The Connection Between Fed Funds Rate and Treasury Yields

The relationship between the federal funds rate and treasury yields is a critical aspect of understanding the dynamics of financial markets and monetary policy. The federal funds rate, the interest rate at which banks lend reserve balances to other banks on an overnight basis, significantly impacts treasury yields, which are the return on investment for U.S. government debt securities. These yields serve as a benchmark for other interest rates in the economy, making their connection to the federal funds rate essential for investors, financial analysts, and policymakers alike.

Understanding the Federal Funds Rate

The federal funds rate is a short-term interest rate set by the Federal Open Market Committee (FOMC), a branch of the Federal Reserve. This rate serves as a primary tool for implementing monetary policy and influencing the supply of money and credit in the U.S. economy. The federal funds rate affects various financial instruments, including treasury yields, interbank lending, and consumer loans.

The FOMC meets eight times a year to assess the economic situation and determine the appropriate federal funds rate level. Factors considered during these meetings include inflation, employment, economic growth, and financial market stability. By adjusting the federal funds rate, the Federal Reserve can either stimulate or restrict economic activity, aiming to maintain price stability and full employment.

The federal funds rate has a direct impact on the borrowing costs of banks, which in turn affects the interest rates offered to consumers and businesses. When the federal funds rate increases, banks typically raise their lending rates, making borrowing more expensive. Conversely, when the federal funds rate decreases, borrowing becomes cheaper, encouraging businesses and consumers to invest and spend, thereby stimulating economic growth.

Treasury Yields: A Closer Look

Treasury yields represent the return on investment for U.S. government debt securities, such as Treasury bills, notes, and bonds. These yields are a crucial component of the financial markets, serving as a benchmark for other interest rates, including mortgage rates, corporate bonds, and municipal bonds. By understanding the different types of treasury yields and their significance, investors and financial analysts can make more informed decisions and optimize their investment strategies.

Nominal yields, the most commonly referenced type of treasury yield, represent the annual interest rate paid on a U.S. Treasury security, expressed as a percentage of its face value. Real yields, on the other hand, account for inflation and represent the annual return on an investment after adjusting for changes in the purchasing power of money.

Breakeven yields, another essential type of treasury yield, are the difference between nominal and real yields. Breakeven yields represent the inflation rate at which an investor would earn the same return from either nominal or inflation-protected securities. By comparing nominal and real yields, investors can gauge market expectations for future inflation rates.

How the Fed Funds Rate Affects Treasury Yields

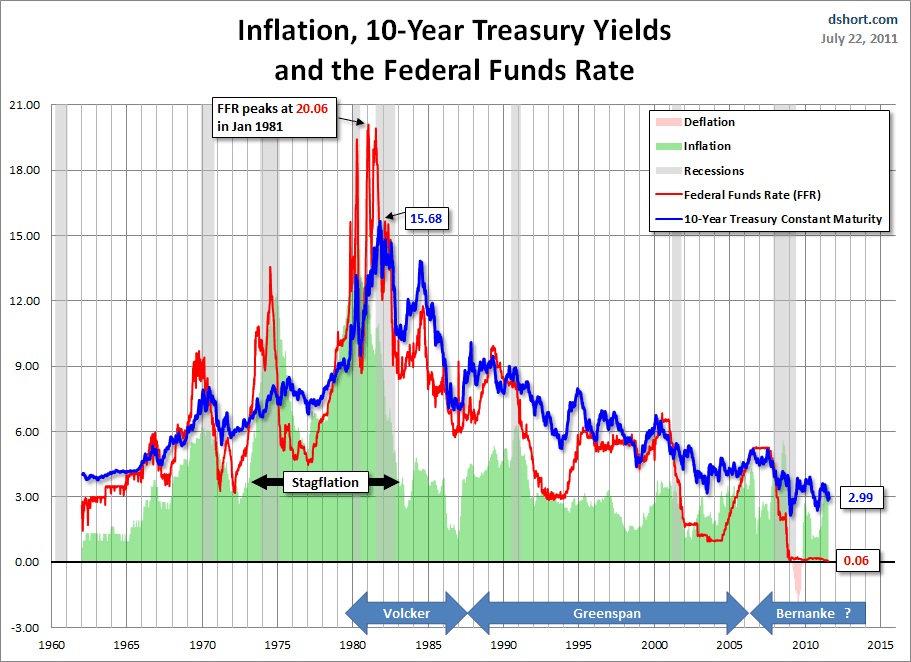

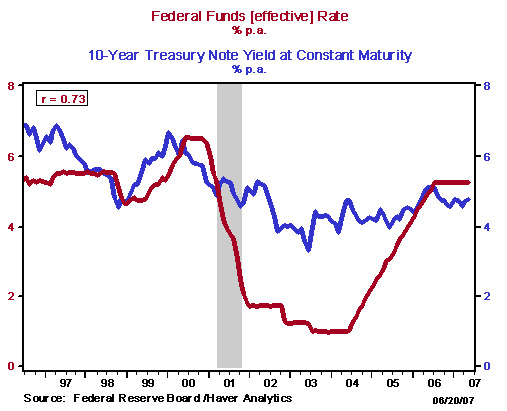

The federal funds rate and treasury yields share a complex relationship, with changes in the federal funds rate often influencing treasury yields and bond prices. When the federal funds rate increases, short-term interest rates generally rise, leading to higher borrowing costs for consumers and businesses. As a result, investors may demand higher yields on treasury securities to compensate for the increased borrowing costs and perceived risk, causing treasury yields to increase.

Conversely, when the federal funds rate decreases, short-term interest rates fall, making borrowing cheaper and stimulating economic growth. In this scenario, investors may accept lower yields on treasury securities, causing treasury yields to decrease. However, other factors, such as inflation expectations and supply and demand dynamics, can also impact treasury yields, making the relationship between the federal funds rate and treasury yields multifaceted.

It is essential to recognize that the relationship between the federal funds rate and treasury yields is not always linear. For instance, during periods of economic uncertainty or market stress, treasury yields may decline even when the federal funds rate increases, as investors seek safe-haven assets. Understanding these nuances is crucial for investors and financial analysts seeking to navigate the relationship between the federal funds rate and treasury yields.

The Role of Market Expectations and Inflation

Market expectations and inflation significantly impact the relationship between the federal funds rate and treasury yields. When investors anticipate future interest rate hikes or inflation, they may demand higher yields on treasury securities to maintain their purchasing power and compensate for the increased borrowing costs. Conversely, when market participants expect lower interest rates or disinflation, treasury yields may decline as investors are willing to accept lower yields.

Real-world scenarios illustrate the influence of market expectations and inflation on the relationship between the federal funds rate and treasury yields. For example, during periods of economic growth and rising inflation, the Federal Reserve may increase the federal funds rate to curb inflationary pressures. In response, treasury yields may also rise as investors demand higher yields to offset the anticipated decline in purchasing power.

However, if the Federal Reserve signals a more dovish monetary policy stance, indicating lower interest rates or accommodative measures, treasury yields may decline as investors expect lower borrowing costs and increased demand for fixed-income securities. Therefore, understanding market expectations and inflation trends is crucial for investors and financial analysts seeking to navigate the relationship between the federal funds rate and treasury yields.

Investment Strategies and Portfolio Management

Investors and portfolio managers can utilize the relationship between the federal funds rate and treasury yields to make informed decisions and optimize their investment strategies. By understanding the dynamics of this relationship, financial professionals can identify trends, assess risks, and capitalize on opportunities in various market conditions.

One strategy involves adjusting the duration of a portfolio based on expectations for the federal funds rate and treasury yields. For instance, when the federal funds rate is expected to rise, investors may shorten the duration of their portfolios by investing in shorter-term treasury securities to minimize interest rate risk. Conversely, when the federal funds rate is anticipated to decline, investors may lengthen the duration of their portfolios by investing in longer-term treasury securities to benefit from capital appreciation and higher yields.

Another strategy involves diversifying a portfolio across different asset classes, such as stocks, bonds, and commodities, to mitigate the impact of changes in the federal funds rate and treasury yields. By allocating assets based on an individual’s risk tolerance, investment horizon, and financial goals, investors can create a well-balanced portfolio that can withstand various market conditions and capitalize on the relationship between the federal funds rate and treasury yields.

Monitoring and Forecasting Future Trends: The Relationship Between Fed Funds Rate and Treasury Yields

Understanding the relationship between the federal funds rate and treasury yields is crucial for investors and portfolio managers looking to make informed decisions and optimize their investment strategies. To achieve long-term success in the financial markets, it is essential to monitor and forecast future trends in this relationship. This article will discuss various economic indicators and financial analysis tools that can help investors and financial professionals make educated predictions about the future of the federal funds rate and treasury yields.

The federal funds rate, which is determined by the Federal Reserve, plays a significant role in the economy and monetary policy. It serves as a benchmark for short-term interest rates, influencing other interest rates, such as those for mortgages, car loans, and credit cards. When the federal funds rate changes, treasury yields often follow, as they are closely interconnected.

To monitor and forecast future trends in the relationship between the federal funds rate and treasury yields, investors and financial professionals can utilize several economic indicators and financial analysis tools. These include:

- Federal Open Market Committee (FOMC) meetings: The FOMC, which is responsible for setting the federal funds rate, holds eight meetings per year. By analyzing the FOMC’s statements and projections, investors can gain insights into potential changes in the federal funds rate and their impact on treasury yields.

- Economic data releases: Regularly monitoring economic data releases, such as the Consumer Price Index (CPI), Producer Price Index (PPI), and Gross Domestic Product (GDP) reports, can provide valuable information about the overall health of the economy. These indicators can help investors predict potential shifts in monetary policy and the federal funds rate, which in turn can influence treasury yields.

- Market sentiment and expectations: Investors should also pay close attention to market sentiment and expectations, as these can significantly impact the relationship between the federal funds rate and treasury yields. For example, if investors anticipate an increase in the federal funds rate due to rising inflation, treasury yields may also rise in response to these expectations.

- Technical analysis: Technical analysis tools, such as trend lines, moving averages, and support and resistance levels, can be applied to historical data on the federal funds rate and treasury yields to identify patterns and predict future trends.

By employing these economic indicators and financial analysis tools, investors and financial professionals can monitor and forecast future trends in the relationship between the federal funds rate and treasury yields. This information can then be used to make informed decisions and optimize investment strategies, ultimately contributing to long-term success in the financial markets.

Conclusion: Navigating the Relationship Between Fed Funds Rate and Treasury Yields for Long-Term Success

Throughout this article, we have explored the relationship between the federal funds rate and treasury yields, discussing their interdependence and the factors that influence this connection. By understanding the federal funds rate, treasury yields, and the relationship between them, investors and portfolio managers can make informed decisions and optimize their investment strategies for long-term success.

The federal funds rate, determined by the Federal Reserve, plays a critical role in the economy and monetary policy. As a benchmark for short-term interest rates, it influences other interest rates, such as those for mortgages, car loans, and credit cards. Treasury yields, which come in various forms, including nominal, real, and breakeven yields, are significant indicators of the financial markets‘ overall health and investors’ expectations.

By analyzing the relationship between the federal funds rate and treasury yields, investors can identify trends, predict future movements, and adapt their investment strategies accordingly. Factors such as market expectations and inflation significantly impact this relationship, making it essential to monitor these indicators to stay ahead of potential shifts.

To effectively navigate the relationship between the federal funds rate and treasury yields, investors and portfolio managers can utilize various economic indicators and financial analysis tools. Regularly analyzing FOMC meetings, economic data releases, market sentiment, and technical analysis can provide valuable insights into future trends and contribute to long-term success in the financial markets.

In summary, understanding the relationship between the federal funds rate and treasury yields is crucial for investors and portfolio managers. By staying informed about the federal funds rate, treasury yields, and the factors that influence their connection, investors can make educated decisions, optimize their investment strategies, and achieve long-term success in the financial markets.