What is SOFR and Why Does it Matter?

In the financial industry, the Secured Overnight Financing Rate (SOFR) has emerged as a reliable alternative to the London Interbank Offered Rate (LIBOR). SOFR is a benchmark rate that measures the cost of borrowing cash overnight, collateralized by U.S. Treasury securities. This rate is calculated and published by the New York Federal Reserve, providing a transparent and robust measure of the U.S. dollar funding market. The significance of SOFR lies in its potential to bring stability and integrity to financial markets, allowing investors and financial institutions to make informed decisions with confidence. As the industry continues to transition from LIBOR to SOFR, understanding the differences between Term SOFR and Compounded SOFR will be crucial for navigating the complex landscape of interest rates and financial transactions. In this article, we will delve into the world of SOFR, exploring the distinct characteristics of Term SOFR and Compounded SOFR, and how they impact financial decisions.

Understanding the Difference: Term SOFR vs Compounded SOFR

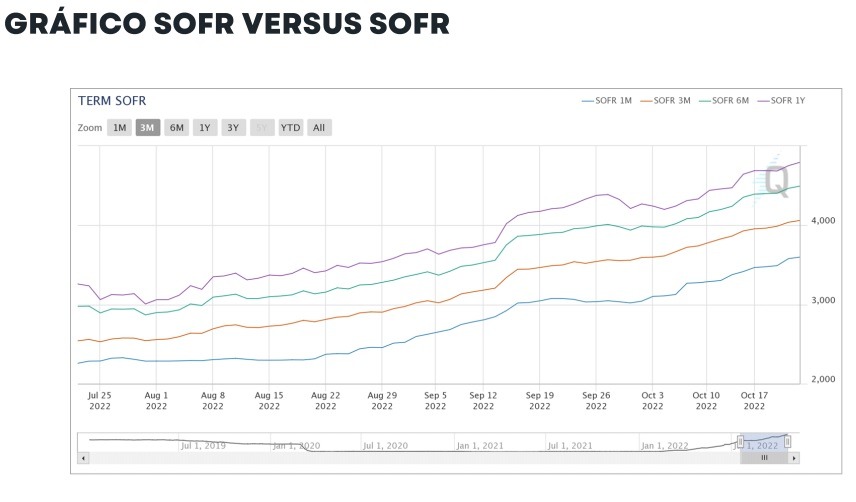

The Secured Overnight Financing Rate (SOFR) comes in two distinct flavors: Term SOFR and Compounded SOFR. While both rates are based on the same underlying data, they differ significantly in their calculation methodologies and applications. Term SOFR is a forward-looking rate that provides a fixed term rate for a specific period, typically ranging from several days to several months. This rate is ideal for financial institutions and investors seeking stability and predictability in their financial transactions. On the other hand, Compounded SOFR is a backward-looking rate that reflects the cumulative effect of overnight rates over a given period. This rate is better suited for applications requiring a more accurate reflection of market conditions, such as loan pricing and risk management. Understanding the differences between Term SOFR and Compounded SOFR is crucial for making informed financial decisions, as each rate has its unique advantages and disadvantages. In the following sections, we will delve deeper into the benefits and applications of each rate, providing guidance on how to choose the right SOFR rate for specific business needs.

How to Choose the Right SOFR Rate for Your Business

Selecting the appropriate SOFR rate for specific business needs is crucial for making informed financial decisions. When deciding between Term SOFR and Compounded SOFR, financial institutions and investors should consider factors such as risk tolerance, investment horizon, and cash flow requirements. For instance, businesses with a low risk tolerance may prefer Term SOFR, which provides a fixed rate for a specific period, offering stability and predictability. On the other hand, companies with a longer investment horizon may benefit from Compounded SOFR, which reflects the cumulative effect of overnight rates over a given period, providing a more accurate reflection of market conditions. Additionally, cash flow requirements play a significant role in determining the suitable SOFR rate. Businesses with variable cash flows may prefer Compounded SOFR, which can help them better manage their liquidity needs. By understanding the distinct characteristics of Term SOFR and Compounded SOFR, businesses can make informed decisions that align with their financial goals and objectives. In the next section, we will explore the advantages of Term SOFR, including its fixed nature, which provides stability and predictability for financial institutions and investors.

The Advantages of Term SOFR: Stability and Predictability

Term SOFR offers several benefits that make it an attractive option for financial institutions and investors. One of the primary advantages of Term SOFR is its fixed nature, which provides stability and predictability in financial transactions. This fixed rate allows businesses to better manage their cash flows, reduce uncertainty, and make informed financial decisions. Additionally, Term SOFR is less susceptible to market volatility, making it an ideal choice for risk-averse investors. The fixed rate also enables financial institutions to offer more competitive loan pricing, which can attract more customers and increase revenue. Furthermore, Term SOFR’s stability and predictability make it an excellent option for long-term investments, such as mortgages and bonds. By understanding the benefits of Term SOFR, businesses can make informed decisions that align with their financial goals and objectives. In the next section, we will explore the advantages of Compounded SOFR, including its ability to reflect market conditions more accurately and provide a more precise measure of borrowing costs.

The Benefits of Compounded SOFR: Flexibility and Accuracy

Compounded SOFR offers several advantages that make it an attractive option for financial institutions and investors. One of the primary benefits of Compounded SOFR is its ability to reflect market conditions more accurately. By compounding the overnight rates over a given period, Compounded SOFR provides a more precise measure of borrowing costs, allowing businesses to make informed financial decisions. Additionally, Compounded SOFR’s flexibility makes it an ideal choice for businesses with variable cash flows or those that require more nuanced risk management strategies. The compounded rate also enables financial institutions to offer more competitive loan pricing, which can attract more customers and increase revenue. Furthermore, Compounded SOFR’s accuracy and flexibility make it an excellent option for short-term investments, such as commercial paper and treasury bills. When considering Term SOFR vs Compounded SOFR, businesses should weigh the benefits of each rate and choose the one that best aligns with their financial goals and objectives. In the next section, we will explore practical examples of how SOFR rates influence financial decisions, such as loan pricing, investment strategies, and risk management.

Real-World Applications: How SOFR Rates Impact Financial Decisions

SOFR rates have a significant impact on various financial decisions, and understanding their influence is crucial for businesses and investors. One of the primary ways SOFR rates affect financial decisions is through loan pricing. Financial institutions use SOFR rates as a benchmark to determine the interest rates they charge on loans. For instance, a company may use Term SOFR to price a long-term loan, while a bank may use Compounded SOFR to price a short-term commercial loan. The choice of SOFR rate can significantly impact the borrowing costs for businesses and individuals. Additionally, SOFR rates influence investment strategies, as investors often use SOFR rates as a reference point to evaluate the attractiveness of different investment opportunities. For example, an investor may compare the yield on a bond to the Term SOFR rate to determine whether the investment is worthwhile. Furthermore, SOFR rates play a critical role in risk management, as they help financial institutions and investors assess and manage their exposure to interest rate risks. By understanding how SOFR rates impact financial decisions, businesses and investors can make informed choices that align with their financial goals and objectives. In the next section, we will explore strategies for managing SOFR rate risk, including hedging strategies, asset liability management, and regulatory compliance.

Managing SOFR Rate Risk: Strategies for Financial Institutions

Financial institutions face significant risks when dealing with SOFR rates, including interest rate risk, basis risk, and liquidity risk. To mitigate these risks, institutions can employ various strategies, such as hedging, asset liability management, and regulatory compliance. Hedging involves taking positions in financial instruments to offset potential losses or gains from changes in SOFR rates. For instance, a bank may use interest rate swaps to hedge against potential losses from a rise in Term SOFR. Asset liability management involves managing the institution’s balance sheet to minimize the impact of SOFR rate changes. This can include adjusting the maturity of assets and liabilities, as well as managing cash flows. Regulatory compliance is also crucial, as institutions must adhere to guidelines set by regulatory bodies, such as the Federal Reserve. Additionally, institutions can use Compounded SOFR to manage risk, as it provides a more accurate reflection of market conditions. By understanding the differences between Term SOFR and Compounded SOFR, institutions can develop effective risk management strategies that align with their business objectives. In the next section, we will explore the evolving landscape of SOFR, including potential changes to its calculation methodology, the impact of regulatory reforms, and emerging trends in the financial industry.

The Future of SOFR: Trends and Developments to Watch

The Secured Overnight Financing Rate (SOFR) is continuously evolving, and its future holds significant implications for the financial industry. One of the key trends to watch is the potential changes to its calculation methodology. The Alternative Reference Rates Committee (ARRC) has proposed several modifications, including the use of a broader set of transactions to calculate SOFR, which could lead to a more robust and representative rate. Additionally, regulatory reforms, such as the LIBOR transition, will continue to shape the SOFR landscape. The increasing adoption of Term SOFR and Compounded SOFR in financial transactions will also influence the development of SOFR. As the financial industry becomes more comfortable with the use of SOFR, it is likely that we will see a rise in the use of Term SOFR vs Compounded SOFR in various applications, such as loan pricing and risk management. Furthermore, emerging trends, such as the use of artificial intelligence and machine learning in financial modeling, will also impact the future of SOFR. As the financial industry continues to evolve, it is essential for businesses and investors to stay informed about the latest developments in SOFR and its applications.