Understanding the Foundations of Security Analysis

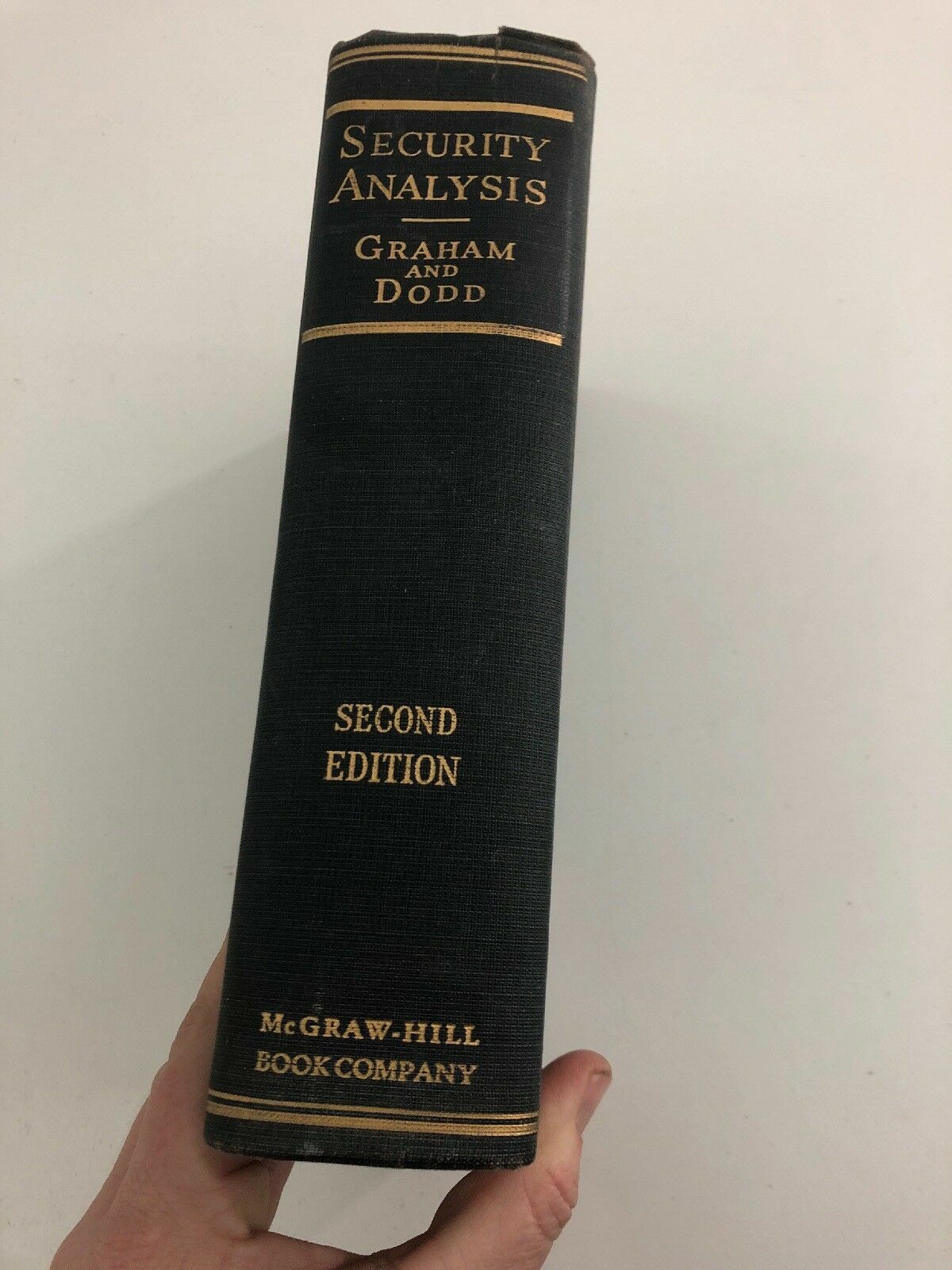

Security analysis is a crucial component of investment decision-making, providing a framework for evaluating securities and making informed investment choices. The classic 1940 edition of Security Analysis, penned by Benjamin Graham and David Dodd, is a seminal work that has stood the test of time. This iconic book has been a cornerstone of investment education, offering a disciplined approach to investing that has been widely adopted by investors. The principles outlined in this edition, including the concept of margin of safety and the importance of stock selection, remain essential reading for investors seeking to build long-term wealth. By grasping the fundamentals of security analysis, investors can develop a robust investment strategy, mitigating risks and maximizing returns. The 1940 edition of Security Analysis is a timeless classic that continues to offer valuable insights into the world of investing, making it an essential read for investors of all levels.

A Glimpse into the Past: The 1940 Edition’s Enduring Relevance

The 1940 edition of Security Analysis was written during a tumultuous period in economic history, with the Great Depression still casting a shadow over the global economy. Despite the challenging investment landscape of the time, Graham and Dodd’s seminal work provided a beacon of hope for investors seeking to navigate the treacherous waters of the stock market. The book’s emphasis on rigorous security analysis, margin of safety, and long-term wealth creation resonated with investors who were desperate for a disciplined approach to investing. Today, the principles outlined in the 1940 edition of Security Analysis remain remarkably relevant, offering a timeless guide to investment success that transcends the vagaries of market cycles and economic trends. By understanding the historical context in which the book was written, investors can gain a deeper appreciation for the enduring wisdom of security analysis the classic 1940 edition, and its continued relevance in modern markets.

How to Apply Timeless Investment Principles in Modern Markets

The 1940 edition of Security Analysis offers a treasure trove of timeless investment principles that remain remarkably relevant in today’s markets. By applying these principles, investors can develop a disciplined approach to investing, mitigating risks and maximizing returns. One of the key takeaways from the 1940 edition is the importance of margin of safety, which involves buying securities at a price significantly below their intrinsic value. This concept remains essential in modern markets, where volatility and uncertainty can be significant. Another crucial principle is the concept of Mr. Market, which personifies the stock market as a moody business partner who offers investors daily opportunities to buy or sell securities. By understanding Mr. Market’s behavior, investors can develop a contrarian approach to investing, buying when others are fearful and selling when others are greedy. Finally, the 1940 edition emphasizes the importance of stock selection, highlighting the need for investors to conduct thorough research and due diligence before making investment decisions. By applying these principles in modern markets, investors can develop a robust investment strategy that is grounded in the timeless wisdom of security analysis the classic 1940 edition.

Ben Graham’s Investment Philosophy: A Blueprint for Success

Benjamin Graham, the father of value investing, co-authored Security Analysis with David Dodd in 1940. Graham’s investment philosophy, which is deeply rooted in the principles of security analysis the classic 1940 edition, offers a timeless blueprint for achieving long-term investment success. At the heart of Graham’s approach is the concept of value investing, which involves buying securities at a price significantly below their intrinsic value. This approach is based on the idea that the market is inherently inefficient, and that careful analysis can uncover undervalued securities with significant upside potential. Graham’s philosophy also emphasizes the importance of a disciplined investment approach, highlighting the need for investors to adopt a long-term perspective and avoid emotional decision-making. By applying Graham’s value investing approach, investors can develop a robust investment strategy that is grounded in the principles of security analysis and designed to deliver consistent returns over the long term. Furthermore, Graham’s philosophy offers a framework for investors to think critically about the investment process, encouraging them to focus on the underlying fundamentals of a security rather than its market price. By adopting this approach, investors can develop a deeper understanding of the investment landscape and make more informed decisions that are aligned with their long-term goals.

Security Analysis in Practice: Real-World Examples and Case Studies

The principles outlined in the 1940 edition of Security Analysis are not just theoretical concepts, but have been successfully applied in real-world investment scenarios. One notable example is the investment approach of Warren Buffett, a renowned value investor who has built his investment philosophy on the principles of security analysis the classic 1940 edition. Buffett’s success is a testament to the enduring relevance of Graham’s value investing approach, which emphasizes the importance of buying securities at a price significantly below their intrinsic value. Another example is the investment firm of Tweedy, Browne, which has consistently delivered strong returns over the long term by applying the principles of security analysis to its investment decisions. The firm’s approach is based on a thorough analysis of a company’s underlying fundamentals, including its financial health, management quality, and competitive advantages. By applying these principles, Tweedy, Browne has been able to identify undervalued securities with significant upside potential, resulting in strong returns for its investors. These real-world examples demonstrate the power of security analysis in practice, highlighting the importance of a disciplined investment approach and a thorough understanding of a company’s underlying fundamentals. By studying these examples and applying the principles of security analysis, investors can develop a robust investment strategy that is designed to deliver long-term success.

Why the 1940 Edition Remains a Must-Read for Investors Today

The 1940 edition of Security Analysis remains a must-read for investors today due to its timeless insights into human psychology, market behavior, and the importance of a disciplined investment approach. One of the key reasons for its continued relevance is its focus on the underlying principles of investment, rather than specific market trends or fads. The 1940 edition’s emphasis on thorough research, critical thinking, and a long-term perspective provides a framework for investors to navigate the complexities of the market and make informed decisions. Furthermore, the book’s exploration of human psychology and behavioral finance offers valuable lessons on how to avoid common investment pitfalls, such as emotional decision-making and groupthink. The 1940 edition’s discussion of Mr. Market, a metaphor for the stock market’s tendency to fluctuate wildly, remains particularly relevant in today’s volatile market environment. By understanding the principles of security analysis the classic 1940 edition, investors can develop a robust investment strategy that is designed to deliver long-term success, regardless of market conditions. In short, the 1940 edition of Security Analysis remains an essential read for investors seeking to build long-term wealth, offering a wealth of knowledge and insights that are just as relevant today as they were when the book was first published.

Integrating Security Analysis into Your Investment Strategy

Integrating the principles of security analysis the classic 1940 edition into an investment strategy requires a disciplined approach and a thorough understanding of the underlying concepts. One key takeaway from the 1940 edition is the importance of margin of safety, which involves buying securities at a price significantly below their intrinsic value. To apply this principle, investors should focus on identifying undervalued securities with strong fundamentals, rather than chasing hot stocks or trendy investments. Additionally, investors should adopt a long-term perspective, recognizing that security analysis is a marathon, not a sprint. By doing so, they can avoid the pitfalls of emotional decision-making and instead, make informed investment decisions based on thorough research and analysis. Another key aspect of integrating security analysis into an investment strategy is portfolio construction. Investors should aim to create a diversified portfolio that balances risk and potential return, with a focus on quality over quantity. This can be achieved by selecting a mix of low-risk, high-quality securities and higher-risk, higher-reward investments. Furthermore, investors should regularly review and rebalance their portfolio to ensure that it remains aligned with their investment objectives. By incorporating the principles of security analysis the classic 1940 edition into an investment strategy, investors can create a robust framework for long-term wealth creation, one that is designed to deliver consistent returns over time.

The Enduring Legacy of Security Analysis

The 1940 edition of Security Analysis has left an indelible mark on the investment community, shaping the way investors think about security analysis and investment decision-making. The book’s timeless principles, including the importance of margin of safety, Mr. Market, and stock selection, continue to influence investment strategies and philosophies to this day. The classic 1940 edition’s emphasis on thorough research, critical thinking, and a disciplined investment approach has inspired generations of investors, from value investing legends like Warren Buffett to individual investors seeking to build long-term wealth. The book’s insights into human psychology and market behavior remain particularly relevant, offering valuable lessons on how to navigate the complexities of the market and avoid common investment pitfalls. As a result, security analysis the classic 1940 edition remains an essential read for investors seeking to build long-term wealth, offering a wealth of knowledge and insights that are just as relevant today as they were when the book was first published. In conclusion, the 1940 edition of Security Analysis is a testament to the power of timeless investment principles, and its enduring legacy continues to inspire and educate investors around the world.