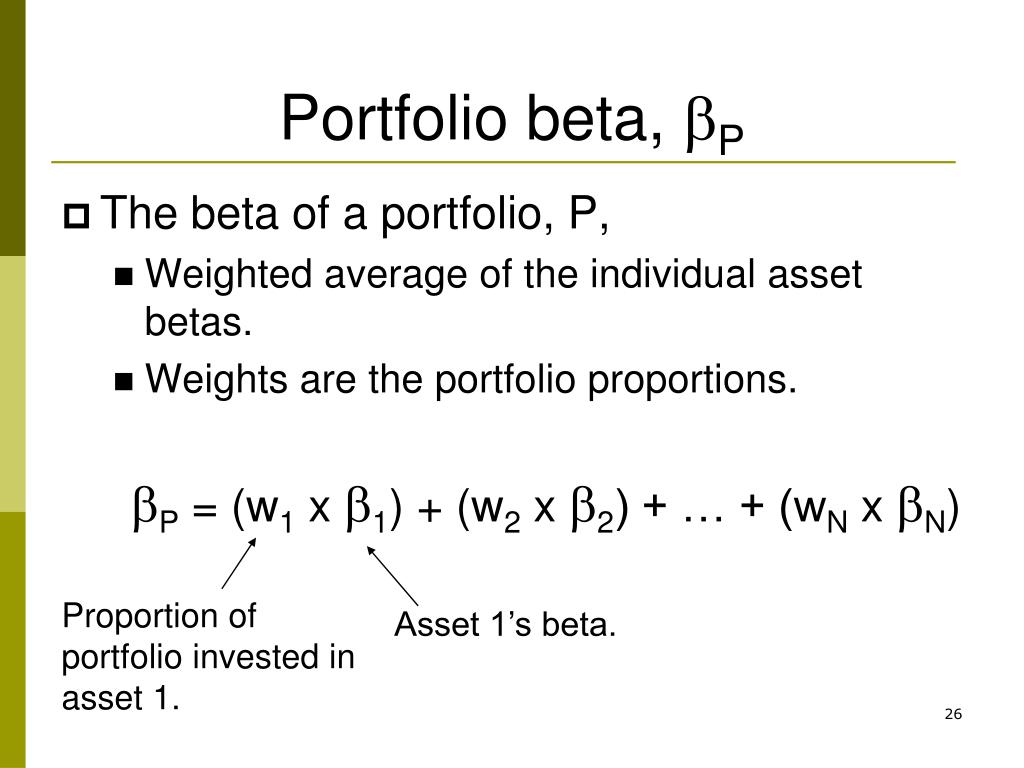

Calculating the beta of the market portfolio is a crucial step in understanding its risk profile and investment implications. The beta of the market portfolio is typically calculated using historical data on the returns of the overall market and the returns of a specific investment. The market portfolio has a beta of 1, which serves as a reference point for evaluating the risk of individual investments.

The calculation of beta involves the following steps:

1. Collect historical data on the returns of the overall market (e.g., S&P 500 index) and the returns of a specific investment.

2. Calculate the covariance between the market returns and the investment returns.

3. Calculate the variance of the market returns.

4. Divide the covariance by the variance to obtain the beta value.

The formula for calculating beta is:

β = Cov(Rm, Ri) / Var(Rm)

Where:

β = beta of the investment

Rm = returns of the overall market

Ri = returns of the specific investment

Cov(Rm, Ri) = covariance between the market returns and the investment returns

Var(Rm) = variance of the market returns

For example, let’s say we want to calculate the beta of a stock using historical data on the S&P 500 index and the stock’s returns. If the covariance between the market returns and the stock returns is 0.05, and the variance of the market returns is 0.01, then the beta of the stock would be:

β = 0.05 / 0.01 = 5

This means that the stock has a beta of 5, indicating that it is five times more volatile than the overall market.

By understanding how to calculate the beta of the market portfolio, investors can gain valuable insights into the risk profile of their investments and make more informed decisions about their portfolio construction.

The Market Portfolio’s Beta: A Historical Perspective

The market portfolio’s beta has undergone significant changes over the years, influenced by various economic and market factors. Understanding the historical trends and patterns of the market portfolio’s beta is essential for investors to make informed decisions about their investments.

Historically, the market portfolio’s beta has fluctuated in response to changes in the overall market conditions. During periods of high market volatility, the beta of the market portfolio tends to increase, indicating higher systematic risk. Conversely, during periods of low market volatility, the beta of the market portfolio tends to decrease, indicating lower systematic risk.

For example, during the 2008 global financial crisis, the beta of the market portfolio increased significantly, reflecting the high level of market volatility and uncertainty. In contrast, during the post-crisis period, the beta of the market portfolio decreased, indicating a decrease in systematic risk.

Another significant factor that has impacted the market portfolio’s beta is the shift towards passive investing. The increasing popularity of index funds and ETFs has led to a decrease in the beta of the market portfolio, as these investments tend to track the overall market rather than attempting to beat it.

The market portfolio has a beta of 1, which serves as a benchmark for evaluating the risk of individual investments. However, the beta of the market portfolio can change over time, reflecting changes in the overall market conditions. Understanding these changes is crucial for investors to make informed decisions about their investments and to adjust their portfolios accordingly.

By examining the historical trends and patterns of the market portfolio’s beta, investors can gain valuable insights into the risk profile of their investments and make more informed decisions about their portfolio construction. This knowledge can help investors to optimize their portfolios, manage risk, and achieve their investment objectives.

What a Beta of 1 Means for the Market Portfolio

A beta of 1 is a unique characteristic of the market portfolio, indicating that it moves in tandem with the overall market. The market portfolio has a beta of 1, which means that its returns are perfectly correlated with the returns of the overall market.

The implications of a beta of 1 for the market portfolio are far-reaching. Firstly, it means that the market portfolio has a neutral risk profile, neither amplifying nor reducing the systematic risk of the overall market. This makes it an ideal benchmark for evaluating the performance of individual investments.

In terms of expected returns, a beta of 1 implies that the market portfolio’s returns are directly tied to the returns of the overall market. This means that investors can expect the market portfolio to generate returns that are in line with the overall market, without any additional risk or return premium.

From an investment strategy perspective, a beta of 1 implies that the market portfolio is a passive investment, tracking the overall market rather than attempting to beat it. This makes it an attractive option for investors who want to gain broad exposure to the market without taking on excessive risk.

The market portfolio’s beta of 1 also has implications for portfolio optimization and risk management. By including the market portfolio in a diversified portfolio, investors can reduce their overall risk exposure and increase their expected returns. This is because the market portfolio’s beta of 1 provides a stable anchor for the portfolio, reducing the impact of individual stock or sector risks.

In conclusion, a beta of 1 is a fundamental characteristic of the market portfolio, reflecting its neutral risk profile, expected returns, and investment implications. By understanding the significance of a beta of 1, investors can make more informed decisions about their investments and optimize their portfolios for better returns.

How to Use the Market Portfolio’s Beta in Investment Decisions

The market portfolio’s beta is a crucial metric that can inform investment decisions and optimize portfolio performance. By understanding the market portfolio’s beta, investors can make more informed decisions about asset allocation, risk management, and portfolio optimization.

One of the primary applications of the market portfolio’s beta is in portfolio optimization. By including the market portfolio in a diversified portfolio, investors can reduce their overall risk exposure and increase their expected returns. This is because the market portfolio’s beta of 1 provides a stable anchor for the portfolio, reducing the impact of individual stock or sector risks.

The market portfolio’s beta is also essential for risk management. By understanding the systematic risk of the market portfolio, investors can better manage their overall risk exposure and make more informed decisions about their investments. For example, investors can use the market portfolio’s beta to determine the optimal asset allocation for their portfolio, balancing risk and return to achieve their investment objectives.

In addition, the market portfolio’s beta can inform asset allocation decisions. By comparing the beta of individual assets or portfolios to the market portfolio’s beta, investors can determine the optimal mix of assets to achieve their investment objectives. For example, investors seeking to reduce their overall risk exposure may opt for a higher allocation to assets with a lower beta, while investors seeking to increase their returns may opt for a higher allocation to assets with a higher beta.

The market portfolio’s beta can also be used to evaluate the performance of individual investments or portfolios. By comparing the returns of an investment or portfolio to the returns of the market portfolio, investors can determine whether their investments are generating excess returns or underperforming the market. This information can be used to make adjustments to the portfolio, rebalancing or reallocating assets to optimize performance.

In conclusion, the market portfolio’s beta is a powerful tool that can inform investment decisions and optimize portfolio performance. By understanding the market portfolio’s beta, investors can make more informed decisions about asset allocation, risk management, and portfolio optimization, ultimately achieving their investment objectives.

Common Misconceptions about the Market Portfolio’s Beta

Despite its importance in finance, the market portfolio’s beta is often misunderstood or misinterpreted. This section aims to address common misconceptions or myths surrounding the market portfolio’s beta, providing clarity and correcting any misunderstandings.

One common misconception is that the market portfolio’s beta is a measure of total risk, rather than systematic risk. This is incorrect, as beta specifically measures the systematic risk of an investment, which is the risk that cannot be diversified away. Total risk, on the other hand, includes both systematic and unsystematic risk.

Another misconception is that a beta of 1 is somehow “better” or more desirable than a beta that is higher or lower. This is not necessarily true, as a beta of 1 simply indicates that the market portfolio moves in tandem with the overall market. A higher or lower beta may be more suitable for certain investment strategies or risk profiles.

Some investors also believe that the market portfolio’s beta is a fixed or constant value, rather than a dynamic metric that can change over time. This is incorrect, as the market portfolio’s beta can fluctuate in response to changes in market conditions, economic trends, or other factors.

Additionally, some investors may think that the market portfolio’s beta is only relevant for individual stocks or securities, rather than for portfolios or asset classes. This is not true, as the market portfolio’s beta can be applied to any investment or portfolio, providing valuable insights into its risk profile and expected returns.

Finally, some investors may believe that the market portfolio’s beta is a complex or abstract concept, only relevant for advanced finance professionals. This is not true, as the market portfolio’s beta is a fundamental concept that can be understood and applied by investors of all levels.

By addressing these common misconceptions, investors can gain a clearer understanding of the market portfolio’s beta and its importance in finance. By recognizing the market portfolio has a beta of 1, investors can make more informed decisions about their investments and optimize their portfolios for better returns.

Conclusion: The Market Portfolio’s Beta in Modern Finance

In conclusion, understanding the market portfolio’s beta is crucial for investors seeking to optimize their portfolios and make informed investment decisions. The market portfolio has a beta of 1, which indicates that it moves in tandem with the overall market, providing a benchmark for investment performance.

By grasping the concept of beta and its significance in finance, investors can better navigate the complexities of the market and make more informed decisions about their investments. The market portfolio’s beta serves as a valuable tool for portfolio optimization, risk management, and asset allocation, allowing investors to tailor their strategies to their individual risk profiles and investment objectives.

Moreover, recognizing the market portfolio has a beta of 1 enables investors to appreciate the importance of diversification and the benefits of a well-balanced portfolio. By incorporating the market portfolio into their investment strategies, investors can reduce their overall risk exposure and increase their expected returns.

In modern finance, the market portfolio’s beta remains a vital component of investment analysis and decision-making. As investors continue to seek ways to optimize their portfolios and navigate the complexities of the market, understanding the market portfolio’s beta will remain essential for achieving their investment objectives.

Ultimately, the market portfolio’s beta serves as a powerful tool for investors, providing valuable insights into the risk profile and expected returns of their investments. By embracing this concept and its applications, investors can unlock the secrets of the market portfolio and achieve greater success in their investment endeavors.