The Cornerstone of Value Investing: Understanding Graham’s Principles

Benjamin Graham, widely regarded as the father of value investing, revolutionized the world of finance with his disciplined and rational approach to stock selection. His seminal work, “Security Analysis by Benjamin Graham,” published in 1934, established a new paradigm for investors, moving away from speculation and towards a focus on intrinsic value. Graham’s core tenets revolve around the idea that stocks are not merely symbols traded on a screen but represent ownership in real businesses. This perspective encourages investors to analyze companies thoroughly, much like buying the entire business. His methodology is designed to protect investors from emotional decision-making, emphasizing careful evaluation of a company’s financial health to identify securities that are trading below their fair value. The significance of Graham’s approach lies in its ability to offer a logical framework for long-term success, distinguishing it from speculative practices that dominate the investment landscape. Through “Security Analysis by Benjamin Graham,” he provided practical, step-by-step guidance for investors to assess businesses based on fundamentals, paving the way for more informed and reliable investment strategies.

The core of his philosophy is the notion of a “margin of safety,” where investors should purchase securities at prices significantly below their perceived worth, thereby creating a buffer against potential errors in judgment or unforeseen events. Graham’s meticulous methods of selecting undervalued companies, as detailed in “Security Analysis by Benjamin Graham,” became the foundation upon which generations of value investors built their success. His emphasis on the balance sheet, profitability, and management quality encourages a comprehensive approach rather than reliance on market sentiment or superficial metrics. The enduring legacy of this work highlights the timeless nature of Graham’s principles, providing practical frameworks for investors to navigate volatile markets while maintaining a long-term investment perspective. This work not only shaped modern investment theory but continues to provide invaluable insights to those seeking to build wealth through disciplined analysis and rational decision-making. The value approach contrasts sharply with the often chaotic and speculation-driven mainstream markets, offering a stable and consistent method for long-term wealth creation.

How to Analyze a Company Using Graham’s Framework

Benjamin Graham’s methodology for fundamental analysis, a cornerstone of value investing, involves a meticulous examination of a company’s financial health. This process starts with a deep dive into the three primary financial statements: the balance sheet, the income statement, and the cash flow statement. The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time, allowing investors to assess its solvency and financial structure. The income statement, on the other hand, details the company’s revenues, expenses, and profits over a reporting period, offering insight into its profitability. Lastly, the cash flow statement tracks the movement of cash both into and out of the company, showing how well the business manages its liquidity. In the context of company valuation, Graham emphasized that these statements reveal crucial information about the operational performance and financial resilience of the business, both of which are necessary for sound security analysis by benjamin graham. Understanding these financial statements is essential to determine if a company is a solid investment.

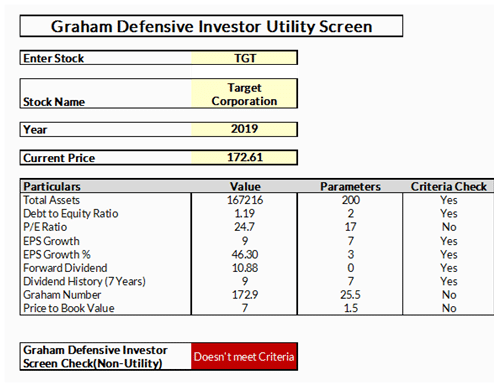

Graham’s framework further incorporates the use of key financial ratios to assess a company’s inherent value. Ratios such as the Price-to-Earnings (P/E) ratio compare the company’s market price to its earnings per share, while the Price-to-Book (P/B) ratio juxtaposes the market value with its book value. Additionally, the Debt-to-Equity ratio helps evaluate a company’s leverage and financial risk. These ratios, when used in conjunction with the financial statements, allowed Graham to determine if a company was trading at a discount to its intrinsic value. A significant component of Graham’s approach is the emphasis on a “margin of safety.” This involves buying a stock for significantly less than what it is worth, providing a buffer against errors in analysis or unexpected market declines. This concept is crucial to a conservative approach to security analysis by benjamin graham. Graham advocated for using these financial analysis techniques to make well informed investment decisions, thereby minimizing potential losses and maximizing the potential for gains.

Furthermore, a value investor should use a critical eye when assessing a company’s fundamentals, not relying solely on formulas and ratios. The principles of security analysis by benjamin graham call for a disciplined approach that integrates these financial metrics and deep understanding of how a company works. The value investor should evaluate the sustainability of a company’s competitive advantages and the quality of management. Graham’s analysis framework thus involves both quantitative analysis and qualitative judgment to ascertain the true value of a business. This holistic view is critical to avoid simple, over-reliance on one number and identify sound investment opportunities.

Delving into the Concept of Intrinsic Value

Intrinsic value, in the context of Benjamin Graham’s teachings, represents the true underlying worth of a company, independent of its current market price. It’s the value that a rational, informed investor would assign to the business based on its assets, earnings potential, and future prospects. This is a critical concept because market prices, influenced by investor sentiment and short-term fluctuations, often deviate from this intrinsic value, creating opportunities for value investors. Graham emphasizes that successful investing lies in identifying these discrepancies, not in speculating on short-term price movements. Understanding the difference between market price and intrinsic value is a cornerstone of the investment philosophy found in “security analysis by benjamin graham.” The idea is that a stock is only worth what you would pay for the entire business considering its assets and earnings potential. For example if a company had assets worth $100,000, and was consistently producing $10,000 in earnings each year, you could try to work out what the total business should be worth and if the share price is far below that value, it may be considered undervalued.

Graham’s approach to calculating intrinsic value was not about precise formulas but rather about reasoned estimation. He advocated for using conservative assumptions when projecting future earnings and analyzing financial statements. This might include using past average performance as a projection for the future or reducing projected revenues to account for industry specific headwinds. He would often focus on tangible assets, such as property and equipment, providing a more concrete sense of a company’s worth. He also recommended using a range of valuations rather than relying on a single, specific number. In his view, the goal was not to pinpoint an exact value but rather to establish a reasonable price that offers a “margin of safety,” a concept central to his investment approach. This margin of safety acts as a cushion, protecting the investor from the negative consequences of calculation errors or unforeseen market downturns. The margin of safety means you have a buffer if your calculations are wrong, meaning that only a severely negative outcome will impact your investment. This is explained in great detail in “security analysis by benjamin graham”.

To exemplify, imagine a company with tangible assets clearly worth $10 million, yet the market undervalues it, selling its entire business for $7 million. According to Graham, this difference provides a margin of safety for the investor. As an investor, you are only risking the $7 million, and if the value was correctly assessed at $10 million, you are already ahead by $3 million. This is a simplified view, but the core principle is to pay less than something is worth. Graham’s focus was on understanding the financial statements, projecting future earnings using conservative methods, and ensuring the price paid had a margin of safety built into it. This highlights the critical distinction between market perception and true underlying worth, which are important for anyone wanting to understand security analysis by benjamin graham.

The Role of the Defensive Investor: A Graham Perspective

Benjamin Graham, in his seminal work “Security Analysis by Benjamin Graham,” distinguishes between two types of investors: the defensive and the enterprising. The defensive investor, often the focus of Graham’s guidance, prioritizes capital preservation and seeks stable, reliable investments over high growth potential. This investor is not looking to outperform the market significantly, but rather aims to achieve satisfactory returns while minimizing risk. A key characteristic of the defensive investor is their aversion to complex or speculative investment strategies. Instead, they seek out well-established companies with a proven track record of profitability and consistent dividend payouts. They understand the wisdom behind “Security Analysis by Benjamin Graham” and diligently apply its principles to ensure their investments are based on solid financial foundations. Their investment process focuses on choosing investments that can navigate market fluctuations and sustain their value over time, thereby avoiding common pitfalls associated with speculation and emotional decision-making, and ensuring their security analysis is backed by solid research and due diligence.

For a defensive investor, the selection process for securities emphasizes companies with robust balance sheets and consistent earnings histories. This often means focusing on large-cap, dividend-paying stocks that are leaders in their respective industries. “Security Analysis by Benjamin Graham” emphasizes the importance of a diversified portfolio to reduce unsystematic risk. A defensive investor will thus allocate investments across different asset classes, such as stocks and bonds, to balance risk and reward. In terms of fixed income, government bonds, or high-quality corporate bonds are typically preferred due to their lower risk profile compared to stocks. They should also avoid obscure or new asset classes, since their investment strategy is to avoid speculative opportunities. The selection criteria for stocks should include a detailed study based on Graham’s framework focusing on metrics that would provide information on the safety of the investment and the margin of safety. The ultimate goal is to create a portfolio that can weather market downturns and provide consistent, albeit moderate, returns.

The defensive investor, guided by principles from “Security Analysis by Benjamin Graham,” also understands that proper portfolio management involves not just buying but also a structured approach to selling. This includes selling when a stock’s price rises significantly above its calculated intrinsic value, or when the company’s fundamentals deteriorate. In essence, the defensive investor’s approach, using techniques described in “Security Analysis by Benjamin Graham”, is to make sound investment decisions that are well reasoned and backed by a deep understanding of the companies they are investing in, with an aversion to risk, resulting in stable and reliable returns. They are not trying to time the market but rather to capitalize on companies that are undervalued by the market by applying the principles of value investing.

Applying Graham’s Teachings in Today’s Market

Benjamin Graham’s principles, foundational to value investing and detailed in his seminal work, “security analysis by benjamin graham,” remain remarkably relevant in today’s complex market. However, applying these principles requires a nuanced understanding of the modern financial landscape. Today’s markets are characterized by rapid technological advancements, increased globalization, and the prevalence of high-frequency trading. These factors can lead to increased volatility and create situations that were not envisioned when Graham first formulated his ideas. Despite these challenges, the core tenets of his philosophy – a focus on intrinsic value, a margin of safety, and a thorough understanding of a company’s financials – continue to provide a robust framework for making sound investment decisions. For instance, while Graham’s specific valuation formulas may need adjustments to account for modern business models and accounting standards, the underlying principle of purchasing assets below their intrinsic value remains fundamental. Investors can adapt his approach by using sophisticated financial modeling tools to forecast future cash flows and determine the discounted present value.

Navigating the market also requires acknowledging the behavioral biases that can drive irrational pricing. Market sentiment and herding behavior often cause the market to misprice assets, which, in turn, can create opportunities for value investors. Investors today should leverage technology to access a wide range of information and research to ensure their fundamental analysis is robust. It also important to assess how modern businesses operate, how they are affected by rapid technological changes and geopolitical risks. For example, companies that are highly dependent on intellectual property or network effects may require additional qualitative analysis in addition to pure quantitative analysis. Graham’s emphasis on a margin of safety becomes even more relevant when dealing with today’s uncertainties. This means being even more conservative in valuations and focusing on companies that have a strong balance sheet and are able to withstand economic downturns. Understanding the context in which the company operates will be essential to make the application of “security analysis by benjamin graham” effective.

Modern investors need to be critical thinkers and avoid simply following popular opinions or trends. It’s important to be patient, disciplined and have the ability to ignore market noise to maintain a long-term perspective. The current market conditions, characterized by quick, unexpected changes, require investors to be adaptable and continue to learn, making sure the principles of “security analysis by benjamin graham” continue to be applied in a practical and informed way. By staying true to the core principles of value investing while adapting to the modern environment, investors can still find mispriced assets and build long-term wealth.

Common Pitfalls to Avoid When Using Graham’s Methodology

Applying Benjamin Graham’s value investing principles, as detailed in his seminal work “security analysis by benjamin graham,” requires a nuanced understanding to avoid common pitfalls. Investors often make the mistake of oversimplifying his methods, rigidly adhering to formulas and ratios without considering the broader context of a business. For instance, relying solely on low Price-to-Earnings or Price-to-Book ratios can lead to the trap of investing in seemingly cheap companies that are actually declining businesses with poor future prospects. This is often referred to as a value trap, where a company’s stock appears undervalued based on historical data but lacks the capacity for future growth or recovery. The framework of “security analysis by benjamin graham” advocates for a more comprehensive approach than simply screening for low multiples. It emphasizes the need to critically assess the sustainability of a company’s earnings, the strength of its balance sheet, and the quality of its management before making an investment decision.

Another frequent error is the failure to account for qualitative factors that can significantly influence a company’s value. While Graham’s methodology relies heavily on quantitative analysis, it doesn’t suggest an ignorance of the underlying business. Blindly applying the numbers from “security analysis by benjamin graham” without understanding the company’s competitive landscape, its long-term growth potential, or its vulnerability to disruptions can lead to significant losses. Ignoring the impact of technological advancements, changing consumer preferences, or increased competition can render even a deeply discounted stock a risky investment. Investors should avoid the temptation to cherry-pick data to justify their investment decisions, and must develop the discipline to challenge their own assumptions. The process of security analysis by benjamin graham, is not a simple checklist but a robust investigation into the fundamental aspects of a business, demanding a holistic view of both numbers and narratives to evaluate real intrinsic value. This includes being critical of management’s strategies and their ability to execute them in a dynamic business world.

Finally, a mistake stemming from misinterpretation of “security analysis by benjamin graham” is the lack of patience and discipline. Value investing is a long-term strategy; short-term price fluctuations are expected and should not drive investment decisions. Investors need to understand that the market may not immediately recognize a company’s value, and selling prematurely can derail potential profits. Investors should be prepared for periods of underperformance, trusting in their analysis and sticking with their process. Over-reliance on the quantitative side of “security analysis by benjamin graham” without the qualitative judgement, may lead to buying a bad investment because it looked cheap, and later selling it for a loss, when the market does not acknowledge its “cheapness”. Ultimately, successfully applying the core principles of “security analysis by benjamin graham”, requires both intellectual rigor and emotional fortitude.

The Enduring Legacy of Graham’s Investment Insights

Benjamin Graham’s profound impact on value investing and the wider financial world remains undeniable, solidifying his position as a key figure in financial history. His principles, carefully articulated in “Security Analysis by Benjamin Graham,” continue to shape the strategies of investors at all levels, from novices to seasoned professionals. The core tenets of his approach, emphasizing the importance of understanding the underlying value of a company rather than being swayed by market fluctuations, resonate even more strongly in today’s often turbulent market landscape. Learning these principles, as taught through his seminal work “security analysis by benjamin graham”, provides a robust framework that, when applied thoughtfully, can lead to improved investment decisions, helping investors navigate the complexities of the financial markets with greater confidence and precision. The enduring relevance of Graham’s teachings lies in their focus on long-term value creation and risk mitigation, both crucial elements of successful investing.

The influence of “Security Analysis by Benjamin Graham” extends beyond individual investors, shaping the investment philosophies of some of the most successful and widely respected investors in the world. Individuals who have embraced and successfully applied Graham’s methodologies include Warren Buffett, who frequently acknowledges the significant impact Graham’s teachings had on his career. This alone speaks volumes about the practical value and enduring power of Graham’s ideas. The framework outlined in “Security Analysis by Benjamin Graham” encourages a patient and disciplined approach to investing, urging investors to look beyond short-term market noise and focus on the intrinsic worth of a business. The practical application of his concepts has resulted in significant wealth creation for those willing to dedicate the time to understand and apply them. The strategies detailed in Graham’s works are a blueprint for investors who seek to achieve long-term financial stability by buying undervalued assets.

Graham’s emphasis on a margin of safety, thorough fundamental analysis, and an understanding of the business behind the stock serves as a critical lesson for investors of all generations. The concepts of ‘security analysis by benjamin graham’ teaches critical thinking and independent judgment, allowing investors to make decisions based on their own analysis rather than relying on market trends or popular opinion. By mastering the principles outlined in his book, investors equip themselves with a toolset capable of withstanding the emotional swings of the market and identifying investment opportunities that offer a greater probability of success. The legacy of Benjamin Graham, therefore, is not just in the creation of value investing, but also in the establishment of a method for more informed and prudent decision-making.

Beyond the Numbers: The Human Element in Graham’s Analysis

While Benjamin Graham’s framework for value investing, heavily detailed in “Security Analysis by Benjamin Graham,” emphasizes quantitative analysis, a deeper understanding reveals a crucial qualitative aspect. This aspect goes beyond simple number crunching, delving into the very essence of a business. Understanding the nature of the business itself—its operations, its industry, and its competitive positioning—becomes paramount. A crucial consideration involves evaluating the competence and integrity of the management team. Are they capable stewards of capital? Do they prioritize long-term value creation over short-term gains? These elements, often difficult to quantify, are critical to assess a company’s true worth. Furthermore, the competitive landscape cannot be ignored. How does the company stack up against its rivals? Does it have a sustainable competitive advantage, or is it vulnerable to disruptive forces? A robust security analysis by benjamin graham requires an examination of these dynamic factors to determine the durability of the business model. These qualitative elements provide the necessary context to interpret the quantitative metrics. For example, while a company may appear undervalued based on its price-to-earnings ratio, a deeper investigation might reveal significant issues within its management structure or a rapidly eroding competitive position, making it a risky investment despite the apparently low valuation.

The application of “security analysis by benjamin graham” is not merely a formulaic process. It demands critical thinking and sound judgment. Investors should not blindly rely on ratios and financial statements but rather use these tools as starting points for more in-depth analysis. The most successful value investors develop an ability to see beyond the numbers, recognizing the subtle nuances of a business and its operating environment. This qualitative understanding is critical in identifying potential risks and opportunities often overlooked by those who rely solely on quantitative measures. While formulas and metrics provide a disciplined framework, they are not a substitute for informed human judgment. Value investing requires an element of subjective analysis to assess the intangible assets of the company such as its brand reputation, its intellectual property, and its customer relationships. This holistic approach, which merges quantitative and qualitative assessment, is essential to a more robust investment approach.

The ability to correctly interpret “security analysis by benjamin graham” requires a blend of financial literacy and business acumen. This approach encourages investors to ask probing questions, such as, what are the company’s future prospects? Does it have the ability to adapt to changing market conditions? And what are the key drivers of its profitability? It is also critical to assess if the financial statements realistically reflect the company’s underlying economics. Accounting standards provide guidelines, but there is also considerable room for interpretation and creative accounting techniques. The most successful investors are able to discern true profitability and financial strength by understanding how management operates the business and uses accounting to paint a financial picture, thus allowing them to make sound investment decisions. In summary, understanding that the human element is integral to a holistic analysis is key to truly implement a successful Graham-inspired investment strategy and truly grasp the essence of security analysis by benjamin graham.