What is a Single Equivalent Discount Rate?

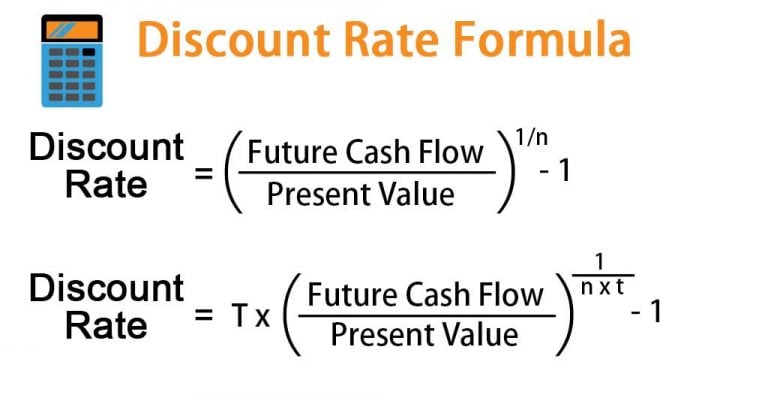

In the realm of finance, discounted cash flow (DCF) analysis is a widely used technique to evaluate the viability of investments and projects. A crucial component of DCF analysis is the discount rate, which represents the rate of return an investor expects from an investment. However, when dealing with multiple cash flows and varying discount rates, calculating the present value of future cash flows can become complex. This is where the concept of a single equivalent discount rate comes into play. A single equivalent discount rate is a rate that, when applied to a series of cash flows, produces the same present value as the original cash flows discounted at different rates. This rate is essential in DCF analysis, as it helps investors and analysts make informed decisions by providing a standardized measure of an investment’s value. By using a single equivalent discount rate, analysts can simplify complex calculations, reduce errors, and gain a deeper understanding of an investment’s potential.

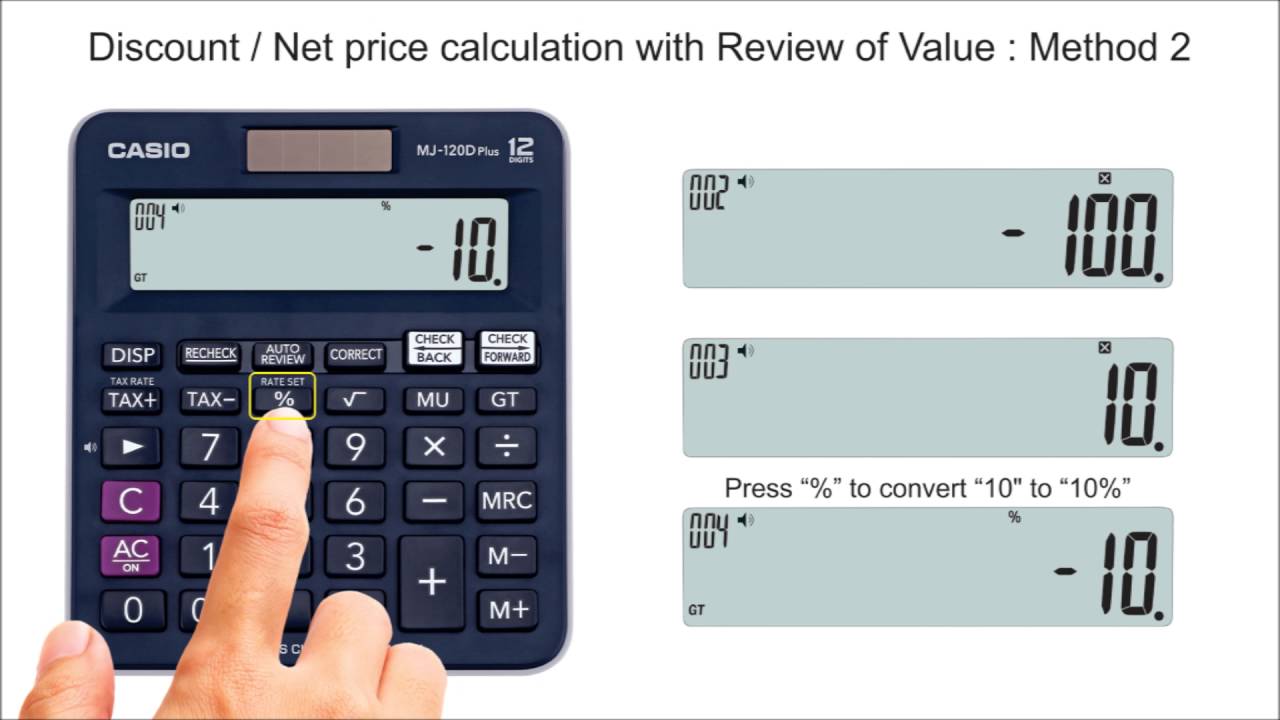

How to Calculate Single Equivalent Discount Rate with Ease

Calculating a single equivalent discount rate can be a complex and time-consuming task, especially when dealing with multiple cash flows and varying discount rates. However, with the advent of technology, analysts can now utilize a single equivalent discount rate calculator to simplify this process. A single equivalent discount rate calculator is a powerful tool that enables users to input various cash flows and discount rates, and then calculates the single equivalent discount rate with ease. This calculator eliminates the need for manual calculations, reducing the risk of errors and saving valuable time. By using a single equivalent discount rate calculator, analysts can focus on higher-level analysis and decision-making, rather than getting bogged down in complex calculations. Additionally, these calculators often provide a range of features, such as customizable inputs and outputs, making it easier to tailor the analysis to specific needs.

The Role of Discount Rates in Investment Appraisal

In investment appraisal, discount rates play a crucial role in evaluating the viability of a project or investment. A discount rate represents the rate of return an investor expects from an investment, and it is used to calculate the present value of future cash flows. The discount rate has a direct impact on the present value of cash flows, with higher discount rates resulting in lower present values and vice versa. This, in turn, affects the overall viability of a project, as a lower present value may indicate that the investment is not worth pursuing. Furthermore, discount rates can also influence the ranking of projects, as projects with higher expected returns may be prioritized over those with lower returns. In this context, a single equivalent discount rate calculator can be a valuable tool, as it enables analysts to calculate a single rate that accurately reflects the expected returns of an investment, thereby facilitating more informed investment decisions.

Common Challenges in Calculating Single Equivalent Discount Rate

Calculating a single equivalent discount rate can be a complex task, and analysts may encounter several challenges and pitfalls along the way. One of the most common challenges is dealing with multiple cash flows, which can make it difficult to determine a single discount rate that accurately reflects the expected returns of an investment. Additionally, varying discount rates can further complicate the calculation, as different rates may be applicable to different cash flows. Another challenge is ensuring that the discount rate is consistent with the investment’s risk profile, as a mismatch can lead to inaccurate results. Furthermore, analysts may struggle with selecting the appropriate discount rate formula, as different formulas can produce different results. In such cases, a single equivalent discount rate calculator can be a valuable tool, as it can simplify the calculation process and reduce the risk of errors. By using a single equivalent discount rate calculator, analysts can overcome these challenges and obtain accurate results, which can inform better investment decisions.

Using a Single Equivalent Discount Rate Calculator for Accurate Results

When it comes to calculating a single equivalent discount rate, accuracy is crucial. A small error in the calculation can lead to significant differences in the present value of future cash flows, ultimately affecting investment decisions. This is where a single equivalent discount rate calculator comes in handy. By using a single equivalent discount rate calculator, analysts can ensure accurate results, saving time and reducing the risk of errors. The calculator simplifies the complex calculation process, allowing users to input the required data and obtain a precise single equivalent discount rate. This, in turn, enables investors and analysts to make informed decisions, backed by reliable data. Furthermore, a single equivalent discount rate calculator can also increase speed and ease of use, making it an indispensable tool for professionals in the field of finance and investment analysis. With a single equivalent discount rate calculator, users can focus on higher-level analysis and decision-making, rather than getting bogged down in complex calculations.

Real-World Applications of Single Equivalent Discount Rate Calculators

Single equivalent discount rate calculators have a wide range of real-world applications in various fields, including finance, investment, and project management. One of the most common applications is in capital budgeting, where a single equivalent discount rate calculator can help evaluate the viability of different projects and investments. By accurately calculating the single equivalent discount rate, businesses can make informed decisions about which projects to pursue and which to reject. Another application is in project evaluation, where a single equivalent discount rate calculator can help assess the performance of ongoing projects and identify areas for improvement. Additionally, single equivalent discount rate calculators are also used in investment analysis, where they help investors evaluate the potential returns of different investment opportunities. For instance, a single equivalent discount rate calculator can be used to calculate the net present value of a potential investment, helping investors determine whether it is a worthwhile opportunity. Overall, single equivalent discount rate calculators are essential tools for anyone involved in investment appraisal, capital budgeting, or project evaluation, providing accurate and reliable results that inform critical business decisions.

Best Practices for Selecting a Single Equivalent Discount Rate Calculator

When selecting a single equivalent discount rate calculator, it’s essential to consider several key factors to ensure that you choose a tool that meets your needs and provides accurate results. One of the most critical factors is ease of use. A user-friendly interface can save time and reduce the risk of errors, making it easier to calculate single equivalent discount rates. Another important factor is accuracy. Look for a single equivalent discount rate calculator that has been thoroughly tested and validated to ensure that it provides reliable results. Customization options are also crucial, as they allow you to tailor the calculator to your specific needs and requirements. Additionally, consider the level of support and resources provided by the calculator’s developer, such as tutorials, documentation, and customer support. By evaluating these factors, you can select a single equivalent discount rate calculator that streamlines your workflow, reduces errors, and provides accurate results. This, in turn, enables you to make informed investment decisions with confidence. A good single equivalent discount rate calculator can be a valuable asset for anyone involved in investment appraisal, capital budgeting, or project evaluation, providing a competitive edge in today’s fast-paced business environment.

Maximizing the Benefits of Single Equivalent Discount Rate Calculators

To fully leverage the power of single equivalent discount rate calculators, it’s essential to use them in conjunction with sound financial analysis and judgment. By combining the accuracy and speed of a single equivalent discount rate calculator with a deep understanding of the underlying financial concepts, investors and analysts can make informed investment decisions with confidence. This integrated approach enables users to identify potential opportunities and risks, and to develop effective strategies for maximizing returns and minimizing costs. Furthermore, by using a single equivalent discount rate calculator as part of a comprehensive financial analysis, users can ensure that their decisions are based on a thorough understanding of the project’s or investment’s financial dynamics. This, in turn, can lead to better investment outcomes, improved capital allocation, and enhanced business performance. By harnessing the full potential of single equivalent discount rate calculators, investors and analysts can gain a competitive edge in today’s fast-paced business environment, and make informed decisions that drive long-term success.