An Introduction to Automated Trading and IBKR

Automated trading, also known as algorithmic trading, refers to the use of computer programs and systems to execute trades based on predefined strategies and criteria. This approach has gained popularity due to its ability to remove human emotions from the trading process, resulting in more consistent and potentially profitable outcomes. The “steps to create a simple trading bot with IBKR” involve setting up an account with Interactive Brokers (IBKR) and utilizing their API to develop a custom trading bot.

IBKR is a well-established online brokerage firm offering access to various financial markets, including stocks, options, futures, and forex. Their API allows developers to create custom applications that can interact with IBKR’s trading system, enabling users to automate their trading activities. By following the outlined steps, you can build a simple trading bot tailored to your specific needs and strategies.

Identifying the Requirements for a Simple Trading Bot

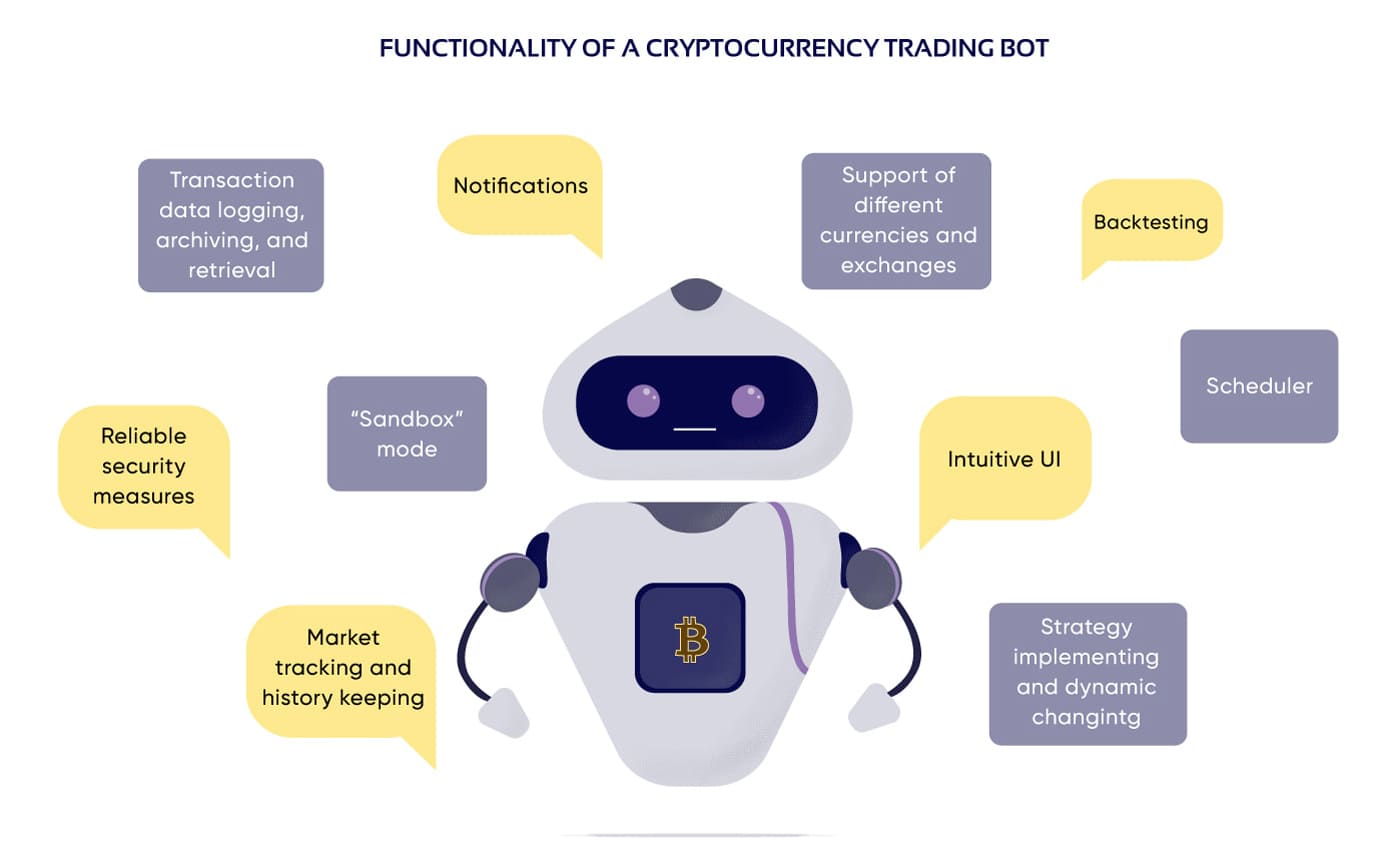

When embarking on the “steps to create a simple trading bot with IBKR,” it’s crucial to outline the essential features required for a successful and efficient trading bot. These features include:

- Automated order entry: A simple trading bot should be capable of automatically entering orders based on predefined criteria, such as price, volume, or time. This feature eliminates the need for manual order entry, reducing the potential for human error and increasing operational efficiency.

- Risk management: Implementing risk management strategies is vital for any trading bot. These strategies may include setting stop-loss orders, position sizing, and diversification to minimize potential losses and protect your investment portfolio. By incorporating risk management, you can ensure that your trading bot operates within predefined risk parameters, reducing the likelihood of catastrophic losses.

- Data-driven decision-making: A simple trading bot should be able to analyze market data and make informed decisions based on that data. This may involve using historical data to identify trends, applying statistical analysis to determine probabilities, or utilizing machine learning algorithms to predict future price movements. By relying on data-driven decision-making, you can create a more robust and reliable trading bot.

By focusing on these core features, you can build a simple trading bot that effectively automates your trading activities, minimizes risk, and leverages data-driven decision-making to generate consistent returns.

Getting Started: Setting Up Your IBKR Account and API Access

To begin the “steps to create a simple trading bot with IBKR,” you must first create an Interactive Brokers (IBKR) account and obtain API credentials. Here’s a step-by-step guide:

- Create an IBKR account: Visit the IBKR website and follow the instructions to create a new account. You will need to provide personal information, such as your name, address, and tax identification number. Ensure you comply with all local regulations and requirements when opening a trading account.

- Fund your account: After your account is approved, you will need to deposit funds to start trading. IBKR offers various funding options, including bank transfers, credit/debit cards, and electronic wallets. Make sure you understand the fees and processing times associated with each funding method.

- Apply for API access: Log in to your IBKR account and navigate to the “Settings” or “Account Management” section. Look for the “API” or “Developer” settings and follow the instructions to apply for API access. IBKR may require additional information or verification to grant API access, so be prepared to provide any necessary documents or details.

- Generate API credentials: Once your API access is approved, generate your API credentials, which typically include an API key, secret key, and other relevant details. Keep these credentials secure, as you will use them to authenticate your trading bot with the IBKR API.

- Set up the software environment: Install the required programming language and libraries for your trading bot. IBKR API supports several programming languages, including Python, Java, and C#. Ensure you have the necessary tools and packages installed to work with the IBKR API.

By completing these steps, you will have successfully set up your IBKR account and obtained API access, enabling you to create a simple trading bot using the IBKR API.

Designing the Architecture of Your Simple Trading Bot

When following the “steps to create a simple trading bot with IBKR,” it’s crucial to design a robust and efficient architecture for your bot. This section outlines the overall structure of the trading bot, including data sources, algorithms, and user interfaces.

Data Sources

A trading bot relies on various data sources to make informed decisions. These sources may include:

- Market data: Real-time and historical price data, trading volumes, and other market-related information.

- Fundamental data: Company financials, earnings reports, and other relevant fundamental data for stocks or other securities.

- Alternative data: Social media sentiment, weather patterns, or other non-traditional data sources that can impact financial markets.

Algorithms

The core of your trading bot consists of algorithms that process data and make trading decisions. These algorithms may include:

- Signal generation: Identifying potential trading opportunities based on predefined criteria, such as moving averages, relative strength index (RSI), or other technical indicators.

- Portfolio optimization: Determining the optimal allocation of assets in your trading portfolio to maximize returns and minimize risk.

- Risk management: Implementing strategies to limit potential losses, such as stop-loss orders, position sizing, or diversification.

User Interfaces

A user-friendly interface is essential for monitoring and controlling your trading bot. Key components of the user interface may include:

- Dashboard: A visual representation of your trading bot’s performance, including key performance indicators (KPIs), portfolio value, and recent trades.

- Settings: Configurable parameters for your trading bot, such as risk tolerance, investment horizon, and asset allocation.

- Logs and alerts: Real-time notifications and historical logs of your trading bot’s activities, enabling you to track its performance and troubleshoot any issues.

By carefully designing the architecture of your simple trading bot, you can ensure that it is efficient, scalable, and user-friendly, making it easier to create, manage, and optimize your automated trading strategy.

Developing the Core Functionality of Your Simple Trading Bot

Once you have designed the architecture of your simple trading bot, it’s time to implement its primary features. This section focuses on the “steps to create a simple trading bot with IBKR” by discussing order management, position tracking, and risk management.

Order Management

Order management involves creating, tracking, and modifying orders within your trading bot. Key aspects of order management include:

- Order types: Familiarize yourself with various order types, such as market orders, limit orders, and stop orders, to ensure your bot can effectively interact with the market.

- Order entry: Implement automated order entry using IBKR’s API to submit orders based on your trading strategy’s rules and conditions.

- Order tracking: Monitor and manage your open orders, ensuring they are filled according to your expectations and minimizing any potential errors or discrepancies.

Position Tracking

Position tracking involves monitoring and managing your current holdings within your trading portfolio. Key aspects of position tracking include:

- Position data: Retrieve and store position data, including the number of shares, instrument type, and average entry price.

- Portfolio valuation: Calculate the total value of your portfolio, taking into account the current market prices of your holdings and any cash reserves.

- Performance metrics: Measure the performance of your portfolio using metrics such as return on investment (ROI), risk-adjusted return, and drawdowns.

Risk Management

Effective risk management is crucial for the long-term success of your trading bot. Key aspects of risk management include:

- Stop-loss orders: Implement stop-loss orders to limit potential losses when the market moves against your positions.

- Position sizing: Determine the optimal number of shares or contracts to trade based on your account size, risk tolerance, and trade expectations.

- Diversification: Diversify your portfolio across various asset classes, sectors, or instruments to minimize concentration risk.

By focusing on order management, position tracking, and risk management, you can develop a robust and user-friendly trading bot that effectively interacts with the IBKR API and contributes to your overall trading success.

Backtesting and Optimizing Your Simple Trading Bot

Once you have developed the core functionality of your simple trading bot, it’s essential to backtest and optimize its performance. This section focuses on the “steps to create a simple trading bot with IBKR” by discussing the importance of backtesting, optimization techniques, and performance evaluation.

The Importance of Backtesting

Backtesting is the process of evaluating your trading bot’s performance using historical data. It allows you to:

- Assess strategy viability: Determine whether your trading strategy is profitable and robust over different market conditions.

- Identify potential issues: Uncover bugs, errors, or suboptimal configurations that may negatively impact your trading bot’s performance.

- Fine-tune parameters: Adjust various parameters within your trading strategy to improve its overall effectiveness.

Optimization Techniques

Optimization involves finding the best combination of parameters for your trading strategy. Key optimization techniques include:

- Grid search: Systematically test different parameter combinations on a predefined grid.

- Random search: Randomly sample parameter combinations to explore a broader solution space.

- Genetic algorithms: Apply evolutionary principles, such as mutation and crossover, to iteratively improve your trading strategy’s performance.

Performance Evaluation

Evaluating your trading bot’s performance is crucial for understanding its strengths and weaknesses. Key performance metrics include:

- Net profit: The total profit or loss generated by your trading strategy.

- Sharpe ratio: A risk-adjusted performance measure that compares your strategy’s returns to its volatility.

- Maximum drawdown: The largest peak-to-trough loss experienced by your trading strategy during the backtesting period.

By backtesting and optimizing your simple trading bot, you can ensure that it is well-equipped to handle various market conditions and contribute to your overall trading success. Continuously monitor and refine your trading bot’s performance to maintain a competitive edge in the ever-evolving world of automated trading.

Deploying and Monitoring Your Simple Trading Bot

After successfully developing and backtesting your simple trading bot, the next step is to deploy it to a production environment and set up monitoring tools. This section focuses on the “steps to create a simple trading bot with IBKR” by discussing the deployment process and monitoring best practices.

Deployment Process

Deploying your trading bot involves moving it from your local development environment to a remote server or cloud platform. Key deployment steps include:

- Choosing a hosting provider: Select a reliable hosting provider that meets your needs in terms of performance, scalability, and cost.

- Configuring the server: Set up the server with the necessary software and dependencies to run your trading bot smoothly.

- Transferring the code: Move your trading bot’s codebase to the server using a version control system or file transfer protocol.

- Installing dependencies: Install any required libraries, packages, or tools necessary for your trading bot’s operation.

- Running the bot: Start your trading bot and ensure it functions correctly in the new environment.

Monitoring Best Practices

Monitoring your trading bot is essential to ensure its smooth operation and identify potential issues. Key monitoring best practices include:

- Logging: Implement comprehensive logging to record critical events, errors, and warnings.

- Alerting: Set up alerting mechanisms to notify you of any issues or abnormal behavior.

- Performance metrics: Regularly track and analyze your trading bot’s performance metrics, such as order execution latency, trade frequency, and profitability.

- Regular updates: Keep your trading bot up-to-date with the latest IBKR API versions and security patches.

By following these deployment and monitoring best practices, you can ensure that your simple trading bot operates smoothly and effectively in a production environment. Continuously monitor and refine your trading bot’s performance to maintain a competitive edge in the ever-evolving world of automated trading.

Staying Updated and Expanding Your Knowledge

To create a simple trading bot with IBKR and maintain a competitive edge in automated trading, continuous learning and improvement are essential. This section highlights resources and best practices for staying updated on trading algorithms, IBKR API updates, and automated trading best practices.

Following IBKR API Updates

Staying informed about IBKR API updates is crucial for ensuring your trading bot remains compatible and leverages the latest features. To stay updated, follow these resources:

- IBKR Developer Portal: Visit the IBKR developer portal (https://www.interactivebrokers.com/en/p/api.php) for API documentation, sample code, and announcements.

- IBKR API GitHub: Follow the IBKR API GitHub repository (https://github.com/InteractiveBrokers/api-samples) for code updates and examples.

- IBKR Community: Engage with the IBKR community through forums and social media channels to learn from other developers and traders.

Exploring Trading Algorithms and Best Practices

Expanding your knowledge of trading algorithms and best practices can help you refine your simple trading bot and improve its performance. Consider these resources:

- Books: Read books on algorithmic trading, quantitative finance, and automated trading strategies to deepen your understanding.

- Online courses: Enroll in online courses and workshops focused on trading algorithms, backtesting, and risk management.

- Industry conferences: Attend conferences and meetups to network with professionals and learn about the latest trends and innovations.

By actively engaging in continuous learning and staying updated on IBKR API updates, trading algorithms, and best practices, you can enhance your simple trading bot and adapt to the ever-evolving world of automated trading. This commitment to growth and improvement will help ensure your trading bot remains competitive and effective in the long term.