Unveiling the Power of Time Series Analysis in Finance

Financial time series data plays a crucial role in understanding market behavior, predicting future trends, and facilitating informed investment strategies. This data, which encompasses various financial instruments such as stock prices, market indices, interest rates, and exchange rates, is collected sequentially over time. Analyzing these time-stamped data points allows financial professionals and researchers to identify patterns, dependencies, and anomalies that would otherwise remain hidden. However, the inherent complexities of financial markets, including volatility, noise, and non-stationarity, present significant challenges to effective analysis. The application of “ruey tsay analysis of financial time series” methodologies is essential for navigating these challenges.

The importance of financial time series analysis lies in its ability to transform raw data into actionable insights. For instance, by analyzing historical stock prices, investors can estimate future price movements and make informed decisions about buying or selling stocks. Similarly, central banks use time series models to forecast inflation and adjust monetary policy accordingly. Risk managers employ time series techniques to assess and manage the volatility of financial assets, thereby mitigating potential losses. The challenges associated with analyzing financial time series data include dealing with missing values, outliers, and structural breaks. Preprocessing techniques, such as data smoothing and outlier detection, are often necessary to improve the accuracy and reliability of the analysis. Furthermore, understanding the statistical properties of the data, such as autocorrelation and heteroscedasticity, is crucial for selecting appropriate analytical methods. “Ruey tsay analysis of financial time series” provides a robust framework for addressing these complexities.

Different types of financial data require different analytical approaches. For example, stock prices are often characterized by high volatility and non-stationarity, requiring advanced time series models such as GARCH and stochastic volatility models. Interest rates, on the other hand, may exhibit mean reversion and seasonality, making ARIMA models more suitable. Exchange rates are influenced by a multitude of factors, including economic indicators, political events, and market sentiment, making their analysis particularly challenging. Despite these challenges, the application of “ruey tsay analysis of financial time series” enables analysts to extract valuable information and make more informed decisions. Financial time series analysis serves as a cornerstone for informed financial decision-making and risk management in today’s complex and dynamic financial landscape.

How to Extract Insights from Financial Data Sequences

Analyzing financial time series data involves a systematic process, beginning with meticulous data collection and culminating in insightful visualizations. The initial step necessitates gathering relevant data from reliable sources, which may include stock exchanges, financial news providers, or specialized data vendors. This raw data often requires rigorous cleaning to address inconsistencies, missing values, and outliers that can distort subsequent analysis. Data cleaning techniques might involve imputation methods for filling gaps, outlier detection algorithms for identifying anomalous data points, and smoothing techniques for reducing noise. Ensuring data quality at this stage is paramount, as the accuracy of subsequent analysis hinges on the integrity of the input data. The ruey tsay analysis of financial time series underscores this point with mathematical exactitude.

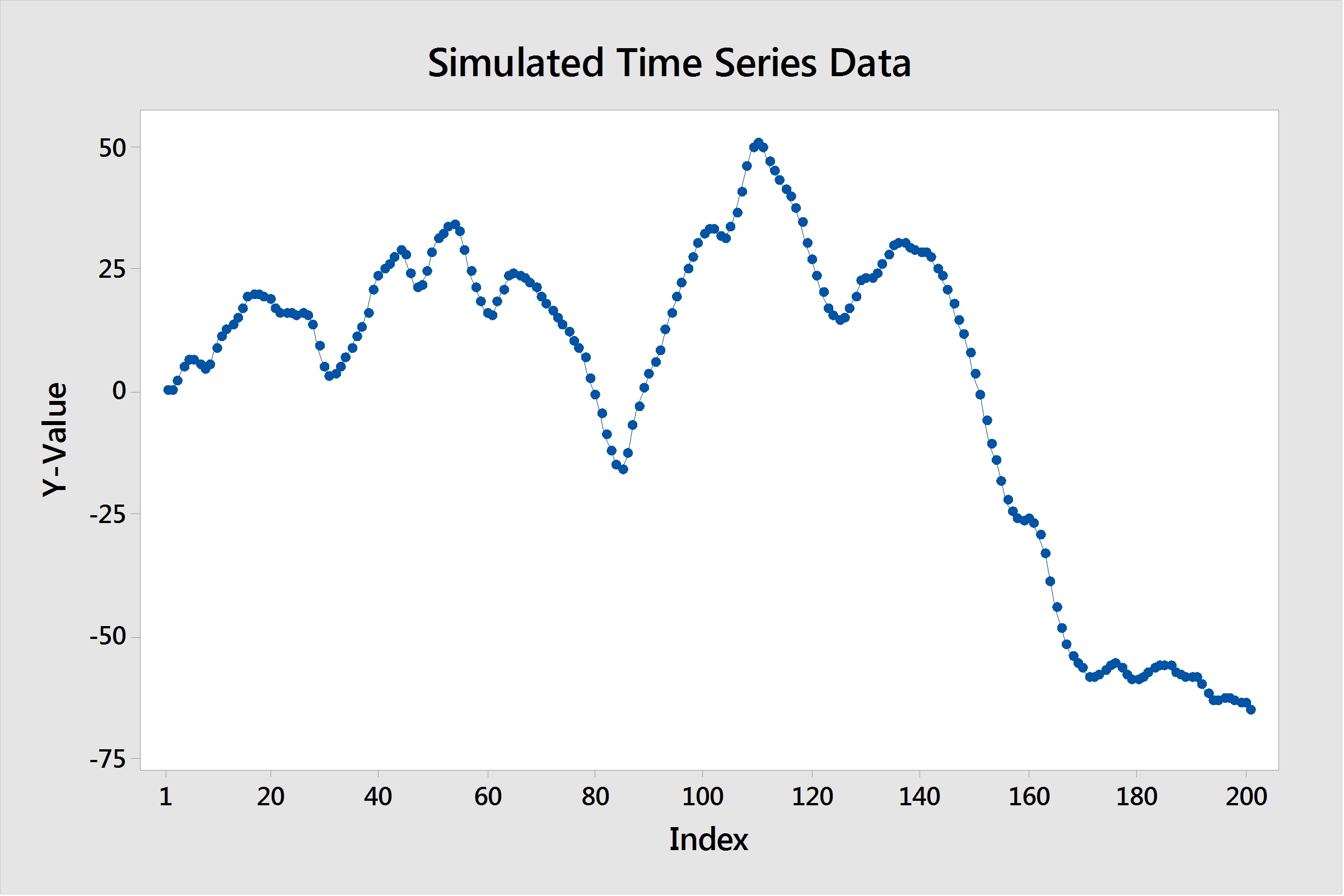

Following data cleaning, transformation techniques are employed to prepare the data for analysis. Common transformations include differencing to achieve stationarity, logarithmic transformations to stabilize variance, and scaling to normalize the range of values. These transformations aim to address the statistical properties of financial time series, such as non-stationarity and heteroscedasticity, which can violate the assumptions of many analytical techniques. Furthermore, data visualization plays a crucial role in exploring patterns and trends within the time series. Techniques like line plots, candlestick charts, and autocorrelation plots can reveal insights into the data’s behavior, aiding in the selection of appropriate analytical methods. A deep dive into the ruey tsay analysis of financial time series will help reveal these patterns.

The analytical phase encompasses a range of statistical and machine learning approaches. Statistical methods, such as ARIMA models and GARCH models, are widely used for forecasting and volatility modeling. Machine learning techniques, including recurrent neural networks and support vector machines, offer alternative approaches for capturing complex non-linear relationships within the data. The choice of method depends on the specific characteristics of the time series and the goals of the analysis. Evaluating the performance of different models is crucial, and metrics like RMSE, MAE, and MAPE can be used to assess their accuracy. A comprehensive understanding of both statistical and machine learning techniques, informed by the ruey tsay analysis of financial time series, is essential for extracting meaningful insights from financial data sequences. Ultimately, the goal is to transform raw financial data into actionable intelligence for informed decision-making.

Understanding Key Statistical Properties of Financial Time Series

Financial time series data possesses unique statistical properties that must be understood to conduct effective analysis. These properties influence the selection of appropriate analytical techniques and the subsequent interpretation of the results. Key characteristics include stationarity, autocorrelation, heteroscedasticity, and seasonality. Addressing these properties correctly is vital for time series analysis, especially when considering the techniques detailed in “ruey tsay analysis of financial time series”.

Stationarity refers to the property where the statistical characteristics of a time series, such as mean and variance, remain constant over time. Many time series models assume stationarity, and non-stationary data often requires transformation, such as differencing, to achieve stationarity. Autocorrelation, also known as serial correlation, measures the correlation between a time series and its lagged values. Significant autocorrelation can indicate predictability in the data and can be exploited for forecasting. Heteroscedasticity refers to the presence of non-constant variance in the error terms of a model. In financial time series, volatility clustering, where periods of high volatility are followed by periods of low volatility, is a common manifestation of heteroscedasticity. Models like GARCH are specifically designed to address heteroscedasticity. Identifying these properties in financial data is key to a robust “ruey tsay analysis of financial time series”.

Seasonality refers to patterns that repeat at regular intervals, such as daily, weekly, or yearly cycles. Seasonality can be present in certain financial time series, such as energy prices or agricultural commodity prices. Identifying and removing seasonality is important for accurate modeling and forecasting. Identifying these statistical properties requires careful examination of the data through visual inspection (time series plots, correlograms) and statistical tests (e.g., Augmented Dickey-Fuller test for stationarity, Ljung-Box test for autocorrelation). For example, observing an upward trend in a stock price chart suggests non-stationarity. A correlogram showing significant spikes at specific lags indicates autocorrelation at those lags. An important aspect of using “ruey tsay analysis of financial time series” is to properly diagnose these properties to ensure the selected model is suitable for the data. Recognizing and appropriately dealing with these properties ensures that the chosen analytical methods are valid and that the insights derived are reliable, leading to more informed decision-making in finance.

Exploring the World of Time Series Models

This section introduces common time series models used extensively in finance. These models provide frameworks for understanding and forecasting financial data. The discussion includes ARIMA (Autoregressive Integrated Moving Average), GARCH (Generalized Autoregressive Conditional Heteroskedasticity), and VAR (Vector Autoregression) models. Each model possesses unique characteristics, assumptions, and application scenarios within the realm of financial analysis. Understanding these models is crucial for anyone delving into ruey tsay analysis of financial time series.

ARIMA models are statistical methods for analyzing and forecasting time series data. They are particularly useful when data shows evidence of non-stationarity. The ARIMA model incorporates autoregressive (AR), integrated (I), and moving average (MA) components to capture the underlying patterns in the data. GARCH models, on the other hand, are specifically designed to model volatility in financial time series. Volatility, the degree of variation of a trading price series over time as measured by standard deviation, is a critical factor in financial risk management. GARCH models capture the time-varying nature of volatility, allowing for more accurate risk assessments. Application of ruey tsay analysis of financial time series can give a better view of the Volatility. VAR models extend the concept of autoregression to multiple time series. They are used to analyze the interdependencies between different financial variables. For example, a VAR model could be used to examine the relationship between stock prices, interest rates, and exchange rates.

The underlying principles of each model are rooted in statistical theory and time series analysis. ARIMA models rely on the autocorrelation and partial autocorrelation functions to identify the appropriate model order. GARCH models are based on the concept of conditional heteroscedasticity, which means that the variance of the error term depends on the past values of the error term. VAR models are based on the assumption that each variable in the system can be expressed as a linear function of its own past values and the past values of the other variables in the system. These models each have their own assumptions, strengths, and weaknesses. ARIMA models assume that the data is stationary after differencing. GARCH models assume that the errors are normally distributed. VAR models assume that the variables in the system are jointly stationary. Furthermore, examples of how to apply these models to specific financial problems, such as forecasting stock prices or volatility, will provide a practical understanding. Thorough ruey tsay analysis of financial time series will provide a more comprehensive view of these models. Applying models in ruey tsay analysis of financial time series can greatly improve forecasting accuracy.

A Deep Dive into Volatility Modeling Techniques

Volatility modeling constitutes a pivotal aspect of financial time series analysis, demanding careful consideration. The financial markets’ inherent uncertainty necessitates sophisticated methods for understanding and predicting volatility. This section focuses on various volatility models, including the Generalized Autoregressive Conditional Heteroskedasticity (GARCH), Exponential GARCH (EGARCH), and Threshold GARCH (TGARCH) models. These models address the time-varying nature of volatility, a critical feature often overlooked by simpler approaches. Understanding these models is essential for risk management and informed investment decisions. The ruey tsay analysis of financial time series provides a robust framework for understanding and implementing these models.

GARCH models, in their various forms, are designed to capture the clustering effect of volatility – the tendency for large changes in asset prices to be followed by other large changes, and small changes to be followed by other small changes. EGARCH models extend this framework by allowing for asymmetric responses to positive and negative shocks, reflecting the empirical observation that negative news often has a greater impact on volatility than positive news of the same magnitude. TGARCH models, similarly, address asymmetry by incorporating a threshold effect. Choosing the appropriate model depends on the specific characteristics of the financial time series being analyzed. The ruey tsay analysis of financial time series emphasizes the importance of model selection based on data characteristics.

Estimating and interpreting volatility model parameters is crucial for practical application. The parameters provide insights into the persistence of volatility, the magnitude of the response to shocks, and the degree of asymmetry. Accurate estimation requires careful attention to data quality and model specification. Furthermore, these models can be used to measure and manage risk by providing estimates of future volatility, which can then be incorporated into portfolio allocation and hedging strategies. The ruey tsay analysis of financial time series provides in-depth coverage of the estimation techniques and interpretation of these models, making it an invaluable resource for practitioners and researchers alike. Employing ruey tsay analysis of financial time series enhances the precision and reliability of volatility modeling in financial applications.

Evaluating Model Performance and Validation Strategies

Rigorous evaluation is crucial before using time series models for financial decisions. Several metrics assess model performance, including Root Mean Squared Error (RMSE), Mean Absolute Error (MAE), and Mean Absolute Percentage Error (MAPE). Lower values generally indicate better model accuracy. RMSE penalizes larger errors more heavily than MAE. MAPE provides a percentage-based error measure, facilitating easier interpretation across different scales. The choice of metric depends on the specific application and the relative importance of different types of errors. Careful consideration of these metrics is vital when comparing different models and making informed selections. Effective model evaluation requires more than just in-sample accuracy. Overfitting, where a model performs well on training data but poorly on unseen data, is a significant concern. This is especially important in ruey tsay analysis of financial time series, where complex models can easily memorize the training data’s nuances rather than capturing underlying patterns.

Out-of-sample validation addresses overfitting. This technique involves splitting the data into training and testing sets. The model is trained on the training set and then evaluated on the unseen testing set. This provides a more realistic assessment of the model’s predictive power. Cross-validation extends this concept by repeatedly splitting the data into different training and testing sets, averaging the results for a more robust evaluation. Careful attention must be paid to the way data is split to ensure the temporal ordering is maintained, preventing data leakage from the future into the past. In financial time series analysis, particularly in the context of ruey tsay analysis of financial time series, failing to consider the temporal dependence can lead to grossly optimistic performance estimates. Proper out-of-sample validation and robust evaluation metrics provide a more accurate measure of a model’s generalization capability, which is crucial for real-world applications.

Data snooping, the practice of repeatedly testing different models and selecting the one with the best performance on the training data, significantly inflates the apparent accuracy. This practice reduces the model’s reliability for future predictions. To mitigate this, researchers often use a hold-out sample, a portion of the data entirely withheld from model development and used only for a final, unbiased evaluation. This prevents the model from being tuned to the peculiarities of the training data. Robust model evaluation is paramount in financial time series analysis, especially within the framework of ruey tsay analysis of financial time series, as it safeguards against inaccurate conclusions and prevents potentially costly errors in investment decisions. By employing appropriate evaluation metrics and validation techniques, analysts enhance the reliability and trustworthiness of their results.

Addressing Challenges and Limitations in Financial Time Series Analysis

Financial time series analysis, while powerful, presents inherent challenges. Data noise, stemming from various market factors and measurement errors, can obscure underlying trends. Non-stationarity, where statistical properties change over time, complicates modeling. Structural breaks, abrupt shifts in data patterns due to events like economic crises or regulatory changes, invalidate assumptions of many models. These complexities require careful consideration and appropriate techniques. For instance, data smoothing methods help reduce noise, while differencing transforms non-stationary series into stationary ones, suitable for models like ARIMA. Regime-switching models acknowledge the potential for structural breaks, adapting to different market states. Analyzing financial data often involves addressing these issues to achieve a more accurate depiction of the market.

Another significant hurdle is the presence of market anomalies. These unpredictable events, often exhibiting unusual volatility or patterns, can significantly impact model accuracy. Furthermore, the assumption of normality, often central to many statistical models, frequently fails to hold true in the context of financial data, which often displays fat tails and excess kurtosis. A robust approach necessitates acknowledging these deviations from normality. The inherent limitations of any model must be understood. Over-reliance on a single model, without considering alternative approaches, can lead to misinterpretations. Therefore, careful model selection, validation, and interpretation are crucial. A thorough understanding of the strengths and weaknesses of chosen methods, such as those discussed in ruey tsay analysis of financial time series, is essential for obtaining reliable results.

Furthermore, the accurate prediction of future market movements remains extremely difficult. While sophisticated models can capture historical patterns, they do not guarantee future performance. External factors, unforeseen events, and inherent market uncertainty limit predictive power. The complexity of financial markets, coupled with the limitations of any model, necessitates a cautious interpretation of results. The application of ruey tsay analysis of financial time series, while valuable, should always be complemented by sound judgment and a deep understanding of market dynamics. The goal is not perfect prediction but rather a more informed understanding of risk and opportunity, guiding better decision-making.

Practical Applications and Real-World Case Studies

Financial time series analysis finds widespread application across various financial domains. Portfolio managers leverage these techniques to optimize asset allocation, minimizing risk while maximizing returns. Sophisticated models, often incorporating elements of ruey tsay analysis of financial time series, help predict asset price movements, informing strategic investment decisions. Risk managers utilize volatility models, such as GARCH, to quantify and manage market risks effectively, protecting portfolios from unexpected downturns. Algorithmic trading strategies heavily rely on accurate forecasts generated from time series analysis, enabling automated execution of trades based on predicted price movements. These algorithms often incorporate advanced techniques, including aspects of ruey tsay analysis of financial time series, to improve trading efficiency and profitability.

A compelling case study involves the application of time series analysis in fraud detection. By analyzing transaction patterns and identifying anomalies in financial data sequences, organizations can pinpoint suspicious activities. Detecting unusual deviations from established patterns allows for timely intervention, preventing significant financial losses. The effectiveness of this approach hinges on the robust modeling of normal transaction behavior, which relies heavily on a deep understanding of the statistical properties of the time series data. This often involves the incorporation of techniques found in ruey tsay analysis of financial time series, which offer advanced methodologies for detecting subtle yet significant patterns. The ability to accurately forecast volatility plays a crucial role in hedging strategies, enabling financial institutions to mitigate potential losses arising from unforeseen market fluctuations. This precise forecasting often incorporates advanced time series techniques.

Another significant application lies in macroeconomic forecasting. Economists utilize time series analysis to predict key economic indicators such as inflation, unemployment, and GDP growth. These forecasts inform government policies and business decisions, guiding strategic planning and resource allocation. Accurate prediction requires sophisticated modeling techniques, often incorporating insights from ruey tsay analysis of financial time series, which account for the complex interdependencies and non-linear relationships often present in macroeconomic data. The analysis of these interdependencies allows for more nuanced forecasts and more informed policy decisions. Understanding the intricacies of these techniques is essential for navigating the complexities of modern finance and making well-informed decisions.