Decoding the Yield Curve: What it Reveals About the Economy

The yield curve is a visual representation of interest rates on debt for a range of maturities. It plots the yields of similar-quality bonds against their maturity dates, offering insights into market expectations. Typically, the yield curve slopes upward, indicating that bonds with longer maturities have higher yields than those with shorter maturities. This normal yield curve reflects the expectation that economic growth will continue and inflation will likely rise over time. Lenders demand higher yields for tying up their money for longer periods, compensating for increased risk and opportunity cost. Understanding the yield curve is crucial for investors and economists alike, as it serves as a barometer of economic health.

There are three primary types of yield curves: normal, inverted, and flat. As previously mentioned, a normal yield curve slopes upward. An inverted yield curve, where short-term yields are higher than long-term yields, is often seen as a predictor of economic recession. This inversion suggests that investors anticipate a decline in future interest rates, typically driven by expectations of weaker economic growth or even deflation. A flat yield curve occurs when there is little difference between short-term and long-term yields. This often indicates uncertainty in the market and can signal a transition between a normal and an inverted curve. The shape of the yield curve provides valuable information about investor sentiment and economic forecasts.

The shape and movement of the yield curve can significantly impact investment strategies, including the approach known as “riding the yield curve.” While this initial context focuses on defining the yield curve, it’s important to note how understanding its dynamics lays the foundation for strategies like “roll down the yield curve” investing. Investors analyze the yield curve to make informed decisions about bond investments, considering factors like maturity, yield, and the overall economic outlook. These factors help to consider how to capitalize on “roll down the yield curve”, ensuring a comprehensive understanding of fixed-income markets.

What Does it Mean to Ride the Curve? A Detailed Explanation

The strategy of “riding the yield curve” presents an interesting opportunity for fixed-income investors. It takes advantage of the usual upward slope of the yield curve. The yield curve plots the yields of similar-quality bonds against their maturities. A normal yield curve shows that bonds with longer maturities typically offer higher yields than those with shorter maturities. This reflects the increased risk and opportunity cost associated with tying up capital for a longer period.

To “ride the yield curve,” an investor purchases bonds with maturities longer than their investment horizon. As time passes, the bond’s maturity shortens. It then “rolls down” the yield curve toward lower yields. This decrease in yield generally translates to an increase in the bond’s price. The investor benefits from both the bond’s coupon payments and this price appreciation. For example, consider an investor who buys a 5-year bond. As it matures, the bond effectively becomes a 4-year bond, then a 3-year bond, and so on. Assuming the yield curve remains stable, each “roll down the yield curve” results in a higher price. This is because shorter-term bonds usually have lower yields. The investor captures this price increase when selling the bond. However, this “roll down the yield curve” strategy is not without risk. One must consider interest rate risk. If interest rates rise unexpectedly, bond prices can fall, potentially offsetting any gains from the “roll down effect.” Credit risk, the possibility of the issuer defaulting, also must be considered.

Despite the risks, “riding the yield curve” can be a profitable strategy. It is especially effective in stable or declining interest rate environments. The key is to carefully analyze the yield curve. Investors should understand its shape and potential future movements. Diversification across different maturities and credit qualities is essential. This can help mitigate the risks associated with this investment approach. Ultimately, successful implementation depends on a thorough understanding of fixed-income markets. It also requires a disciplined approach to risk management. Consider consulting with a financial advisor before implementing a “roll down the yield curve” strategy.

Unveiling the “Roll Down”: How Yields Change Over Time

The “roll down effect” is a crucial element in understanding fixed-income investments and strategies like “riding the yield curve.” It describes how a bond’s yield and price change as its maturity date approaches. As time passes, a bond with a longer maturity gradually transforms into a bond with a shorter maturity. This shift has significant implications for its yield. The yield curve typically slopes upward, meaning that bonds with longer maturities offer higher yields than those with shorter maturities. Therefore, as a bond’s maturity decreases, its yield tends to “roll down” the yield curve toward the lower yields associated with shorter-term bonds. This convergence of yield has a direct impact on the bond’s price.

As the bond’s yield decreases to match the shorter-term rates, its price appreciates. This price appreciation contributes to the investor’s overall return, in addition to the coupon payments received. To illustrate, consider a bond with 10 years to maturity. As one year elapses, it becomes a bond with nine years to maturity. If the yield curve is upward-sloping, the nine-year bond will typically have a slightly lower yield than the original 10-year bond. The bond’s price will increase to reflect this lower yield. The investor then benefits from both the interest income and the capital appreciation resulting from the “roll down the yield curve.” Understanding this roll-down effect is vital for investors looking to strategically “roll down the yield curve” and enhance their returns.

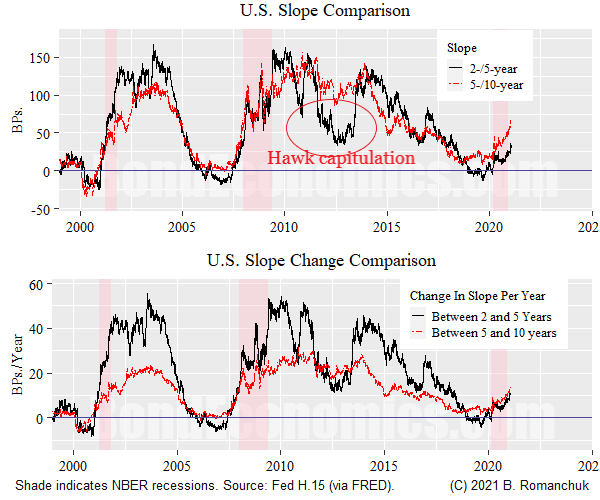

The magnitude of the “roll down” effect depends on the shape and steepness of the yield curve. A steeper yield curve offers greater potential for price appreciation as the bond “rolls down.” Conversely, a flat or inverted yield curve may diminish or even reverse the effect. Furthermore, market volatility and changes in interest rate expectations can also influence the “roll down” process. Investors should carefully consider these factors when evaluating the potential benefits of “riding the yield curve” and the associated “roll down the yield curve.” By effectively leveraging the “roll down,” investors can potentially optimize their fixed-income returns, but this requires careful monitoring and a thorough understanding of yield curve dynamics. The interplay between time, yield, and price is what makes the “roll down the yield curve” a potentially lucrative, yet also potentially risky, strategy.

How to Capitalize on Yield Curve Shifts: Strategies for Investors

Investors can leverage yield curve dynamics to inform strategic investment decisions. Different yield curve environments favor distinct approaches. In a steepening yield curve environment, where the difference between long-term and short-term interest rates widens, investors might consider increasing their allocation to longer-term bonds. This strategy aims to capture the higher yields offered by these bonds and benefit from potential price appreciation as the yield curve normalizes. As longer-term bond yields fall, their prices rise, enhancing returns. Understanding the roll down the yield curve effect is paramount to implementing this strategy.

Conversely, a flattening yield curve, characterized by a narrowing spread between long-term and short-term rates, suggests a different approach. In this scenario, investors might favor shorter-term bonds or floating-rate securities. Shorter-term bonds are less sensitive to interest rate changes, mitigating potential losses if rates rise. Floating-rate securities, whose interest rates adjust periodically based on a benchmark rate, offer protection against rising rates. Investors should carefully assess how to roll down the yield curve to their advantage in this scenario. Another strategy involves barbell and bullet portfolios. A barbell strategy concentrates investments in very short-term and very long-term maturities, while a bullet strategy focuses on a specific maturity date. The optimal choice depends on the investor’s outlook and risk tolerance.

Furthermore, the roll down the yield curve phenomenon plays a crucial role in investment strategy. Actively managing bond portfolios to capitalize on anticipated yield curve shifts requires careful analysis and a deep understanding of macroeconomic factors. For instance, if an investor anticipates a steepening yield curve, they might purchase bonds with maturities slightly longer than their desired holding period, planning to sell them as they “roll down the yield curve” and appreciate in value. The roll down the yield curve strategy can be particularly effective when combined with insights into central bank policies and economic forecasts. However, investors must remain vigilant and monitor market conditions, as unexpected events can significantly alter the yield curve and impact investment outcomes. Understanding the intricacies of how to roll down the yield curve is essential for maximizing returns and mitigating risks.

Impact of Central Bank Policies on Interest Rate Trends

Central bank policies exert a significant influence on interest rate trends, shaping the yield curve and creating both opportunities and risks for investors. Actions taken by central banks, such as adjusting benchmark interest rates or implementing quantitative easing (QE) programs, directly impact the cost of borrowing and the overall supply of money in the economy. These interventions ripple through the bond market, causing shifts in the yield curve’s shape and level. Understanding these dynamics is crucial for investors seeking to capitalize on or mitigate the effects of “riding the yield curve.”

When a central bank raises interest rates, it typically leads to an upward shift in the entire yield curve. This is because higher short-term rates tend to pull up longer-term rates as well, reflecting increased borrowing costs and potentially higher inflation expectations. Conversely, when a central bank cuts interest rates, the yield curve usually shifts downward. Quantitative easing, which involves a central bank purchasing government bonds or other assets, can also flatten the yield curve by pushing down longer-term interest rates. These policy changes can significantly impact the potential profitability of strategies like “riding the yield curve” and benefiting from the “roll down the yield curve” effect.

For investors engaged in “riding the yield curve,” understanding the central bank’s policy stance and its likely future actions is paramount. For example, if a central bank signals a series of interest rate hikes, investors may anticipate a flattening or even an inversion of the yield curve. This could make shorter-term bonds more attractive, as their prices may be less sensitive to rising rates than longer-term bonds. Conversely, if a central bank is expected to maintain low interest rates for an extended period, investors might find opportunities in longer-term bonds, anticipating continued price appreciation as they “roll down the yield curve.” Therefore, keeping abreast of central bank communications and economic forecasts is essential for making informed investment decisions and navigating the complexities of interest rate dynamics when employing strategies to “roll down the yield curve.”

Assessing the Risks: Understanding Potential Drawbacks

While the strategy to roll down the yield curve can be appealing, it’s crucial to acknowledge and understand the inherent risks. Interest rate risk is a primary concern. Should interest rates rise unexpectedly, the value of existing bonds held in a portfolio will likely decline. This inverse relationship between interest rates and bond prices means potential capital losses for investors.

Credit risk, also known as default risk, represents the possibility that the bond issuer may be unable to fulfill its debt obligations. A downgrade in the issuer’s credit rating or, worse, a default, can significantly erode the value of the bond. Inflation risk is another critical factor to consider. Unexpected inflation can diminish the real return on bond investments, as the fixed interest payments become less valuable in terms of purchasing power. Furthermore, the anticipated benefits of trying to roll down the yield curve may not materialize if the yield curve shifts unexpectedly, potentially leading to lower-than-expected returns or even losses.

Mitigating these risks requires a diversified approach and robust risk management strategies. Diversification across different bond issuers, credit ratings, and maturities can help to reduce the impact of any single bond performing poorly. Employing strategies such as setting stop-loss orders can limit potential losses. Thorough due diligence and continuous monitoring of market conditions are essential. Investors should carefully assess their risk tolerance, investment goals, and time horizon before implementing a roll down the yield curve strategy. Understanding the macroeconomic environment, including inflation expectations and central bank policies, is also crucial for informed decision-making. By carefully considering these risks and implementing appropriate safeguards, investors can better navigate the complexities of the bond market and potentially enhance their returns while managing potential downsides from attempting to roll down the yield curve.

Analyzing the Current Shape and its Implications for the Future

The yield curve’s current shape offers valuable clues about the health of the economy and future investment prospects. Recently, the yield curve has exhibited periods of inversion, where short-term Treasury yields exceed those of longer-term maturities. This phenomenon has historically been seen as a potential predictor of economic recession. An inverted yield curve suggests that investors anticipate slower economic growth or even contraction in the future, leading them to seek the safety of longer-dated bonds, driving their yields down.

Several factors are driving the current shape of the yield curve. Central bank policies, particularly interest rate adjustments, play a significant role. If the central bank raises short-term interest rates to combat inflation, it can cause the short end of the curve to rise. At the same time, long-term yields may not rise as much if investors believe that the central bank’s actions will eventually slow down economic growth and bring inflation under control. Global economic conditions, inflation expectations, and geopolitical events also influence investor sentiment and, consequently, the yield curve. Investors need to understand the interplay of these forces to make informed decisions about strategies like roll down the yield curve. The strategy of roll down the yield curve, requires carefully monitoring of these shifts.

Looking ahead, the future trajectory of the yield curve remains uncertain. Several potential scenarios could unfold. If economic growth rebounds and inflation remains elevated, the yield curve could steepen, with long-term yields rising faster than short-term yields. Alternatively, if economic growth slows and inflation moderates, the yield curve could flatten further or even invert more deeply. The implications for investors implementing a strategy to roll down the yield curve, are considerable, requiring careful assessment of risk tolerance and investment objectives. The successful navigation of roll down the yield curve, hinges on a keen understanding of economic indicators and central bank policies. Investors should closely monitor economic data releases, central bank communications, and geopolitical developments to assess the likely direction of the yield curve and adjust their investment strategies accordingly. This includes assessing the potential for “roll down the yield curve” to generate returns in various market conditions, while also being aware of the associated risks.

Is Riding the Yield Curve Right for You? Considerations Before Investing

Before embarking on a “riding the yield curve” strategy, a thorough self-assessment is crucial. This investment approach, while potentially rewarding, is not without its risks. It’s essential to align your investment strategy with your individual financial circumstances, risk tolerance, and long-term goals. Consider this a checklist to guide your decision-making process.

First, honestly evaluate your risk tolerance. “Riding the yield curve” involves investing in bonds, which are subject to interest rate risk. If interest rates rise unexpectedly, the value of your bond holdings may decline. Are you comfortable with this potential for short-term losses? Furthermore, assess your investment goals. Are you seeking long-term capital appreciation, or are you primarily focused on generating current income? The “roll down the yield curve” strategy is typically better suited for investors with a longer time horizon, as it allows the strategy to play out and potentially benefit from price appreciation as the bond nears maturity. Conversely, short-term investors may find the strategy less appealing due to the potential for volatility and the need to frequently reinvest. A key aspect of the roll down the yield curve benefit is understanding how yields change over time. Consider your time horizon. How long are you willing to hold the bonds? “Riding the yield curve” typically requires a commitment of several years to fully realize the potential benefits. If you have a short-term investment horizon, other strategies may be more appropriate. Also, understanding your financial situation is key. Do you have sufficient capital to invest in bonds? Diversification is essential to managing risk, so avoid putting all your eggs in one basket. Understanding the yield curve and the strategy to “roll down the yield curve” takes time and effort.

Finally, consider seeking professional financial advice. A qualified financial advisor can help you assess your individual circumstances and determine whether “riding the yield curve” is an appropriate strategy for you. They can also provide guidance on selecting suitable bonds and managing the associated risks. The concept of roll down the yield curve requires careful evaluation before investing. The advisor may help understand the dynamics of interest rates. Remember, investing involves risk, and there are no guarantees of returns. “Riding the yield curve” can be a potentially rewarding strategy, but it’s crucial to approach it with a clear understanding of the risks and a well-defined investment plan. Do your homework, seek professional advice if needed, and make informed decisions that align with your individual financial goals. The concept of the “roll down the yield curve” can seem complex, but with proper research and professional guidance, it can become a valuable tool in your investment portfolio.