Accessing Decades of S&P 500 Index Performance

Unlocking valuable stock market insights begins with understanding the historical performance of key indices. The S&P 500 index, a benchmark for the U.S. equity market, offers a wealth of information for investors and analysts alike. Retrieving historical data related to the S&P 500 provides a foundation for informed decision-making. This information allows for thorough analysis, rigorous backtesting of investment strategies, and a deeper understanding of market dynamics. Accessing reliable s&p 500 historical data download is crucial for anyone seeking to navigate the complexities of the stock market.

The significance of s&p 500 historical data download extends beyond simple price tracking. It allows users to identify long-term trends, assess market volatility, and evaluate the impact of economic events on stock performance. Analyzing past performance can reveal patterns that might not be apparent from current market conditions alone. Furthermore, s&p 500 historical data download is essential for creating predictive models and stress-testing investment portfolios. By examining how the S&P 500 has reacted to various market conditions in the past, investors can better prepare for future uncertainties. Accessing s&p 500 historical data download offers a unique opportunity to gain a competitive edge through data-driven insights.

The ability to effectively utilize s&p 500 historical data download hinges on its availability and accessibility. Fortunately, numerous resources exist for obtaining this valuable information. From free online platforms to premium data providers, investors have a range of options to suit their needs and budgets. Each source offers different levels of detail, accuracy, and historical depth. Therefore, carefully evaluating the available options is crucial to ensure that the s&p 500 historical data download meets the specific requirements of your analysis or investment strategy. Using this data responsibly empowers users to see beyond daily fluctuations and gain a broader, more informed perspective on market behavior.

How to Obtain S&P 500 Index Values from Past Years

Obtaining S&P 500 index values from past years is crucial for investors and analysts. Several avenues exist for accessing this valuable information. These range from free resources to premium data providers. Each source offers varying degrees of accuracy, frequency, and historical depth.

Free resources like Yahoo Finance and Google Finance provide readily available S&P 500 historical data download. These platforms are excellent starting points for basic analysis and quick reference. They typically offer daily or weekly data, often extending back several decades. However, users should be aware of potential limitations. Data accuracy may vary, and intraday data may not be consistently available. API access might be restricted or unavailable, limiting programmatic data retrieval. Despite these limitations, these free sources provide a valuable service for many users seeking s&p 500 historical data download for initial investigations.

For more sophisticated analysis and professional use, premium financial data providers such as Refinitiv and Bloomberg are popular choices. These services offer comprehensive S&P 500 historical data download, including intraday, daily, and weekly data with high accuracy and reliability. They provide extensive historical depth, often going back to the index’s inception. Premium providers typically offer robust APIs, facilitating seamless integration with analytical tools and trading platforms. This allows for automated data retrieval and backtesting. While these services come at a cost, the enhanced accuracy, frequency, and accessibility can be invaluable for serious investors and financial institutions. When selecting a source for s&p 500 historical data download, consider factors such as data accuracy, update frequency, API accessibility, and historical depth. Identifying a reliable data source is essential for conducting meaningful analysis and making informed investment decisions. A careful evaluation of available options is crucial to ensure the chosen source meets your specific needs and requirements. Whether opting for a free or premium service, understanding the strengths and limitations of each source is paramount to leveraging S&P 500 historical data effectively.

Comparing Free and Premium S&P 500 Data Sources

When seeking s&p 500 historical data download options, users encounter a choice between free and premium sources. Understanding the nuances of each is critical for effective analysis. Free sources, such as Yahoo Finance and Google Finance, offer readily accessible historical data. However, their data accuracy and reliability may vary. The frequency of updates could be limited to daily or weekly intervals. This can restrict the ability to conduct high-frequency trading analysis or perform detailed intraday studies. API accessibility, which allows for automated data retrieval, is often either absent or limited in free options. The historical depth might also be curtailed, potentially hindering long-term trend analysis.

Premium data providers like Refinitiv and Bloomberg offer several advantages. These services typically guarantee higher data accuracy and provide more granular updates, sometimes down to the minute. This is essential for sophisticated trading strategies. They provide robust APIs, enabling seamless integration with analytical tools and custom applications. Premium subscriptions usually grant access to a more extensive historical database, facilitating comprehensive backtesting and long-term market assessments. While the cost of premium services can be a barrier, the enhanced data quality, frequency, and accessibility can justify the investment for serious investors and financial institutions looking for s&p 500 historical data download options.

The decision between free and premium s&p 500 historical data download sources hinges on the intended use and required level of precision. For basic trend analysis and educational purposes, free resources might suffice. However, for professional trading, rigorous backtesting, and in-depth research, premium data sources are generally recommended. It’s crucial to evaluate data needs against budgetary constraints to determine the most suitable option. Factors to consider include the required data frequency, the length of the historical period needed, and the importance of data accuracy. Regardless of the chosen source, always verify the data’s integrity and be aware of potential limitations. This ensures the reliability of any conclusions drawn from the s&p 500 historical data download information.

Working with S&P 500 Data: Formats and Compatibility

S&P 500 historical data download often comes in several standard formats. Understanding these formats is crucial for effective analysis. The most common formats include CSV (Comma Separated Values), Excel (.xls or .xlsx), and JSON (JavaScript Object Notation). Each format has its strengths and is suitable for different applications and software.

CSV is a plain text format. Each data point is separated by a comma, making it universally compatible. It is ideal for importing into databases or using with scripting languages. Excel files are spreadsheet formats that allow for data manipulation and visualization within Excel. JSON is a human-readable format used for transmitting data objects. It is frequently used in web applications and APIs to facilitate s&p 500 historical data download. Choosing the appropriate format depends on the intended use and the tools available.

Importing and working with S&P 500 historical data download requires appropriate tools. Excel is a user-friendly option for basic analysis and charting. However, for more sophisticated analysis, programming languages like Python are preferred. The Pandas library in Python is specifically designed for data manipulation and analysis. It allows for easy importing, cleaning, and transformation of S&P 500 historical data download. Statistical software packages like R and SAS are also viable options for advanced statistical modeling and analysis of S&P 500 historical data download. Regardless of the tool chosen, data cleaning is essential. This involves handling missing values, correcting errors, and ensuring data consistency. Proper formatting, such as ensuring date formats are consistent, is also necessary for accurate analysis of s&p 500 historical data download.

Analyzing S&P 500 Trends Over Time

This section illustrates how to use historical S&P 500 data for analyzing market trends. Several analytical techniques can be applied to understand the behavior of the S&P 500 index over different periods. Accessing s&p 500 historical data download enables investors to identify patterns and make informed decisions.

One common method involves calculating moving averages. Moving averages smooth out price fluctuations and highlight the underlying trend. Short-term moving averages respond quickly to price changes, while long-term averages provide a broader view of market direction. By comparing different moving averages, analysts can identify potential buy and sell signals. Identifying support and resistance levels is another crucial technique. Support levels represent price points where buying pressure is expected to prevent further declines. Resistance levels indicate price points where selling pressure may limit upward movement. Analyzing s&p 500 historical data download helps determine these levels, which can be used to set entry and exit points for trades.

Regression analysis is a more advanced technique that can be used to quantify the relationship between the S&P 500 and other variables. For instance, one might investigate the correlation between interest rates and the S&P 500’s performance. By performing regression analysis on s&p 500 historical data download, analysts can develop models to forecast future market behavior. These models can be valuable tools for portfolio management and risk assessment. These insights obtained through the analysis of s&p 500 historical data download can be used to understand market behavior and inform investment strategies. Careful analysis of s&p 500 historical data download allows a more nuanced understanding of market dynamics.

Using Historical Data to Backtest Investment Strategies

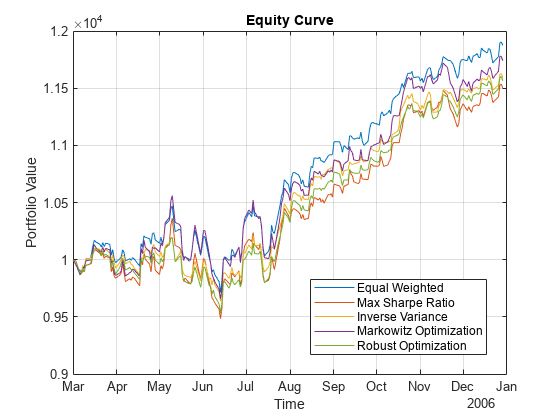

Backtesting is a crucial process for evaluating the viability of investment strategies. S&P 500 historical data download provides the raw material for simulating how a strategy would have performed in the past. This involves applying a set of rules to the historical data and observing the resulting returns, drawdowns, and other performance metrics. A comprehensive backtest helps investors understand the potential risks and rewards associated with a particular approach before committing real capital. The S&P 500 historical data is invaluable in this process.

When backtesting with S&P 500 historical data download, avoiding look-ahead bias is paramount. Look-ahead bias occurs when information that would not have been available at the time is used in the simulation. For example, using closing prices from the next day to make trading decisions today would introduce this bias and artificially inflate performance results. Rigorous backtesting requires careful attention to detail and realistic assumptions about transaction costs, slippage, and other market factors. Furthermore, the availability of S&P 500 historical data download facilitates experimentation with various strategies, from simple moving average crossovers to more complex algorithmic approaches.

Consider a simple backtesting scenario: a strategy that buys the S&P 500 when the 50-day moving average crosses above the 200-day moving average and sells when the opposite occurs. By applying this rule to S&P 500 historical data download spanning several decades, an investor can assess the strategy’s historical performance across different market conditions, including bull markets, bear markets, and periods of high volatility. Another example might involve testing a value investing strategy that buys companies with low price-to-earnings ratios, using historical financial data and S&P 500 index levels. These simulations provide valuable insights, but should not be the sole basis for investment decisions. Always remember that past performance is not indicative of future results, and the market dynamics captured in S&P 500 historical data download may evolve over time.

Pitfalls to Avoid When Using S&P 500 Historical Data

Working with S&P 500 historical data offers invaluable insights. However, pitfalls exist. Data quality varies significantly across sources. Some free s&p 500 historical data download options may contain inaccuracies or inconsistencies. Always verify data from multiple reputable sources before relying on it for critical analysis. Inconsistencies can significantly impact your findings and conclusions. Always cross-reference your data. Using a single source may lead to biased results.

Survivorship bias is another common problem. This bias arises from only including companies that survived over the period. Companies that failed are excluded. This skews the representation of the market’s overall performance. It creates an overly optimistic view. S&P 500 historical data download sources often address survivorship bias. However, researchers must remain aware of potential issues. They should adjust their analysis accordingly. Backtesting, for example, requires careful consideration of this bias.

Finally, remember that past performance doesn’t guarantee future results. Using s&p 500 historical data download to predict future market movements is unreliable. Market conditions change constantly. External factors significantly impact performance. Over-reliance on historical data can lead to flawed investment strategies. Combine historical analysis with other factors. These factors include current economic indicators and qualitative assessments. This will create a more robust approach to investment decision-making. The accurate interpretation of s&p 500 historical data download requires critical thinking and a balanced perspective.

Maximizing the Value of S&P 500 Historical Information

Accessing reliable S&P 500 historical data offers significant advantages for investors and market analysts. By utilizing resources like Yahoo Finance or premium services such as Refinitiv, individuals can gain valuable insights into market trends and patterns. Remember, the accuracy and frequency of updates vary across data sources. Careful consideration of these factors is crucial when choosing a provider for your s&p 500 historical data download needs. Understanding data limitations, such as survivorship bias, is vital for accurate analysis and informed decision-making. Always approach historical data with a critical eye, acknowledging that past performance does not guarantee future results.

Effective analysis of s&p 500 historical data involves more than simply downloading numbers. Tools like Excel and Python’s Pandas library facilitate data manipulation and analysis. Techniques such as calculating moving averages, identifying support and resistance levels, and conducting regression analysis can reveal meaningful trends. These insights empower investors to develop robust investment strategies and to backtest their ideas against historical market performance. Remember to avoid look-ahead bias when backtesting to ensure objective evaluation of your strategies. The ability to download s&p 500 historical data in various formats (CSV, Excel, JSON) ensures compatibility with different analytical tools. Choosing the right format simplifies the process and enhances efficiency.

Ultimately, the value of s&p 500 historical data lies in its capacity to inform investment decisions. By combining reliable data sources with sound analytical techniques, investors can gain a deeper understanding of market dynamics. This knowledge empowers them to make better-informed choices, manage risk effectively, and potentially improve investment outcomes. The careful and strategic use of s&p 500 historical data download resources represents a significant step towards achieving long-term investment success. Remember to always prioritize data quality and critical analysis in your investment process. A well-informed approach is key to maximizing the potential benefits offered by historical market data.