What is a Growing Annuity and Why is it Important?

A growing annuity is a financial product that provides a steady income stream that increases over time, typically to keep pace with inflation. Unlike fixed annuities, which offer a fixed payment amount, growing annuities offer a payment amount that grows at a specified rate. This makes them an attractive option for individuals seeking to maintain their purchasing power in retirement or achieve long-term financial goals. The benefits of growing annuities are numerous, including providing a predictable income stream, adapting to inflation, and offering a sense of financial security. By understanding the concept of growing annuities, individuals can make informed decisions about their investments and create a more sustainable financial future.

How to Calculate the Present Value of a Growing Annuity

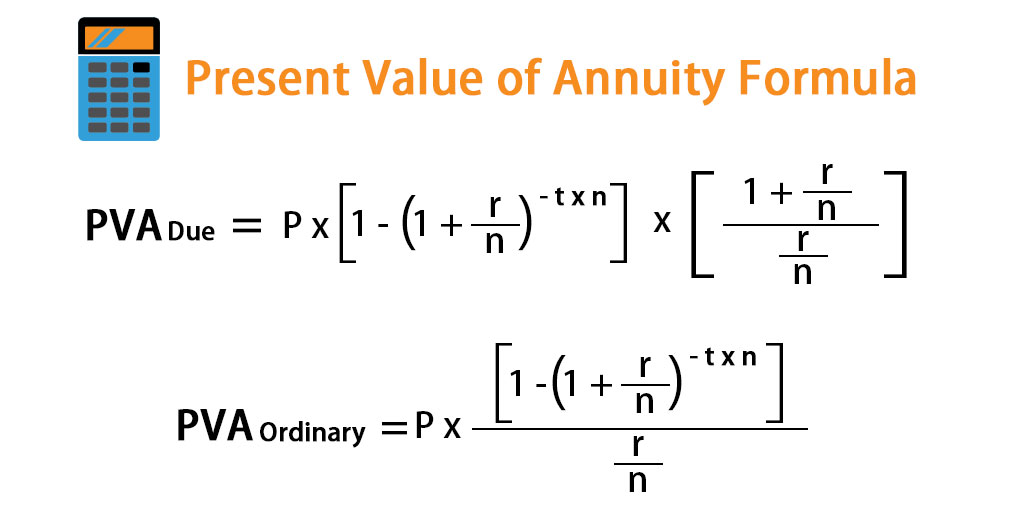

The present value of a growing annuity formula is a crucial concept in financial planning, as it enables individuals to calculate the current value of future cash flows. The formula involves several variables, including the periodic payment, growth rate, discount rate, and number of periods. To calculate the present value of a growing annuity, one must understand how to plug in these variables correctly. The present value of a growing annuity formula is PV = PMT x [(1 – (1 + g)^(-n)) / (r – g)], where PV is the present value, PMT is the periodic payment, g is the growth rate, r is the discount rate, and n is the number of periods. Understanding this formula is essential in financial decision-making, as it helps individuals determine the feasibility of investments and make informed decisions about their financial future.

Understanding the Formula: Breaking Down the Variables

Delving deeper into the present value of a growing annuity formula, it’s essential to understand each variable involved in the calculation. The formula, PV = PMT x [(1 – (1 + g)^(-n)) / (r – g)], consists of four primary variables: periodic payment (PMT), growth rate (g), discount rate (r), and number of periods (n). The periodic payment represents the regular income stream provided by the annuity, while the growth rate reflects the annual increase in payment amount. The discount

Real-World Applications of Growing Annuities

Growing annuities have numerous practical applications in various aspects of financial planning. One of the most significant uses of growing annuities is in retirement planning, where they provide a steady income stream that adapts to inflation, ensuring that retirees maintain their purchasing power over time. Additionally, growing annuities are often used in pension funds to provide a predictable income stream for beneficiaries. Insurance policies also utilize growing annuities to offer policyholders a guaranteed income stream in the event of death or disability. Furthermore, growing annuities can be used in investment portfolios to diversify risk and generate a predictable return. For instance, an investor may use a growing annuity to provide a steady income stream while also investing in stocks or real estate to generate higher returns. By understanding the present value of growing annuity formula, individuals can make informed decisions about their financial future and create a sustainable income stream that meets their long-term goals.

Common Mistakes to Avoid When Calculating Present Value

When calculating the present value of a growing annuity, it’s essential to avoid common mistakes that can lead to inaccurate results. One of the most frequent errors is inputting incorrect values for the variables involved in the present value of growing annuity formula. For instance, using an incorrect growth rate or discount rate can significantly impact the calculated present value. Another common mistake is misunderstanding the formula itself, such as incorrectly applying the growth rate or discount rate to the periodic payment. To avoid these mistakes, it’s crucial to carefully review the input values and ensure a thorough understanding of the present value of growing annuity formula. Additionally, using online calculators or spreadsheet software can help simplify the calculation process and reduce the likelihood of errors. By being aware of these common mistakes and taking steps to avoid them, individuals can ensure accurate calculations and make informed financial decisions.

Using Online Calculators and Spreadsheets to Simplify the Process

Calculating the present value of a growing annuity can be a complex and time-consuming task, especially for those without a strong mathematical background. Fortunately, there are various online tools and spreadsheet software available that can simplify the calculation process and reduce the likelihood of errors. Financial calculators, such as Texas Instruments or Hewlett-Packard calculators, offer built-in functions for calculating the present value of a growing annuity. These calculators can save time and effort by automating the calculation process. Additionally, spreadsheet software like Microsoft Excel or Google Sheets can be used to create custom templates for calculating the present value of a growing annuity. These templates can be easily modified to accommodate different scenarios and variables, making it easier to compare and analyze different growing annuity options. By leveraging these online tools and spreadsheet software, individuals can quickly and accurately calculate the present value of a growing annuity, enabling them to make informed financial decisions. For instance, using an online calculator or spreadsheet software can help individuals determine the optimal growing annuity strategy for their retirement planning or investment portfolio. By understanding how to effectively use these tools, individuals can unlock the full potential of growing annuities and achieve their long-term financial goals.

Advanced Topics: Handling Complex Growing Annuity Scenarios

While the present value of a growing annuity formula provides a solid foundation for understanding growing annuities, there are more advanced topics to explore when dealing with complex scenarios. One such scenario is handling irregular payment periods, where the periodic payments are not uniform or do not occur at regular intervals. In such cases, the present value of a growing annuity formula needs to be modified to accommodate these irregularities. Another advanced topic is varying growth rates, where the growth rate of the annuity changes over time. This requires a more nuanced approach to calculating the present value, taking into account the different growth rates and their impact on the annuity’s value. Additionally, multiple annuities can be used to create a more diversified investment portfolio, but this introduces additional complexity in calculating the present value. To tackle these complex scenarios, it’s essential to have a deep understanding of the present value of growing annuity formula and its underlying variables. By mastering these advanced topics, individuals can unlock the full potential of growing annuities and make more informed financial decisions. For instance, understanding how to handle irregular payment periods can help individuals optimize their retirement planning strategy, while grasping varying growth rates can enable them to create a more resilient investment portfolio. By exploring these advanced topics, individuals can gain a more comprehensive understanding of growing annuities and achieve their long-term financial goals.

Conclusion: Mastering the Present Value of Growing Annuities

In conclusion, understanding the present value of growing annuities is a crucial aspect of financial planning and decision-making. By grasping the present value of growing annuity formula and its underlying variables, individuals can make informed decisions about their investments and retirement planning. This comprehensive guide has provided a thorough exploration of growing annuities, from the basics to advanced topics. By applying the knowledge gained from this article, individuals can unlock the full potential of growing annuities and achieve their long-term financial goals. Whether it’s optimizing retirement income, creating a diversified investment portfolio, or adapting to inflation, growing annuities offer a powerful tool for securing financial stability. By mastering the present value of growing annuities, individuals can take control of their financial future and make informed decisions that will benefit them for years to come. Remember, understanding the present value of growing annuity formula is key to unlocking the power of growing annuities, and with this knowledge, individuals can create a brighter financial future.

+for+evaluating+growing+annuities+can+be+derived+intuitively+from+the+growing+perpetuity+model..jpg)