Unlocking the Power of Put Options in the S&P 500

In the world of options trading, put options are a powerful tool for investors seeking to hedge against market downturns. A put option gives the holder the right, but not the obligation, to sell an underlying asset at a predetermined price, known as the strike price. When it comes to the S&P 500, put options prices play a crucial role in determining the potential returns on investment. Understanding S&P 500 put options prices is essential for investors looking to mitigate risk and maximize gains in their portfolios. By grasping the concept of put options and their role in hedging, investors can make more informed decisions about their investments and navigate the complexities of the S&P 500 market. In today’s volatile market, having a solid understanding of S&P 500 put options prices can be the key to unlocking profitable trading opportunities.

How to Navigate S&P 500 Put Options Prices for Maximum Returns

When it comes to S&P 500 put options prices, understanding the factors that influence them is crucial for making informed trading decisions. Three key factors that impact S&P 500 put options prices are volatility, interest rates, and time decay. Volatility, in particular, plays a significant role in determining S&P 500 put options prices, as it measures the market’s expected fluctuations. Higher volatility typically leads to higher S&P 500 put options prices, while lower volatility results in lower prices. Interest rates also have an impact, as they affect the cost of carrying a position. Time decay, or the erosion of an option’s value over time, is another essential factor to consider. By analyzing these factors and understanding how they interact, traders can make more accurate predictions about S&P 500 put options prices and adjust their strategies accordingly. For instance, traders may opt for a long put strategy during periods of high volatility or adjust their strike prices based on interest rate changes. By grasping the intricacies of S&P 500 put options prices, traders can unlock new opportunities for profit and minimize potential losses.

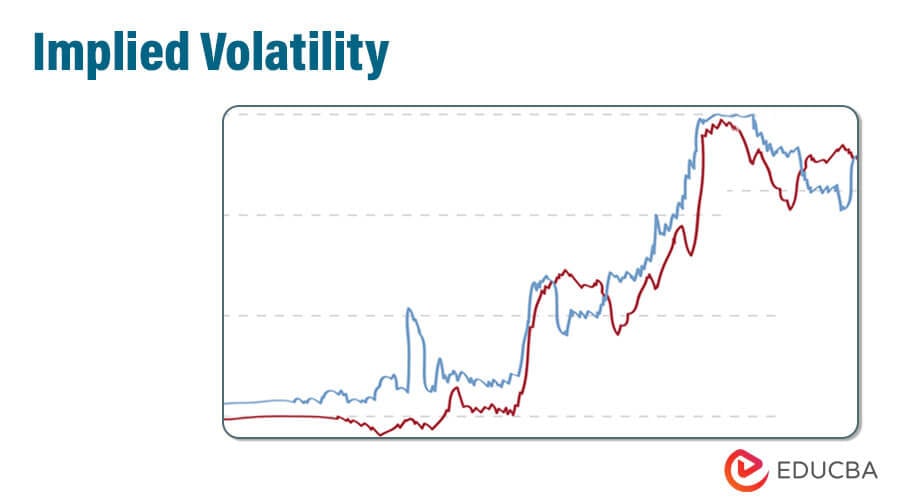

The Role of Implied Volatility in S&P 500 Put Options Pricing

Implied volatility plays a crucial role in determining S&P 500 put options prices. It represents the market’s expected volatility of the underlying asset, and it has a direct impact on the option’s premium. When implied volatility increases, S&P 500 put options prices tend to rise, making them more expensive to buy. Conversely, when implied volatility decreases, S&P 500 put options prices tend to fall, making them cheaper to purchase. To make accurate predictions about S&P 500 put options prices, traders must understand how to analyze implied volatility. One way to do this is by using volatility indices, such as the VIX, which provides a benchmark for market volatility. Historical data can also be used to identify patterns and trends in implied volatility, allowing traders to make more informed decisions about S&P 500 put options prices. For instance, if a trader expects implied volatility to increase, they may opt for a long put strategy, while a decrease in implied volatility may lead to a short put strategy. By grasping the concept of implied volatility and its impact on S&P 500 put options prices, traders can gain a competitive edge in the market and make more profitable trades.

Understanding the Greeks: Delta, Gamma, and Theta in S&P 500 Put Options

In options trading, the Greeks – delta, gamma, and theta – play a crucial role in understanding how S&P 500 put options prices behave. These metrics provide valuable insights into the risks and potential rewards associated with different trading strategies. Delta, which measures the rate of change of an option’s price with respect to the underlying asset’s price, is essential for determining the likelihood of an option expiring in the money. Gamma, which measures the rate of change of an option’s delta, helps traders understand how the option’s sensitivity to the underlying asset’s price changes over time. Theta, which measures the rate of change of an option’s price with respect to time, is critical for understanding the impact of time decay on S&P 500 put options prices. By grasping the Greeks, traders can make more informed decisions about S&P 500 put options prices and develop effective trading strategies. For instance, a trader may use delta to determine the optimal strike price for a put option, while gamma can help identify the potential risks associated with a particular strategy. By incorporating the Greeks into their analysis, traders can gain a deeper understanding of S&P 500 put options prices and make more profitable trades.

Strategies for Trading S&P 500 Put Options: From Basic to Advanced

When it comes to trading S&P 500 put options, having a solid understanding of various strategies is crucial for success. From basic buy-writes to more complex spreads and iron condors, each approach offers unique benefits and risks. One popular strategy is the protective put, which involves buying a put option to hedge against potential losses in a long stock position. This strategy can help limit potential losses, but it also reduces potential gains. Another approach is the cash-secured put, which involves selling a put option and simultaneously setting aside enough cash to buy the underlying stock if the option is exercised. This strategy can provide a steady income stream, but it also exposes the trader to potential losses if the stock price falls significantly. More advanced strategies, such as the iron condor and the butterfly spread, offer the potential for higher returns, but they also require a deeper understanding of options trading and S&P 500 put options prices. By mastering these strategies and understanding how they interact with S&P 500 put options prices, traders can develop a robust trading plan that helps them achieve their investment goals.

Managing Risk with S&P 500 Put Options: Stop-Losses and Position Sizing

Risk management is a crucial aspect of S&P 500 put options trading, as it helps traders limit potential losses and maximize gains. One effective way to manage risk is by using stop-losses, which automatically close a trade when it reaches a certain price level. This strategy can help prevent significant losses, but it also requires careful consideration of the stop-loss price to avoid premature closure of a trade. Another key aspect of risk management is position sizing, which involves determining the optimal amount of capital to allocate to a trade. By adjusting position size based on market conditions and S&P 500 put options prices, traders can minimize potential losses and maximize returns. Additionally, traders can use various risk management techniques, such as diversification and hedging, to further reduce exposure to market volatility. By incorporating these strategies into their trading plan, traders can develop a robust risk management framework that helps them navigate the complexities of S&P 500 put options prices and achieve their investment goals.

Real-World Examples of S&P 500 Put Options Trading in Action

To illustrate the effectiveness of S&P 500 put options trading strategies, let’s examine a few real-world examples. In one instance, a trader anticipated a market downturn and purchased a put option on the S&P 500 index with a strike price of 3,500. As the market declined, the trader exercised the put option and sold the underlying stock at the higher strike price, limiting their losses. In another example, a trader used a protective put strategy to hedge against potential losses in a long stock position. By purchasing a put option with a strike price near the current market price, the trader was able to limit their potential losses while still benefiting from potential gains. These examples demonstrate the versatility of S&P 500 put options prices and the importance of understanding how to analyze and utilize them in trading strategies. By studying these examples and staying up-to-date on market trends and analysis, traders can develop a deeper understanding of S&P 500 put options prices and make more informed trading decisions.

Staying Ahead of the Curve: Market Analysis and S&P 500 Put Options Prices

To make informed decisions about S&P 500 put options prices and trading strategies, it’s essential to stay informed about market trends and analysis. This involves monitoring economic indicators, such as GDP growth and inflation rates, as well as tracking market sentiment and volatility. By analyzing these factors, traders can gain a better understanding of the underlying market dynamics and make more accurate predictions about S&P 500 put options prices. Additionally, staying up-to-date on market news and events, such as earnings reports and central bank decisions, can help traders identify potential trading opportunities and adjust their strategies accordingly. Furthermore, utilizing technical analysis tools, such as charts and indicators, can provide valuable insights into market trends and patterns, allowing traders to make more informed decisions about S&P 500 put options prices. By combining these approaches, traders can develop a comprehensive understanding of the market and make more effective trading decisions. This, in turn, can help traders stay ahead of the curve and maximize their returns in the S&P 500 put options market.