Understanding the 4-Week T-Bill Rate

In the world of short-term investments, the 4-week T-bill stands out as a popular option, offering a unique combination of liquidity and yield. The 4-week T-bill rate, in particular, plays a crucial role in shaping the financial market, influencing investor decisions, and reflecting the overall health of the economy.

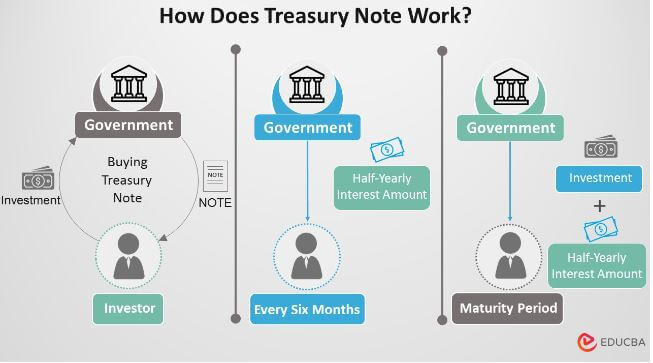

The 4-week T-bill rate is the interest rate at which investors can lend money to the government for a 4-week period. This rate serves as a benchmark for other short-term investments, such as commercial paper and certificates of deposit. As a result, changes in the 4-week T-bill rate have a ripple effect on the entire financial system, impacting borrowing costs, consumer spending, and business investment.

For investors, the 4-week T-bill rate represents an attractive option for parking excess funds, as it offers a low-risk, liquid investment with a fixed return. The rate also serves as a gauge of market sentiment, with changes in the rate reflecting shifts in investor confidence and expectations. By understanding the 4-week T-bill rate, investors can make informed decisions about their investment portfolios and navigate the complexities of the financial market.

The 4-week T-bill rate is also closely tied to the overall state of the economy. During times of economic uncertainty, investors often flock to the safety of T-bills, driving up demand and pushing rates lower. Conversely, in periods of economic growth, investors may be more willing to take on risk, leading to higher yields and higher 4-week T-bill rates. As a result, the 4-week T-bill rate serves as a valuable indicator of economic health, providing insights into the direction of the economy and the sentiment of investors.

How to Invest in 4-Week Treasury Bills

Investing in 4-week T-bills is a straightforward process that can be completed through various channels. Here’s a step-by-step guide to help you get started:

Step 1: Determine Your Investment Amount – Decide how much you want to invest in 4-week T-bills. The minimum investment amount is typically $1,000, but this may vary depending on the auction or investment platform.

Step 2: Choose Your Investment Platform – You can invest in 4-week T-bills through the U.S. Department of the Treasury’s website, TreasuryDirect, or through a brokerage firm that offers T-bill investments. Compare fees and services before selecting a platform.

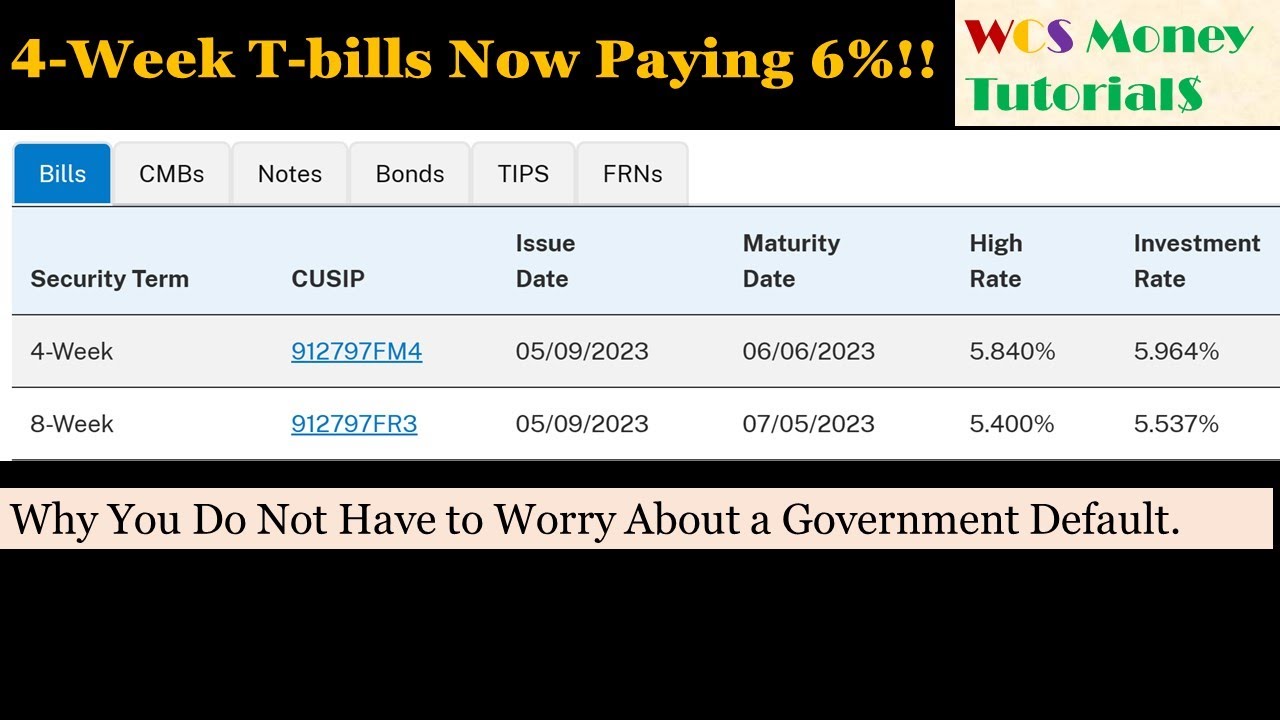

Step 3: Participate in a T-Bill Auction – The Treasury Department holds weekly auctions for 4-week T-bills. You can participate in these auctions through TreasuryDirect or your chosen brokerage firm. Simply submit a bid indicating the amount you’re willing to invest and the rate you’re willing to accept.

Step 4: Receive Your Investment – If your bid is accepted, you’ll receive your 4-week T-bill investment. The Treasury Department will issue the T-bill in electronic form, and you’ll receive the face value plus interest at maturity.

Benefits of Investing in 4-Week T-Bills – Investing in 4-week T-bills offers several benefits, including low risk, liquidity, and a fixed return. T-bills are backed by the full faith and credit of the U.S. government, making them an extremely low-risk investment. Additionally, T-bills are highly liquid, allowing you to easily sell them before maturity if needed. Finally, the 4-week T-bill rate provides a fixed return, giving you a predictable income stream.

In conclusion, investing in 4-week T-bills is a simple and secure way to generate a low-risk return. By following these steps and understanding the benefits of T-bill investments, you can make informed decisions about your investment portfolio and achieve your financial goals.

The Impact of Economic Indicators on 4-Week T-Bill Rates

The 4-week T-bill rate is closely tied to various economic indicators, which can influence its direction and volatility. Understanding these indicators is crucial for investors seeking to make informed decisions about their investments.

Inflation is a key economic indicator that affects the 4-week T-bill rate. When inflation rises, the Federal Reserve may increase interest rates to combat inflationary pressures, leading to higher 4-week T-bill rates. Conversely, low inflation or deflationary environments may result in lower 4-week T-bill rates.

GDP growth is another important indicator that impacts the 4-week T-bill rate. A strong economy with robust GDP growth may lead to higher interest rates and, subsequently, higher 4-week T-bill rates. On the other hand, a slowing economy may result in lower 4-week T-bill rates.

Monetary policy decisions, such as those made by the Federal Reserve, also play a significant role in shaping the 4-week T-bill rate. When the Fed raises interest rates, it can lead to higher 4-week T-bill rates, making borrowing more expensive and reducing the attractiveness of T-bills. Conversely, when the Fed lowers interest rates, it can lead to lower 4-week T-bill rates, making borrowing cheaper and increasing the appeal of T-bills.

Other economic indicators, such as unemployment rates, consumer spending, and business confidence, can also influence the 4-week T-bill rate. By monitoring these indicators, investors can gain insights into the direction of the economy and make informed decisions about their investments.

In conclusion, the 4-week T-bill rate is closely tied to various economic indicators, which can influence its direction and volatility. By understanding these indicators, investors can make informed decisions about their investments and navigate the complex world of 4-week T-bill rates.

Comparing 4-Week T-Bill Rates to Other Short-Term Investments

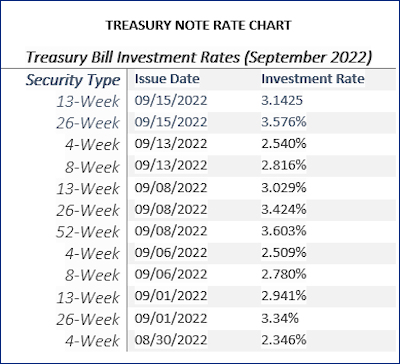

When considering short-term investment options, investors often compare the 4-week T-bill rate to other low-risk securities. This comparison is essential to determine which investment best suits their financial goals and risk tolerance.

Commercial paper, issued by corporations to raise short-term funds, offers a similar investment horizon to 4-week T-bills. However, commercial paper typically carries a higher credit risk, as it is not backed by the full faith and credit of the U.S. government. As a result, commercial paper rates are often higher than the 4-week T-bill rate to compensate for the increased risk.

Certificates of deposit (CDs) are another popular short-term investment option. CDs offer a fixed interest rate for a specific term, usually ranging from a few weeks to several years. While CDs tend to offer higher interest rates than 4-week T-bills, they often come with penalties for early withdrawal, making them less liquid than T-bills.

Money market funds, which invest in a diversified portfolio of low-risk securities, provide another alternative to 4-week T-bills. These funds typically offer competitive interest rates and high liquidity, but may come with management fees and other expenses.

In comparison to these alternatives, the 4-week T-bill rate offers a unique combination of low risk, high liquidity, and a fixed return. While the rates may be lower than those offered by commercial paper or CDs, the safety and security of T-bills make them an attractive option for investors seeking to minimize risk.

Ultimately, the choice between these short-term investment options depends on an investor’s individual financial goals, risk tolerance, and time horizon. By understanding the advantages and disadvantages of each option, investors can make informed decisions and optimize their investment portfolios.

Historical Trends and Patterns in 4-Week T-Bill Rates

Examining historical data on 4-week T-bill rates can provide valuable insights for investors and market participants. By analyzing trends and patterns in these rates, investors can better understand the factors that influence the t bill rate 4 week and make more informed investment decisions.

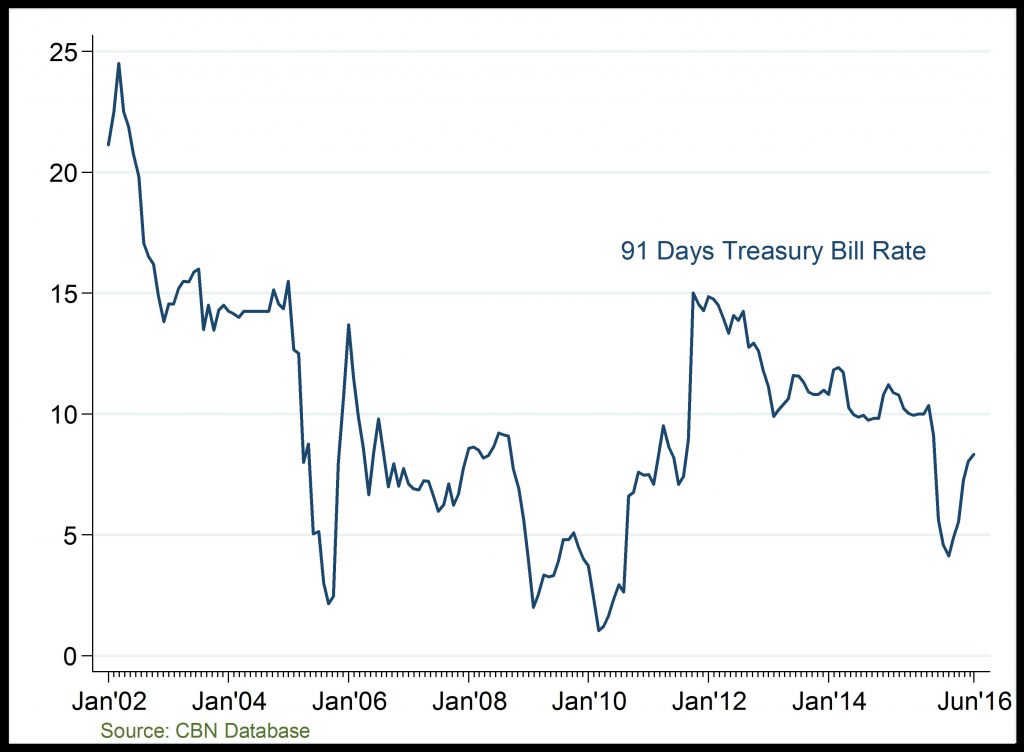

One notable trend in 4-week T-bill rates is their inverse relationship with economic growth. During periods of strong economic growth, the 4-week T-bill rate tends to rise, as the Federal Reserve increases interest rates to combat inflationary pressures. Conversely, during economic downturns, the 4-week T-bill rate tends to fall, as the Fed lowers interest rates to stimulate economic growth.

Another pattern observed in 4-week T-bill rates is their correlation with monetary policy decisions. When the Federal Reserve tightens monetary policy by raising interest rates, the 4-week T-bill rate tends to increase. Conversely, when the Fed eases monetary policy by lowering interest rates, the 4-week T-bill rate tends to decrease.

Seasonal patterns also exist in 4-week T-bill rates, with rates tend to be higher during the summer months and lower during the winter months. This pattern is attributed to the increased demand for short-term funding during the summer, driven by factors such as tax payments and summer vacations.

By understanding these historical trends and patterns, investors can better navigate the complex world of 4-week T-bill rates. For example, investors may choose to invest in 4-week T-bills during periods of economic growth, when rates are likely to be higher, or during periods of monetary policy easing, when rates are likely to be lower.

Ultimately, analyzing historical data on 4-week T-bill rates can provide valuable insights for investors seeking to optimize their investment portfolios and manage risk in the short-term fixed-income market.

The Role of the Federal Reserve in Shaping 4-Week T-Bill Rates

The Federal Reserve plays a crucial role in influencing the 4-week T-bill rate through its monetary policy decisions. As the central bank of the United States, the Fed has the authority to set interest rates, buy or sell securities, and regulate the money supply. These actions have a direct impact on the t bill rate 4 week, which in turn affects investors and the economy.

One of the primary ways the Fed influences the 4-week T-bill rate is through its setting of the federal funds target rate. This rate determines the cost of borrowing for banks and other depository institutions, which in turn affects the interest rates offered on short-term securities like 4-week T-bills. When the Fed raises the federal funds target rate, it increases the cost of borrowing, which can lead to higher 4-week T-bill rates. Conversely, when the Fed lowers the federal funds target rate, it reduces the cost of borrowing, which can lead to lower 4-week T-bill rates.

The Fed also influences the 4-week T-bill rate through its open market operations. By buying or selling securities on the open market, the Fed can increase or decrease the supply of money in the economy, which affects the demand for short-term securities like 4-week T-bills. When the Fed buys securities, it injects liquidity into the market, which can lead to lower 4-week T-bill rates. Conversely, when the Fed sells securities, it reduces liquidity, which can lead to higher 4-week T-bill rates.

In addition to its monetary policy decisions, the Fed also communicates its economic outlook and policy intentions to the market through various channels, including press conferences, speeches, and minutes of its meetings. These communications can influence market expectations and sentiment, which can in turn affect the 4-week T-bill rate.

By understanding the role of the Federal Reserve in shaping the 4-week T-bill rate, investors can better navigate the complex world of short-term fixed-income securities. By monitoring the Fed’s monetary policy decisions and communications, investors can make more informed investment decisions and optimize their portfolios in response to changing market conditions.

Managing Risk with 4-Week T-Bill Laddering Strategies

Investing in 4-week T-bills can be an attractive option for investors seeking low-risk, short-term returns. However, like any investment, 4-week T-bills carry some level of risk, particularly with regards to interest rate fluctuations and liquidity. To manage these risks and maximize returns, investors can employ laddering strategies, which involve spreading investments across different maturity dates.

A laddering strategy for 4-week T-bills involves dividing an investment portfolio into smaller, equal portions, and investing each portion in 4-week T-bills with staggered maturity dates. For example, an investor could invest $10,000 in 4-week T-bills, with $2,000 maturing every week for five weeks. This approach allows investors to take advantage of the t bill rate 4 week, while minimizing the impact of interest rate changes and liquidity risks.

By laddering investments, investors can benefit from a number of advantages, including reduced interest rate risk, improved liquidity, and increased returns. When interest rates rise, investors can take advantage of higher yields on new investments, while avoiding the impact of rate changes on existing investments. Similarly, when interest rates fall, investors can minimize the impact of lower yields on their existing investments.

Laddering strategies can also help investors to manage liquidity risks, by ensuring that a portion of their investment portfolio is always maturing and available for reinvestment or withdrawal. This approach can be particularly useful for investors with short-term cash flow needs, such as businesses or individuals with regular expenses.

Ultimately, laddering strategies can be an effective way to manage risk and maximize returns when investing in 4-week T-bills. By spreading investments across different maturity dates, investors can take advantage of the t bill rate 4 week, while minimizing the impact of interest rate fluctuations and liquidity risks.

Conclusion: Navigating the World of 4-Week T-Bill Rates

In conclusion, understanding the 4-week T-bill rate is crucial for investors and market participants seeking to navigate the complex world of short-term fixed-income securities. By grasping the significance of the 4-week T-bill rate, investors can make informed investment decisions and optimize their portfolios in response to changing market conditions.

Throughout this article, we have explored the concept of short-term treasury bills, specifically the 4-week T-bill, and its significance in the financial market. We have discussed how to invest in 4-week T-bills, the impact of economic indicators on the t bill rate 4 week, and how it compares to other short-term investment options. Additionally, we have analyzed historical trends and patterns in 4-week T-bill rates and examined the role of the Federal Reserve in shaping these rates.

By employing laddering strategies and managing risk, investors can maximize returns and minimize the impact of interest rate fluctuations and liquidity risks. As the t bill rate 4 week continues to play a vital role in the financial market, it is essential for investors and market participants to stay informed and adapt to changing market conditions.

Ultimately, navigating the world of 4-week T-bill rates requires a deep understanding of the complex interactions between economic indicators, monetary policy decisions, and market forces. By staying informed and adapting to changing market conditions, investors and market participants can unlock the power of short-term treasury bills and achieve their investment goals.