What Constitutes a Safe Haven Investment?

The quest for a “risk-free” investment is a cornerstone of financial theory. While absolute safety is unattainable, the concept helps establish a baseline for evaluating investment opportunities. In practice, government bonds issued by stable economies are often used as a proxy for the risk-free rate of interest formula. These bonds are perceived as having a very low risk of default, especially those from countries with strong credit ratings and stable political systems.

A safe haven is an investment that is expected to maintain or increase in value during times of market turbulence. Investors flock to these assets when uncertainty rises. This increased demand can drive up prices and lower yields. Government bonds, particularly those from nations like the United States or Germany, possess characteristics that make them attractive safe havens. These qualities include high liquidity, a history of reliable payments, and the backing of a sovereign entity. Therefore, they are often used for approximating the risk free rate of interest formula.

The theoretical basis for using government bonds relies on the assumption that the issuing government will honor its debt obligations. While not entirely devoid of risk – factors like inflation and currency fluctuations can impact returns – these bonds represent one of the safest available investments. They provide a benchmark against which other, riskier assets can be compared. The yield on these bonds serves as an approximation for the risk free rate of interest formula, allowing investors to assess the potential returns relative to a perceived baseline of safety. Understanding this benchmark is crucial for informed investment decisions, and using a government bond yield remains a standard practice when estimating the risk free rate of interest formula, despite its inherent limitations.

The Formula Unveiled: Deriving the Benchmark Rate of Return

The cornerstone of financial modeling often involves approximating the risk-free rate. The most common approach is to use the yield on a government bond. This bond should have a maturity that aligns with the investment’s time horizon. This yield represents the benchmark rate of return. Understanding the risk free rate of interest formula is critical for investment analysis. The risk free rate of interest formula assists investors in assessing potential returns.

The yield-to-maturity (YTM) is generally the preferred measure. YTM reflects the total return anticipated if the bond is held until it matures. It considers the bond’s current market price, par value, coupon interest rate, and time to maturity. While it’s a widely accepted practice, remember this is an approximation. It is vital to acknowledge that the risk free rate of interest formula provides a theoretical baseline. It does not guarantee a return completely devoid of risk.

Several factors influence the selection of a government bond for the risk free rate of interest formula. The stability and creditworthiness of the issuing government are paramount. Bonds from governments with strong economies are generally preferred. This minimizes the risk of default. Furthermore, the bond’s liquidity is important. Liquid bonds are easily bought and sold. This ensures the yield accurately reflects current market conditions. The risk free rate of interest formula serves as a foundational element in various financial calculations. It is important for evaluating investment opportunities and project feasibility. The effective application of the risk free rate of interest formula requires careful consideration of market dynamics.

How to Find Government Bond Yields: A Practical Approach

Obtaining current government bond yields is crucial for approximating the risk free rate of interest formula. Several reliable sources provide this data. Government websites are primary sources. For example, the U.S. TreasuryDirect.gov provides yields for U.S. Treasury bonds. These websites offer the most accurate and up-to-date information directly from the source. Financial news outlets are another excellent resource. Bloomberg, Reuters, and the Wall Street Journal regularly publish government bond yields. These outlets often provide analysis and context around yield movements, helping to understand the factors influencing the risk free rate of interest formula.

Brokerage platforms also offer access to government bond yields. If you have a brokerage account, you can typically find this information within the platform’s fixed income or bond section. These platforms often provide tools and resources for analyzing bond yields and comparing them to other investments. When seeking government bond yields, prioritize using current data. Bond yields fluctuate constantly, so using outdated information can lead to inaccurate calculations. Make sure the data is as close to real-time as possible to ensure the most precise approximation of the risk free rate of interest formula. Utilizing current data is paramount for the risk free rate of interest formula.

To ensure accuracy, cross-reference data from multiple sources. This helps to verify the information and identify any discrepancies. For instance, compare the yield data from TreasuryDirect.gov with that reported by Bloomberg or Reuters. Paying attention to the specific bond maturity is also essential. The risk free rate of interest formula requires aligning the bond’s maturity with the investment horizon. Using a 10-year Treasury yield for a 5-year investment would be inappropriate. Match the maturity of the government bond to the duration of the investment being analyzed to derive a sound risk free rate of interest formula. The current yield, combined with a matching investment horizon, makes the risk free rate of interest formula more reliable.

Factors Influencing Government Bond Yields: A Deeper Dive

Government bond yields, which often serve as a benchmark for the risk free rate of interest formula, are not static. They fluctuate based on a complex interplay of economic forces and market sentiment. Understanding these factors is crucial for interpreting the risk free rate of interest formula accurately and applying it effectively in investment decisions. One of the primary drivers of government bond yields is inflation expectations. When investors anticipate higher inflation, they demand a higher yield to compensate for the erosion of purchasing power. Central banks, like the Federal Reserve, play a significant role through their monetary policy. Interest rate hikes tend to push bond yields upward, while rate cuts can have the opposite effect. These actions directly impact the risk free rate of interest formula.

Economic growth also exerts considerable influence. A robust economy typically leads to higher bond yields as increased demand for capital drives up interest rates. Conversely, during economic slowdowns or recessions, investors often seek the safety of government bonds, increasing demand and pushing yields downward. Global events, such as geopolitical tensions or major economic crises, can trigger significant shifts in bond yields as investors reallocate capital based on perceived risk. Therefore, any calculation of the risk free rate of interest formula should be done with these considerations in mind. The perceived stability and creditworthiness of the issuing government are also paramount. Bonds issued by countries with strong economies and stable political systems generally offer lower yields, reflecting their lower perceived risk.

Changes in any of these factors can alter the perceived “risk-free” rate. For example, if inflation expectations rise sharply, the yield on government bonds will likely increase, leading to a higher risk free rate of interest formula. Similarly, if a country’s economic outlook weakens, its government bond yields may fall as investors seek safer assets. Understanding these dynamics is essential for using government bond yields as a reliable proxy for the risk free rate of interest formula and ensuring that investment decisions are based on a comprehensive assessment of market conditions. By monitoring these key indicators, investors can make more informed judgments about the true cost of capital and the appropriate risk-adjusted return for their investments. The influence of these factors are key to understanding the risk free rate of interest formula.

Limitations of Using Government Bond Yields: Caveats and Considerations

While government bond yields are widely used as a proxy for the risk free rate of interest formula, it’s crucial to understand their inherent limitations. The term “risk-free” is, in itself, a theoretical construct. Even government bonds, particularly those issued by developed nations, are not entirely devoid of risk. Several factors can influence their yields and impact their suitability as a true reflection of a safe return. The risk free rate of interest formula is an important tool but should not be considered infallible.

One primary concern is inflation risk. The purchasing power of future bond payments can be eroded if inflation rises unexpectedly. While inflation-indexed bonds (TIPS) offer some protection, they may not perfectly match the specific inflation concerns of an investor. Reinvestment risk is another factor. If interest rates fall, the proceeds from maturing bonds may have to be reinvested at lower yields, reducing the overall return. Default risk, while minimal for bonds issued by stable governments, still exists, particularly in times of economic distress or political instability. Changes in the perceived creditworthiness of a government can affect bond yields, impacting the accuracy of the risk free rate of interest formula. Furthermore, market liquidity can also impact the appeal of government bonds. The risk free rate of interest formula relies on the efficiency and stability of the government bond market, which might not always hold true, especially during periods of financial turmoil.

The risk free rate of interest formula should be viewed as a theoretical tool that provides a baseline for investment analysis. Its application requires careful consideration of prevailing market conditions, economic forecasts, and the specific characteristics of the investment being evaluated. Investors should recognize that it is an approximation and not a guarantee of a zero-risk return. The perceived “risk-free” rate is constantly evolving, influenced by a multitude of macroeconomic factors. Therefore, relying solely on government bond yields without considering these nuances can lead to inaccurate assessments of investment opportunities. Sophisticated investors will always perform robust due diligence to ensure that their investment decisions are aligned with the level of risk they are willing to accept.

Applying the Benchmark Rate: Examples in Investment Analysis

The calculated risk-free rate is a cornerstone of modern investment analysis. One prominent application is within the Capital Asset Pricing Model (CAPM). The CAPM helps determine the required rate of return for an investment. The risk free rate of interest formula serves as the starting point. It is the theoretical return an investor would expect from a risk-free investment over a specific period. By adding a risk premium, based on the investment’s beta (its volatility relative to the market), the CAPM estimates the return needed to compensate for the investment’s risk. This is a fundamental application of the risk free rate of interest formula.

Beyond the CAPM, the risk-free rate is crucial for evaluating investment opportunities. Consider calculating the net present value (NPV) of a potential project. The NPV discounts future cash flows back to their present value using a discount rate. This rate often incorporates the risk-free rate as a base, plus a premium reflecting the project’s specific risks. A higher risk free rate of interest formula will result in a lower NPV, making the project less attractive. Conversely, a lower risk free rate of interest formula can boost the NPV. The risk free rate of interest formula therefore has a significant impact on investment decisions.

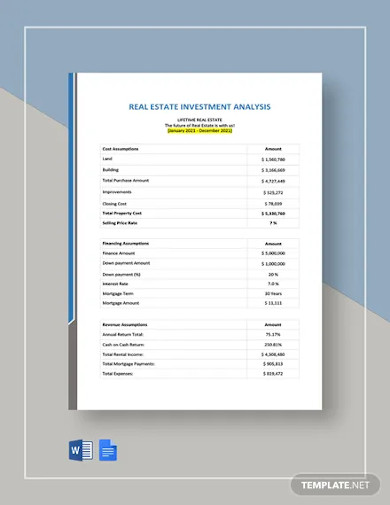

For instance, imagine a company considering a new manufacturing plant. The projected cash flows are analyzed and discounted back to the present. The discount rate used includes the current yield on a government bond, representing the risk free rate. This benchmark provides a baseline against which the project’s potential return is measured. If the NPV is positive, the project is deemed feasible. The risk free rate of interest formula is also vital in determining project feasibility in real estate investment. Investors compare the potential rental income and appreciation against the risk-free rate to assess the attractiveness of the investment. In essence, the risk free rate serves as a hurdle rate. Only investments expected to exceed this rate are considered worthwhile. The risk free rate of interest formula application ensures a sound investment strategy.

Alternative Proxies for a Safe Return: Exploring Different Options

While government bond yields are a common proxy for the risk-free rate, other options exist. These alternatives attempt to address some of the limitations associated with using government bonds alone. One such alternative is Treasury Inflation-Protected Securities (TIPS). TIPS are designed to protect investors from inflation by adjusting their principal based on changes in the Consumer Price Index (CPI). The yield on TIPS can be considered a real risk-free rate, as it represents the return above inflation. When evaluating the risk free rate of interest formula, TIPS offer a valuable perspective by factoring in inflation expectations.

Another proxy sometimes used is the yield on high-grade corporate bonds. These bonds, issued by companies with strong credit ratings, offer a slightly higher yield than government bonds. This is because they carry a small degree of credit risk. However, the difference, or spread, between the yield on high-grade corporate bonds and government bonds can be used to gauge market sentiment and risk appetite. The risk free rate of interest formula is frequently used as a benchmark to compare against these corporate bond yields. Money market accounts and certificates of deposit (CDs) from well-capitalized banks represent other low-risk alternatives. These offer FDIC insurance, providing a level of safety, although their returns are typically lower than government bond yields.

Each alternative has advantages and disadvantages. TIPS protect against inflation but may have lower nominal yields. High-grade corporate bonds offer higher yields but carry some credit risk. Money market accounts and CDs are safe but offer the lowest returns. When choosing a proxy for the risk free rate of interest formula, investors must carefully consider their individual circumstances, risk tolerance, and investment goals. The selection of an appropriate proxy plays a crucial role in accurately assessing investment opportunities and making informed financial decisions. Ultimately, understanding the nuances of each option contributes to a more comprehensive and robust investment strategy.

The Risk-Free Rate in Different Economic Climates: Adapting to Change

The application and interpretation of the risk-free rate of interest formula varies significantly across different economic environments. High inflation, economic recession, or political instability can drastically alter investor behavior and, consequently, the perceived and actual safe return. During periods of high inflation, for example, investors demand a higher return to compensate for the erosion of purchasing power. The nominal yield on government bonds rises to reflect these inflation expectations. Therefore, the risk free rate of interest formula must be adjusted to account for inflation, perhaps by using inflation-indexed bonds (TIPS) as a proxy.

In times of economic recession or significant uncertainty, investors often seek safe-haven assets. This “flight to safety” drives up the demand for government bonds, pushing their yields down. A lower yield translates to a lower risk-free rate of interest formula output. This does not necessarily mean investments are less risky; rather, it indicates a higher premium being placed on safety and preservation of capital. The selection of an appropriate proxy for the risk-free rate becomes critical. The government bond of a country perceived as politically and economically stable might be favored over others, even if those others offer slightly higher yields. The risk free rate of interest formula’s applicability is directly related to the global context.

Furthermore, in periods of political instability, the perceived risk associated with even government bonds can increase. Investors might demand a higher yield to compensate for the perceived risk of default or currency devaluation, again affecting the risk free rate of interest formula. Understanding these dynamics is crucial for accurate investment analysis. A static application of the risk-free rate of interest formula, without considering the prevailing economic climate, can lead to flawed investment decisions. Investment professionals must adjust their strategies and interpretations based on the constant flux of the economic landscape, including potential black swan events, updating their calculations as necessary to reflect the most current risk assessments.