What is a Callable Bond and How Does it Work?

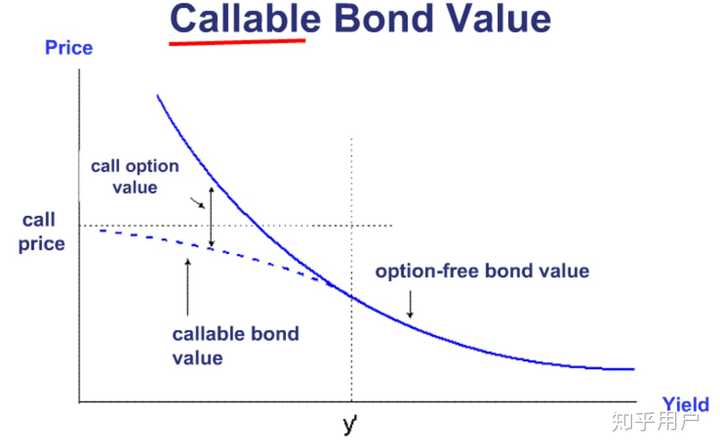

A callable bond is a type of bond that gives the issuer the right to redeem the bond at a specific price before its maturity date. This unique feature allows the issuer to take advantage of favorable market conditions, such as lower interest rates, to refinance their debt at a lower cost. Callable bonds are often used by corporations and governments to manage their debt and optimize their financing strategies.

In a callable bond, the issuer sets a call price, which is the price at which the bond can be redeemed. The call price is usually higher than the bond’s face value, providing an incentive for the issuer to redeem the bond early. The bond’s indenture, a legal agreement between the issuer and the bondholders, outlines the terms and conditions of the callable feature.

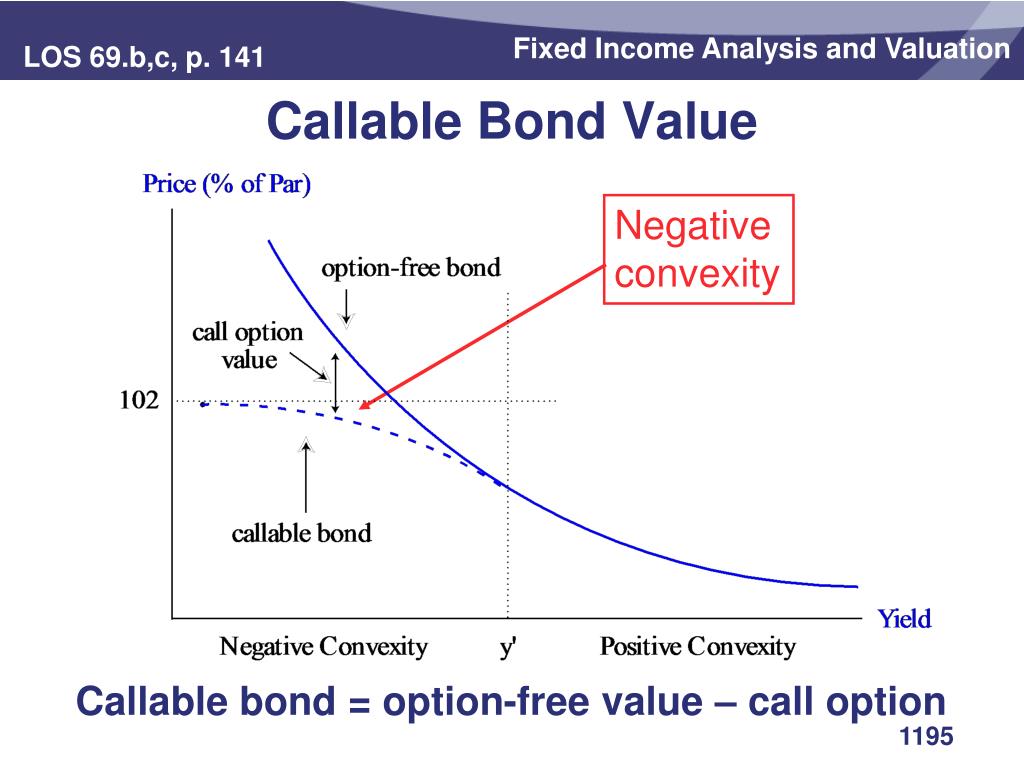

Understanding the mechanics of callable bonds is essential for investors seeking to capitalize on their unique features. By grasping the concepts of callable bonds, investors can make informed decisions about their investment portfolios and optimize their returns. The price of a callable bond is influenced by various factors, including interest rates, credit ratings, and market conditions, which will be discussed in the following sections.

Understanding the Factors that Influence Callable Bond Prices

The price of a callable bond is influenced by a complex array of factors, including interest rates, credit ratings, and market conditions. Understanding how these factors interact is crucial for investors seeking to make informed decisions about their investment portfolios.

Interest rates play a significant role in determining the price of a callable bond. When interest rates fall, the issuer may exercise their call option, redeeming the bond at a lower interest rate. This can result in a lower return on investment for the bondholder. Conversely, when interest rates rise, the issuer may be less likely to call the bond, resulting in a higher return on investment for the bondholder.

Credit ratings also have a significant impact on the price of a callable bond. A higher credit rating indicates a lower risk of default, which can result in a lower yield and a higher price for the bond. Conversely, a lower credit rating indicates a higher risk of default, which can result in a higher yield and a lower price for the bond.

Market conditions, such as supply and demand, also influence the price of a callable bond. In a market with high demand for callable bonds, prices may be driven up, resulting in a lower yield for investors. Conversely, in a market with low demand, prices may be driven down, resulting in a higher yield for investors.

By understanding how these factors interact, investors can make informed decisions about their investment portfolios and optimize their returns. In the following sections, we will provide a step-by-step guide on how to calculate the price of a callable bond, including the formulas and variables involved.

How to Calculate the Price of a Callable Bond: A Step-by-Step Guide

Calculating the price of a callable bond involves a series of complex steps, requiring a deep understanding of financial mathematics and bond valuation principles. In this section, we will provide a detailed, step-by-step guide on how to calculate the price of a callable bond, including the formulas and variables involved.

Step 1: Determine the Bond’s Characteristics

The first step in calculating the price of a callable bond is to determine the bond’s characteristics, including its face value, coupon rate, maturity date, and call price. These characteristics are essential in determining the bond’s cash flows and ultimately, its price.

Step 2: Calculate the Bond’s Cash Flows

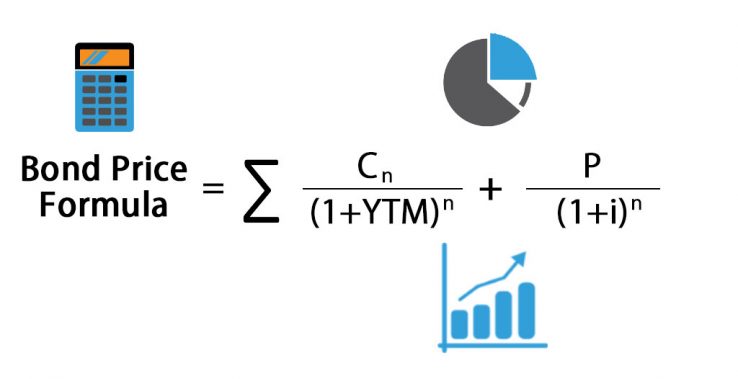

The next step is to calculate the bond’s cash flows, including the coupon payments and principal repayment. The cash flows can be calculated using the following formula:

Cash Flow = Coupon Rate x Face Value

Step 3: Determine the Discount Rate

The discount rate is a critical component in calculating the price of a callable bond. The discount rate can be determined using the yield curve, which reflects the market’s expectations of future interest rates.

Step 4: Calculate the Present Value of Cash Flows

Using the discount rate, calculate the present value of each cash flow using the following formula:

PV = CF / (1 + Discount Rate)^t

where PV is the present value, CF is the cash flow, and t is the time period.

Step 5: Calculate the Price of the Callable Bond

The final step is to calculate the price of the callable bond by summing the present values of each cash flow. The price of the callable bond can be calculated using the following formula:

Price of Callable Bond = Σ PV

where Σ PV is the sum of the present values of each cash flow.

Example:

Suppose we have a callable bond with a face value of $1,000, a coupon rate of 5%, and a maturity date of 5 years. The bond can be called at a price of $1,050 after 3 years. Using the steps outlined above, we can calculate the price of the callable bond as follows:

Cash Flow = 5% x $1,000 = $50

Discount Rate = 4% (based on the yield curve)

PV = $50 / (1 + 0.04)^1 = $48.08

PV = $50 / (1 + 0.04)^2 = $46.34

PV = $50 / (1 + 0.04)^3 = $44.73

PV = $1,050 / (1 + 0.04)^3 = $944.91

Price of Callable Bond = $48.08 + $46.34 + $44.73 + $944.91 = $1,034.06

By following these steps, investors can calculate the price of a callable bond and make informed investment decisions. In the next section, we will discuss the role of yield to call and yield to maturity in callable bond pricing.

The Role of Yield to Call and Yield to Maturity in Callable Bond Pricing

When evaluating the price of a callable bond, investors must consider two critical yields: yield to call and yield to maturity. These yields play a crucial role in determining the bond’s value and are essential for making informed investment decisions.

Yield to Call (YTC)

The yield to call represents the total return an investor can expect to earn if the bond is called by the issuer at a specific price before maturity. It takes into account the bond’s coupon rate, call price, and time to call. The yield to call is calculated using the following formula:

YTC = (Coupon Rate x Face Value + (Call Price – Face Value) / Time to Call) / Face Value

Yield to Maturity (YTM)

The yield to maturity, on the other hand, represents the total return an investor can expect to earn if the bond is held until maturity. It takes into account the bond’s coupon rate, face value, and maturity date. The yield to maturity is calculated using the following formula:

YTM = (Coupon Rate x Face Value + (Face Value – Present Value) / Time to Maturity) / Face Value

Importance of Considering YTC and YTM

When evaluating the price of a callable bond, investors must consider both the yield to call and yield to maturity. This is because the issuer may choose to call the bond at a specific price before maturity, affecting the bond’s value. By considering both yields, investors can make a more informed decision about the bond’s potential return and risk.

For example, suppose we have a callable bond with a face value of $1,000, a coupon rate of 5%, and a maturity date of 5 years. The bond can be called at a price of $1,050 after 3 years. Using the formulas above, we can calculate the yield to call and yield to maturity as follows:

YTC = (5% x $1,000 + ($1,050 – $1,000) / 3) / $1,000 = 5.33%

YTM = (5% x $1,000 + ($1,000 – $944.91) / 5) / $1,000 = 5.51%

In this example, the yield to call is 5.33%, and the yield to maturity is 5.51%. By considering both yields, investors can determine the bond’s potential return and risk, making a more informed investment decision.

In the next section, we will discuss common pricing models used for callable bonds, including the binomial model and the finite difference method.

Callable Bond Pricing Models: An Overview

Callable bond pricing models are essential tools for investors and analysts seeking to determine the price of a callable bond. These models take into account the complex interactions between the bond’s features, market conditions, and issuer characteristics to estimate the bond’s value. In this section, we will introduce two common pricing models used for callable bonds: the binomial model and the finite difference method.

Binomial Model

The binomial model is a popular pricing model for callable bonds. It assumes that the bond’s price can move up or down by a certain amount over a short period, creating a binomial tree of possible prices. The model then calculates the expected present value of the bond’s cash flows at each node, taking into account the probability of the bond being called at each point. The binomial model is useful for pricing callable bonds with simple call features, but it can become computationally intensive for more complex bonds.

Finite Difference Method

The finite difference method is a numerical approach to pricing callable bonds. It involves discretizing the bond’s price and time to maturity, creating a grid of possible prices and times. The model then solves a set of partial differential equations to estimate the bond’s price at each point on the grid. The finite difference method is more flexible than the binomial model, allowing for the pricing of callable bonds with complex call features and multiple call dates.

Strengths and Limitations

Both the binomial model and the finite difference method have their strengths and limitations. The binomial model is easy to implement and provides a clear visual representation of the bond’s price dynamics. However, it can become computationally intensive for complex bonds and may not accurately capture the bond’s price behavior. The finite difference method is more flexible and can handle complex call features, but it requires significant computational resources and may be difficult to implement for non-experts.

In the next section, we will provide real-world examples of callable bond issuances, including the bond’s terms, pricing, and performance. We will analyze the factors that influenced the bond’s price and yield, providing valuable insights for investors and analysts.

Real-World Examples of Callable Bond Pricing in Action

Callable bonds are widely used in various industries, and their pricing can have a significant impact on investors’ returns. In this section, we will examine real-world examples of callable bond issuances, analyzing the factors that influenced their price and yield.

Example 1: XYZ Corporation’s 5-Year Callable Bond

In 2020, XYZ Corporation issued a 5-year callable bond with a face value of $1,000, a coupon rate of 4%, and a call price of $1,050. The bond was callable after 3 years, and the issuer had the right to redeem the bond at the call price. At the time of issuance, the market interest rate was 3.5%, and the credit rating of XYZ Corporation was A-.

Using a callable bond pricing model, we can estimate the price of the bond at issuance to be around $985. The yield to call was approximately 4.25%, and the yield to maturity was around 4.5%. The bond’s price was influenced by the market interest rate, credit rating, and call feature.

Example 2: ABC Bank’s 10-Year Callable Bond

In 2018, ABC Bank issued a 10-year callable bond with a face value of $1,000, a coupon rate of 5%, and a call price of $1,100. The bond was callable after 5 years, and the issuer had the right to redeem the bond at the call price. At the time of issuance, the market interest rate was 4%, and the credit rating of ABC Bank was AA-.

Using a callable bond pricing model, we can estimate the price of the bond at issuance to be around $1,020. The yield to call was approximately 5.15%, and the yield to maturity was around 5.5%. The bond’s price was influenced by the market interest rate, credit rating, and call feature.

Analysis

In both examples, the price of the callable bond was influenced by a combination of factors, including the market interest rate, credit rating, and call feature. The yield to call and yield to maturity also played a crucial role in determining the bond’s value. By analyzing these factors, investors can gain a better understanding of the price of a callable bond and make more informed investment decisions.

In the next section, we will provide practical advice for investors on how to approach callable bond pricing, including tips on risk management, diversification, and yield optimization.

Callable Bond Pricing Strategies for Investors

When it comes to investing in callable bonds, a well-thought-out strategy is essential to maximize returns and minimize risks. In this section, we will provide practical advice for investors on how to approach callable bond pricing, including tips on risk management, diversification, and yield optimization.

Risk Management

Callable bonds come with unique risks, such as the risk of the issuer calling the bond at a lower price than the market value. To mitigate this risk, investors can diversify their portfolio by investing in multiple callable bonds with different issuers, maturities, and call features. This can help reduce the impact of a single bond’s price fluctuations on the overall portfolio.

Diversification

Diversification is a key strategy for investors seeking to minimize risk and maximize returns. By investing in a mix of callable bonds with different characteristics, investors can reduce their exposure to specific risks and increase the potential for returns. For example, investors can diversify their portfolio by investing in callable bonds with different credit ratings, industries, or maturities.

Yield Optimization

Yield optimization is a critical aspect of callable bond investing. Investors can optimize their yields by carefully selecting callable bonds with attractive yields to call and yields to maturity. By analyzing the bond’s terms, credit rating, and market conditions, investors can identify opportunities to maximize their returns while minimizing risks.

Callable Bond Ladders

A callable bond ladder is a strategy that involves investing in multiple callable bonds with staggered maturities. This approach can help investors manage their cash flow and reduce the impact of interest rate changes on their portfolio. By investing in a ladder of callable bonds, investors can create a steady stream of income and minimize the risk of reinvestment at lower interest rates.

Active Management

Active management is a strategy that involves regularly monitoring and adjusting the portfolio to respond to changes in market conditions and interest rates. By actively managing their callable bond portfolio, investors can take advantage of opportunities to optimize their yields and minimize risks.

In the next section, we will discuss the impact of market volatility on callable bond prices and provide guidance on how investors can navigate these fluctuations to achieve their investment goals.

Navigating Callable Bond Market Volatility: Best Practices

Market volatility can significantly impact the price of a callable bond, making it essential for investors to understand how to navigate these fluctuations to achieve their investment goals. In this section, we will discuss the impact of market volatility on callable bond prices and provide guidance on how investors can navigate these fluctuations.

Understanding Market Volatility

Market volatility refers to the fluctuations in the market value of a callable bond due to changes in interest rates, credit ratings, and market conditions. These fluctuations can result in changes to the bond’s price, yield, and overall value.

Impact on Callable Bond Prices

Market volatility can have a significant impact on the price of a callable bond. For example, an increase in interest rates can lead to a decrease in the bond’s price, while a decrease in interest rates can lead to an increase in the bond’s price. Similarly, changes in credit ratings and market conditions can also affect the bond’s price.

Best Practices for Navigating Market Volatility

To navigate market volatility, investors can employ several best practices, including:

Diversification

Diversifying a portfolio by investing in multiple callable bonds with different issuers, maturities, and call features can help reduce the impact of market volatility on the overall portfolio.

Active Management

Actively managing a callable bond portfolio by regularly monitoring and adjusting the portfolio to respond to changes in market conditions and interest rates can help investors optimize their yields and minimize risks.

Yield Curve Analysis

Analyzing the yield curve can help investors understand the relationship between interest rates and bond prices, enabling them to make more informed investment decisions.

Callable Bond Ladders

Investing in a ladder of callable bonds with staggered maturities can help investors manage their cash flow and reduce the impact of interest rate changes on their portfolio.

By understanding the impact of market volatility on callable bond prices and employing these best practices, investors can navigate these fluctuations to achieve their investment goals and optimize the price of a callable bond.