What Drives the Price of Gold?

The price of gold is influenced by a complex array of factors, making it a fascinating and often unpredictable market. At its core, the price of gold is driven by the fundamental principles of supply and demand. When demand for gold is high, and supply is limited, prices tend to rise. Conversely, when demand is low, and supply is abundant, prices tend to fall. However, this simple equation is complicated by a range of other factors that can impact the price of gold.

Central banks’ actions, for instance, play a significant role in shaping the price of gold. By adjusting interest rates and implementing monetary policies, central banks can influence the value of gold. For example, when central banks increase the money supply, it can lead to inflation, which can drive up the price of gold. To stay informed about the price of gold, investors can use online resources such as Yahoo Finance to track gold prices and stay up-to-date with market news and analysis.

Geopolitical events also have a profound impact on the price of gold. During times of economic uncertainty, political instability, or conflict, investors often turn to gold as a safe-haven asset. This increased demand can drive up the price of gold. For instance, during the 2008 financial crisis, the price of gold surged as investors sought refuge in the precious metal. By understanding these complex factors, investors can make more informed investment decisions and navigate the often-volatile gold market.

How to Track Gold Prices with Yahoo Finance

Tracking gold prices is an essential part of making informed investment decisions. With the rise of online financial platforms, it’s easier than ever to stay up-to-date with the latest gold price movements. One of the most popular and user-friendly platforms for tracking gold prices is Yahoo Finance. In this guide, we’ll walk you through the steps to track gold prices with Yahoo Finance, including setting up a watchlist and customizing charts.

To get started, simply navigate to the Yahoo Finance website and search for “gold price” or “GC=F” (the ticker symbol for gold). This will take you to the gold price page, where you can view the current price, as well as historical data and charts. From here, you can set up a watchlist to track the gold price alongside other assets, such as stocks or currencies.

Customizing charts is another key feature of Yahoo Finance. By clicking on the “Charts” tab, you can view a range of different chart types, including line charts, candlestick charts, and more. You can also adjust the time frame, from intraday to long-term, to suit your investment goals. For example, if you’re a short-term trader, you may want to focus on the 1-minute or 1-hour chart. If you’re a long-term investor, you may prefer to view the daily or weekly chart.

By tracking gold prices with Yahoo Finance, you can stay informed about market movements and make more informed investment decisions. Whether you’re a seasoned investor or just starting out, Yahoo Finance provides a range of tools and resources to help you navigate the gold market. So why not get started today and see how tracking gold prices with Yahoo Finance can help you unlock the value of gold?

Understanding Gold Price Charts: A Beginner’s Guide

When it comes to tracking the price of gold, charts are an essential tool for investors. By understanding how to read gold price charts, investors can gain valuable insights into market trends and make more informed investment decisions. In this guide, we’ll take a closer look at the basics of reading gold price charts, including candlestick patterns, support and resistance levels, and moving averages.

Candlestick patterns are a key component of gold price charts. These patterns provide a visual representation of the price action, making it easier to identify trends and patterns. For example, a bullish engulfing pattern may indicate a potential upward trend, while a bearish engulfing pattern may suggest a downward trend. By recognizing these patterns, investors can make more informed decisions about when to buy or sell gold.

Support and resistance levels are another important aspect of gold price charts. These levels represent the prices at which the gold market has historically reacted, either by bouncing back (support) or falling back (resistance). By identifying these levels, investors can anticipate potential price movements and adjust their investment strategies accordingly. For instance, if the price of gold is approaching a strong resistance level, investors may want to consider selling or taking profits.

Moving averages are a popular technical indicator used to analyze gold price charts. These averages provide a smoothed-out view of the price action, helping to identify trends and patterns. For example, a 50-day moving average may indicate a short-term trend, while a 200-day moving average may suggest a long-term trend. By combining moving averages with other technical indicators, investors can gain a more comprehensive understanding of the gold market.

By mastering the basics of reading gold price charts, investors can unlock the value of gold and make more informed investment decisions. Whether you’re a seasoned investor or just starting out, understanding gold price charts is an essential skill for navigating the gold market. And with online resources like Yahoo Finance, tracking the price of gold has never been easier. Simply search for “price of gold Yahoo Finance” to get started.

The Impact of Inflation on Gold Prices

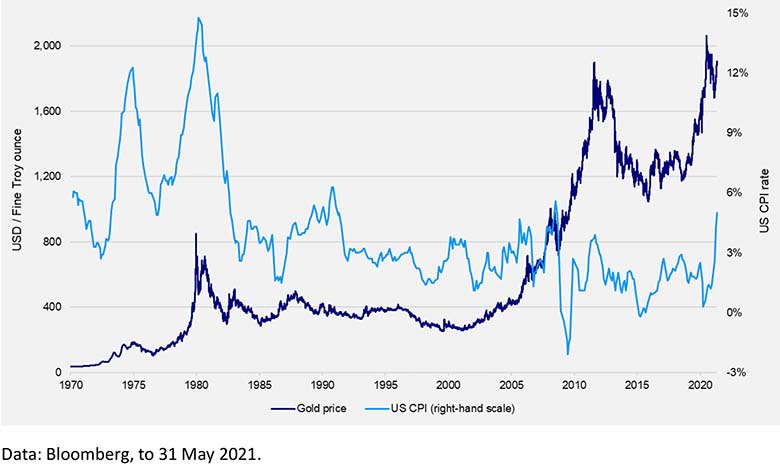

Inflation is a critical factor that affects the price of gold. As a store of value, gold is often seen as a hedge against inflation, which is why its price tends to rise when inflation increases. But what exactly is the relationship between inflation and gold prices, and how do central banks’ monetary policies affect the value of gold?

To understand the impact of inflation on gold prices, it’s essential to recognize that gold is a commodity that is often used as a store of value. When inflation rises, the purchasing power of currencies like the US dollar decreases, making gold a more attractive investment option. As a result, demand for gold increases, driving up its price. This is why gold is often referred to as a “safe-haven” asset, as it provides a hedge against inflation and market volatility.

Central banks’ monetary policies also play a significant role in shaping the price of gold. When central banks print more money, it can lead to inflation, which in turn drives up the price of gold. On the other hand, when central banks raise interest rates to combat inflation, it can make gold a less attractive investment option, causing its price to fall. This is why gold prices are often closely tied to central banks’ monetary policies, particularly in times of economic uncertainty.

For investors, understanding the impact of inflation on gold prices is crucial. By tracking inflation rates and central banks’ monetary policies, investors can make more informed decisions about when to buy or sell gold. And with online resources like Yahoo Finance, tracking the price of gold has never been easier. Simply search for “price of gold Yahoo Finance” to get started.

In conclusion, the impact of inflation on gold prices is a complex and multifaceted topic. By recognizing the relationship between inflation and gold prices, and understanding how central banks’ monetary policies affect the value of gold, investors can make more informed investment decisions and unlock the value of gold.

Gold Price Forecast: Expert Insights and Predictions

When it comes to investing in gold, understanding the future direction of gold prices is crucial. While no one can predict the future with certainty, expert insights and predictions can provide valuable guidance for investors. In this article, we’ll take a closer look at the expert opinions and predictions on gold price trends, including insights from top analysts and market experts.

According to a recent survey by the London Bullion Market Association, gold prices are expected to rise in the coming years, driven by increasing demand from central banks and investors. Many experts believe that gold prices will reach $1,500 per ounce by the end of the year, with some predicting even higher prices.

One of the key factors driving the bullish sentiment on gold is the ongoing trade tensions between the US and China. As the trade war escalates, investors are seeking safe-haven assets like gold to hedge against market volatility. Additionally, the recent decline in interest rates by central banks has increased the appeal of gold as a store of value.

Top analysts from banks like Goldman Sachs and Morgan Stanley are also predicting a rise in gold prices. They cite the increasing demand for gold from emerging markets, particularly China and India, as a key driver of the price increase. Furthermore, the ongoing devaluation of currencies like the US dollar is expected to drive up gold prices in the coming years.

While expert opinions and predictions can provide valuable insights, it’s essential to remember that gold prices can be volatile and subject to sudden changes. To stay ahead of the curve, investors should track gold prices regularly, using online resources like Yahoo Finance to stay informed. Simply search for “price of gold Yahoo Finance” to get the latest prices and news.

By understanding the expert insights and predictions on gold price trends, investors can make more informed investment decisions and unlock the value of gold. Whether you’re a seasoned investor or just starting out, staying informed about gold prices is crucial in today’s volatile market.

Investing in Gold: A Safe-Haven Asset or a Risky Bet?

Gold has long been considered a safe-haven asset, a store of value that investors turn to in times of market volatility and economic uncertainty. But is investing in gold always a wise decision, or are there risks and limitations to consider? In this article, we’ll explore the pros and cons of investing in gold, helping you make an informed decision about whether to add this precious metal to your portfolio.

One of the primary benefits of investing in gold is its potential as a hedge against inflation and market volatility. When inflation rises, the purchasing power of currencies like the US dollar decreases, making gold a more attractive investment option. Additionally, gold tends to perform well during times of economic uncertainty, making it a popular safe-haven asset.

However, investing in gold is not without its risks. One of the main limitations of gold is its lack of yield, meaning that it does not generate interest or dividends like other investments. Additionally, gold prices can be volatile, subject to sudden changes in response to geopolitical events or changes in supply and demand.

Another important consideration is the cost of investing in gold. Physical gold, such as coins or bullion, can be expensive to purchase and store, while gold ETFs and mining stocks come with their own set of risks and fees. Furthermore, investing in gold may not provide the same level of diversification as other investments, such as stocks or bonds.

Despite these risks and limitations, many investors still find gold to be a valuable addition to their portfolios. To get started, investors can track gold prices using online resources like Yahoo Finance, searching for “price of gold Yahoo Finance” to get the latest prices and news. From there, investors can explore different investment options, such as physical gold, gold ETFs, or mining stocks.

Ultimately, whether investing in gold is a safe-haven asset or a risky bet depends on your individual financial goals and risk tolerance. By understanding the pros and cons of investing in gold, you can make an informed decision about whether to add this precious metal to your portfolio.

Gold Price vs. Other Precious Metals: A Comparative Analysis

When it comes to investing in precious metals, gold is often the first metal that comes to mind. However, other precious metals like silver, platinum, and palladium also offer unique investment opportunities. In this article, we’ll compare the price performance of gold with other precious metals, highlighting their unique characteristics and investment opportunities.

One of the key differences between gold and other precious metals is their price volatility. While gold prices tend to be less volatile, silver prices can be more prone to sudden changes in response to changes in industrial demand. Platinum and palladium, on the other hand, are often more expensive than gold due to their rarity and limited supply.

In terms of investment opportunities, each precious metal has its own unique advantages. Gold is often seen as a safe-haven asset, a store of value that investors turn to in times of market volatility. Silver, on the other hand, has a higher industrial demand, making it a more attractive investment option for those looking to capitalize on growth in industries like solar energy and electronics.

Platinum and palladium, often used in catalytic converters for vehicles, offer investment opportunities tied to the automotive industry. Additionally, these metals are often used in jewelry and other luxury items, making them a popular investment option for those looking to capitalize on consumer demand.

To track the prices of these precious metals, investors can use online resources like Yahoo Finance, searching for “price of gold Yahoo Finance” or “price of silver Yahoo Finance” to get the latest prices and news. By comparing the price performance of gold with other precious metals, investors can make more informed investment decisions and diversify their portfolios.

Ultimately, the choice between investing in gold, silver, platinum, or palladium depends on your individual financial goals and risk tolerance. By understanding the unique characteristics and investment opportunities of each precious metal, you can make a more informed decision about which metal to add to your portfolio.

Staying Ahead of the Curve: Gold Price News and Updates

Staying informed about gold price news and updates is crucial for investors looking to make informed investment decisions. With the gold market constantly evolving, it’s essential to have access to reliable sources of information to stay ahead of the curve.

One of the top sources for gold market analysis and news is Yahoo Finance, where investors can track the latest gold prices and news by searching for “price of gold Yahoo Finance”. Additionally, websites like Kitco, GoldPrice.org, and Bloomberg provide up-to-date gold price charts, news, and analysis.

Investors can also stay informed about gold price news and updates by following top gold market experts and analysts on social media platforms like Twitter and LinkedIn. Many experts share their insights and predictions on gold price trends, providing valuable information for investors.

Another way to stay informed is by setting up customized news alerts on gold prices and market trends. This can be done through online news aggregators like Google News or through mobile apps like CNBC or Bloomberg. By receiving timely updates on gold price news and updates, investors can make more informed investment decisions and stay ahead of the curve.

Furthermore, investors can also stay informed by reading gold market reports and analysis from top financial institutions like Goldman Sachs, JP Morgan, and Bank of America. These reports provide in-depth analysis of gold price trends and market forecasts, helping investors make more informed investment decisions.

Ultimately, staying informed about gold price news and updates is crucial for investors looking to make informed investment decisions. By leveraging top sources of information and staying up-to-date on the latest gold market trends, investors can stay ahead of the curve and make the most of their investment opportunities.