What is Quantum Computing and How Does it Impact Trading Bots?

Quantum computing is a revolutionary technology that leverages the principles of quantum mechanics to perform complex calculations at unprecedented speeds. In contrast to classical computers, which use bits to represent information as either 0s or 1s, quantum computers use quantum bits, or qubits, which can exist in multiple states simultaneously. This unique property, known as superposition, enables quantum computers to process vast amounts of data in parallel, making them ideal for solving complex problems that are beyond the capabilities of classical computers. The integration of quantum computing with trading bots has the potential to significantly impact the financial industry. By harnessing the power of quantum computing, trading bots can analyze vast amounts of data in real-time, enabling them to make more informed and profitable trades. The advantages of quantum computing with trading bots include faster processing times, improved data analysis, and enhanced decision-making capabilities.

One of the most significant benefits of quantum computing with trading bots is the ability to perform high-frequency trading at unprecedented speeds. High-frequency trading involves executing trades at extremely fast rates, often in microseconds. By using quantum computing, trading bots can analyze market data and execute trades at a much faster rate than classical computers, enabling them to take advantage of market inefficiencies and generate higher profits.

Quantum computing can also improve risk management for trading bots. By analyzing vast amounts of data in real-time, trading bots can identify potential risks and adjust their trading strategies accordingly. This can help to minimize losses and maximize profits, making trading bots more effective and efficient.

In addition, quantum computing can optimize portfolio management for trading bots. By analyzing market trends and identifying investment opportunities, trading bots can create more diversified and profitable portfolios. This can help to reduce risk and increase returns, making trading bots more attractive to investors.

Despite the potential benefits of quantum computing with trading bots, there are still challenges and limitations to implementing this technology. One of the main challenges is the need for specialized programming languages and software tools to develop quantum algorithms. Additionally, quantum computers are still in the early stages of development, and there are limitations to the number of qubits that can be used in a single quantum computer.

However, despite these challenges, the potential benefits of quantum computing with trading bots are too significant to ignore. As quantum computing technology continues to advance, we can expect to see more companies and organizations adopting this technology to improve their trading bot capabilities.

In conclusion, quantum computing has the potential to significantly impact the financial industry by enabling trading bots to analyze vast amounts of data in real-time, perform high-frequency trading at unprecedented speeds, improve risk management, and optimize portfolio management. While there are still challenges and limitations to implementing this technology, the potential benefits make it an exciting and promising field for innovation and growth in the financial industry.

The Intersection of Quantum Computing and Trading Algorithms

Quantum computing has the potential to revolutionize the way trading algorithms operate. By integrating quantum computing with trading algorithms, financial institutions can gain a competitive edge in the market. Quantum computing with trading bots can significantly improve the speed and accuracy of high-frequency trading. Traditional high-frequency trading algorithms rely on complex mathematical models to analyze market data and execute trades in milliseconds. However, these algorithms are limited by the processing power of classical computers. Quantum computing, on the other hand, can process vast amounts of data in parallel, enabling trading bots to analyze market data and execute trades at unprecedented speeds.

In addition to high-frequency trading, quantum computing with trading bots can also improve risk management. Traditional risk management algorithms rely on historical data to predict future market trends. However, these algorithms are limited by the amount of data they can analyze and the accuracy of their predictions. Quantum computing with trading bots can analyze vast amounts of data in real-time, enabling them to make more accurate predictions and adjust trading strategies accordingly.

Quantum computing can also optimize portfolio management for trading bots. Traditional portfolio management algorithms rely on mathematical models to create diversified portfolios. However, these algorithms are limited by the number of variables they can analyze and the accuracy of their predictions. Quantum computing with trading bots can analyze a much larger number of variables and make more accurate predictions, enabling them to create more diversified and profitable portfolios.

Despite the potential benefits of quantum computing with trading bots, there are still challenges and limitations to implementing this technology. One of the main challenges is the need for specialized programming languages and software tools to develop quantum algorithms. Additionally, quantum computers are still in the early stages of development, and there are limitations to the number of qubits that can be used in a single quantum computer.

However, despite these challenges, the potential benefits of quantum computing with trading bots are too significant to ignore. Companies and organizations around the world are investing in quantum computing research and development, and we can expect to see more companies and organizations adopting this technology in the coming years.

In conclusion, the integration of quantum computing with trading algorithms has the potential to significantly impact the financial industry. By enabling trading bots to analyze vast amounts of data in real-time, perform high-frequency trading at unprecedented speeds, improve risk management, and optimize portfolio management, quantum computing with trading bots can provide a competitive edge in the market. While there are still challenges and limitations to implementing this technology, the potential benefits make it an exciting and promising field for innovation and growth in the financial industry.

Current State of Quantum Computing in Trading Bot Technology

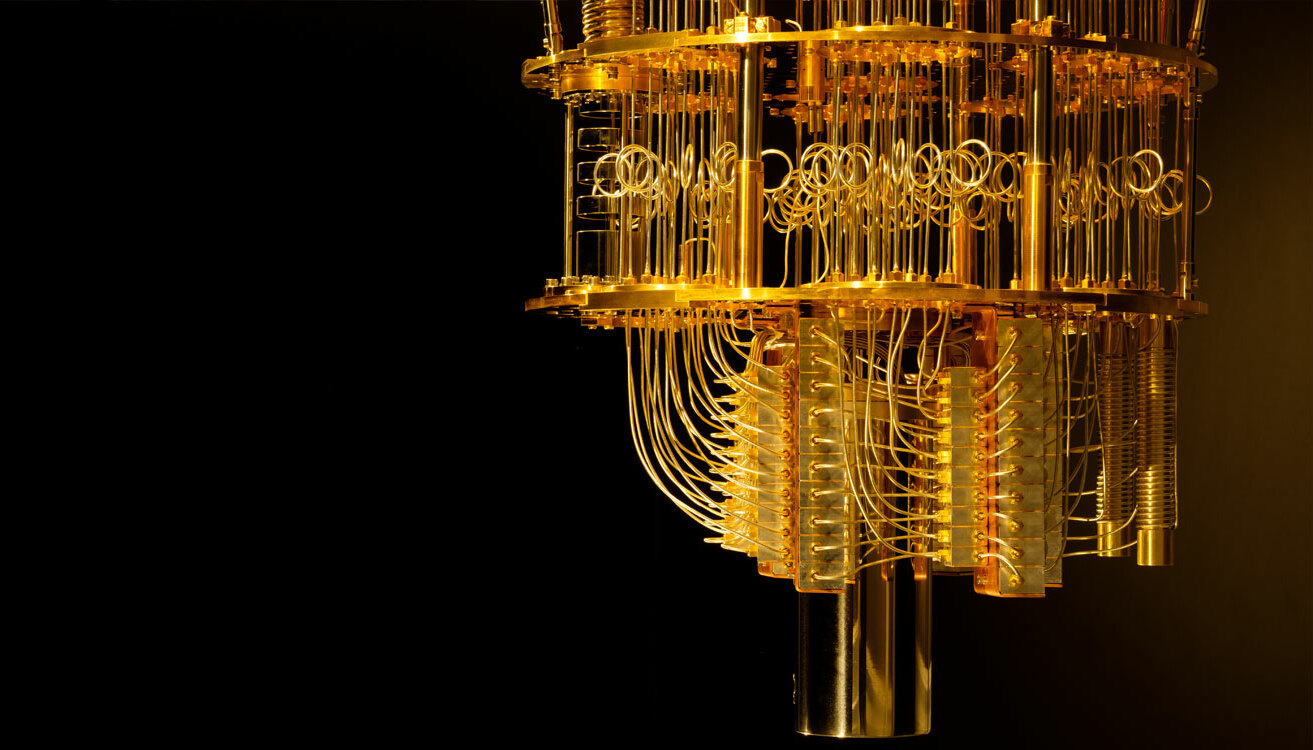

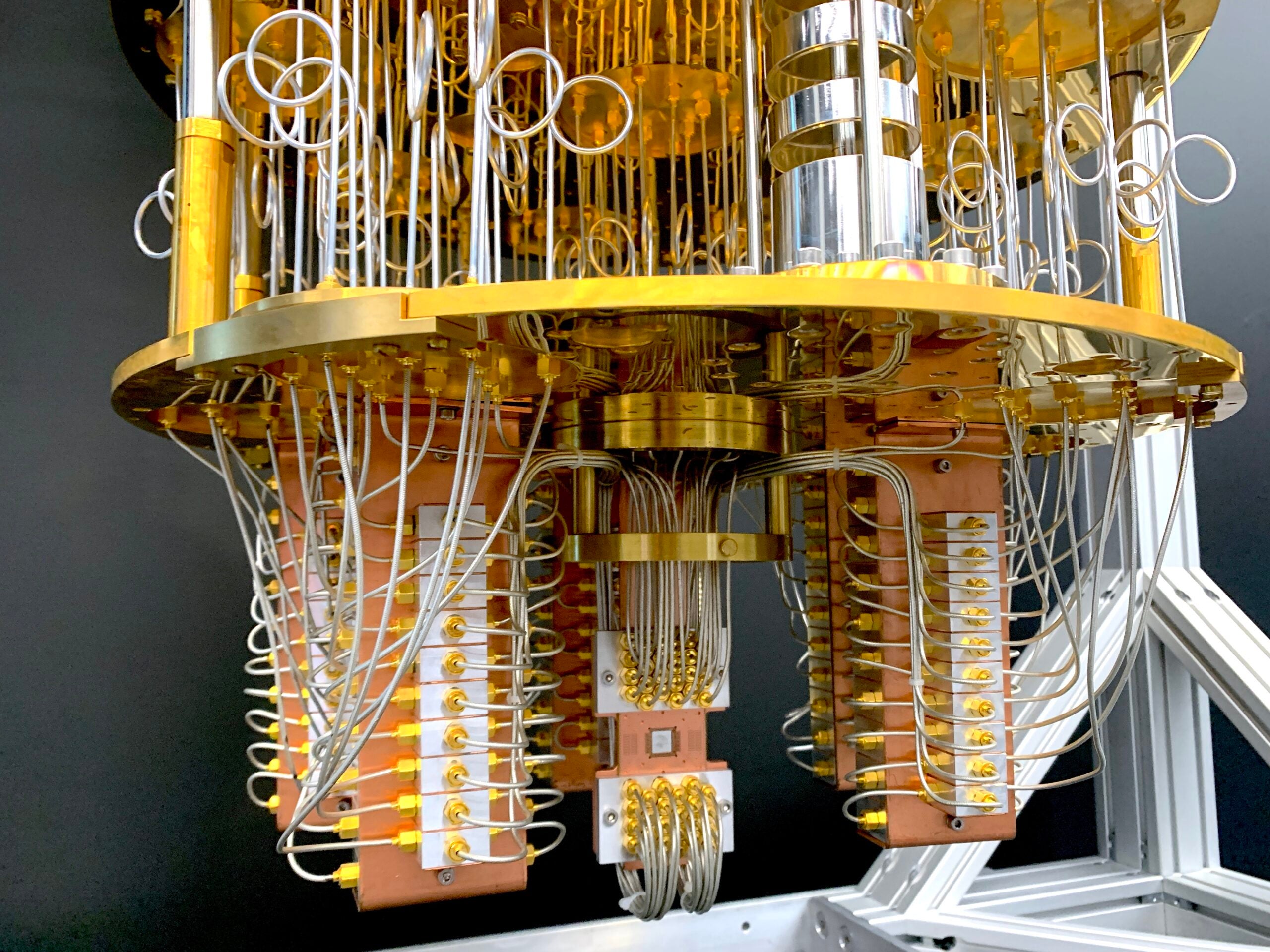

Quantum computing with trading bots is still in its infancy, and there are several challenges and limitations to implementing this technology. One of the main challenges is the need for specialized programming languages and software tools to develop quantum algorithms. Currently, there are only a few programming languages and software tools available for quantum computing, and they require a high level of expertise to use. Another challenge is the limited availability of quantum computers. Quantum computers are still in the early stages of development, and there are only a few available for commercial use. Additionally, quantum computers are expensive to build and maintain, which limits their availability to large financial institutions and technology companies.

Furthermore, quantum computing with trading bots is still subject to the limitations of quantum computers. Quantum computers rely on qubits, which are fragile and prone to errors. This means that quantum computers can only perform a limited number of calculations before the qubits decohere and lose their quantum properties.

Despite these challenges, there are several companies and organizations that are currently using quantum computing in trading bot technology. For example, JPMorgan Chase has partnered with IBM to explore the use of quantum computing in trading algorithms. The partnership aims to develop quantum algorithms that can analyze large datasets and optimize trading strategies.

Another example is Goldman Sachs, which has also partnered with IBM to explore the use of quantum computing in risk management. The partnership aims to develop quantum algorithms that can analyze market data and predict potential risks in real-time.

In conclusion, the current state of quantum computing in trading bot technology is still in its infancy. While there are several challenges and limitations to implementing this technology, there are also several companies and organizations that are currently using quantum computing in trading bot technology. These examples demonstrate the potential benefits of quantum computing with trading bots, such as faster processing times, improved data analysis, and more accurate predictions. As quantum computing technology continues to advance, we can expect to see more companies and organizations adopting this technology in the coming years.

Real-World Applications of Quantum Computing in Trading Bots

Quantum computing with trading bots is no longer just a theoretical concept. Several companies and organizations have already started exploring the potential of this technology in real-world applications. One example is Volkswagen, which has partnered with D-Wave Systems to develop a quantum algorithm for traffic flow optimization. While not directly related to trading bots, this example demonstrates the potential of quantum computing in optimizing complex systems. In the future, similar quantum algorithms could be used to optimize trading strategies and portfolios.

Another example is First Derivatives, a financial services technology provider that has partnered with Cambridge Quantum Computing to explore the use of quantum computing in trading algorithms. The partnership aims to develop quantum algorithms for high-frequency trading, risk management, and portfolio optimization.

In addition to these partnerships, several startups have also emerged in the space of quantum computing with trading bots. For example, QC Ware is a startup that provides quantum computing services for enterprises, including those in the financial services industry. The company has developed a quantum algorithm for option pricing, which can be used in trading algorithms.

Another startup is 1QBit, which provides quantum software solutions for enterprises. The company has developed a quantum-based optimization platform that can be used for portfolio optimization and risk management.

These real-world examples demonstrate the potential of quantum computing with trading bots. By using quantum algorithms, trading bots can process large datasets faster and more accurately, leading to improved trading strategies and portfolio optimization. However, it is important to note that quantum computing is still in the early stages of development, and there are several challenges and limitations to implementing this technology in trading algorithms.

In conclusion, several companies and organizations are already exploring the potential of quantum computing with trading bots in real-world applications. These examples demonstrate the potential benefits of this technology, such as faster processing times and improved data analysis. As quantum computing technology continues to advance, we can expect to see more companies and organizations adopting this technology in the coming years.

How to Implement Quantum Computing in Trading Bot Technology

Quantum computing has the potential to revolutionize trading bot technology, but how can businesses and organizations implement this technology? Here is a step-by-step guide on how to implement quantum computing in trading bot technology.

Understand the Basics of Quantum Computing: Before implementing quantum computing in trading bot technology, it is essential to understand the basics of quantum computing. This includes understanding the principles of quantum mechanics, such as superposition and entanglement, and how they can be used to perform complex calculations.

Identify the Problem: The next step is to identify the problem that quantum computing can solve. In the case of trading bot technology, this could be high-frequency trading, risk management, or portfolio optimization.

Choose the Right Quantum Computing Platform: There are several quantum computing platforms available, such as D-Wave, IBM Q, and Google Quantum AI. Each platform has its strengths and weaknesses, so it is essential to choose the right platform for the specific problem.

Develop a Quantum Algorithm: Once the platform is chosen, the next step is to develop a quantum algorithm that can solve the problem. This requires a deep understanding of quantum mechanics and quantum computing algorithms.

Integrate the Quantum Algorithm with the Trading Bot: After developing the quantum algorithm, the next step is to integrate it with the trading bot. This requires a deep understanding of both quantum computing and trading bot technology.

Test and Optimize the Quantum Trading Bot: The final step is to test and optimize the quantum trading bot. This involves testing the bot in different market conditions and optimizing the quantum algorithm to improve its performance.

In terms of technical requirements, implementing quantum computing in trading bot technology requires a deep understanding of quantum mechanics and quantum computing algorithms. Programming languages such as Q#, Qiskit, and Cirq are commonly used in quantum computing. Additionally, software tools such as the Quantum Development Kit and the Quantum AI platform can be helpful in implementing quantum computing in trading bot technology.

In conclusion, implementing quantum computing in trading bot technology is a complex process that requires a deep understanding of quantum mechanics and quantum computing algorithms. However, by following the step-by-step guide outlined above, businesses and organizations can harness the power of quantum computing to improve their trading bot technology.

The Future of Quantum Computing in Trading Bot Technology

Quantum computing has the potential to revolutionize the way trading bots operate, offering faster processing times, improved data analysis, and more accurate predictions. As the technology continues to advance, we can expect to see even more sophisticated trading algorithms that can process vast amounts of data in real-time. One of the most significant opportunities for quantum computing in trading bot technology is in the area of high-frequency trading. With quantum computing, trading bots can process and analyze data at unprecedented speeds, allowing them to execute trades in microseconds. This can give traders a significant advantage in fast-moving markets, enabling them to capitalize on even the smallest market movements.

Another area where quantum computing can have a major impact is in risk management. By analyzing vast amounts of data in real-time, trading bots can identify potential risks and threats more quickly and accurately, allowing traders to adjust their strategies accordingly. This can help to reduce losses and increase profits, making trading more efficient and effective.

Portfolio optimization is another area where quantum computing can provide significant benefits. By analyzing large datasets and identifying patterns and trends, trading bots can optimize investment portfolios more effectively, maximizing returns and minimizing risk. This can help traders to achieve their financial goals more quickly and efficiently, making trading more accessible and profitable for a wider range of investors.

Despite the many opportunities, there are also challenges and limitations to implementing quantum computing in trading bot technology. One of the biggest challenges is the need for specialized hardware and software, which can be expensive and difficult to obtain. Additionally, quantum computing is still a relatively new technology, and there is a limited pool of skilled professionals who are familiar with its complexities.

Another challenge is the need for new programming languages and software tools that are specifically designed for quantum computing. While some progress has been made in this area, there is still a long way to go before quantum computing can be fully integrated into trading bot technology.

Despite these challenges, the future potential of quantum computing in trading bot technology is enormous. As the technology continues to advance, we can expect to see even more sophisticated trading algorithms that can process vast amounts of data in real-time, enabling traders to make more informed and profitable decisions.

To realize this potential, however, the industry must address the challenges and limitations of implementing quantum computing in trading bot technology. This will require significant investment in research and development, as well as a commitment to building a skilled workforce that is familiar with the complexities of quantum computing.

In conclusion, the future of quantum computing in trading bot technology is bright, with significant opportunities for high-frequency trading, risk management, and portfolio optimization. While there are challenges and limitations to implementing this technology, the potential benefits are too great to ignore. By investing in research and development and building a skilled workforce, the industry can unlock the full potential of quantum computing in trading bot technology, ushering in a new era of efficiency, accuracy, and profitability.

Potential Risks and Limitations of Quantum Computing in Trading Bot Technology

As with any emerging technology, there are potential risks and limitations to consider when it comes to quantum computing with trading bots. One of the primary concerns is the ethical considerations surrounding the use of this technology. With the ability to process vast amounts of data and execute trades at unprecedented speeds, there is a risk of exacerbating existing market inequalities and creating new ones. It is essential that the industry adheres to ethical guidelines and regulations to ensure fair and equitable use of quantum computing in trading bot technology. Security is another significant concern when it comes to quantum computing with trading bots. As quantum computers become more powerful, they may be able to crack encryption codes and security protocols that are currently used to protect sensitive financial data. This could put traders and investors at risk of cyber attacks and data breaches, leading to significant financial losses. It is crucial that the industry invests in robust security measures to protect against these risks.

Regulatory challenges are also a concern when it comes to quantum computing with trading bots. As this technology is still in its infancy, there are currently no clear regulations or guidelines surrounding its use in trading. This can make it difficult for companies to navigate the legal landscape and can lead to regulatory uncertainty. It is essential that the industry works closely with regulators to develop clear and effective regulations that promote innovation while protecting consumers.

Another limitation of quantum computing with trading bots is the need for specialized hardware and software. Quantum computers are still relatively rare and expensive, making it difficult for many companies to access this technology. Additionally, there is a limited pool of skilled professionals who are familiar with quantum computing, making it challenging to find the expertise needed to implement this technology in trading bots.

Despite these potential risks and limitations, the benefits of quantum computing with trading bots are too great to ignore. By addressing these challenges and investing in research and development, the industry can unlock the full potential of this technology and create more efficient, accurate, and profitable trading bots.

In conclusion, while there are potential risks and limitations to consider when it comes to quantum computing with trading bots, these challenges can be addressed through ethical considerations, robust security measures, clear regulations, and investment in research and development. By embracing this exciting new technology, the industry can create more sophisticated and profitable trading bots that can help traders and investors to achieve their financial goals.

Conclusion: Embracing the Quantum Computing Revolution in Trading Bot Technology

In conclusion, quantum computing has the potential to revolutionize the trading bot industry by providing faster processing times, improved data analysis, and more sophisticated trading algorithms. By integrating quantum computing with trading algorithms, companies can gain a competitive edge in high-frequency trading, risk management, and portfolio optimization. While there are still challenges and limitations to implementing quantum computing in trading bot technology, such as the need for specialized hardware and software and regulatory uncertainty, the benefits far outweigh the risks. Companies that embrace this technology early on will be better positioned to take advantage of its full potential and stay ahead of the curve in the rapidly evolving world of trading bot technology.

To implement quantum computing in trading bot technology, companies should consider the technical requirements, programming languages, and software tools needed for implementation. By working with experienced professionals and investing in research and development, companies can create more efficient, accurate, and profitable trading bots that can help traders and investors to achieve their financial goals.

As we look to the future, the potential of quantum computing in trading bot technology is vast. With continued investment and innovation, we can expect to see even more sophisticated and profitable trading bots that can help traders and investors to make better decisions and maximize their returns.

In conclusion, the quantum computing revolution in trading bot technology is an exciting and promising field that has the potential to transform the industry. By embracing this technology and investing in research and development, companies can unlock new opportunities and create more sophisticated and profitable trading bots that can help traders and investors to achieve their financial goals. So, let’s embrace this revolution and explore the possibilities of quantum computing with trading bots!