What Drives the Yield of a 2-Year Treasury Note

The rate for a 2-year treasury note is influenced by a complex array of factors, including economic indicators, monetary policy, and market sentiment. One of the primary drivers of the yield is the state of the economy. When the economy is growing, the demand for credit increases, and interest rates tend to rise. Conversely, during periods of economic downturn, the demand for credit decreases, and interest rates tend to fall. The yield of a 2-year treasury note is also sensitive to changes in inflation expectations. When inflation is expected to rise, investors demand higher returns to compensate for the erosion of purchasing power, which drives up the yield. Additionally, the Federal Reserve’s monetary policy decisions, such as setting short-term interest rates and implementing quantitative easing, can also impact the rate for a 2-year treasury note. Market sentiment, including investor confidence and risk appetite, also plays a significant role in shaping the yield. By understanding these factors, investors can better navigate the complexities of the bond market and make informed investment decisions.

How to Interpret the Yield Curve and Its Impact on Short-Term Rates

Understanding the yield curve is crucial for investors seeking to navigate the complexities of the bond market. The yield curve, which plots the yields of bonds with different maturities, provides valuable insights into the market’s expectations of future interest rates. When interpreting the yield curve, investors should focus on its shape, slope, and shifts. A normal yield curve, where longer-term yields are higher than shorter-term yields, indicates a healthy economy with moderate growth. An inverted yield curve, where shorter-term yields are higher than longer-term yields, may signal a potential recession. The yield curve’s impact on short-term rates, including the rate for a 2-year treasury note, is significant. For instance, when the yield curve steepens, indicating a growing economy, short-term rates tend to rise, and the rate for a 2-year treasury note increases. Conversely, when the yield curve flattens, indicating a slowing economy, short-term rates tend to fall, and the rate for a 2-year treasury note decreases. By understanding the yield curve and its impact on short-term rates, investors can make informed investment decisions and optimize their portfolios.

The Role of the Federal Reserve in Shaping Short-Term Interest Rates

The Federal Reserve plays a crucial role in shaping short-term interest rates, including the rate for a 2-year treasury note. As the central bank of the United States, the Fed has the authority to set short-term interest rates through its monetary policy decisions. The Fed’s primary tool for influencing interest rates is the federal funds rate, which is the rate at which banks and other depository institutions lend and borrow money from each other. By adjusting the federal funds rate, the Fed can influence the entire yield curve, including the rate for a 2-year treasury note. For instance, when the Fed lowers the federal funds rate, it reduces the cost of borrowing, which can lead to lower short-term interest rates, including the rate for a 2-year treasury note. Conversely, when the Fed raises the federal funds rate, it increases the cost of borrowing, which can lead to higher short-term interest rates, including the rate for a 2-year treasury note. The Fed also uses other tools, such as forward guidance and quantitative easing, to influence interest rates and shape the yield curve. By understanding the Fed’s role in shaping short-term interest rates, investors can better anticipate changes in the rate for a 2-year treasury note and make informed investment decisions.

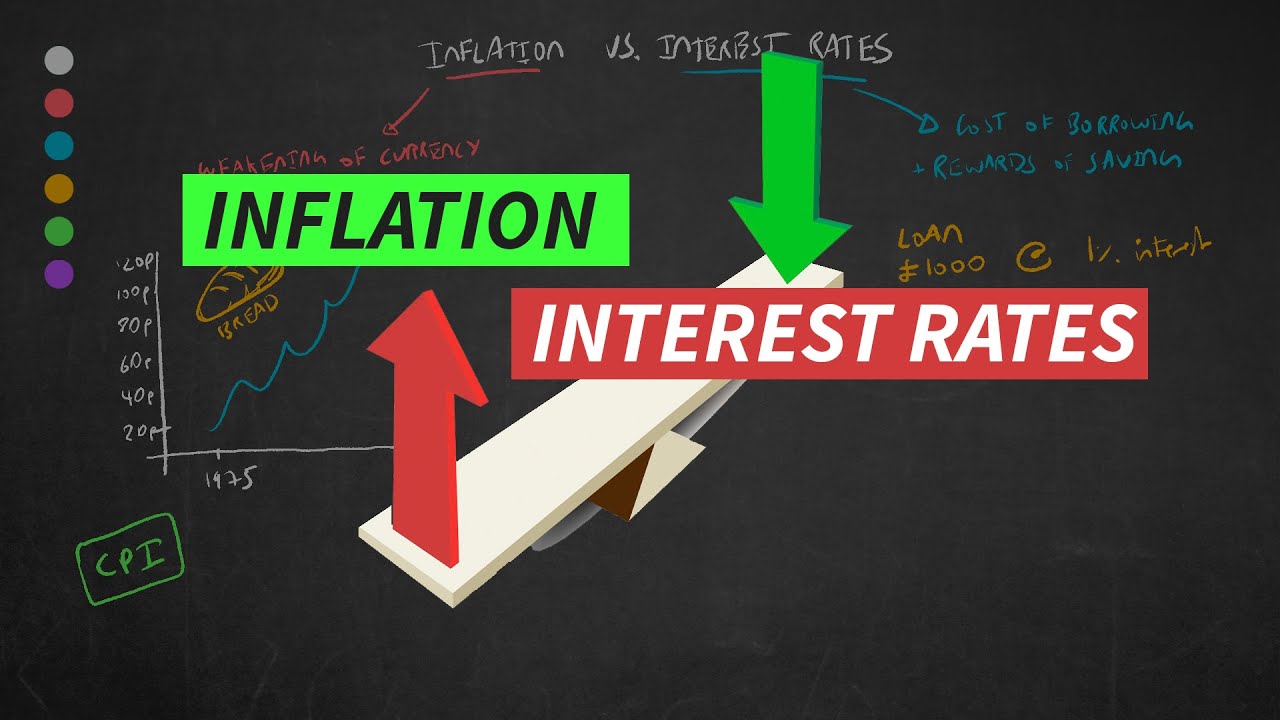

Understanding the Relationship Between Inflation and Short-Term Interest Rates

Inflation plays a significant role in shaping short-term interest rates, including the rate for a 2-year treasury note. When inflation expectations rise, investors demand higher returns to compensate for the erosion of purchasing power, leading to higher short-term interest rates. Conversely, when inflation expectations fall, investors are willing to accept lower returns, resulting in lower short-term interest rates. The Federal Reserve, in its effort to maintain price stability, closely monitors inflation indicators, such as the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index, to determine the appropriate monetary policy stance. When inflation is above the Fed’s target rate of 2%, it may raise short-term interest rates, including the rate for a 2-year treasury note, to combat inflationary pressures. On the other hand, when inflation is below target, the Fed may lower short-term interest rates to stimulate economic growth. By understanding the relationship between inflation and short-term interest rates, investors can better anticipate changes in the rate for a 2-year treasury note and make informed investment decisions. For instance, if inflation expectations are rising, investors may expect the rate for a 2-year treasury note to increase, leading to higher yields and lower bond prices.

What Do Changes in the 2-Year Treasury Note Rate Mean for Investors?

Changes in the rate for a 2-year treasury note have significant implications for investors. When the rate for a 2-year treasury note increases, it can lead to higher yields and lower bond prices. This is because investors demand higher returns to compensate for the increased risk of lending to the government. As a result, existing bondholders may experience a decline in the value of their investments. On the other hand, when the rate for a 2-year treasury note decreases, it can lead to lower yields and higher bond prices. This can be beneficial for investors who are looking to buy bonds at a lower cost. Changes in the rate for a 2-year treasury note can also impact overall portfolio performance. For instance, a rise in the rate can lead to a decline in the value of other fixed-income investments, such as corporate bonds and commercial paper, which can negatively impact portfolio returns. Conversely, a fall in the rate can lead to an increase in the value of these investments, which can positively impact portfolio returns. By understanding the implications of changes in the rate for a 2-year treasury note, investors can make informed investment decisions and adjust their portfolios accordingly to maximize returns and minimize risk.

A Historical Perspective on 2-Year Treasury Note Rates

The rate for a 2-year treasury note has undergone significant changes over the years, influenced by various economic and monetary factors. Historically, the rate for a 2-year treasury note has been closely tied to the federal funds rate, which is set by the Federal Reserve. During times of economic expansion, the Fed has increased the federal funds rate to combat inflation, leading to higher rates for 2-year treasury notes. Conversely, during times of economic contraction, the Fed has lowered the federal funds rate to stimulate growth, resulting in lower rates for 2-year treasury notes. For instance, during the 2008 financial crisis, the rate for a 2-year treasury note plummeted to near zero as the Fed implemented quantitative easing to stabilize the financial system. In contrast, during the 2015-2019 period, the rate for a 2-year treasury note increased steadily as the Fed raised interest rates to normalize monetary policy. Understanding the historical trends and patterns of the rate for a 2-year treasury note can provide valuable insights for investors, helping them to anticipate future changes and make informed investment decisions. By analyzing the historical context of the rate for a 2-year treasury note, investors can better navigate the complexities of the fixed-income market and optimize their portfolios for maximum returns.

How to Use the 2-Year Treasury Note Rate as a Benchmark for Other Investments

The rate for a 2-year treasury note serves as a benchmark for other short-term investments, providing a risk-free rate of return against which other investments can be compared. Corporate bonds, certificates of deposit (CDs), and commercial paper are just a few examples of investments that are often benchmarked against the rate for a 2-year treasury note. By comparing the yields of these investments to the rate for a 2-year treasury note, investors can assess the relative value and risk of each investment. For instance, if the yield on a corporate bond is significantly higher than the rate for a 2-year treasury note, it may indicate that the bond carries additional credit risk or other factors that justify the higher return. Conversely, if the yield on a CD is lower than the rate for a 2-year treasury note, it may suggest that the CD is a relatively safer investment. By using the rate for a 2-year treasury note as a benchmark, investors can make more informed decisions about their investments and optimize their portfolios for maximum returns. Additionally, the rate for a 2-year treasury note can also serve as a benchmark for other short-term interest rates, such as the prime rate and the federal funds rate, providing a broader context for understanding the overall direction of interest rates.

Expert Insights: What to Expect from the 2-Year Treasury Note Rate in the Future

As the global economy continues to evolve, the rate for a 2-year treasury note is likely to be influenced by a complex array of factors. According to experts, the future direction of the rate for a 2-year treasury note will be shaped by the interplay between monetary policy, economic indicators, and market sentiment. In the near term, the rate for a 2-year treasury note is expected to remain sensitive to changes in the federal funds rate, with potential rate hikes or cuts having a direct impact on the yield of the 2-year treasury note. Additionally, the ongoing impact of the COVID-19 pandemic, coupled with the rise of inflationary pressures, may lead to increased volatility in the rate for a 2-year treasury note. Despite these challenges, many experts believe that the rate for a 2-year treasury note will continue to play a critical role in shaping the overall direction of short-term interest rates, providing a benchmark for investors and policymakers alike. Looking ahead, investors would be well-advised to closely monitor the rate for a 2-year treasury note, as it is likely to remain a key indicator of the overall health of the economy and the direction of interest rates. By staying informed about the latest developments in the rate for a 2-year treasury note, investors can make more informed decisions about their investments and optimize their portfolios for maximum returns.