Understanding Interest Rate Benchmarks: T-Bills vs. LIBOR

Interest rate benchmarks are crucial to the financial system. They serve as reference points for pricing various financial instruments, from loans to derivatives. These benchmarks reflect the cost of borrowing money in different markets and tenors. Understanding these benchmarks is essential for investors, borrowers, and financial institutions alike. Several types of benchmarks exist, each with its own characteristics and underlying methodology. This article will focus on comparing two prominent benchmarks: Treasury Bills (T-Bills) and the London Interbank Offered Rate (LIBOR). Understanding the difference between LIBOR and the Treasury Bill rate is fundamental to grasping market dynamics.

Treasury Bills represent short-term debt obligations of a government. LIBOR, on the other hand, reflected the average rate at which banks were willing to lend to each other. The difference between LIBOR and the Treasury Bill rate stems from the underlying credit risk and market dynamics. T-Bills are generally considered risk-free because they are backed by the full faith and credit of the issuing government. LIBOR, however, incorporated the credit risk of lending to banks. This risk is the difference between LIBOR and the Treasury Bill rate. Market participants closely monitor these benchmarks to gauge economic conditions and assess risk appetite.

The comparison between T-Bills and LIBOR provides insights into the overall health of the financial system. The difference between LIBOR and the Treasury Bill rate can indicate the level of stress in the interbank lending market. A widening spread between the two rates may signal increased risk aversion or concerns about the stability of financial institutions. In contrast, a narrowing spread may suggest improved market confidence and liquidity. Understanding the difference between LIBOR and the Treasury Bill rate helps market participants to make informed decisions and manage their risk exposures effectively. The subsequent sections will delve deeper into the mechanics of each benchmark. We will explore their calculation methodologies, key distinctions, and practical applications in finance.

What is the Treasury Bill Rate and How is it Calculated?

Treasury Bills, commonly known as T-Bills, are short-term debt obligations backed by the U.S. government. Understanding how the Treasury Bill rate is determined is essential to grasping the difference between LIBOR and the Treasury Bill rate. T-Bill rates are established through auctions conducted by the U.S. Department of the Treasury. During these auctions, investors bid on the T-Bills, and the bills are awarded to the highest bidders. The yield, or rate of return, is determined by the discount at which the T-Bills are sold relative to their face value.

Several factors influence Treasury Bill rates. The creditworthiness of the U.S. government plays a significant role; since the U.S. government is considered a low-risk borrower, T-Bills are often viewed as a risk-free investment. Supply and demand dynamics also affect T-Bill rates. Increased demand for T-Bills, often seen during times of economic uncertainty, can drive rates down, while increased supply can push rates up. Overall economic conditions, including inflation and economic growth, also impact T-Bill rates. The Federal Reserve’s monetary policy, such as adjusting the federal funds rate, also influences short-term interest rates like those of T-Bills. The difference between LIBOR and the Treasury Bill rate reflects varying risk premiums and market perceptions.

The calculation of the T-Bill rate involves understanding the discount yield formula. The discount yield is the annualized percentage difference between the face value of the T-Bill and its purchase price. It is important to note that this is a simple interest calculation and doesn’t account for compounding. The auction process and the subsequent trading in the secondary market ensure that T-Bill rates reflect the current market sentiment and expectations. Due to its nature, the difference between LIBOR and the Treasury Bill rate is crucial for understanding market risk appetite. Investors closely monitor T-Bill auctions as they provide insights into the government’s borrowing costs and the overall health of the financial market.

LIBOR Explained: Its Function and Calculation

LIBOR, the London Interbank Offered Rate, served as a crucial benchmark for short-term interest rates globally. It represented the average rate at which major banks were willing to lend unsecured funds to one another in the London interbank market. Understanding the difference between LIBOR and the Treasury Bill rate requires insight into how LIBOR was calculated and its underlying risks. LIBOR’s function was to provide a standardized reference point for pricing various financial instruments, including loans, mortgages, and derivatives.

The calculation of LIBOR involved a daily survey of a panel of banks. These banks submitted their perceived borrowing rates for specific currencies and maturities. The currencies included the US dollar, Euro, British pound, Japanese yen, and Swiss franc. Maturities ranged from overnight to twelve months. After the submissions, the highest and lowest quartiles were discarded, and the remaining rates were averaged to determine the daily LIBOR rate for each currency and maturity. This process aimed to reflect the prevailing market conditions and the creditworthiness of the contributing banks. However, the methodology was not without its flaws, leading to manipulation and ultimately, the discontinuation of LIBOR. The difference between LIBOR and the Treasury Bill rate often reflected the perceived credit risk within the interbank lending market.

The historical controversies surrounding LIBOR centered on allegations of rate manipulation by panel banks. These banks were accused of colluding to artificially inflate or deflate LIBOR for their own financial gain. The scandals eroded trust in LIBOR and prompted regulatory reforms. Consequently, global regulators initiated a transition away from LIBOR, seeking more robust and transparent alternative reference rates. This transition has led to the adoption of rates like SOFR (Secured Overnight Financing Rate) in the United States and similar risk-free rates in other jurisdictions. The legacy of LIBOR underscores the importance of reliable benchmarks in maintaining the integrity of financial markets. Analyzing the difference between LIBOR and the Treasury Bill rate in the past provides valuable context for understanding current market dynamics and the role of benchmark rates.

Key Distinctions Between T-Bill Rate and LIBOR

A fundamental aspect to grasp is the difference between LIBOR and the Treasury Bill rate. These two benchmarks serve distinct purposes within the financial landscape. Treasury Bills represent debt obligations of a government, typically with short-term maturities ranging from a few weeks to a year. Their yields are determined through auctions, reflecting investor demand and the government’s creditworthiness. LIBOR, on the other hand, represents the average rate at which banks are willing to lend to each other in the London interbank market. This rate encompasses a variety of currencies and maturities, predominantly short-term. Understanding the difference between LIBOR and the Treasury Bill rate is crucial for assessing risk and market sentiment.

One of the most significant distinctions lies in the underlying risk. Treasury Bills are generally considered risk-free assets, backed by the full faith and credit of the issuing government. While default is still theoretically possible, it’s an extremely rare occurrence for developed nations. LIBOR, however, reflects the credit risk associated with lending between banks. This interbank lending carries the risk that a participating bank might default on its obligation. Consequently, LIBOR rates typically trade at a premium to Treasury Bill rates to compensate for this added credit risk. The markets they represent also differ significantly; T-Bills are government securities, while LIBOR reflects money market lending between banks. Factors influencing each rate also vary. Treasury Bill rates are sensitive to government credit ratings, economic conditions, and overall market supply and demand. LIBOR is affected by factors such as bank creditworthiness, liquidity in the interbank market, and global economic uncertainty. The difference between LIBOR and the Treasury Bill rate provides insight into the health of the financial system.

The maturity lengths also contribute to the difference between LIBOR and the Treasury Bill rate. While both benchmarks primarily focus on short-term rates, the specific maturities available can vary. Treasury Bills are issued with standard maturities, providing investors with a range of short-term options. LIBOR, prior to its discontinuation, offered a broader array of maturities, catering to the specific needs of interbank lending. This difference in available maturities can influence the relative levels of the two rates. Ultimately, understanding the difference between LIBOR and the Treasury Bill rate requires a nuanced understanding of the risks, markets, and factors that influence each benchmark. The perceived risk-free nature of T-Bills, contrasted with the credit risk inherent in LIBOR, forms the core of their fundamental distinction. As LIBOR is replaced with alternative reference rates, the difference between these new rates and the Treasury Bill rate will continue to be a key indicator for financial markets.

Credit Risk and the Spread: Why LIBOR is Generally Higher

The credit risk inherent in LIBOR is a crucial factor contributing to the difference between libor and the treasury bill rate. LIBOR, representing the rate at which banks lend to each other, inherently carries credit risk, as there’s a possibility that a bank might default on its loan obligations. This contrasts with Treasury Bills, which are backed by the full faith and credit of the U.S. government, making them virtually risk-free from a credit perspective. Consequently, LIBOR typically trades at a premium to the Treasury Bill rate to compensate lenders for assuming this additional credit risk. The magnitude of this premium, known as the spread, fluctuates based on market conditions and perceptions of bank solvency.

Several factors influence the spread between LIBOR and the Treasury Bill rate. Perceived financial stability plays a significant role; during periods of economic uncertainty or when concerns arise about the health of the banking sector, the spread tends to widen. This is because lenders demand a higher premium for lending to banks when the perceived risk of default increases. Liquidity in the interbank market also affects the spread; reduced liquidity can lead to higher borrowing costs for banks, pushing LIBOR higher relative to Treasury Bills. Overall economic uncertainty, stemming from factors such as geopolitical events or unexpected economic data, also contributes to a wider spread as investors seek the safety of government securities. The difference between libor and the treasury bill rate is therefore a barometer of market sentiment and financial stability.

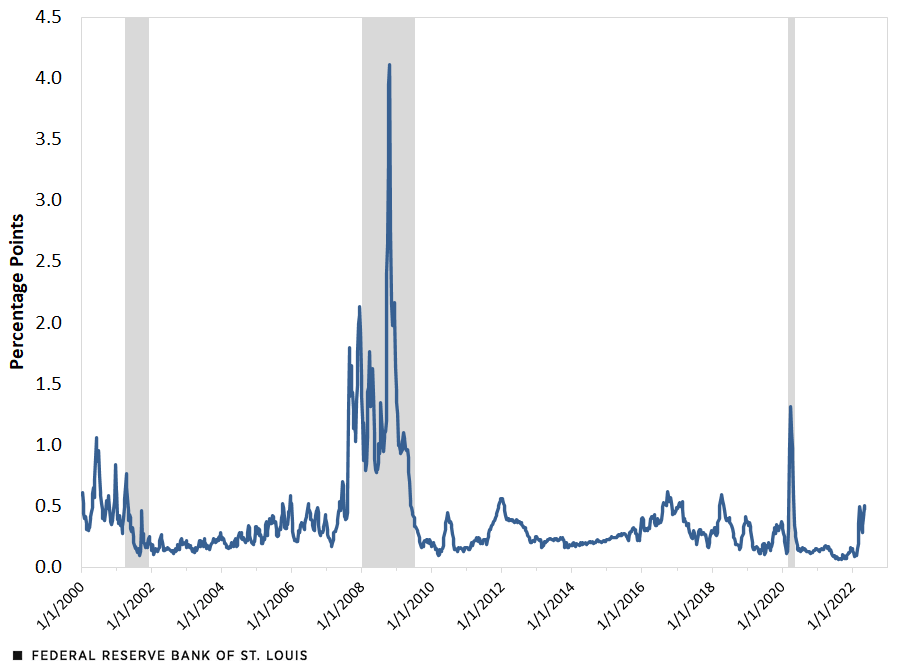

During times of crisis, the spread between LIBOR and the Treasury Bill rate can widen dramatically. The difference between libor and the treasury bill rate reflects heightened risk aversion and a flight to safety. For instance, during the 2008 financial crisis, concerns about the solvency of banks led to a significant increase in the LIBOR-OIS spread (a similar measure using overnight indexed swaps), indicating a breakdown in trust within the interbank lending market. This illustrates how the spread can serve as an early warning signal of potential problems in the financial system. Monitoring this spread provides valuable insights into the perceived health of the banking sector and the overall level of risk aversion among market participants. The difference between libor and the treasury bill rate is a key indicator of financial stress.

How to Interpret the T-Bill and LIBOR Differential

The difference between LIBOR and the Treasury Bill rate, often referred to as the spread, serves as a valuable indicator of market sentiment and overall financial health. This spread reflects the premium investors demand for taking on the credit risk associated with lending to banks, as opposed to the virtually risk-free investment in U.S. government debt represented by Treasury Bills. A wider spread typically indicates increased risk aversion, suggesting that market participants are more concerned about the financial stability of banks and the overall economic outlook. Conversely, a narrower spread often signals greater confidence in the banking system and a more optimistic economic outlook. Understanding how to interpret the difference between LIBOR and the Treasury Bill rate provides critical insight into the dynamics of the financial markets.

Specifically, the spread between LIBOR and the Treasury Bill rate can be used to gauge the health of the banking system. When banks are perceived as being financially sound, the spread tends to narrow, as lenders are more willing to lend to each other at lower rates. However, during times of financial stress or economic uncertainty, the spread widens significantly. This widening reflects increased apprehension about the creditworthiness of banks and a greater reluctance to engage in interbank lending. The 2008 financial crisis, for example, witnessed a dramatic widening of the LIBOR-Treasury Bill spread, as concerns about bank solvency reached alarming levels. Therefore, monitoring the spread provides a real-time assessment of the perceived risk within the banking sector and the broader economy. The difference between LIBOR and the Treasury Bill rate encapsulates a wealth of information about the perceived stability and risk within financial institutions.

Market participants utilize the difference between LIBOR and the Treasury Bill rate to inform their investment decisions and risk management strategies. A widening spread may prompt investors to reduce their exposure to riskier assets, such as corporate bonds or equities, and increase their allocation to safer assets like Treasury securities. Conversely, a narrowing spread may encourage investors to take on more risk in pursuit of higher returns. Central banks and other regulatory bodies also closely monitor the spread as a key indicator of financial stability. Significant movements in the spread may trigger policy responses aimed at stabilizing the financial system and mitigating potential risks. The ability to accurately interpret the difference between LIBOR and the Treasury Bill rate is, therefore, crucial for making informed decisions in the complex world of finance. The difference between LIBOR and the Treasury Bill rate remains a significant benchmark, even with the transition away from LIBOR, as successor rates are also compared to Treasury Bill rates to assess market risk.

The Transition Away from LIBOR: What Replaced It?

The London Interbank Offered Rate (LIBOR), once a cornerstone of global finance, has been phased out. This transition stemmed from concerns about its manipulation and lack of underlying transaction data. Regulatory bodies and financial institutions collaborated to identify and implement alternative reference rates. The goal was to establish more robust and reliable benchmarks. This shift marks a significant change in how interest rates are determined and utilized in financial markets. Understanding the difference between LIBOR and the Treasury Bill rate is crucial for grasping this evolution.

Secured Overnight Financing Rate (SOFR) emerged as a primary replacement for USD LIBOR. SOFR is a broad measure of the cost of borrowing cash overnight. It is secured by U.S. Treasury securities. Unlike LIBOR, which relied on estimations from panel banks, SOFR is based on actual transactions. Other currencies have also transitioned to new risk-free rates (RFRs). These include the Sterling Overnight Index Average (SONIA) in the UK, the Euro Short-Term Rate (€STR) in the Eurozone, and the Tokyo Overnight Average Rate (TONAR) in Japan. These RFRs generally reflect overnight borrowing rates in their respective currencies. The difference between LIBOR and the Treasury Bill rate, in the context of this transition, highlights the move from credit-sensitive to risk-free benchmarks.

These new RFRs differ significantly from LIBOR in several key aspects. LIBOR incorporated a bank credit risk component, reflecting the perceived risk of lending to other banks. RFRs, on the other hand, are based on transactions collateralized by government securities or overnight lending. This makes them virtually risk-free. The move to RFRs has implications for various financial instruments. Derivatives, loans, and mortgages are now increasingly referencing SOFR or other RFRs. This requires adjustments to contracts and valuation models. Understanding the difference between LIBOR and the Treasury Bill rate is essential for adapting to this new landscape. The transition aims to create a more transparent and resilient financial system, less susceptible to manipulation and better equipped to reflect actual market conditions. The difference between LIBOR and the Treasury Bill rate, formerly reflecting interbank credit risk, is now more clearly separated, with Treasury Bills representing a near risk-free rate and SOFR reflecting the cost of overnight borrowing secured by treasuries.

Practical Applications: Utilizing T-Bill Rates and LIBOR Successors in Finance

Treasury Bill rates and the successor rates to LIBOR play crucial roles in the financial world. Understanding their applications is essential for borrowers, lenders, and investors. The difference between LIBOR and the Treasury Bill rate, even with LIBOR’s sunset, remains a key concept for grasping market dynamics. T-Bill rates serve as a benchmark for short-term, risk-free investments, while LIBOR successors reflect the cost of funds in interbank lending. These rates are used extensively in pricing financial instruments.

Mortgages are a prime example. Adjustable-rate mortgages (ARMs) often tie their interest rates to benchmarks. Previously, LIBOR was a common reference rate. Now, rates like SOFR (Secured Overnight Financing Rate) are frequently used. When the benchmark rate increases, the mortgage interest rate also rises, leading to higher monthly payments for borrowers. Conversely, a decrease in the benchmark rate can lower borrowing costs. The difference between LIBOR and the Treasury Bill rate, and now the difference between SOFR and the Treasury Bill rate, reflects the credit risk and liquidity premiums embedded in lending rates. The spread between these rates can affect the overall cost of borrowing.

Loans, both personal and commercial, also rely on these benchmarks. Business loans, for instance, often have interest rates linked to a reference rate plus a margin that reflects the borrower’s creditworthiness. Derivatives, complex financial instruments used for hedging or speculation, heavily utilize benchmark rates. Interest rate swaps, options, and futures contracts use these rates for pricing and settlement. The difference between LIBOR and the Treasury Bill rate, and subsequently SOFR and the Treasury Bill rate, is a critical input for valuing these derivatives. The transition from LIBOR has required adjustments to these contracts. The market still considers the underlying principles of the difference between LIBOR and the Treasury Bill rate in financial modeling, even with new benchmarks in place. Investors and financial institutions carefully monitor these rates to manage risk and optimize returns. Changes impact investment strategies and portfolio performance. Understanding these applications is crucial for navigating the financial markets effectively. These rates also serve as indicators of economic health.

:max_bytes(150000):strip_icc()/ejOLS-federal-reserve-average-and-median-available-aprs4-a748861e380c4b1e86bad40ea44b5307.png)