Understanding Treasury Bills (T-Bills)

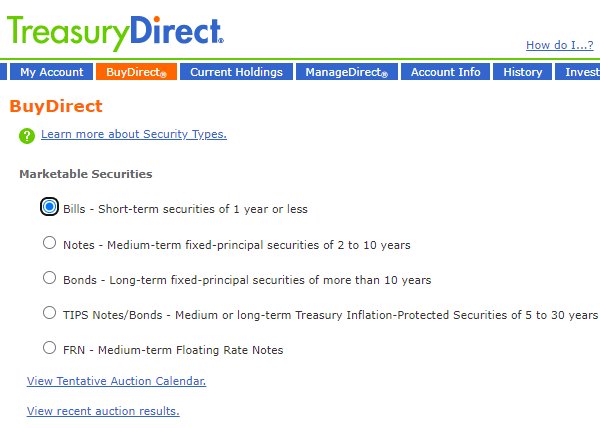

Treasury Bills, or T-bills, are short-term debt securities issued by governments. They represent a loan made by an investor to the government. T-bills are highly sought after by investors due to their low risk and short-term maturity. The government promises to repay the investor the face value of the bill at maturity. This makes them an attractive option for risk-averse investors seeking a safe haven for their funds. Understanding the t bill discount rate formula is crucial for maximizing returns on these investments. T-bills are sold at a discount to their face value, and the difference between the purchase price and face value represents the investor’s return. The short-term nature of T-bills makes them highly liquid, meaning they can be easily bought and sold in the secondary market. This liquidity makes them an appealing investment for those who may need quick access to their capital.

The market for T-bills plays a vital role in the overall financial system. They serve as a benchmark for short-term interest rates, influencing borrowing costs for businesses and consumers. The demand for T-bills reflects investor confidence in the government’s ability to repay its debts. Changes in demand can impact the yields, providing insights into overall market sentiment. The t bill discount rate formula helps investors calculate the return on their investment, considering the time value of money. Accurate calculation of this rate is essential to compare T-bill yields with other investment options and understand the true return generated. Moreover, a deep understanding of the t bill discount rate formula allows investors to make informed decisions regarding their portfolio allocation, aligning their investments with their risk tolerance and financial goals.

Investors use the t bill discount rate formula to determine the yield on their investment. This calculation considers several factors, including the face value of the bill, the purchase price, and the number of days until maturity. The formula facilitates a clear comparison with other short-term investments and allows for a precise assessment of the return against the risk. A thorough understanding of the t bill discount rate formula empowers investors to confidently navigate the complexities of the Treasury bill market and make rational investment choices. The formula allows for an objective evaluation of potential returns, ensuring investors make data-driven decisions, minimizing potential risks and maximizing profits.

How to Calculate the T-Bill Discount Rate

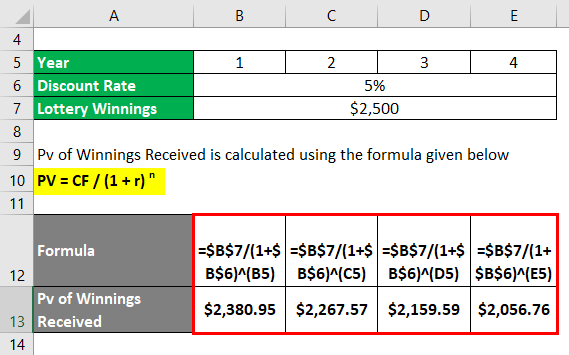

The t bill discount rate formula is crucial for understanding the return on Treasury Bills. It calculates the discount rate, representing the difference between the face value and the purchase price. The formula is: Discount Rate = [(Face Value – Purchase Price) / Face Value] * (360 / Days to Maturity). This formula helps determine the yield on a T-bill investment. To illustrate, consider a $10,000 T-bill purchased for $9,800 with 90 days until maturity. The calculation would be: Discount Rate = [($10,000 – $9,800) / $10,000] * (360 / 90) = 0.02 * 4 = 0.08, or 8%. This 8% represents the discount rate for this specific T-bill.

Understanding each component of the t bill discount rate formula is key. Face Value signifies the amount the investor receives at maturity. The Purchase Price is the amount paid to acquire the bill. Days to Maturity represents the number of days remaining until the bill matures. Accurate calculation of these three factors is critical to obtaining the correct discount rate. Small errors in any of these inputs can significantly affect the final result. It is therefore essential to verify all data before calculating the discount rate.

The t bill discount rate formula provides a clear method for determining the return on a T-bill investment. The formula’s simplicity allows for easy comparison between different T-bill investments. Investors can use this information to make informed decisions based on their risk tolerance and financial goals. Using the formula consistently provides a standardized approach to assessing the potential profitability of various Treasury Bills. This consistent approach facilitates informed investment decisions based on a sound understanding of the underlying formula.

Breaking Down the Formula: Face Value and Purchase Price

The t bill discount rate formula relies on two key values: face value and purchase price. Understanding these is crucial for accurate calculations. The face value represents the amount the investor will receive upon the T-bill’s maturity. This is the nominal value printed on the bill. It’s the amount the U.S. Treasury promises to pay the investor at the end of the term. For example, a T-bill might have a face value of $10,000. This means the investor will receive $10,000 when the bill matures. The purchase price, on the other hand, is the amount the investor pays to acquire the T-bill. This price is always less than the face value, reflecting the discount inherent in T-bills. This discount is the basis for calculating the t bill discount rate formula’s yield.

The difference between the face value and the purchase price directly impacts the discount rate. A larger difference indicates a higher discount rate and, consequently, a potentially higher yield. For instance, if a $10,000 T-bill is purchased for $9,800, the discount is $200. Conversely, if the same T-bill is purchased for $9,900, the discount is only $100, resulting in a lower discount rate. The t bill discount rate formula effectively measures this discount as a percentage of the face value over the investment period. Accurate input of both the face value and the purchase price is essential for calculating the yield using the t bill discount rate formula. Incorrect values will lead to inaccurate yield calculations, impacting investment decisions.

Consider two scenarios using the t bill discount rate formula to illustrate this point. In the first scenario, a $10,000 T-bill with a purchase price of $9,700 will yield a higher discount rate than a $10,000 T-bill purchased for $9,900. The difference in purchase price directly impacts the final yield calculation. The t bill discount rate formula precisely quantifies this difference, providing investors with a clear understanding of their potential return. Understanding the relationship between face value, purchase price, and the resulting discount is fundamental to utilizing the t bill discount rate formula effectively and making sound investment choices.

Days to Maturity: Its Role in Yield Calculation

The “days to maturity” component in the t bill discount rate formula is crucial. It represents the exact number of calendar days between the purchase date and the maturity date of the T-bill. This factor directly impacts the yield. A longer maturity period generally leads to a higher yield, all else being equal. Accurately calculating the days to maturity is therefore essential for precise yield calculations. The calculation requires careful attention to detail, especially when considering leap years.

To calculate days to maturity, one must determine the precise number of days. This includes weekends and holidays. Several methods exist. One could use a dedicated financial calculator. Spreadsheet software also frequently includes functions for this calculation. Alternatively, a simple calendar can be used for manual counting. This is particularly useful for understanding the impact of the t bill discount rate formula. However, remember to account for any adjustments needed for leap years, as these can impact the calculation. Accuracy in this aspect is paramount for avoiding errors in the final yield calculation using the t bill discount rate formula. An incorrect count will lead to a miscalculation of the discount rate.

The impact of the days to maturity on the t bill discount rate formula is significant. Consider two identical T-bills, with the same face value and purchase price. The one with a longer maturity period will have a higher discount rate. This is because the investor’s money is tied up for a longer period, so the yield needs to compensate accordingly. Understanding this relationship is key to interpreting the results of the t bill discount rate formula and to making informed investment decisions. Careful consideration of the days to maturity is a critical element in applying the t bill discount rate formula effectively and accurately. Ignoring this critical component could lead to misinterpretations of the yield. The impact of this factor directly affects the overall calculation of the t bill discount rate formula.

Annualized Yield: Converting the Discount Rate

The t bill discount rate formula provides a discount rate reflecting the return over the T-bill’s life. However, investors typically compare yields on an annual basis. This necessitates converting the discount rate to an annualized yield. The annualized yield allows for straightforward comparisons with other investments offering different maturities. To annualize, one must consider the number of days in a year (360 or 365, depending on the convention used) and the T-bill’s maturity period. The formula for annualizing the discount rate involves multiplying the discount rate by the number of 360-day years in a given year. This calculation provides a standardized measure of return. Using a 360-day year simplifies the computation, a common practice in the financial industry.

The precise calculation depends on whether a 360-day or a 365-day year is used. For instance, using a 360-day year, the annualized yield is calculated by multiplying the discount rate by (360 / days to maturity). This adjustment accounts for the difference in time between the T-bill’s actual maturity and a full year. It’s crucial to note that the choice between a 360-day or 365-day year impacts the final annualized yield. Consistency in applying this convention is key when comparing different T-bill yields. The t bill discount rate formula itself doesn’t inherently account for annualization. The annualization step is a necessary post-calculation adjustment to standardize the yield for comparison purposes.

Understanding the annualized yield is critical for informed investment decisions. It provides a clearer picture of the return on investment when compared to other short-term instruments. Investors should always request the annualized yield when evaluating T-bill investments. This allows for more effective comparisons and helps in making sound financial choices. The accuracy of the annualized yield directly depends on the accuracy of the initial t bill discount rate formula calculation. Errors in the initial calculation will propagate to the annualized yield, leading to potentially flawed investment decisions. Therefore, meticulous attention to detail is crucial throughout the entire process.

Example Calculation with Real-World T-Bill Data

To illustrate the practical application of the t bill discount rate formula, let’s analyze a hypothetical scenario based on recent Treasury bill auction data. Assume a 13-week T-bill with a face value of $10,000 was auctioned at a price of $9,850. The auction date was March 1st, 2024, and the maturity date is May 22nd, 2024. To calculate the number of days to maturity, we account for the exact number of days between these dates: This is 83 days (52 days in March, 30 in April, and 1 in May). The t bill discount rate formula is then applied: Discount = (Face Value – Purchase Price) / Face Value * (360 / Days to Maturity). Substituting the values, the calculation is as follows: Discount = ($10,000 – $9,850) / $10,000 * (360 / 83) = 0.015 * 4.337 = 0.0650. This translates to a discount rate of approximately 6.5%. To annualize this discount rate, we simply multiply by (365/83): Annualized Yield ≈ 0.0650 * (365/83) ≈ 0.286 or 28.6%. This demonstrates how the t bill discount rate formula converts the discount to an annualized yield percentage, allowing for meaningful comparisons across different investment options.

Understanding the nuances of the t bill discount rate formula is vital for accurate yield calculations. Factors such as the precise number of days to maturity, especially around leap years or holidays, demand careful attention. Inaccurate day counts can lead to significant errors in the final yield calculation. For example, if one erroneously calculated the number of days to maturity as 82 instead of 83, the discount would be higher (approximately 6.6%), affecting the annualized yield. In this particular example, the annualized yield would be higher (approximately 29.2%). This illustrates the importance of using precise day counts when employing the t bill discount rate formula. The t bill discount rate formula is essential for investors to accurately evaluate the return on their investment in these short-term securities. By correctly calculating the discount rate, investors can make more informed decisions based on the expected return from investing in Treasury bills.

Moreover, accurately calculating the t bill discount rate is crucial for comparing Treasury bills to other short-term investments. The annualized yield allows investors to easily compare the return of Treasury bills with other investment options. Incorrectly calculating the discount rate, particularly neglecting to annualize it, can lead to flawed comparisons and potentially suboptimal investment choices. Therefore, investors should strive for accuracy in applying the t bill discount rate formula, paying careful attention to each component of the formula and using appropriate day count conventions. This meticulousness will ensure the comparison of investment opportunities yields accurate and reliable results when investing in T-bills.

Common Mistakes to Avoid When Calculating T-Bill Yields

Calculating the t bill discount rate formula accurately requires precision. One common mistake involves miscalculating the number of days to maturity. Incorrectly accounting for leap years or weekend/holiday adjustments can significantly skew the result. Always use a reliable day count convention to ensure accuracy. Another frequent error arises from misinterpreting the discount rate itself. The discount rate represents the percentage reduction from the face value, not the yield percentage. Investors often mistakenly use this figure directly as their annualized return without performing the necessary conversion. This misunderstanding leads to an inaccurate assessment of the investment’s true profitability. Remember to convert the discount rate into an annualized yield using the appropriate formula to gain a meaningful comparison with other investment options. The t bill discount rate formula, while seemingly straightforward, can also be misinterpreted when dealing with unusual maturities or irregular settlement dates. In such cases, consulting financial professionals or utilizing specialized software can help ensure accurate calculations.

Another area where errors can creep into t bill discount rate formula calculations is in handling the purchase price. The purchase price should reflect the actual amount paid for the T-bill, including any commissions or fees. Failing to account for these charges will inflate the calculated yield, providing a false sense of return. Therefore, it’s crucial to utilize the net purchase price in the calculation to obtain a truly representative yield. Furthermore, some investors overlook the impact of reinvestment risk when evaluating T-bill yields. While T-bills offer a relatively low-risk investment opportunity, the return is fixed, meaning it is not adjusted for changing interest rate environments. Therefore, failing to consider the opportunity cost of tying up capital in a T-bill, particularly when interest rates might be rising, can lead to an incomplete assessment of its true value. The t bill discount rate formula itself is not flawed, but its effective application requires attention to detail and a comprehensive understanding of the underlying financial principles. Accurate calculations are paramount for informed decision-making.

Finally, a critical mistake involves neglecting to annualize the yield. The discount rate derived from the t bill discount rate formula is based on the specific maturity period of the T-bill, usually less than a year. Simply reporting this figure without annualizing it prevents proper comparison with other investments that typically offer annual yields. The annualized yield provides a standardized measure allowing investors to compare various investment opportunities effectively, including T-bills, bonds, and other fixed-income securities. The process of annualizing involves adjusting the discount rate to reflect the equivalent annual return, taking into account the actual number of days in the T-bill’s maturity period. Using the annualized yield allows investors to make more informed decisions based on the true return potential of a T-bill compared to alternative investments, making the t bill discount rate formula’s application truly effective and meaningful. Remember, careful attention to detail and a thorough understanding of the formula’s components are crucial to avoiding errors and ensuring accurate yield calculations.

Beyond the Formula: Interpreting T-Bill Yields in Investment Decisions

Understanding the t bill discount rate formula is crucial for making informed investment choices. The calculated discount rate provides a precise measure of the return an investor can expect from a Treasury bill. This rate directly reflects the prevailing market interest rates, offering insights into the overall economic environment. Low yields may suggest a period of low inflation and economic uncertainty, while higher yields might signal expectations of future inflation or economic growth. Investors use this information to adjust their portfolios, seeking higher returns during periods of economic expansion and greater capital preservation during periods of uncertainty.

Comparing the t bill discount rate formula’s output to yields on other short-term investments, such as certificates of deposit (CDs) or money market accounts, allows investors to assess the relative attractiveness of Treasury bills. The perceived risk associated with each investment type influences its yield. Since Treasury bills are considered virtually risk-free, their yields typically serve as a benchmark against which other investments are measured. A higher yield on an alternative investment suggests a higher risk premium demanded by the market to compensate for the associated risk. Conversely, a lower yield on a comparable investment might suggest a more attractive risk-adjusted return for that alternative.

The t bill discount rate formula, therefore, plays a vital role in investment strategy. By understanding the implications of the calculated yield within the broader financial context, investors can effectively assess risk, optimize returns, and construct well-diversified portfolios. The formula’s simplicity belies its power; mastering its use unlocks a key element in successfully navigating the complexities of the financial markets. A thorough grasp of this formula empowers investors to make strategic decisions based on a clear understanding of the expected return and the implications for their overall investment goals.