Understanding Treasury Bills

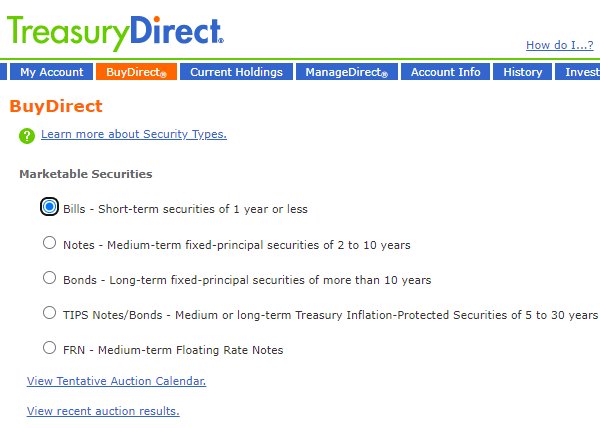

Treasury Bills (T-Bills) are short-term debt securities issued by the U.S. Department of the Treasury. These instruments play a vital role in the money market, providing a means for the government to borrow money. A crucial feature of T-Bills is their discounted payment structure. Investors purchase T-Bills at a price below their face value. The difference between the face value and the purchase price represents the interest earned. Understanding the “t bill discount rate formula” is essential for evaluating these investments.

T-Bills are highly liquid and readily marketable, making them attractive to investors seeking short-term investments. Their discounted payment structure allows for a straightforward calculation of the rate of return, often called the “t bill discount rate formula.” This structure makes these securities accessible to a broad range of investors. The precise calculation of the discount rate relies on a formula that includes key variables such as the face value, discount rate, time period, and purchase price of the Treasury Bill. Understanding these elements provides a more thorough understanding of the pricing and returns on these securities.

The process of calculating the discount rate involves several key components and considerations. The face value represents the amount the investor receives at maturity. The discount rate is the rate at which the investor’s payment is discounted. The time period, typically measured in days, is the length of time until maturity. Lastly, the purchase price represents the amount the investor pays for the T-Bill. Each of these components is crucial to the accuracy of the calculation and interpretation of the “t bill discount rate formula.” Understanding their interrelationships is vital for accurate evaluations of the potential returns of these securities.

Key Components of the T-Bill Discount Rate Formula

The t-bill discount rate formula requires several key components for accurate calculation. Understanding each element is crucial for proper application. The face value represents the amount the Treasury promises to pay at maturity. This fixed amount is a critical element in calculating the discount. The discount rate itself is the percentage reduction applied to the face value to determine the purchase price. The time period, typically measured in days, is essential for determining the period of the investment. Finally, the purchase price reflects the amount an investor pays for the Treasury bill. Each of these factors influences the eventual t-bill discount rate calculation.

The face value is important because it’s the basis for the entire calculation. The discount rate is the percentage reduction applied to the face value to arrive at the purchase price. The time period affects the rate, as a longer period generally correlates with a higher discount rate. Finally, the purchase price is the key output derived from the calculation and represents the amount investors invest. By understanding each of these key elements in the t bill discount rate formula, investors can accurately calculate the discount rate and make informed investment decisions.

Careful consideration of these components is crucial to accurately calculating the t-bill discount rate. Using consistent units, particularly for the time period, is essential for an accurate calculation. Mistakes in these units can lead to inaccurate discount rates, which can cause significant errors in investment decisions. Each component of the formula is crucial for determining the overall t bill discount rate and the investor’s return on the investment. Understanding each component and their interrelation ensures the accuracy of the calculated discount rate.

Deriving the T-Bill Discount Rate Formula

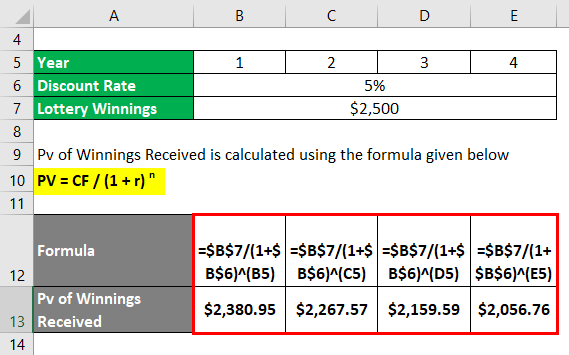

Calculating the t bill discount rate involves a specific formula. The formula hinges on the relationship between face value, discount rate, time period, and purchase price. Understanding this relationship is key for accurately calculating the discount rate for a Treasury Bill.

The fundamental equation for the t bill discount rate formula involves the face value (FV) of the bill, the discount rate (DR), the time period (in days) and the purchase price (PP). The formula is derived from the concept that the difference between the face value and the purchase price represents the discount. This discount, generated over the specified time, effectively represents the interest earned by the investor. The t bill discount rate formula, expressed mathematically, can help investors understand the inherent value of a t-bill.

To derive the discount rate, the formula starts with the basic principle that discount is equal to (face value – purchase price). This discount is earned over the term of the bill. Rearranging the terms allows for the expression of the discount rate. Crucially, the time period (in days) plays a critical role in this calculation. The resulting discount rate represents the cost of borrowing the money for that specific period. A proper understanding of the units (days) is critical to avoid errors and arrive at the accurate t-bill discount rate.

A thorough understanding of these fundamental aspects enables accurate calculations and provides insight into the financial characteristics of Treasury Bills. Critically, accurately determining the t-bill discount rate is fundamental to financial decision-making for investors.

Practical Application: Examples

Illustrative examples demonstrate the application of the t bill discount rate formula. Consider a Treasury bill (T-Bill) with a face value of $10,000 and a purchase price of $9,800. The bill matures in 90 days. Applying the formula, determine the discount rate. First, calculate the discount: $10,000 – $9,800 = $200. Next, determine the discount rate using the formula. The time period is 90 days. The annual discount rate can be calculated using the following steps:

($200 / $10,000) * (365 / 90) = 0.081, which converts to 8.1%. This calculation reveals the discount rate for this T-Bill. Alternatively, consider a different scenario. A T-Bill with a face value of $5,000, purchased at $4,900, and maturing in 60 days. Calculating the discount reveals a discount of $100. Using the formula, the annual discount rate equals ($100 / $5,000) * (365 / 60) = 0.1216, or 12.16%. Notice how the discount rate varies with changes in the time period and face value of the t bill. The t bill discount rate formula plays a pivotal role in accurately determining the rate of return on these short-term investments. For instance, a longer maturity period typically results in a lower discount rate. Conversely, a higher face value might lead to a reduced discount rate, all things being equal. Understanding these relationships is essential for investment decisions involving T-Bills.

To gain further insight, consider a T-Bill with a face value of $1,000, a purchase price of $980, and a maturity period of 30 days. Calculating the discount using the t bill discount rate formula yields a discount of $20. Now, calculate the discount rate: ($20 / $1,000) * (365 / 30) = 0.243, or 24.3%. These examples highlight the importance of precision and accuracy in applying the formula and how these variables affect the t bill discount rate. These calculations reveal the rate of return on the T-Bill investments. This insight helps compare different investment options.

How to Calculate a T-Bill’s Discount Rate

This section provides a step-by-step procedure for determining the t bill discount rate. Understanding this process is crucial for accurately evaluating these short-term investments. Follow these instructions carefully to calculate the t bill discount rate correctly.

Step 1: Gather the Necessary Data. Collect the required information: the face value of the Treasury Bill, the purchase price, and the time period (in days) until maturity. Ensure accurate data entry for precise calculation results. Proper data input is vital for correct outcomes.

Step 2: Apply the Formula. Use the t bill discount rate formula to determine the discount rate. The formula calculates the discount rate by subtracting the purchase price from the face value, then dividing the result by the face value and multiplying by (360/time period). Careful attention must be given to units of time (days) to get accurate results.

Step 3: Input Values into the Formula. Substitute the collected data (face value, purchase price, and time) into the appropriate place in the t bill discount rate formula. Inputting the correct data points is crucial for the accuracy of the calculation. Verify all inputs before proceeding.

Step 4: Perform the Calculation. Use a calculator or spreadsheet program to perform the calculation, following the order of operations (PEMDAS/BODMAS). Double-check your calculation process to ensure accuracy. The calculated result represents the discount rate for the specific T-Bill.

Step 5: Interpret the Result. The calculated discount rate directly reflects the cost of borrowing for the government. This rate, applied to the face value and time to maturity, determines the purchase price. The rate can be compared with current market rates for comparable investments, aiding investment decision-making. Understanding the factors influencing the discount rate helps to interpret the result effectively.

Step 6: Double-Check Your Work. Carefully review the input data and the calculation process. Verify that all steps have been executed accurately to avoid errors. A precise calculation is crucial for understanding the financial implications of a Treasury Bill investment. Accuracy is paramount in financial calculations.

Interpreting the Results

The calculated t bill discount rate formula represents the cost of borrowing for the U.S. Treasury, essentially the price of a Treasury bill (T-Bill) relative to its face value. This rate, expressed as a percentage, indicates the financial institution’s expected return on their investment. A higher discount rate means a lower purchase price for the T-Bill. Conversely, a lower rate equates to a higher purchase price, which translates to a better deal for investors.

Understanding this discount rate helps investors compare potential returns from Treasury Bills against other investment options. Comparing the calculated discount rate to current market rates and the yields of other comparable securities provides an informed decision-making process. A thorough analysis of the discount rate’s relationship to prevailing market interest rates, and other similar investment vehicles, allows for insightful assessments.

The discount rate serves as a crucial indicator in the evaluation process for T-Bills. Investors consider this along with factors like the length of the investment period to make informed financial choices. Investors can use this knowledge of the t bill discount rate formula to assess the potential return of T-Bills in comparison to other market securities and investment options. Comparing calculated discount rates to historical data and market trends aids in understanding T-Bill performance. This knowledge proves invaluable when assessing and evaluating the potential yield of a Treasury bill (T-Bill) against other comparable market instruments. This comparison contributes to comprehensive investment strategy development.

Discount Rate vs. Yield to Maturity

Understanding the relationship between the discount rate and yield to maturity is crucial for investors analyzing Treasury Bills (T-Bills). While closely related, these concepts differ subtly. The discount rate represents the rate at which the T-Bill’s face value is discounted to arrive at its purchase price. Conversely, yield to maturity (YTM) reflects the total return anticipated on the T-Bill if held until its maturity date. This includes both the discount rate and any accrued interest during the holding period.

The t bill discount rate formula calculates the discount rate directly from the known variables of face value, purchase price, and time period. Calculating the yield to maturity is slightly more complex and requires the use of a financial calculator or spreadsheet software that employs iterative techniques. The crucial difference rests on calculating the return considering the future value of the T-Bill at maturity. This method accurately accounts for the total return over the investment’s lifetime. Consequently, the yield to maturity is typically higher than the discount rate, reflecting the time value of money over the T-Bill’s duration. Recognizing this difference is essential for strategic financial decisions.

For instance, a T-Bill with a discount rate of 4% might exhibit a yield to maturity of 4.1% due to interest accruing throughout the holding period. Investors should be aware of this subtle difference when evaluating various investment options. The discount rate calculation provides a direct measure of the cost of the T-Bill, while the yield to maturity gives a more comprehensive view of the overall return potential. These metrics, when combined, create a thorough understanding of the T-Bill’s value proposition, aiding in informed investment choices.

Important Considerations and Factors Affecting T-Bill Discount Rates

Several factors influence the treasury bill discount rate formula. Understanding these factors is crucial for accurately interpreting fluctuations in the market. Market conditions play a significant role. A rising demand for T-bills often leads to lower discount rates, while decreased demand typically results in higher rates. This relationship reflects the supply and demand dynamics of the financial market. Economic indicators, such as inflation and interest rates, also directly affect the t bill discount rate formula.

Inflation typically leads to higher treasury bill discount rates. When inflation increases, investors demand higher returns to compensate for the eroding purchasing power of their investments. Conversely, periods of low or stable inflation often result in lower discount rates for T-bills. The relationship between interest rates and treasury bill discount rates is closely linked. Changes in broader market interest rates often influence the rates of T-bills. The relationship can be complex and sometimes even counterintuitive, depending on various market factors. The overall health of the economy affects investor sentiment, which in turn, impacts the demand for Treasury securities, and thus, t bill discount rate formula calculations.

Analyzing historical data on treasury bill discount rates offers insights into these market fluctuations. This historical data can be a valuable tool for understanding the broader economic context and anticipating potential shifts in market conditions. Investors can use this historical information to assess the risk associated with particular investment opportunities, particularly those involving T-bills. The t bill discount rate formula is essential for making informed investment decisions and navigating the complexities of financial markets.