What is Excess Return and Why Does it Matter?

In the realm of investment analysis, excess return plays a vital role in helping investors make informed decisions. It is a measure of the return generated by an investment above the return of a risk-free asset, such as a U.S. Treasury bond. The excess return is computed as the difference between the investment’s return and the risk-free rate, providing a clear picture of the investment’s performance. This metric is essential in evaluating the effectiveness of an investment strategy, as it helps investors determine whether their investments are generating sufficient returns to justify the associated risks. By understanding excess return, investors can identify opportunities to optimize their portfolios, minimize risk, and maximize returns. In essence, excess return serves as a benchmark for investment success, enabling investors to make data-driven decisions that drive long-term financial growth.

How to Calculate Excess Return: A Step-by-Step Guide

Calculating excess return is a straightforward process that involves subtracting the risk-free rate from the investment’s return. The excess return is computed as the difference between the investment’s return and the risk-free rate, providing a clear picture of the investment’s performance. The formula for calculating excess return is as follows:

R_excess = R_investment – R_risk-free

Where R_excess is the excess return, R_investment is the return of the investment, and R_risk-free is the risk-free rate. For instance, if an investment generates a return of 10% and the risk-free rate is 2%, the excess return would be 8% (10% – 2%).

In real-world scenarios, investors can apply this formula to evaluate the performance of their investments. For example, an investor may want to compare the excess return of two different mutual funds to determine which one is generating higher returns relative to the risk-free rate. Alternatively, an investor may use excess return to evaluate the performance of their overall portfolio, identifying areas where they can optimize their investments to achieve higher returns.

The Role of Risk-Free Rate in Excess Return Calculation

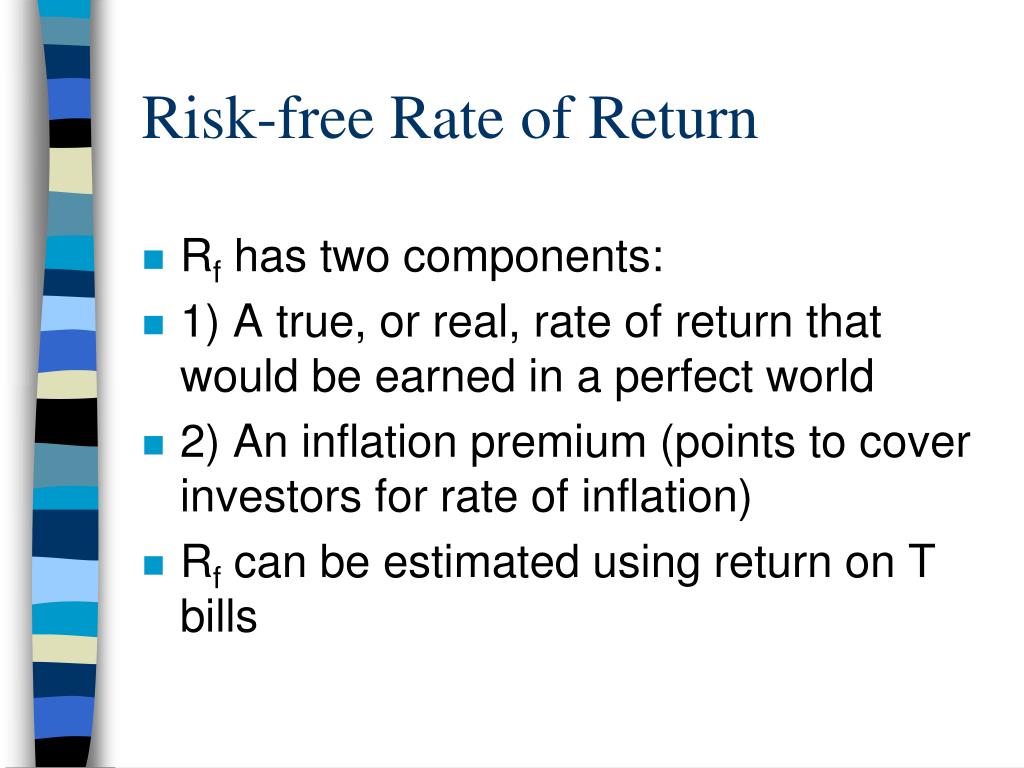

The risk-free rate plays a crucial role in excess return calculation, as it serves as a benchmark for evaluating the performance of an investment. The risk-free rate represents the return an investor can earn from a completely risk-free investment, such as a U.S. Treasury bond. In the excess return formula, the risk-free rate is subtracted from the investment’s return to determine the excess return. The excess return is computed as the difference between the investment’s return and the risk-free rate, providing a clear picture of the investment’s performance.

The choice of risk-free rate can significantly impact investment decisions, as it affects the calculation of excess return. A higher risk-free rate will result in a lower excess return, while a lower risk-free rate will result in a higher excess return. Therefore, it is essential to choose an appropriate risk-free rate that accurately reflects the current market conditions. In general, investors can use the yield on a short-term government bond, such as the 3-month Treasury bill, as a proxy for the risk-free rate.

The risk-free rate also influences investment strategy, as it affects the evaluation of investment opportunities. For instance, if the risk-free rate is high, investors may be more likely to invest in risk-free assets, such as bonds, rather than taking on riskier investments. On the other hand, if the risk-free rate is low, investors may be more willing to take on riskier investments in pursuit of higher returns. By understanding the role of the risk-free rate in excess return calculation, investors can make more informed decisions and optimize their investment portfolios.

Understanding the Difference Between Excess Return and Total Return

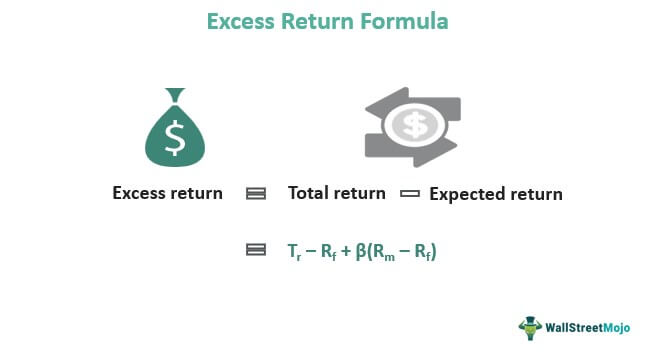

When evaluating investment performance, it’s essential to understand the distinction between excess return and total return. While both metrics are used to measure investment performance, they provide different insights into an investment’s behavior. Total return represents the overall return of an investment, including dividends, interest, and capital gains. In contrast, excess return is computed as the difference between the investment’s return and the risk-free rate, providing a more nuanced view of an investment’s performance.

The key benefit of using excess return in investment analysis is that it helps investors separate the return generated by the investment from the return that could be earned from a risk-free asset. This distinction is crucial, as it allows investors to evaluate the investment’s performance in relation to the risk taken. For instance, an investment with a high total return may not necessarily be a good investment if the excess return is low, indicating that the investment is not generating sufficient returns to justify the risk taken.

In addition, excess return is a more accurate measure of an investment’s performance, as it takes into account the opportunity cost of investing in a risk-free asset. This is particularly important in today’s low-interest-rate environment, where investors may be tempted to take on excessive risk in pursuit of higher returns. By using excess return, investors can make more informed decisions and avoid investments that do not provide sufficient returns to justify the risk taken.

Real-World Applications of Excess Return in Investment Analysis

Excess return is a powerful tool in investment analysis, and its applications are diverse and far-reaching. In this section, we’ll explore some practical examples of excess return in action, highlighting its use in evaluating investment portfolios, comparing fund performance, and making asset allocation decisions.

One of the most common applications of excess return is in evaluating investment portfolios. By calculating the excess return of a portfolio, investors can determine whether the portfolio is generating sufficient returns to justify the risk taken. For instance, a portfolio with a high excess return may indicate that the investment manager is adding value through their investment decisions, while a low excess return may suggest that the portfolio is not generating sufficient returns to justify the risk.

Excess return is also useful in comparing the performance of different funds. By calculating the excess return of each fund, investors can determine which fund is generating the highest returns relative to the risk-free rate. This can help investors make more informed decisions when selecting a fund, as they can focus on funds that are generating high excess returns.

In addition, excess return can be used to make asset allocation decisions. By calculating the excess return of different asset classes, investors can determine which assets are generating the highest returns relative to the risk-free rate. This can help investors optimize their asset allocation, focusing on assets that are generating high excess returns and avoiding those that are not.

For example, an investor may use excess return to compare the performance of stocks and bonds. If the excess return of stocks is higher than that of bonds, the investor may decide to allocate a larger portion of their portfolio to stocks. On the other hand, if the excess return of bonds is higher, the investor may decide to allocate a larger portion of their portfolio to bonds.

In conclusion, excess return is a versatile tool that can be applied in a variety of ways in investment analysis. By understanding how to calculate excess return and its applications, investors can make more informed decisions and drive better investment outcomes.

Common Pitfalls to Avoid When Calculating Excess Return

When calculating excess return, investors must be aware of common pitfalls that can lead to inaccurate results and misguided investment decisions. In this section, we’ll identify common mistakes investors make when calculating excess return and provide guidance on how to avoid these errors.

One common mistake is ignoring risk premiums. The excess return is computed as the difference between the investment’s return and the risk-free rate, and failing to account for risk premiums can lead to an inaccurate calculation. For instance, if an investment has a high risk premium, the excess return may be lower than expected, and ignoring this premium can result in an overly optimistic assessment of the investment’s performance.

Another common pitfall is using incorrect time periods. The excess return calculation requires a specific time period, and using an incorrect time period can lead to inaccurate results. For example, if an investor uses a 1-year time period instead of a 5-year time period, the excess return calculation may not accurately reflect the investment’s long-term performance.

In addition, investors must be careful when selecting a risk-free rate. The risk-free rate is a critical component of the excess return calculation, and using an inappropriate rate can lead to inaccurate results. For instance, using a short-term Treasury bill rate instead of a long-term government bond rate may not accurately reflect the investment’s risk profile.

Furthermore, investors must avoid using simplistic calculations that do not account for the complexities of real-world investments. For example, using a simple arithmetic average instead of a geometric average can lead to inaccurate results, as it does not account for the compounding effect of returns over time.

To avoid these pitfalls, investors must carefully select the appropriate risk-free rate, time period, and calculation methodology. By doing so, investors can ensure that their excess return calculations are accurate and reliable, providing a solid foundation for informed investment decisions.

The Impact of Excess Return on Investment Strategy

The excess return has a profound impact on investment strategy, influencing key decisions such as asset allocation, risk management, and performance evaluation. By understanding the excess return of an investment, investors can make informed decisions that drive long-term financial success.

In terms of asset allocation, the excess return helps investors determine the optimal mix of assets in their portfolio. For instance, if an investment has a high excess return, it may be allocated a larger portion of the portfolio, as it is generating returns above the risk-free rate. Conversely, an investment with a low excess return may be allocated a smaller portion of the portfolio, as it is not generating sufficient returns to justify the risk.

The excess return also plays a critical role in risk management. By understanding the excess return of an investment, investors can assess the level of risk they are taking on and adjust their portfolio accordingly. For example, if an investment has a high excess return but also comes with high risk, an investor may decide to diversify their portfolio to reduce risk and increase potential returns.

In addition, the excess return is a key metric in performance evaluation. By comparing the excess return of different investments, investors can determine which investments are generating the highest returns relative to the risk-free rate. This information can be used to make informed decisions about which investments to hold or sell, and which to add to the portfolio.

Furthermore, the excess return can influence the overall investment strategy of an investor. For instance, an investor who is seeking high returns may focus on investments with high excess returns, while an investor who is seeking income may focus on investments with lower excess returns but higher yields. By understanding the excess return of an investment, investors can tailor their investment strategy to meet their specific financial goals.

In conclusion, the excess return has a significant impact on investment strategy, influencing key decisions such as asset allocation, risk management, and performance evaluation. By understanding the excess return of an investment, investors can make informed decisions that drive long-term financial success.

Conclusion: The Power of Excess Return in Informed Investing

In conclusion, the excess return is a powerful tool in investment analysis, providing investors with a nuanced understanding of their investments’ performance. By calculating the excess return, investors can make informed decisions that drive long-term financial success. The excess return is computed as the difference between an investment’s return and the risk-free rate, providing a clear picture of an investment’s value-added performance.

Throughout this article, we have explored the significance of excess return in investment analysis, including its role in evaluating investment portfolios, comparing fund performance, and making asset allocation decisions. We have also discussed the importance of the risk-free rate in excess return calculation and the common pitfalls to avoid when calculating excess return.

By understanding the excess return, investors can develop a more sophisticated investment strategy, one that takes into account the nuances of investment performance. Whether an investor is seeking high returns, income, or capital preservation, the excess return provides a valuable framework for making informed investment decisions.

In today’s complex investment landscape, the excess return is a critical component of any investment strategy. By incorporating the excess return into their analysis, investors can gain a deeper understanding of their investments and make more informed decisions. Ultimately, the excess return is a powerful tool in the pursuit of long-term financial success.

:max_bytes(150000):strip_icc()/EfficientFrontier-CML-JPEG-6cef956488a3436c9ca019451b9e5905.jpg)