Why Probabilistic Models are Essential in Finance

Financial markets are inherently unpredictable, characterized by a constant flux of information and investor sentiment that renders deterministic models inadequate for capturing their true nature. Traditional methods, which assume a predictable, linear progression of asset prices and interest rates, often fail to account for the inherent randomness that drives market dynamics. This is where the power of stochastic modeling becomes apparent. Stochastic processes, unlike their deterministic counterparts, explicitly incorporate randomness, allowing for a more realistic representation of financial variables. Asset prices, for example, do not follow a smooth, predefined path; rather, they exhibit random fluctuations, often referred to as “noise,” driven by a myriad of factors including news announcements, macroeconomic indicators, and investor behavior. Interest rates, similarly, are subject to unforeseen shifts, making a probabilistic approach essential for accurate forecasting and risk management. The challenge lies in capturing the uncertainty and unpredictability observed in markets, which deterministic models are unable to do. This leads directly to the application of stochastic differential equations in finance, a critical tool for navigating and modeling complex financial phenomena.

The need for stochastic models is further reinforced by the understanding that financial data often displays characteristics that are incompatible with deterministic frameworks, such as sudden jumps, volatility clustering, and skewed distributions. These features demand models that can handle the dynamic and often discontinuous nature of real-world market behavior. Rather than attempting to predict future outcomes with certainty, stochastic models focus on characterizing the probability distributions of future events, enabling traders and risk managers to quantify uncertainty and evaluate a range of potential scenarios. For instance, a stochastic model can provide a range of likely values for a stock price at a future date, rather than a single, deterministic point estimate. This approach is more consistent with the reality of financial markets and provides a robust framework for informed decision-making. Stochastic differential equations in finance are crucial for modeling these dynamic processes, providing a mathematical framework to analyze and manage financial risk and to price derivatives. Therefore, incorporating randomness through these equations is not just a desirable addition but a fundamental requirement for accurate and reliable financial modeling, recognizing that unpredictable changes are the norm rather than an exception.

Deciphering Stochastic Differential Equations: The Core of Financial Modeling

At the heart of modern financial modeling lies the concept of stochastic differential equations in finance. Unlike deterministic equations that predict outcomes with certainty, stochastic differential equations (SDEs) acknowledge and incorporate the inherent randomness observed in financial markets. Essentially, an SDE is a differential equation where at least one of its terms is a stochastic, or random, process. This crucial difference allows SDEs to capture the unpredictable fluctuations of asset prices, interest rates, and other financial variables that deterministic models simply cannot. Instead of providing a single, precise outcome, stochastic differential equations in finance produce a range of probable outcomes, reflecting the reality that financial variables evolve over time in an uncertain manner. The building blocks of an SDE typically involve three key components. First, a ‘drift’ term, representing the expected average change of the variable, in other words, its overall tendency. Second, a ‘diffusion’ term, which captures the volatility or randomness of the variable and is usually directly linked to the size and unpredictability of the fluctuations. And finally, the ‘Wiener process,’ a mathematical construct describing the random element that drives the diffusion, which is often seen as the accumulation of infinitesimal random shocks or variations that create the probabilistic nature of the SDE. Understanding these components is critical to comprehending how stochastic differential equations in finance are used to model asset price dynamics. The beauty of SDEs is their ability to simulate the path-dependent nature of financial variables, where future values are influenced by the path they have followed so far.

The application of stochastic differential equations in finance begins with a recognition that financial markets are inherently unpredictable. Deterministic models, which assume perfect knowledge and predictability of market behavior, are often inadequate to describe these complex behaviors. The use of SDEs provides a more realistic way to model such markets by embedding the idea of continuous randomness. Take, for example, modeling a stock price using an SDE; the equation won’t predict a specific price at a given time, but rather, a probability distribution of prices, illustrating that there is uncertainty about the future. In practice, SDEs mathematically describe how the price of an asset changes over time by defining a balance between the predictable part (drift) and the random part (diffusion), driven by the Wiener process. The drift term in an SDE might capture the long-term growth rate of an asset, while the diffusion term captures how much it tends to jump around. For instance, a high diffusion coefficient signifies that a stock is highly volatile and that its price can change considerably within a brief period. Therefore, stochastic differential equations in finance give analysts a powerful tool to describe, analyze, and forecast asset behavior under various market conditions, which is crucial for pricing derivatives and risk management.

How to Utilize SDEs for Option Pricing and Risk Management

Stochastic differential equations in finance are not merely theoretical constructs; they form the bedrock of numerous practical applications, particularly in option pricing and risk management. The mathematical framework provided by SDEs allows financial professionals to model the dynamic behavior of asset prices, which is crucial for valuing derivative securities such as options. The renowned Black-Scholes model, a cornerstone of options pricing, directly relies on the assumption that asset prices follow a geometric Brownian motion, a specific type of SDE. By modeling the volatility of asset prices with appropriate stochastic processes, one can estimate the fair value of options and manage the risks associated with these instruments. Furthermore, variations and extensions of the Black-Scholes model that incorporate more complex stochastic differential equations in finance, such as those that account for stochastic volatility, have been developed to address its limitations and provide more realistic valuations. The use of SDEs extends beyond basic option pricing, it provides a powerful framework for constructing portfolio risk management tools. By employing SDEs to simulate the behavior of various assets within a portfolio, financial firms are able to assess the potential losses and stress-test their positions under various market scenarios. This approach enables a more proactive and rigorous method of risk oversight, allowing firms to take more informed positions.

The application of stochastic differential equations in finance plays a vital role in real-world financial operations. For example, investment banks use SDE-based models to generate pricing quotes for complex derivative contracts. Hedge funds rely on these models to manage their risk exposure and make informed investment decisions. Risk managers within financial institutions use models based on SDEs to estimate market risk, credit risk, and operational risk, all critical components of financial stability. Moreover, SDEs help to model and simulate extreme market events, assisting firms in understanding their potential impact. These simulation tools can provide estimates of risk that are not available through standard historical analysis alone. The ability to understand the underlying stochastic processes that drive financial asset dynamics is not a luxury but a necessity for any financial institution or investor operating within a globalized and volatile financial market. By leveraging the power of stochastic differential equations in finance, participants can achieve superior risk adjusted returns and maintain a competitive advantage. Thus, a robust grasp of SDEs and the models they underpin is a key element for success in modern financial markets.

Examples of Popular SDE Models in Financial Engineering

Within the realm of financial engineering, several specific stochastic differential equations (SDEs) stand out due to their frequent use and practical relevance. A cornerstone model is geometric Brownian motion (GBM), which is often employed to describe the price dynamics of assets like stocks. In GBM, the asset price is assumed to follow a random walk, where percentage changes in price are random and have a constant drift and volatility. The equation’s simplicity makes it tractable for analytical solutions, yet it captures the essential randomness of price movements. Another class of SDEs crucial for modeling financial variables involves mean-reverting processes. The Ornstein-Uhlenbeck process, for example, models interest rates and commodity prices. In contrast to GBM, which assumes that prices can wander off indefinitely, mean-reverting models incorporate a tendency for prices to revert to a long-run average, which is particularly useful for assets exhibiting cyclical behavior. These stochastic differential equations in finance allow for capturing the concept of equilibrium in markets. The parameters governing the rate of mean reversion and volatility are key for these models, allowing one to model an equilibrium with some volatility.

Further expanding on the practical applications of stochastic differential equations in finance, stochastic volatility models are designed to address the limitation of constant volatility in models like GBM. In reality, volatility itself exhibits random behavior, which greatly impacts option prices and risk management. Models like the Heston model treat volatility as a separate stochastic process, typically correlated with asset prices. This added complexity leads to more realistic and nuanced representation of financial market dynamics. These models are important because the volatility is not necessarily constant, it is also a random factor in the equations. The practical impact of these models are wide and vast in any type of asset. These variations to the stochastic differential equations in finance provide a more robust and realistic analysis, capturing the dynamics in volatile and complex markets. Each model serves specific purposes: GBM to model price movements in stocks, mean reverting models for rates or commodities and stochastic volatility for more complex assets.

In summary, these specific stochastic differential equations (SDEs) provide essential tools for understanding and modeling financial markets. Each model, from simple geometric Brownian motion to complex stochastic volatility, highlights the power and versatility of mathematical models in addressing the varied challenges of financial analysis. The selection of the proper model depends on the application and its specific characteristics of the variables. Understanding these different stochastic differential equations in finance and their applications is essential for developing trading strategies, risk management, and a deeper understanding of the market.

The Relationship Between Stochastic Calculus and Financial Mathematics

Stochastic differential equations in finance are not merely abstract mathematical constructs; they are deeply rooted in the rigorous framework of stochastic calculus. This branch of mathematics provides the essential tools for handling random processes and their dynamic evolution over time, which is crucial for financial modeling. Concepts such as Itô’s lemma, a cornerstone of stochastic calculus, enable us to understand how functions of stochastic processes, like asset prices, change. Itô’s lemma, in particular, provides a way to derive the stochastic differential equation of a function of a stochastic process. This is an extremely useful technique when we deal with stochastic differential equations in finance. Moreover, the theory of martingales, another key component of stochastic calculus, allows for a precise formulation of the concept of a “fair game” in a stochastic setting. In the financial world, a martingale property implies that the expected future price of an asset, given all information up to the present time, is simply its current price. This is a crucial aspect of no-arbitrage pricing theory. Understanding these mathematical foundations ensures that the models we develop for asset pricing and risk management are built upon a solid base, contributing to the reliability and robustness of stochastic differential equations in finance.

While the formal proofs and deep mathematical arguments of stochastic calculus can be quite intricate, the fundamental ideas are accessible even without a formal mathematical background. The essential concept is that of viewing financial variables as continuously evolving stochastic processes, rather than deterministic functions. Stochastic calculus provides the mathematical language and tools for expressing and analyzing these random evolutions, including stochastic differential equations in finance. For example, the seemingly complex concept of a Wiener process, which forms a basis for modeling randomness in many SDEs, can be understood as a continuous-time random walk, each step being infinitely small, with a standard normal distribution. This allows the stochastic differential equations to accurately replicate the real market randomness. By relying on the mathematical rigor provided by stochastic calculus, financial professionals gain the ability to effectively use stochastic differential equations in finance. This approach is not about making financial predictions but about creating robust models that incorporate randomness appropriately, and that can provide probabilities of different outcomes, leading to better informed financial decisions. The integration of these mathematical concepts with financial theory leads to a more complete and trustworthy understanding of market behavior, which is the goal when using stochastic differential equations in finance.

Computational Methods for Solving and Simulating SDEs

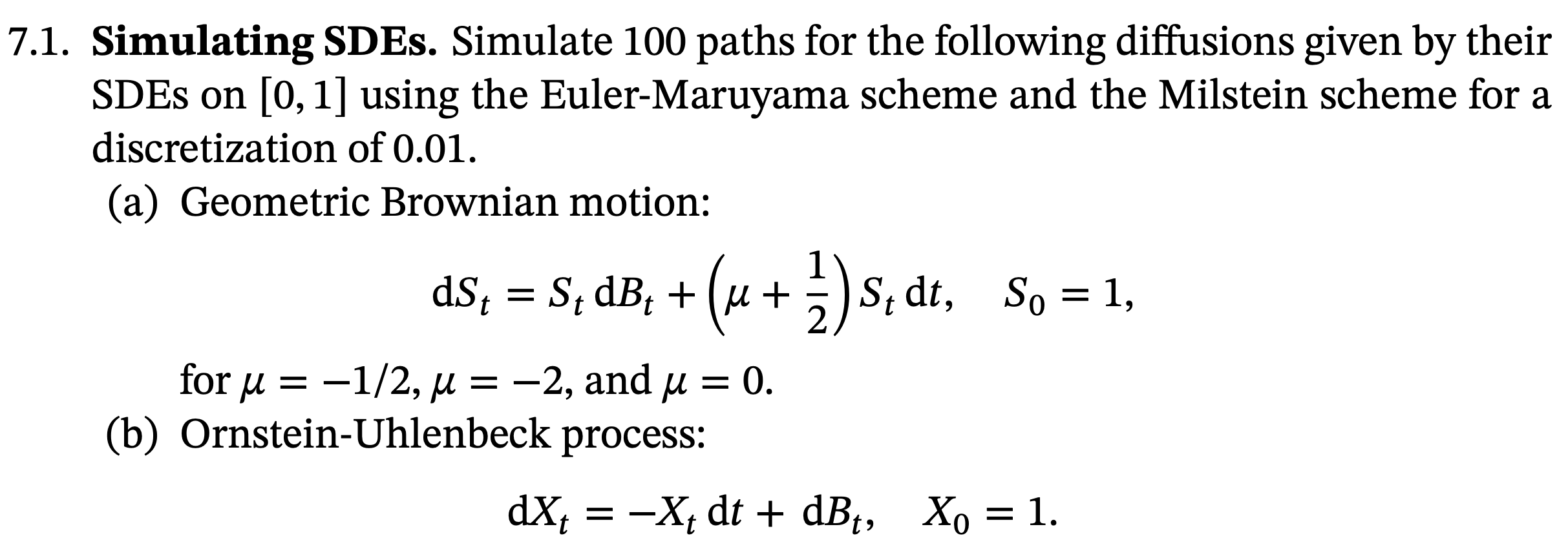

Analytical solutions to stochastic differential equations in finance are often elusive, necessitating the use of numerical methods. These computational techniques allow practitioners to approximate solutions and simulate the behavior of financial variables over time. The Euler-Maruyama method stands as a fundamental approach for discretizing stochastic differential equations. This method approximates the continuous-time SDE by dividing the time horizon into small intervals and iteratively updating the variable’s value using a discrete-time approximation. Specifically, it uses the drift and diffusion terms of the SDE, along with random draws from a standard normal distribution scaled by the square root of the time step to simulate the random component of the stochastic process. This process essentially generates a sample path, which is one possible trajectory of the financial variable under the model. Beyond Euler-Maruyama, various other simulation methods exist, including higher-order schemes like the Milstein method, which provide more accurate approximations at the cost of increased computational complexity. These simulation techniques form the backbone for building tools to simulate a variety of financial scenarios and model the dynamics of asset prices under uncertainty.

The practical implementation of these methods often involves programming languages like Python, which offers libraries that facilitate the simulation of stochastic differential equations in finance. For example, one can leverage NumPy for numerical computations and SciPy for generating random numbers that emulate the Wiener process. These tools allow financial analysts and modelers to create thousands or even millions of sample paths, offering a wide distribution of potential outcomes. The ability to generate these simulations is key for many tasks, from pricing complex options to stress-testing portfolios against various market scenarios. By visualizing the various simulated paths and their distributions, it becomes much clearer to assess the expected behavior of different financial assets or instruments. The use of these computational methods also allows for sensitivity analysis, where model parameters are altered to determine their effect on the simulation outcome, thus providing a deeper understanding of how different factors influence the overall behavior. The application of these computational methods is crucial for dealing with the practical aspects of stochastic modeling in finance where analytical solutions are not typically available, thereby enabling robust risk assessment and informed decision-making.

Challenges and Limitations of Using Stochastic Models in Finance

While stochastic differential equations in finance provide a powerful framework for modeling financial markets, it is crucial to acknowledge their inherent limitations and assumptions. One significant challenge is the concept of model risk, which arises from the fact that any model, no matter how sophisticated, is a simplification of reality. The parameters used in stochastic differential equations, such as volatility, are often estimated from historical data, and these estimates can be subject to error. This leads to uncertainties in the model’s predictions and can have substantial impacts on financial decision-making. For example, the Black-Scholes model, a widely used option pricing model derived from stochastic differential equations, relies on assumptions such as constant volatility and normally distributed asset returns, which are often violated in real-world markets. This can lead to mispricing of options and inaccurate risk assessments. Moreover, calibrating these models to fit observed market prices can be complex and may require adjustments that can introduce further uncertainties.

Another key limitation of models based on stochastic differential equations in finance concerns their inability to fully capture extreme market events. Financial asset returns often exhibit “fat tails”, meaning that extreme price movements occur more frequently than predicted by normal distributions, which is often a common assumption within those models. These events, sometimes referred to as “black swans,” can have devastating consequences and are difficult to model effectively. Furthermore, many stochastic models assume that markets are efficient and that past price movements do not predict future ones. This assumption can break down during periods of market stress or when behavioral biases influence trading patterns. The predictive power of stochastic differential equations in finance is also limited by the fact that future market conditions are influenced by various factors that cannot be accurately predicted by any model, such as geopolitical events, technological disruptions, and unexpected changes in investor sentiment. Thus, it is essential to use these models with caution, recognizing their limitations and employing them as one tool among many for making informed financial decisions. Understanding and accounting for model risk, limitations to capture “fat tails”, and calibration issues are therefore critical when using stochastic differential equations in finance.

The Future of Stochastic Analysis in Financial Modeling

The field of stochastic differential equations in finance is in constant evolution, driven by the need to model increasingly complex market dynamics. Ongoing research seeks to refine existing models and develop new approaches that can better capture real-world phenomena. One prominent area of focus is the study of rough volatility, which challenges the traditional assumptions of smooth and predictable volatility patterns. This research delves into fractional Brownian motion and other non-Markovian processes to create more realistic models. Simultaneously, the integration of machine learning techniques is gaining traction, leveraging data-driven methods to estimate model parameters, identify hidden patterns, and improve forecast accuracy. This fusion of stochastic calculus with artificial intelligence has the potential to generate more adaptable and robust financial models. Furthermore, exploring alternative probability measures, like those used in risk-neutral valuation, remains a critical area of research, providing new lenses through which to view financial risk and pricing.

The application of stochastic differential equations in finance continues to expand beyond traditional areas, such as option pricing and risk management. Innovations are being explored in areas including algorithmic trading, portfolio optimization, and the modeling of credit risk. For example, research is being conducted to develop models that can adapt more quickly to market regime shifts, recognizing how different market conditions may lead to distinct stochastic behaviors. The pursuit of more robust and adaptable models remains a priority, and researchers are focusing on model validation techniques, particularly for evaluating the performance of sophisticated SDE models under stress conditions. Such validation is crucial for ensuring model reliability and for building confidence in the financial decisions informed by these complex systems. Additionally, researchers are investigating new simulation methodologies that allow faster and more precise path generation, particularly for increasingly complex stochastic models and are adapting these for more granular analysis of financial markets.

Looking ahead, the field of stochastic differential equations in finance will continue to evolve, driven by both theoretical insights and practical needs. The increasing availability of data and computational power, combined with sophisticated mathematical and statistical techniques, will continue to power the advancement of more refined models. The focus will remain on developing models that are not only theoretically sound, but also robust, reliable, and adaptable to the ever-evolving financial landscape. This will entail ongoing collaborative efforts between researchers, practitioners, and regulators to ensure a greater level of market understanding, fostering stability and sustainability in the global financial system. The goal is to make stochastic differential equations in finance a more powerful tool for understanding and navigating the complexities of modern markets. The ongoing development in this field is critical for a robust and adaptable financial future.