Understanding the Basics of Bond Pricing

Bond pricing is a fundamental concept in finance that involves calculating the value of a bond. Bonds are debt securities issued by borrowers to raise capital from investors, and their prices are influenced by various factors such as face value, coupon rate, yield to maturity, and time to maturity. In finance, accurate bond pricing is crucial for investors, issuers, and analysts to make informed decisions. Excel, a powerful tool, plays a significant role in simplifying complex bond pricing calculations, making it an essential skill for finance professionals to master. The price of bond formula in Excel is a critical component of bond pricing, and understanding its components is vital for accurate calculations. There are different types of bonds, including government bonds, corporate bonds, and municipal bonds, each with its unique characteristics. Government bonds, for instance, are backed by the credit of the government, while corporate bonds are issued by companies to raise capital. Municipal bonds, on the other hand, are issued by local governments and other public entities to finance infrastructure projects. Understanding the basics of bond pricing and its importance in finance is essential for anyone looking to succeed in the financial industry.

How to Calculate Bond Price Using Excel Formulas

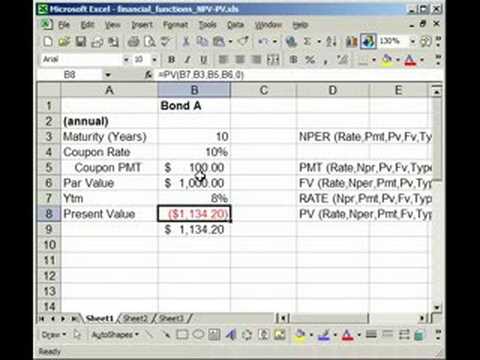

Calculating the price of a bond using Excel formulas is a crucial skill for finance professionals. The price of bond formula in Excel is a complex calculation that involves several variables, including the face value, coupon rate, yield to maturity, and time to maturity. To calculate the bond price, follow these steps:

Step 1: Determine the face value, coupon rate, yield to maturity, and time to maturity of the bond.

Step 2: Set up an Excel worksheet with the following columns: Period, Cash Flow, Discount Factor, and Present Value.

Step 3: Calculate the cash flow for each period using the formula: Cash Flow = Face Value x Coupon Rate.

Step 4: Calculate the discount factor for each period using the formula: Discount Factor = 1 / (1 + Yield to Maturity)^Period.

Step 5: Calculate the present value of each cash flow using the formula: Present Value = Cash Flow x Discount Factor.

Step 6: Calculate the bond price by summing up the present values of all cash flows.

For example, suppose we want to calculate the price of a 10-year bond with a face value of $1,000, a coupon rate of 5%, and a yield to maturity of 4%. The Excel formula for the bond price would be:

=SUM(PV(0.04,10,{1000,1000,1000,1000,1000,1000,1000,1000,1000,1000}))

This formula uses the PV function in Excel to calculate the present value of each cash flow and then sums up the present values to get the bond price.

By following these steps and using the price of bond formula in Excel, finance professionals can accurately calculate the price of a bond and make informed investment decisions.

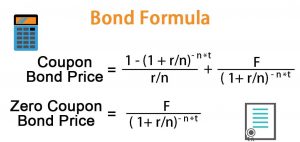

The Price of Bond Formula: Breaking Down the Components

The price of bond formula in Excel is a complex calculation that involves several variables. To accurately calculate the price of a bond, it’s essential to understand each component of the formula. In this section, we’ll break down the price of bond formula into its components and explain each one in detail.

Face Value (FV): The face value, also known as the principal, is the amount borrowed by the issuer and repaid to the investor at maturity. It’s the nominal value of the bond and is typically stated on the bond certificate.

Coupon Rate (CR): The coupon rate is the interest rate paid periodically to the investor, usually semi-annually or annually. It’s expressed as a decimal value and is a percentage of the face value.

Yield to Maturity (YTM): The yield to maturity is the total return on investment, including the coupon payments and the capital gain or loss from the bond’s sale. It’s the discount rate used to calculate the present value of the bond’s cash flows.

Time to Maturity (T): The time to maturity is the number of years until the bond reaches its maturity date. It’s used to calculate the present value of the bond’s cash flows.

The price of bond formula in Excel combines these components to calculate the present value of the bond’s cash flows. The formula is:

Price of Bond = Σ (CFt / (1 + YTM)^t)

Where CFt is the cash flow at time t, and YTM is the yield to maturity.

By understanding each component of the price of bond formula, finance professionals can accurately calculate the price of a bond and make informed investment decisions. In the next section, we’ll explore how to use Excel functions to calculate bond prices.

Using Excel Functions for Bond Pricing: PV, FV, and XNPV

Excel provides a range of functions that can be used to calculate bond prices, making it easier to analyze and manage bond portfolios. In this section, we’ll explore three essential Excel functions for bond pricing: PV, FV, and XNPV.

PV Function: The PV function in Excel calculates the present value of a series of cash flows. It’s commonly used to calculate the price of a bond, as it takes into account the coupon rate, yield to maturity, and time to maturity. The syntax for the PV function is:

=PV(rate, nper, pmt, [fv], [type])

Where rate is the discount rate, nper is the number of periods, pmt is the payment, fv is the future value, and type is the payment type.

FV Function: The FV function in Excel calculates the future value of a series of cash flows. It’s used to calculate the future value of a bond, taking into account the coupon rate, yield to maturity, and time to maturity. The syntax for the FV function is:

=FV(rate, nper, pmt, [pv], [type])

Where rate is the discount rate, nper is the number of periods, pmt is the payment, pv is the present value, and type is the payment type.

XNPV Function: The XNPV function in Excel calculates the present value of a series of cash flows that are not periodic. It’s commonly used to calculate the price of a bond with non-periodic cash flows, such as a bond with a sinking fund provision. The syntax for the XNPV function is:

=XNPV(rate, dates, cash flows)

Where rate is the discount rate, dates is the array of dates, and cash flows is the array of cash flows.

By using these Excel functions, finance professionals can quickly and accurately calculate bond prices, making it easier to analyze and manage bond portfolios. In the next section, we’ll explore real-world applications of bond pricing in Excel.

Real-World Applications of Bond Pricing in Excel

Bond pricing in Excel has numerous real-world applications in finance, making it an essential skill for finance professionals. In this section, we’ll explore some examples of how bond pricing in Excel can be used in practice.

Calculating Bond Yields: One of the most common applications of bond pricing in Excel is calculating bond yields. By using the price of bond formula in Excel, finance professionals can calculate the yield to maturity of a bond, which is essential for investment decisions.

Determining Bond Values: Bond pricing in Excel can also be used to determine the value of a bond. By calculating the present value of a bond’s cash flows, finance professionals can determine the bond’s value and make informed investment decisions.

Analyzing Bond Portfolios: Bond pricing in Excel can be used to analyze bond portfolios, which is essential for portfolio managers and investment analysts. By calculating the price of bond formula in Excel, finance professionals can analyze the performance of a bond portfolio and make informed investment decisions.

Scenario Analysis: Bond pricing in Excel can also be used for scenario analysis, which involves analyzing the impact of different scenarios on bond prices. By using the price of bond formula in Excel, finance professionals can analyze the impact of changes in interest rates, credit ratings, and other factors on bond prices.

Risk Management: Bond pricing in Excel can also be used for risk management, which involves identifying and managing risks associated with bond investments. By calculating the price of bond formula in Excel, finance professionals can identify potential risks and take steps to mitigate them.

By applying bond pricing in Excel to real-world scenarios, finance professionals can make informed investment decisions, manage risk, and optimize portfolio performance. In the next section, we’ll explore common errors that can occur in bond pricing calculations and provide troubleshooting tips to resolve them.

Troubleshooting Common Errors in Bond Pricing Calculations

When calculating bond prices in Excel, errors can occur due to various reasons, including incorrect formula construction, data entry mistakes, and misunderstanding of bond pricing concepts. In this section, we’ll identify common errors that can occur in bond pricing calculations and provide troubleshooting tips to resolve them.

Error 1: Incorrect Formula Construction: One of the most common errors in bond pricing calculations is incorrect formula construction. This can occur when the formula is not correctly structured or when the wrong functions are used. To troubleshoot this error, review the formula construction and ensure that it is correct. Check the Excel documentation or online resources for guidance on constructing the correct formula.

Error 2: Data Entry Mistakes: Data entry mistakes can occur when incorrect data is entered into the Excel spreadsheet. This can include incorrect face values, coupon rates, or yield to maturity values. To troubleshoot this error, review the data entry and ensure that it is accurate. Double-check the data against the bond’s documentation or online resources.

Error 3: Misunderstanding of Bond Pricing Concepts: Misunderstanding of bond pricing concepts can lead to errors in bond pricing calculations. This can occur when the concepts of face value, coupon rate, and yield to maturity are not fully understood. To troubleshoot this error, review the bond pricing concepts and ensure that they are fully understood. Consult online resources or financial textbooks for guidance.

Error 4: Incorrect Time to Maturity: Incorrect time to maturity can lead to errors in bond pricing calculations. This can occur when the time to maturity is not correctly calculated or when it is not updated correctly. To troubleshoot this error, review the time to maturity calculation and ensure that it is correct. Check the bond’s documentation or online resources for guidance.

By identifying and troubleshooting common errors in bond pricing calculations, finance professionals can ensure accurate and reliable results. In the next section, we’ll explore best practices for bond pricing in Excel, including tips on data organization, formula construction, and error checking.

Best Practices for Bond Pricing in Excel: Tips and Tricks

When it comes to bond pricing in Excel, following best practices can ensure accurate and reliable results. In this section, we’ll provide tips and tricks for data organization, formula construction, and error checking to help finance professionals master bond pricing in Excel.

Data Organization: Organizing data correctly is essential for accurate bond pricing calculations. Use separate columns for each data input, such as face value, coupon rate, yield to maturity, and time to maturity. This will make it easier to construct formulas and reduce errors.

Formula Construction: When constructing formulas, use the price of bond formula Excel to ensure accuracy. Break down the formula into its components, including face value, coupon rate, yield to maturity, and time to maturity. Use Excel functions such as PV, FV, and XNPV to simplify the calculation process.

Error Checking: Error checking is crucial to ensure accurate results. Check formulas for errors, and review data entry to ensure accuracy. Use Excel’s built-in error checking tools, such as the IFERROR function, to identify and resolve errors.

Use of Excel Templates: Using Excel templates can simplify the bond pricing calculation process. Create a template with pre-built formulas and formats to ensure consistency and accuracy. This will also reduce the risk of errors and save time.

Documentation: Documenting bond pricing calculations is essential for transparency and audit purposes. Use Excel’s commenting feature to document formulas and assumptions, and provide a clear explanation of the calculation process.

By following these best practices, finance professionals can ensure accurate and reliable bond pricing calculations in Excel. In the next section, we’ll summarize the importance of mastering bond pricing in Excel and how it can contribute to financial success.

Conclusion: Mastering Bond Pricing in Excel for Financial Success

Mastering bond pricing in Excel is a crucial skill for finance professionals, enabling them to make informed investment decisions and optimize portfolio performance. By following the step-by-step guide outlined in this article, readers can confidently calculate bond prices using Excel formulas, including the price of bond formula Excel, and apply their knowledge in real-world applications.

The importance of accurate bond pricing cannot be overstated, as it directly impacts investment returns and risk management. By mastering bond pricing in Excel, finance professionals can gain a competitive edge in the market, make data-driven decisions, and drive business growth.

In conclusion, this comprehensive guide has provided a thorough understanding of bond pricing in Excel, from the basics of bond pricing to advanced techniques using Excel functions. By practicing and applying their knowledge, readers can unlock the full potential of bond pricing in Excel and achieve financial success.

Remember, mastering bond pricing in Excel requires patience, practice, and dedication. With this guide, readers have the tools and knowledge to take their skills to the next level and make a meaningful impact in the world of finance.