What are Treasury Bills and How Do They Work?

Treasury Bills, commonly referred to as T-Bills, are a type of short-term government debt security issued by the U.S. Department of the Treasury to raise capital. They are backed by the full faith and credit of the U.S. government, making them an extremely low-risk investment option. T-Bills are issued with various maturity periods, ranging from a few weeks to a year, with the 3-month T-Bill being a popular option among investors. The 3-month T-Bill rate, in particular, is a key indicator of short-term interest rates and is closely watched by investors and economists alike. With a low-risk profile and a relatively short maturity period, T-Bills are an attractive option for investors seeking to park their funds for a short duration. They are also a popular choice for investors who want to diversify their portfolio and reduce their exposure to market volatility.

Understanding the 3-Month T-Bill Rate: A Key to Maximizing Returns

The 3-month T-Bill rate is a crucial indicator of short-term interest rates and is closely watched by investors and economists alike. The rate is determined at auction, where investors bid on the price they are willing to pay for a T-Bill with a 3-month maturity period. The highest bid prices are accepted, and the corresponding interest rate is set as the 3-month T-Bill rate. This rate is influenced by market conditions, such as inflation expectations, economic growth, and monetary policy. For instance, during periods of high inflation, the 3-month T-Bill rate may increase to combat inflationary pressures. Conversely, during economic downturns, the rate may decrease to stimulate growth.

Investing in 3-month T-Bills offers several benefits, including a low-risk profile, competitive returns, and high liquidity. The 3-month T-Bill rate is generally higher than the rate offered by traditional savings accounts, making it an attractive option for short-term investors. Furthermore, T-Bills are backed by the full faith and credit of the U.S. government, ensuring that investors receive their principal investment plus interest at maturity. By understanding the 3-month T-Bill rate and its relationship with market conditions, investors can make informed decisions to maximize their returns and achieve their investment goals.

How to Invest in 3-Month T-Bills: A Step-by-Step Guide

Investing in 3-month T-Bills is a straightforward process that can be completed online or through a bank. Here’s a step-by-step guide to help you get started:

Step 1: Determine Your Investment Amount – Decide how much you want to invest in 3-month T-Bills. The minimum investment amount is $100, and you can invest up to $5 million.

Step 2: Choose Your Purchase Method – You can buy 3-month T-Bills directly from the U.S. Department of the Treasury’s website, TreasuryDirect, or through a bank or broker. TreasuryDirect is a convenient and cost-effective option, as it eliminates the need for intermediaries.

Step 3: Create a TreasuryDirect Account – If you choose to buy through TreasuryDirect, you’ll need to create an account. This involves providing personal and banking information, as well as verifying your identity.

Step 4: Bid on a 3-Month T-Bill – Once you have a TreasuryDirect account, you can bid on a 3-month T-Bill auction. You can choose to bid at a competitive rate, which means you specify the discount rate you’re willing to accept, or a non-competitive rate, which means you accept the auction’s high yield.

Step 5: Purchase Your 3-Month T-Bill – After the auction, you’ll be notified if your bid is accepted. If it is, the 3-month T-Bill will be credited to your TreasuryDirect account.

Step 6: Monitor Your Investment – You can monitor your 3-month T-Bill investment through your TreasuryDirect account. You’ll receive interest payments every month, and your principal investment will be returned at maturity.

By following these steps, you can easily invest in 3-month T-Bills and take advantage of their low-risk, competitive returns, and high liquidity. Remember to consider the current 3-month T-Bill rate and market conditions before making your investment decision.

The Benefits of Investing in 3-Month T-Bills: Liquidity and Low Risk

Investing in 3-month T-Bills offers a range of benefits that make them an attractive option for short-term investors. One of the primary advantages of 3-month T-Bills is their high liquidity. With a maturity period of just 3 months, investors can easily access their funds when needed, making them an ideal choice for those who require quick access to their capital.

Another significant benefit of 3-month T-Bills is their low-risk profile. Backed by the full faith and credit of the U.S. government, 3-month T-Bills are considered to be one of the safest investment options available. This means that investors can enjoy peace of mind, knowing that their principal investment is secure and will be returned at maturity.

In addition to their liquidity and low risk, 3-month T-Bills also offer competitive returns. The 3-month T-Bill rate is generally higher than the rate offered by traditional savings accounts, making them a more attractive option for investors seeking to generate stable returns over a short period.

Furthermore, 3-month T-Bills are a low-maintenance investment option. With no need to actively manage the investment, investors can simply purchase the T-Bill and wait for the maturity date to receive their principal investment plus interest. This makes them an ideal choice for those who want to invest in a hassle-free manner.

Overall, the benefits of investing in 3-month T-Bills make them an attractive option for short-term investors. With their high liquidity, low risk, competitive returns, and low-maintenance requirements, 3-month T-Bills are an excellent way to generate stable returns while minimizing potential losses. By understanding the current 3-month T-Bill rate and market conditions, investors can make informed decisions to maximize their returns and achieve their investment goals.

Comparing 3-Month T-Bill Rates: Historical Trends and Market Analysis

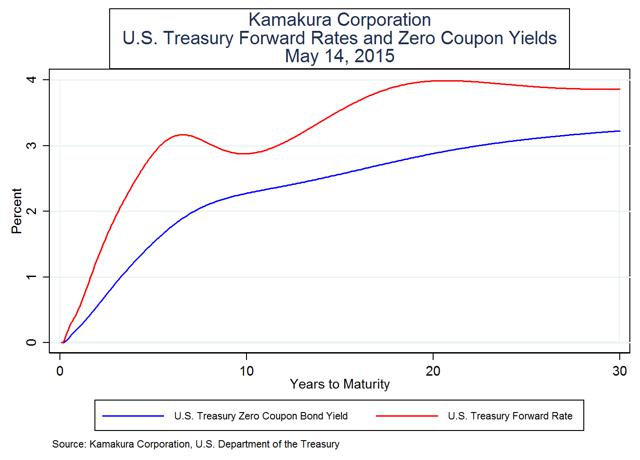

Understanding the historical trends of 3-month T-Bill rates is crucial for investors seeking to maximize their returns. By analyzing the past performance of 3-month T-Bill rates, investors can gain valuable insights into the impact of economic indicators, monetary policy, and market conditions on the rates.

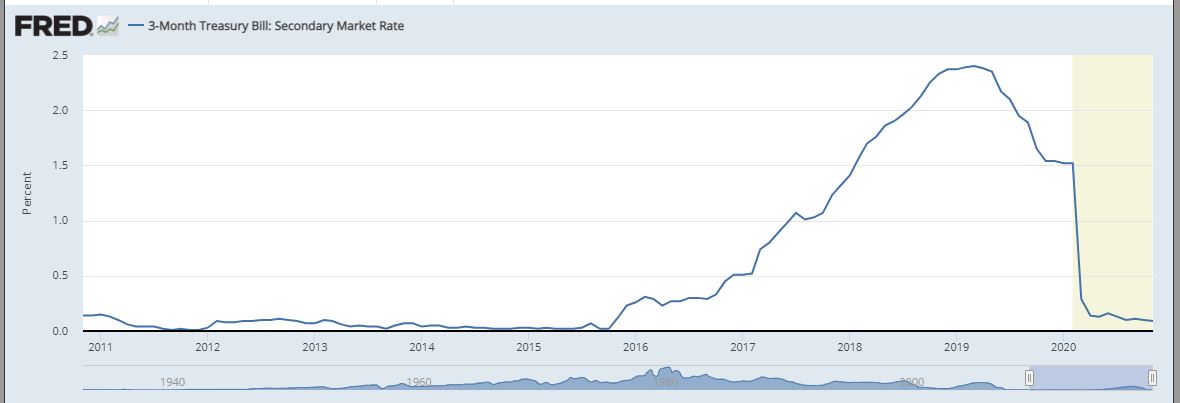

Historically, 3-month T-Bill rates have been influenced by the state of the economy. During periods of economic growth, 3-month T-Bill rates tend to rise as the demand for credit increases. Conversely, during economic downturns, 3-month T-Bill rates tend to fall as the demand for credit decreases.

Monetary policy also plays a significant role in shaping 3-month T-Bill rates. The Federal Reserve, the central bank of the United States, sets interest rates to influence the money supply and inflation. When the Federal Reserve raises interest rates, 3-month T-Bill rates tend to increase, and when it lowers interest rates, 3-month T-Bill rates tend to decrease.

Market conditions, such as the yield curve and inflation expectations, also impact 3-month T-Bill rates. When the yield curve is steep, indicating a strong economy, 3-month T-Bill rates tend to rise. Conversely, when the yield curve is flat, indicating a weak economy, 3-month T-Bill rates tend to fall.

By analyzing these historical trends and market conditions, investors can gain a better understanding of the 3-month T-Bill rate and make informed investment decisions. For example, during periods of economic growth, investors may consider investing in 3-month T-Bills to take advantage of the higher rates. Conversely, during economic downturns, investors may consider investing in longer-term T-Bills to lock in higher rates.

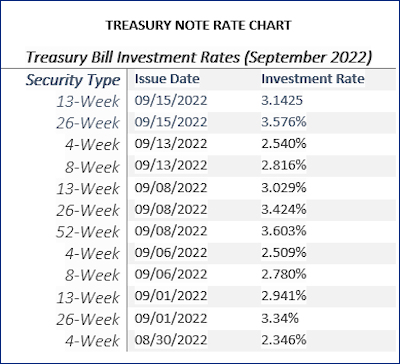

Currently, the 3-month T-Bill rate is around 1.5%. While this rate may seem low compared to historical standards, it is still an attractive option for short-term investors seeking to generate stable returns. By understanding the historical trends and market conditions that influence the 3-month T-Bill rate, investors can make informed decisions to maximize their returns and achieve their investment goals.

Managing Risk: Strategies for Investing in 3-Month T-Bills

Investing in 3-month T-Bills is considered a low-risk investment option, but it’s essential to understand that there are still risks involved. To minimize potential losses, investors can employ various strategies to manage risk when investing in 3-month T-Bills.

One effective strategy is diversification. By spreading investments across different asset classes, including 3-month T-Bills, investors can reduce their exposure to any one particular market or sector. This can help to mitigate potential losses and increase the overall stability of the investment portfolio.

Laddering is another strategy that can help investors manage risk when investing in 3-month T-Bills. This involves investing in a series of 3-month T-Bills with staggered maturity dates, rather than investing a lump sum in a single T-Bill. This approach can help to reduce the impact of interest rate fluctuations and provide a more consistent return on investment.

Hedging is a more advanced strategy that can be used to manage risk when investing in 3-month T-Bills. This involves taking positions in other investments that offset potential losses in the T-Bill investment. For example, an investor could take a short position in a bond fund to offset the potential losses in a 3-month T-Bill investment.

Another strategy is to consider the credit rating of the issuer. While 3-month T-Bills are backed by the full faith and credit of the U.S. government, other issuers may have lower credit ratings. Investors should carefully evaluate the creditworthiness of the issuer before investing in a 3-month T-Bill.

In addition to these strategies, investors should also consider the current market conditions and interest rate environment before investing in 3-month T-Bills. For example, if interest rates are rising, it may be more beneficial to invest in shorter-term T-Bills to take advantage of the higher rates. Conversely, if interest rates are falling, it may be more beneficial to invest in longer-term T-Bills to lock in the higher rates.

By employing these strategies, investors can effectively manage risk when investing in 3-month T-Bills and increase the potential for generating stable returns. It’s essential to remember that investing in 3-month T-Bills is not a one-size-fits-all approach, and investors should carefully evaluate their individual financial goals and risk tolerance before investing.

Tax Implications of Investing in 3-Month T-Bills: What You Need to Know

When investing in 3-month T-Bills, it’s essential to understand the tax implications of these investments. The tax treatment of interest earned on 3-month T-Bills can have a significant impact on an investor’s overall return on investment.

In the United States, the interest earned on 3-month T-Bills is subject to federal income tax. However, the interest is exempt from state and local income taxes. This means that investors will need to report the interest earned on their federal tax return, but they will not need to pay state or local taxes on this income.

It’s also important to note that 3-month T-Bills are not subject to capital gains tax, as they are not considered a capital asset. This means that investors will not need to pay capital gains tax when they sell their 3-month T-Bills.

Another tax implication to consider is the impact of inflation on the purchasing power of the interest earned. While the interest earned on 3-month T-Bills may be exempt from state and local taxes, it may not keep pace with inflation, reducing the purchasing power of the interest earned.

Investors should also be aware of the tax implications of investing in 3-month T-Bills in a taxable brokerage account versus a tax-deferred account, such as an IRA or 401(k). In a taxable brokerage account, the interest earned will be subject to federal income tax, while in a tax-deferred account, the interest earned will not be subject to tax until withdrawal.

Finally, investors should consider the impact of the t bill 3 month rate on their overall tax strategy. For example, if an investor is in a high tax bracket, they may want to consider investing in tax-exempt securities, such as municipal bonds, in addition to 3-month T-Bills.

By understanding the tax implications of investing in 3-month T-Bills, investors can make informed decisions about their investment strategy and minimize their tax liability. It’s essential to consult with a tax professional or financial advisor to determine the best approach for individual circumstances.

Conclusion: Why 3-Month T-Bills Should Be Part of Your Investment Portfolio

In conclusion, 3-month T-Bills offer a unique combination of benefits that make them an attractive option for short-term investors. With their high liquidity, low risk, and competitive returns, 3-month T-Bills provide a stable source of income for investors seeking to minimize risk.

The t bill 3 month rate, which is determined by market forces, provides a benchmark for investors to evaluate the potential returns of their investment. By understanding the factors that influence the 3-month T-Bill rate, investors can make informed decisions about their investment strategy.

Moreover, 3-month T-Bills offer a range of benefits, including easy access to capital, low minimum investment requirements, and a high degree of safety. These benefits make 3-month T-Bills an ideal option for investors seeking to diversify their portfolio and reduce risk.

By incorporating 3-month T-Bills into their investment portfolio, investors can create a balanced and diversified portfolio that is better equipped to weather market fluctuations. Additionally, the tax implications of investing in 3-month T-Bills are relatively straightforward, making it easier for investors to plan their tax strategy.

In today’s fast-paced and volatile market environment, 3-month T-Bills offer a rare combination of stability and returns. By taking advantage of the benefits of 3-month T-Bills, investors can create a more resilient and profitable investment portfolio.

Ultimately, the t bill 3 month rate is just one aspect of the broader investment landscape. By understanding the benefits and risks of 3-month T-Bills, investors can make informed decisions about their investment strategy and achieve their financial goals.