Why Short-Term Treasury ETFs Are a Popular Choice

Investors seeking low-risk, stable returns have increasingly turned to short-term Treasury ETFs as a preferred investment option. These exchange-traded funds (ETFs) provide a convenient way to invest in government bonds, which are backed by the full faith and credit of the US government. As a result, short-term Treasury ETFs offer a high degree of safety, making them an attractive choice for risk-averse investors. The benefits of investing in government bonds, including low risk and stable returns, have contributed to the growing popularity of short-term Treasury ETFs. In particular, short 10-year Treasury ETFs have gained traction among investors, offering a unique combination of low risk and potential for long-term returns.

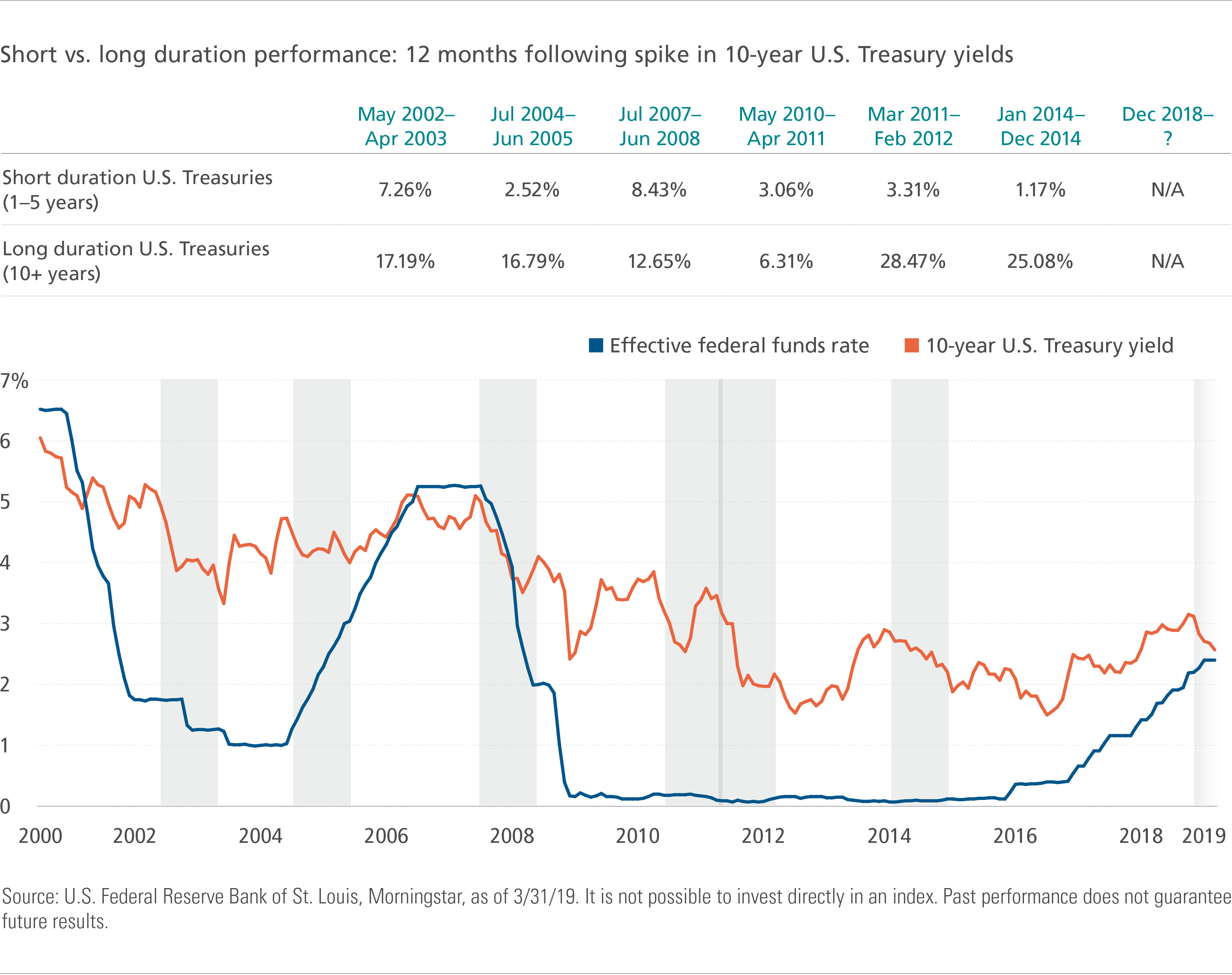

Understanding the 10-Year Treasury Yield

The 10-year Treasury yield is a widely followed benchmark in the bond market, serving as a proxy for long-term interest rates. It represents the return on investment for a 10-year US Treasury bond, which is considered a risk-free asset. The 10-year Treasury yield has significant implications for the economy and investor sentiment, as it influences borrowing costs, consumer spending, and business investment. A rising 10-year Treasury yield can indicate a strong economy, while a declining yield may signal economic uncertainty. In the context of short 10-year Treasury ETFs, understanding the 10-year Treasury yield is crucial, as it affects the performance of these ETFs and the overall bond market.

How to Invest in Short 10-Year Treasury ETFs

Investing in short 10-year Treasury ETFs is a straightforward process that can be completed in a few steps. To get started, investors should first determine their investment goals and risk tolerance. This will help them decide which type of short 10-year Treasury ETF is best suited for their needs. There are several types of ETFs available, including those that track a specific Treasury yield index, such as the Bloomberg Barclays 1-10 Year U.S. Treasury Index, and those that use an active management approach to select a portfolio of Treasury securities. Once the type of ETF has been selected, investors can purchase shares through a brokerage firm or an online trading platform. It is essential to evaluate the fees and expenses associated with each ETF, as well as the investment strategy and risk profile, to ensure that it aligns with their investment objectives. By following these steps, investors can easily add short 10-year Treasury ETFs to their portfolio and benefit from their low-risk, stable returns.

Top Short 10-Year Treasury ETFs to Consider

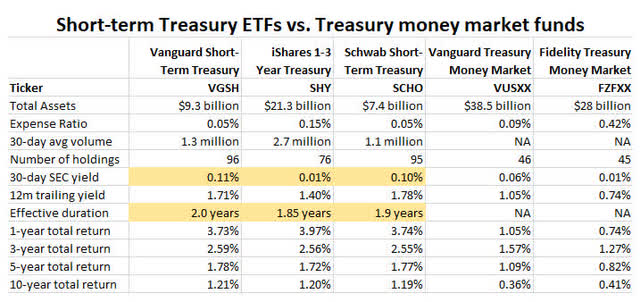

When selecting a short 10-year Treasury ETF, it’s essential to evaluate the performance, fees, and investment strategies of various options. Here are some top short 10-year Treasury ETFs to consider:

The iShares 1-3 Year Treasury Bond ETF (SHY) is a popular choice, with a low expense ratio of 0.15% and a diversified portfolio of short-term Treasury securities. The Vanguard Short-Term Government Bond ETF (VGIT) is another option, offering a low expense ratio of 0.07% and a broad range of short-term government bonds. The SPDR Bloomberg Barclays 1-10 Year U.S. Treasury Bond ETF (TLO) is a more actively managed option, with a slightly higher expense ratio of 0.16% and a focus on optimizing returns through dynamic bond selection.

Other notable short 10-year Treasury ETFs include the Schwab Short-Term U.S. Treasury ETF (SCHO) and the Invesco Treasury Collateral ETF (CLTL). When evaluating these ETFs, investors should consider their investment objectives, risk tolerance, and overall portfolio strategy to determine which short 10-year Treasury ETF is best suited for their needs. By selecting a high-quality short 10-year Treasury ETF, investors can benefit from the low-risk, stable returns offered by these investment vehicles.

The Benefits of Diversification with Short-Term Treasury ETFs

Diversification is a crucial aspect of portfolio management, and short-term Treasury ETFs can play a significant role in achieving this goal. By incorporating short 10-year Treasury ETFs into a portfolio, investors can reduce their exposure to risk and increase potential returns. This is because short-term Treasury ETFs tend to have a low correlation with other asset classes, such as stocks and commodities, which means that their performance is not closely tied to these markets.

Additionally, short-term Treasury ETFs can help to mitigate the impact of market volatility on a portfolio. During times of economic uncertainty, investors often flock to safe-haven assets, such as government bonds, which can drive up their prices. By holding a short 10-year Treasury ETF, investors can benefit from this flight to safety, while also reducing their exposure to riskier assets.

Furthermore, short-term Treasury ETFs can be used to diversify a fixed-income portfolio. By combining short 10-year Treasury ETFs with other fixed-income investments, such as corporate bonds or municipal bonds, investors can create a more balanced portfolio that is better equipped to handle changing market conditions. This can be particularly useful for investors who are seeking to generate income from their investments, as short-term Treasury ETFs can provide a regular stream of interest payments.

Overall, incorporating short-term Treasury ETFs into a portfolio can be an effective way to reduce risk and increase potential returns. By taking advantage of the benefits of diversification, investors can create a more resilient portfolio that is better equipped to handle the challenges of the investment landscape.

Managing Interest Rate Risk with Short 10-Year Treasury ETFs

Interest rate changes can have a significant impact on bond prices, and short 10-year Treasury ETFs are no exception. When interest rates rise, existing bonds with lower yields become less attractive, causing their prices to fall. Conversely, when interest rates fall, existing bonds with higher yields become more attractive, causing their prices to rise. This inverse relationship between interest rates and bond prices can be a challenge for investors seeking to manage their interest rate risk.

Short 10-year Treasury ETFs can help mitigate this risk in several ways. Firstly, they have a shorter duration than longer-term Treasury bonds, which means that their prices are less sensitive to changes in interest rates. This makes them a more attractive option for investors who are concerned about interest rate risk. Secondly, short 10-year Treasury ETFs often have a more diversified portfolio of bonds, which can help to reduce their exposure to any one particular bond or interest rate environment.

Additionally, some short 10-year Treasury ETFs employ active management strategies to mitigate interest rate risk. For example, they may use derivatives to hedge against potential losses or adjust their portfolio composition in response to changes in interest rates. By investing in a short 10-year Treasury ETF, investors can benefit from the expertise of professional managers who are dedicated to managing interest rate risk.

Overall, short 10-year Treasury ETFs can be an effective way to manage interest rate risk and achieve low-risk, stable returns. By understanding the impact of interest rate changes on bond prices and using short 10-year Treasury ETFs to mitigate this risk, investors can create a more resilient portfolio that is better equipped to handle the challenges of the investment landscape.

Short 10-Year Treasury ETFs vs. Other Fixed-Income Investments

When it comes to fixed-income investments, investors have a range of options to choose from. Short 10-year Treasury ETFs are just one of many options, and it’s essential to understand how they compare to other fixed-income investments. In this section, we’ll explore the benefits and drawbacks of short 10-year Treasury ETFs compared to CDs, bonds, and money market funds.

CDs, or certificates of deposit, are time deposits offered by banks with a fixed interest rate and maturity date. They tend to be low-risk and provide a fixed return, but they often come with penalties for early withdrawal. In contrast, short 10-year Treasury ETFs offer more flexibility and liquidity, allowing investors to buy and sell shares throughout the day.

Bonds, on the other hand, are debt securities issued by corporations or governments to raise capital. They typically offer a higher return than short 10-year Treasury ETFs, but they also come with a higher level of credit risk. Short 10-year Treasury ETFs, by contrast, are backed by the full faith and credit of the US government, making them a much safer investment option.

Money market funds, which invest in low-risk, short-term debt securities, are another popular fixed-income investment option. They tend to offer a lower return than short 10-year Treasury ETFs, but they provide a high level of liquidity and are often used as a cash management tool. Short 10-year Treasury ETFs, on the other hand, offer a more diversified portfolio of bonds and can provide a higher return over the long term.

Ultimately, the choice between short 10-year Treasury ETFs and other fixed-income investments will depend on an investor’s individual goals and risk tolerance. However, for investors seeking a low-risk, stable return, short 10-year Treasury ETFs can be an attractive option. By understanding the benefits and drawbacks of each investment option, investors can make informed decisions and create a more diversified portfolio.

Conclusion: A Low-Risk Investment Option for the Long Term

In conclusion, short 10-year Treasury ETFs offer a compelling investment opportunity for those seeking low-risk, stable returns. With their unique benefits, including low credit risk, high liquidity, and diversification potential, they can be an attractive addition to a portfolio. By understanding the benefits and drawbacks of short 10-year Treasury ETFs, as well as how they compare to other fixed-income investments, investors can make informed decisions and create a more resilient portfolio.

For investors seeking a long-term, low-risk investment option, short 10-year Treasury ETFs can be an excellent choice. They offer a stable source of income, with returns that are generally more predictable than those of stocks or other higher-risk investments. Additionally, they can help to reduce overall portfolio risk and increase returns through diversification.

By investing in a short 10-year Treasury ETF, investors can gain exposure to a diversified portfolio of high-quality, short-term Treasury bonds, without the need for individual bond selection or management. This can be particularly appealing for investors who lack the time, expertise, or resources to manage a bond portfolio on their own.

Ultimately, short 10-year Treasury ETFs can be a valuable addition to a portfolio, providing a low-risk, stable source of returns over the long term. By incorporating them into a diversified investment strategy, investors can help to ensure a more secure financial future.

:max_bytes(150000):strip_icc()/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)