What Influences Speculation About Central Bank Policy?

Speculation surrounding the Federal Reserve’s interest rate decisions is a constant feature of financial markets. A multitude of factors contribute to this ongoing debate, creating a complex landscape for investors and economists alike. Economic indicators form the bedrock of this speculation. Inflation, measured by metrics such as the Consumer Price Index (CPI) and the Producer Price Index (PPI), is a primary focus. Rising inflation often prompts expectations of rate hikes, as the Fed aims to cool down the economy and maintain price stability. Conversely, low inflation may suggest the Fed will hold rates steady or even lower them to stimulate growth.

Unemployment figures are another crucial indicator. A strong labor market, characterized by low unemployment, can signal inflationary pressures and increase the probability of a fed rate hike. Gross Domestic Product (GDP) growth provides a broader view of the economy’s health. Robust GDP growth may support higher interest rates, while weak or negative growth could lead to rate cuts. Beyond these core economic indicators, geopolitical events also play a significant role. Global uncertainties, such as trade tensions, political instability, or international conflicts, can influence the Fed’s decisions. These events can impact economic growth and inflation, leading the Fed to adjust its policy accordingly. Market sentiment, often reflected in stock market performance and investor confidence, further shapes expectations. A buoyant stock market might suggest a healthy economy and increase the probability of a fed rate hike, while a market downturn could prompt the Fed to adopt a more cautious approach. All these elements create a feedback loop where economic data, global events, and market perceptions interact to drive speculation about the Fed’s next move. The interplay of these forces makes predicting the Fed’s actions a challenging but essential task for anyone involved in financial markets. Understanding these influences is paramount for accurately assessing the probability of a fed rate hike.

Furthermore, unexpected shocks to the economic system, such as supply chain disruptions or sudden shifts in consumer behavior, can rapidly alter the outlook and, consequently, expectations regarding interest rate policy. The Federal Reserve must weigh these diverse factors carefully, and its ultimate decision reflects a complex balancing act aimed at achieving its dual mandate of price stability and maximum employment. The weight given to each factor can vary over time, depending on the prevailing economic conditions and the Fed’s assessment of the greatest risks to the economy. Staying abreast of these developments is crucial for gauging the probability of a fed rate hike and anticipating its potential impact on the financial landscape.

How to Interpret Economic Data for Insights into Monetary Policy

Understanding potential Fed actions requires careful interpretation of key economic indicators. Several reports offer clues about the Federal Reserve’s next moves, impacting the probability of a fed rate hike. These reports reveal the health of the economy and provide insight into the Fed’s decision-making process.

The Consumer Price Index (CPI) and Producer Price Index (PPI) are critical for gauging inflation. The CPI measures changes in the price of goods and services purchased by households. A rising CPI signals increasing inflation, potentially prompting the Fed to consider raising interest rates to cool down the economy. The PPI, on the other hand, measures changes in the prices received by domestic producers. An increase in the PPI can indicate future inflationary pressures as producers pass on higher costs to consumers. The Fed closely monitors both headline and core inflation (excluding volatile food and energy prices) to get a comprehensive view. Higher inflation increases the probability of a fed rate hike.

The jobs report, released monthly by the Bureau of Labor Statistics, provides insights into the labor market. Key aspects include the unemployment rate, the number of jobs added or lost, and average hourly earnings. A strong jobs report, with low unemployment and rising wages, suggests a healthy economy. This might give the Fed confidence to raise interest rates. Conversely, a weak jobs report could deter the Fed from tightening monetary policy. Retail sales figures also offer valuable information. These figures indicate consumer spending, a major driver of economic growth. Strong retail sales suggest consumer confidence and economic strength. The Federal Reserve considers these figures when assessing the need to adjust interest rates. These factors weigh heavily on the probability of a fed rate hike. By carefully analyzing these reports, observers can better understand potential Fed actions and the factors influencing the probability of a fed rate hike.

Analyzing Federal Reserve Communications for Clues

Decoding Federal Reserve (Fed) communications is crucial for gauging the probability of a fed rate hike or cut. The Fed employs carefully crafted language, often referred to as “Fed-speak,” in its official statements. These statements provide insights into the central bank’s thinking and intentions. Key communication channels include the Federal Open Market Committee (FOMC) meeting minutes, speeches by Fed officials, and press conferences, particularly those led by the Fed Chair. Analyzing these sources requires a keen understanding of the nuances and subtle signals embedded within the language.

FOMC meeting minutes offer a detailed account of the discussions and debates among committee members. These minutes reveal the range of opinions on the economy and the outlook for monetary policy. Pay close attention to the voting record of the committee members, as any dissents can signal internal disagreements about the appropriate course of action. Speeches by Fed officials, especially the Chair, are also valuable sources of information. These speeches often provide a broader context for the Fed’s policy decisions and offer clues about future policy moves. Identifying hawkish or dovish signals is essential. A hawkish tone suggests a bias towards tightening monetary policy, potentially leading to a higher probability of a fed rate hike, while a dovish tone indicates a preference for easing or maintaining current policy. Analyzing the frequency and intensity of certain keywords or phrases can provide insights into the Fed’s evolving views.

Press conferences, particularly those following FOMC meetings, offer an opportunity for the Fed Chair to elaborate on the committee’s decisions and answer questions from the media. These Q&A sessions can provide further clarity on the Fed’s thinking and its response to changing economic conditions. Market participants closely scrutinize the Chair’s responses for any hints about future policy intentions. Understanding the Fed’s communication strategy is essential for accurately interpreting its messages and assessing the probability of a fed rate hike. Furthermore, it’s important to remember that the Fed’s communication strategy evolves over time depending on economic circumstances, so it is crucial to consider the context of the overall economic outlook when interpreting Fed statements. Economic data releases play a vital role in forming the basis of discussion for these meetings. Ultimately, it is a combination of data, expert insights, and understanding the communication strategy that best informs any decision making.

The Role of Market Expectations in Predicting Rate Changes

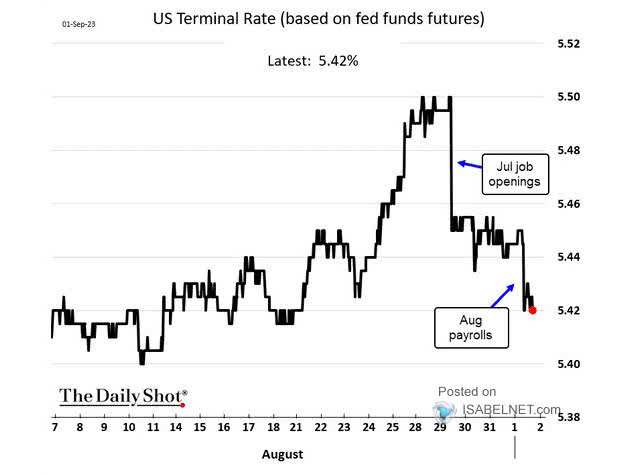

Market expectations play a crucial role in anticipating potential shifts in Federal Reserve policy. These expectations, reflected in various financial instruments, offer valuable insights into the market’s perceived probability of a fed rate hike or cut. Understanding these instruments and their signals is essential for gauging the likely direction of monetary policy.

Fed Funds futures are a primary tool for assessing market expectations regarding the federal funds rate. These futures contracts represent the market’s consensus view of where the federal funds rate will be at specific points in the future. By analyzing the pricing of these contracts, it’s possible to derive the market’s implied probability of a fed rate hike or cut at upcoming FOMC meetings. A significant increase in the price of Fed Funds futures suggests that market participants anticipate a rate hike, while a decrease suggests expectations of a rate cut. Treasury yields also provide clues about market expectations. The yield curve, which plots Treasury yields of different maturities, can signal expectations about future economic growth and inflation. An upward-sloping yield curve typically indicates expectations of economic expansion and potentially higher interest rates, while an inverted yield curve (where short-term yields are higher than long-term yields) can signal recessionary concerns and potential rate cuts. Inflation expectations, often measured by Treasury Inflation-Protected Securities (TIPS), reflect the market’s view on future inflation. Rising inflation expectations can put pressure on the Fed to raise interest rates to maintain price stability. Conversely, declining inflation expectations may prompt the Fed to consider easing monetary policy.

It’s important to note that market expectations are not always accurate predictors of Fed policy. The Fed may deviate from market expectations based on its own assessment of economic conditions and its policy objectives. However, monitoring these market-based indicators provides a valuable framework for understanding the market’s perceived probability of a fed rate hike and for anticipating potential shifts in monetary policy. Analyzing these instruments in conjunction with economic data and Fed communications can provide a more comprehensive view of the likely path of interest rates. Changes in market sentiment can also rapidly shift expectations, so constant monitoring of these indicators is vital for any informed financial decision-making process.

Comparing Current Economic Conditions with Past Policy Decisions

Analysis of current economic conditions requires a comparison with historical periods when the Federal Reserve implemented similar policy decisions. Examining past instances of rate hikes or cuts provides valuable context for understanding the potential trajectory of monetary policy. Specifically, the rationale behind previous actions, alongside the prevailing economic environment, needs careful consideration to assess its applicability today. For example, the Fed might raise rates to combat inflation, as it has done in the past. However, the effectiveness of such a strategy depends on whether current inflationary pressures stem from the same sources as in previous episodes. Supply-side shocks versus demand-pull inflation require different policy responses. Understanding these nuances helps to estimate the probability of a fed rate hike.

When comparing current economic data to historical precedents, it’s essential to focus on key indicators. Inflation rates, unemployment levels, and GDP growth figures should be scrutinized against corresponding data from past periods of monetary policy adjustments. A period of robust economic growth coupled with rising inflation may warrant a rate hike, mirroring strategies employed in the late 1990s. Conversely, a stagnant economy with low inflation might prompt rate cuts, similar to actions taken during periods of recession or financial crisis. Evaluating the similarities and differences between these periods enhances the accuracy of predicting the probability of a fed rate hike. Furthermore, comparing current financial market conditions, such as Treasury yields and credit spreads, with historical data can provide insights into market sentiment and expectations regarding future policy moves. Consideration of the global economic landscape is also critical, as international factors can significantly influence the Fed’s decisions.

Assessing whether past rationales for rate hikes or cuts apply in the current environment involves a thorough evaluation of the underlying economic dynamics. If the current economic challenges differ significantly from those experienced in the past, the Fed might adopt a different approach. For instance, if technological advancements are driving productivity gains and dampening inflationary pressures, the Fed might be less inclined to raise rates aggressively, even if economic growth is strong. Similarly, if global economic conditions are weak, the Fed might hesitate to raise rates, even if the domestic economy is performing well. Understanding the interconnectedness of the global economy and the unique characteristics of the current economic cycle are vital for accurately assessing the probability of a fed rate hike. A nuanced analysis of these factors allows for a more informed prediction of the Fed’s future policy decisions and their potential impact on the economy. Therefore, assessing probability of a fed rate hike involves a holistic view, encompassing both historical context and current economic realities.

Expert Opinions: What Economists and Analysts Are Saying

The anticipated trajectory of Federal Reserve interest rate policy is a subject of intense debate among economists and market analysts. Assessing the probability of a Fed rate hike requires careful consideration of these expert viewpoints. Currently, opinions are widely dispersed, reflecting the complex interplay of economic data and geopolitical uncertainties. Some analysts emphasize the persistent inflationary pressures and the still-tight labor market as indicators supporting further rate increases. They point to the possibility that the Fed may need to maintain a hawkish stance to ensure price stability. Their analysis suggests a higher probability of a Fed rate hike in the coming months.

Conversely, other experts argue that the Fed is likely to pause its rate hike cycle, or even begin cutting rates, sooner than anticipated. These analysts highlight the slowing economic growth, moderating inflation, and potential risks to financial stability. They suggest that the lagged effects of previous rate hikes are already being felt throughout the economy. These experts believe that further tightening could trigger a recession. Their assessments reflect a lower probability of a Fed rate hike and a higher probability of a rate cut. The divergence in opinions underscores the inherent uncertainty surrounding the Fed’s future actions and the difficulty in predicting the exact timing and magnitude of any policy changes.

Evaluating the credibility of different sources is crucial when interpreting expert opinions. Established economic research institutions, seasoned market strategists at reputable financial firms, and academics specializing in monetary policy often provide valuable insights. It is important to consider the track record and biases of each source. For example, analysts affiliated with firms that stand to benefit from higher interest rates may present a more hawkish outlook. Similarly, those aligned with entities that would benefit from lower rates might lean dovish. By aggregating a diverse range of perspectives and critically evaluating the underlying analysis, it is possible to form a more balanced understanding of the probability of a Fed rate hike and the potential implications for the economy and financial markets. Accurately gauging the probability of a Fed rate hike necessitates continuous monitoring of expert commentary and a deep understanding of their analytical frameworks.

Understanding the Potential Impacts of Different Rate Hike Scenarios

The potential impacts of different rate hike scenarios are varied and affect numerous sectors. A moderate rate hike, for instance, might have a limited impact on housing. However, aggressive rate increases can significantly cool the housing market. This typically leads to higher mortgage rates and reduced affordability. Consequently, home sales may decline, and price growth could slow or even reverse. The probability of a fed rate hike impacting the housing sector is high, especially for those with adjustable-rate mortgages.

Consumer spending is also sensitive to interest rate changes. Higher rates make borrowing more expensive, discouraging large purchases financed with credit. This could lead to reduced spending on durable goods, such as cars and appliances. The probability of a fed rate hike influencing consumer behavior is a key consideration for retailers. Corporate investment decisions are likewise influenced. Increased borrowing costs can make new projects less appealing, potentially slowing down economic growth. Businesses may postpone expansions or reduce capital expenditures, impacting overall productivity and employment levels. The probability of a fed rate hike affecting corporate profitability is a concern for investors.

Financial markets react significantly to changes in interest rates. Stock markets often experience volatility. Increased rates can lead to lower corporate earnings and reduced investor confidence. Bond markets are directly impacted, with bond yields typically rising as interest rates increase. This can lead to lower bond prices, especially for longer-duration bonds. The currency exchange rates are also affected, as higher interest rates can attract foreign investment, strengthening the domestic currency. However, an aggressive hiking cycle could lead to concerns about economic slowdown, potentially weakening the currency in the long run. Understanding the probability of a fed rate hike and its consequences is essential for investors and businesses alike.

Staying Informed: Tracking Key Indicators and Events

Remaining well-informed about economic indicators, Federal Reserve communications, and market movements is crucial for understanding the potential trajectory of interest rates and, consequently, the probability of a fed rate hike. To effectively gauge the probability of a fed rate hike, consistent monitoring and access to reliable information sources are essential. Staying ahead of the curve involves actively tracking key data releases and understanding how to interpret the signals they provide.

To stay informed, regularly consult official sources such as the Federal Reserve’s website (federalreserve.gov). Here, one can find FOMC meeting minutes, transcripts of speeches by Fed officials (especially the Chair), and press releases. These documents offer direct insights into the Fed’s thinking and policy outlook. Pay close attention to the language used, noting any shifts in tone that could signal a change in the committee’s views on inflation, employment, or economic growth. Economic data releases from the Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis (BEA) are also paramount. The Consumer Price Index (CPI), Producer Price Index (PPI), employment situation report (jobs report), and GDP growth figures are critical indicators that influence the Fed’s decisions. Monitoring these releases provides a real-time view of the economy’s health and its implications for monetary policy. Financial news outlets like the Wall Street Journal, Bloomberg, and Reuters offer in-depth analysis and commentary on these economic developments. The probability of a fed rate hike is often discussed extensively on these platforms.

For a more granular understanding of market expectations, track financial instruments such as Fed Funds futures, Treasury yields, and inflation expectation gauges. These instruments reflect the market’s collective view on the likely path of interest rates. For example, an increase in Fed Funds futures prices may suggest a higher perceived probability of a fed rate hike. Actively following these indicators can provide a valuable perspective that complements the information gathered from official sources and news outlets. Creating a routine to review these sources will ensure you remain current on the factors influencing monetary policy and the likelihood of future rate adjustments. By following these practices, a clearer view of the probability of a fed rate hike can be obtained, and any impacts to different sectors of the economy can be anticipated.