Mastering Volatility Trading: A Comprehensive Guide to Strangle and Straddle Options

Unlocking the Power of Options Trading Strategies

Options trading has emerged as a popular investment approach, offering investors a range of benefits, including flexibility and risk management capabilities. By understanding different options strategies, investors can tailor their portfolios to individual investment goals and navigate complex market conditions with confidence. Two of the most popular options strategies are the strangle and straddle, each with its unique characteristics and applications. In this article, we will delve into the world of strangle vs straddle option strategy, exploring their components, advantages, and real-world examples to help investors make informed decisions.

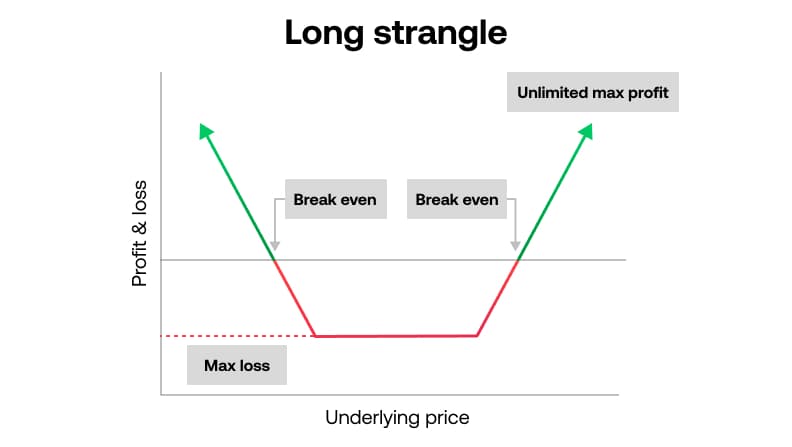

What is a Strangle Option Strategy?

A strangle option strategy is a popular volatility trading approach that involves buying or selling a combination of call and put options with different strike prices, but the same expiration date. This strategy is often used by investors who anticipate a significant price movement in the underlying asset, but are uncertain about the direction of the move. By using a strangle strategy, investors can potentially profit from large price swings, while limiting their risk exposure. For instance, a strangle strategy can be used to capitalize on earnings announcements, mergers and acquisitions, or other market events that may trigger significant price movements. The advantages of a strangle strategy include its flexibility, as it can be tailored to individual investment goals and risk tolerance, and its potential for high returns, especially in volatile market conditions.

How to Implement a Strangle Option Strategy Effectively

To successfully implement a strangle option strategy, it’s essential to set the right strike prices, manage risk, and adjust the strategy based on market conditions. When selecting strike prices, consider the volatility of the underlying asset, as well as the investor’s risk tolerance and investment goals. A general rule of thumb is to choose strike prices that are slightly out-of-the-money, as this can provide a higher potential return while limiting risk. Additionally, investors should consider the expiration date of the options, as well as the overall market conditions, to ensure that the strategy is aligned with their investment goals. Effective risk management is also crucial, as it can help mitigate potential losses. This can be achieved by setting stop-loss orders, diversifying the portfolio, and continuously monitoring market conditions. By following these best practices, investors can increase their chances of success when using a strangle option strategy, and make informed decisions when considering a strangle vs straddle option strategy.

What is a Straddle Option Strategy?

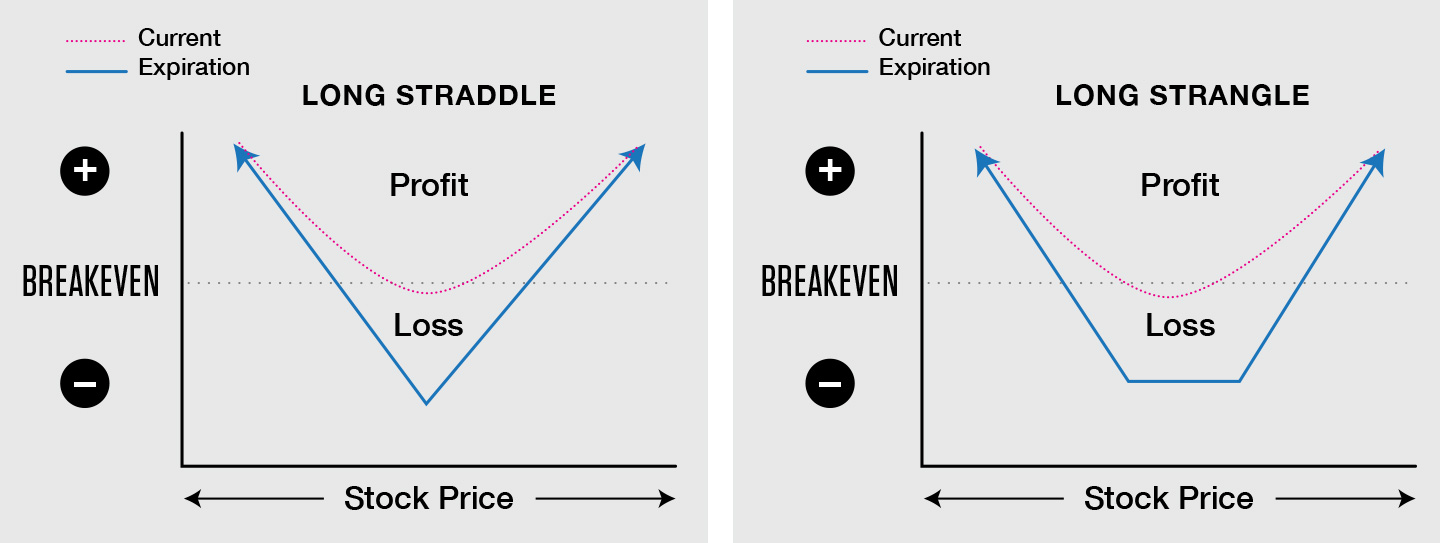

A straddle option strategy is a volatility trading approach that involves buying or selling a call and put option with the same strike price and expiration date. This strategy is often used by investors who expect a significant price movement in the underlying asset, but are uncertain about the direction of the move. By using a straddle strategy, investors can potentially profit from large price swings, while limiting their risk exposure. The advantages of a straddle strategy include its simplicity, as it involves buying or selling two options with the same strike price, and its potential for high returns, especially in highly volatile market conditions. For instance, a straddle strategy can be used to capitalize on earnings announcements, mergers and acquisitions, or other market events that may trigger significant price movements. When considering a strangle vs straddle option strategy, investors should weigh the benefits of each approach and choose the one that best aligns with their investment goals and risk tolerance.

Key Differences Between Strangle and Straddle Option Strategies

When considering a strangle vs straddle option strategy, it’s essential to understand the key differences between these two volatility trading approaches. While both strategies involve buying or selling call and put options, they differ in their strike prices and expiration dates. A strangle strategy involves buying or selling call and put options with different strike prices, but the same expiration date. In contrast, a straddle strategy involves buying or selling call and put options with the same strike price and expiration date. This difference in strike prices affects the risk and potential returns of each strategy. Strangle strategies are often used when investors expect a moderate price movement, while straddle strategies are used when investors expect a significant price movement. Additionally, strangle strategies tend to be less expensive than straddle strategies, but also offer lower potential returns. By understanding the pros and cons of each strategy, investors can make informed decisions about which approach to use in different market conditions. For instance, a strangle strategy may be more suitable for investors who expect a moderate price movement, while a straddle strategy may be more suitable for investors who expect a significant price movement. By choosing the right strategy, investors can increase their chances of success in volatility trading.

When to Use a Strangle vs Straddle Option Strategy

Deciding when to use a strangle vs straddle option strategy depends on various factors, including market conditions, volatility levels, and investment goals. In general, a strangle strategy is more suitable for investors who expect a moderate price movement, while a straddle strategy is more suitable for investors who expect a significant price movement. For instance, if an investor expects a moderate price increase or decrease, a strangle strategy may be more appropriate. On the other hand, if an investor expects a significant price movement, such as during earnings announcements or mergers and acquisitions, a straddle strategy may be more suitable. Additionally, investors should consider their risk tolerance and investment goals when choosing between a strangle vs straddle option strategy. If an investor is risk-averse and wants to limit their potential losses, a strangle strategy may be more suitable. However, if an investor is willing to take on more risk in pursuit of higher returns, a straddle strategy may be more suitable. By understanding the market conditions, volatility levels, and investment goals, investors can make informed decisions about when to use a strangle vs straddle option strategy and increase their chances of success in volatility trading.

Real-World Examples of Strangle and Straddle Option Strategies

Let’s take a look at some real-world examples of how strangle and straddle option strategies have been used successfully in different market conditions. In 2020, during the COVID-19 pandemic, the stock market experienced high volatility. An investor who expected a significant price movement in a particular stock could have used a straddle option strategy, buying a call and put option with the same strike price and expiration date. As the stock price moved significantly, the investor could have profited from the increased volatility. On the other hand, an investor who expected a moderate price movement could have used a strangle option strategy, buying a call and put option with different strike prices. As the stock price moved moderately, the investor could have profited from the price movement. Another example is during earnings announcements, when companies release their quarterly earnings reports. Investors who expect a significant price movement after the announcement could use a straddle option strategy, while those who expect a moderate price movement could use a strangle option strategy. By analyzing these real-world examples, investors can gain insights into how to use strangle vs straddle option strategies effectively in different market conditions. By understanding the benefits and drawbacks of each strategy, investors can make informed decisions about which approach to use and increase their chances of success in volatility trading.

Conclusion: Choosing the Right Option Strategy for Your Investment Goals

In conclusion, mastering volatility trading requires a deep understanding of different options strategies, including strangle and straddle. By grasping the concepts of strangle vs straddle option strategies, investors can make informed decisions about which approach to use in different market conditions. Whether an investor is seeking to profit from moderate or significant price movements, a strangle or straddle option strategy can be an effective tool for managing risk and maximizing returns. When choosing between a strangle vs straddle option strategy, investors should consider their investment goals, risk tolerance, and market conditions. By doing so, investors can increase their chances of success in volatility trading and achieve their investment objectives. Remember, understanding strangle and straddle option strategies is key to unlocking the power of options trading and achieving long-term success in the markets.

:max_bytes(150000):strip_icc()/strangle-Final-12984203025d4a6181f069fca09fe437.jpg)