Why Asset Allocation Matters in Your Investment Strategy

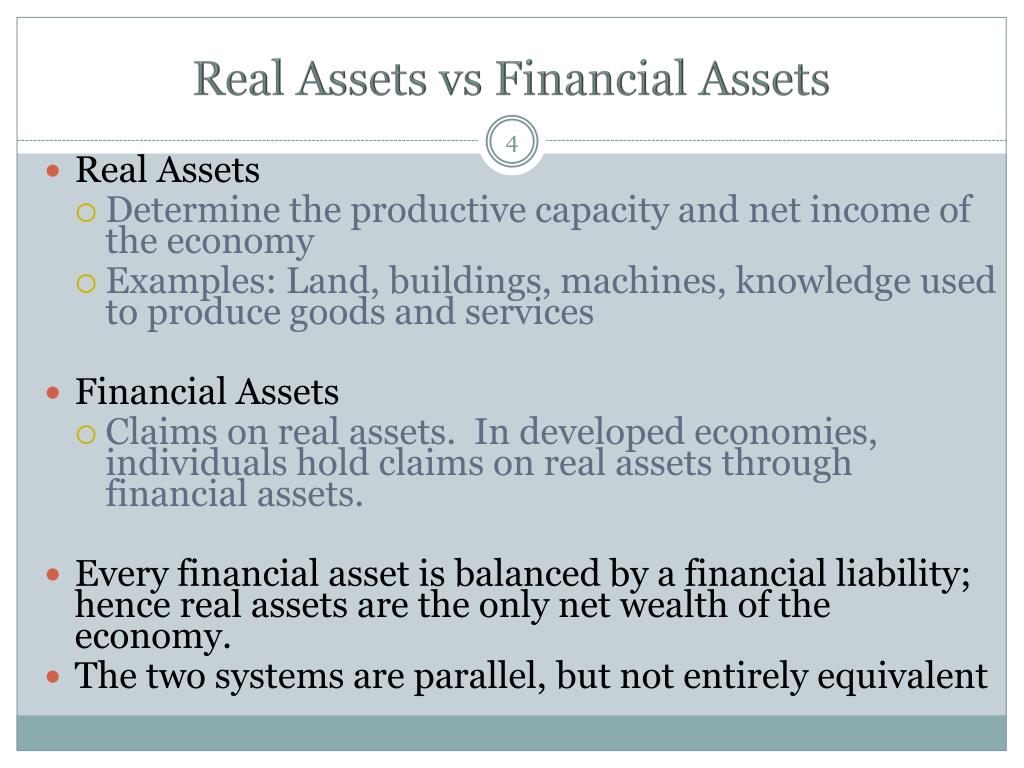

Effective asset allocation is crucial for achieving long-term financial goals. It involves dividing your investment portfolio into different asset classes, such as real assets and financial assets, to minimize risk and maximize returns. Understanding the distinction between real assets vs financial assets is vital in this process, as each type of asset has its unique characteristics, benefits, and risks. Real assets, such as property and commodities, offer tangible value and diversification benefits, while financial assets, such as stocks and bonds, provide liquidity and potential for high returns. By allocating your assets effectively, you can create a balanced portfolio that helps you achieve your financial objectives. In this article, we will explore the importance of understanding real assets vs financial assets and how to create a diversified portfolio that incorporates both.

Defining Real Assets: What Are They and Why Do They Matter?

Real assets are tangible, physical assets that have inherent value and can provide a sense of security and stability to an investment portfolio. Examples of real assets include property, such as commercial or residential real estate, commodities, such as gold, oil, or agricultural products, and collectibles, such as art, rare coins, or vintage cars. These assets offer a range of benefits, including tangible value, diversification, and potential for long-term appreciation. Real assets can also provide a hedge against inflation, market volatility, and currency fluctuations, making them an attractive option for investors seeking to minimize risk. In contrast to financial assets, real assets are less likely to be affected by market sentiment and can provide a sense of control and ownership. By incorporating real assets into a diversified portfolio, investors can reduce their reliance on financial assets and create a more balanced investment strategy that incorporates both real assets vs financial assets.

The World of Financial Assets: Stocks, Bonds, and More

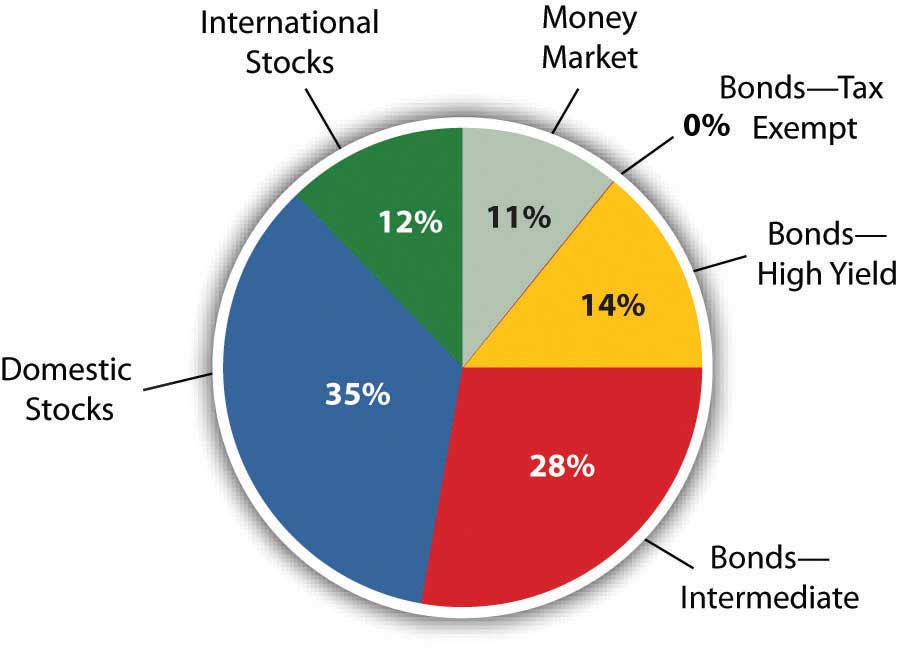

Financial assets, on the other hand, are intangible, non-physical assets that represent a claim on ownership or a contractual right to receive future cash flows. Examples of financial assets include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and derivatives. These assets offer a range of benefits, including liquidity, potential for high returns, and ease of diversification. Financial assets are often traded on public markets, making it easy to buy and sell them. They also provide a way to participate in the growth and profits of companies, industries, or economies, without directly owning physical assets. However, financial assets are also subject to market volatility, credit risk, and liquidity risk, which can impact their value. Understanding the characteristics and benefits of financial assets is crucial when deciding how to allocate assets between real assets vs financial assets in a diversified portfolio.

How to Diversify Your Portfolio with a Mix of Real and Financial Assets

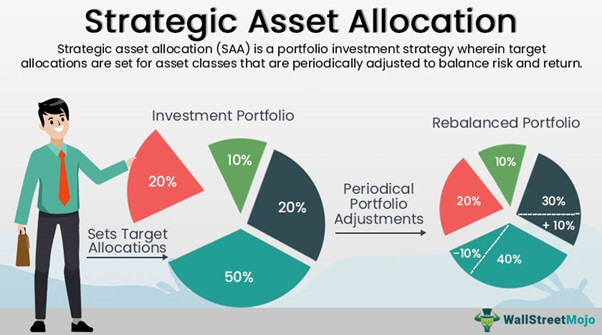

Creating a diversified portfolio that incorporates both real assets and financial assets is crucial for achieving long-term financial goals. A balanced portfolio can help mitigate risk, increase potential returns, and provide a hedge against market volatility. To diversify a portfolio, investors should consider allocating assets between real assets, such as property or commodities, and financial assets, such as stocks or bonds. This can be achieved by setting a target asset allocation, based on an investor’s risk tolerance, investment horizon, and financial goals. For example, a conservative investor may allocate 60% of their portfolio to financial assets, such as bonds, and 40% to real assets, such as property. On the other hand, a more aggressive investor may allocate 70% of their portfolio to financial assets, such as stocks, and 30% to real assets, such as commodities. It’s also important to consider asset correlation, to ensure that the assets in the portfolio are not highly correlated, which can increase risk. By diversifying a portfolio with a mix of real assets vs financial assets, investors can create a robust investment strategy that is better equipped to weather market fluctuations.

The Pros and Cons of Investing in Real Assets vs Financial Assets

When it comes to building wealth, investors often face a crucial decision: whether to invest in real assets or financial assets. Both options have their advantages and disadvantages, and understanding these pros and cons is essential for making informed investment decisions. Real assets, such as property or commodities, offer tangible value, diversification, and a hedge against inflation. However, they often require a significant upfront investment, can be illiquid, and may be subject to physical risks. On the other hand, financial assets, such as stocks or bonds, offer liquidity, potential for high returns, and ease of diversification. However, they are often subject to market volatility, credit risk, and liquidity risk. When considering real assets vs financial assets, investors should weigh these pros and cons carefully, taking into account their individual financial goals, risk tolerance, and investment horizon. For example, investors seeking long-term growth may prefer financial assets, while those seeking diversification and tangible value may prefer real assets. By understanding the advantages and disadvantages of each, investors can make informed decisions and create a balanced portfolio that incorporates both real and financial assets.

Real Assets in Action: Case Studies of Successful Investors

While understanding the benefits and drawbacks of real assets vs financial assets is essential, seeing these concepts in action can be even more illuminating. Let’s take a look at some real-life examples of successful investors who have built wealth through real assets. One notable example is property investor, Sam Zell, who built a real estate empire through strategic acquisitions and development. Zell’s focus on tangible assets, such as property, allowed him to weather market fluctuations and build long-term wealth. Another example is commodity trader, Jim Rogers, who made a fortune by investing in physical commodities, such as gold and oil. Rogers’ ability to identify trends and invest in real assets allowed him to generate significant returns, even in turbulent markets. These case studies demonstrate the potential of real assets to generate wealth and provide a hedge against market volatility. By understanding how successful investors have utilized real assets, individuals can gain valuable insights into building their own wealth through a diversified portfolio that incorporates both real and financial assets.

Financial Assets in Action: Case Studies of Successful Investors

While real assets have their advantages, financial assets have also been a key component of many successful investors’ portfolios. Let’s take a look at some real-life examples of investors who have built wealth through financial assets. One notable example is Warren Buffett, who has generated impressive returns through his value investing approach, focusing on stocks and bonds. Buffett’s ability to identify undervalued companies and invest in financial assets has allowed him to build a massive fortune. Another example is Ray Dalio, founder of Bridgewater Associates, who has built a successful hedge fund through his investment in financial assets, such as stocks, bonds, and currencies. Dalio’s ability to navigate complex financial markets and invest in a diversified portfolio of financial assets has allowed him to generate significant returns, even in turbulent times. These case studies demonstrate the potential of financial assets to generate wealth and provide liquidity, and highlight the importance of incorporating both real and financial assets in a diversified portfolio. By understanding how successful investors have utilized financial assets, individuals can gain valuable insights into building their own wealth through a balanced portfolio that incorporates both real assets and financial assets, ultimately achieving their long-term financial goals.

Conclusion: Creating a Balanced Portfolio with Real and Financial Assets

In conclusion, understanding the distinction between real assets and financial assets is crucial in achieving long-term financial goals. By recognizing the benefits and drawbacks of each, individuals can create a diversified portfolio that incorporates both tangible and intangible assets. Real assets, such as property and commodities, offer tangible value and diversification, while financial assets, such as stocks and bonds, provide liquidity and potential for high returns. By allocating assets between real and financial assets, individuals can manage risk, optimize returns, and achieve a balanced portfolio. The case studies of successful investors highlighted in this article demonstrate the potential of both real assets and financial assets to generate wealth. Ultimately, a balanced portfolio that incorporates both real assets and financial assets is key to achieving long-term financial success. By understanding the importance of asset allocation and the distinction between real assets vs financial assets, individuals can make informed investment decisions and build a strong foundation for their financial future.