What Are Prepaid Expenses and Why Do They Matter?

In the realm of financial management, prepaid expenses play a vital role in a company’s overall financial health. A prepaid expense is a payment made by a business for goods or services that have not yet been received. These expenses are considered prepaid because they are paid in advance of receiving the goods or services. Prepaid expenses are an asset because they represent a future benefit to the business.

Prepaid expenses differ from other types of expenses, such as accrued expenses or accounts payable, in that they are paid in advance. This distinction is critical, as it affects how these expenses are recorded and reported in financial statements. Accurate accounting for prepaid expenses is essential to maintain a clear picture of a company’s financial position.

The importance of prepaid expenses lies in their ability to provide a snapshot of a company’s financial health. By accurately accounting for prepaid expenses, businesses can gain insights into their cash flow, identify areas for cost reduction, and make informed decisions about investments and funding. In essence, prepaid expenses are an asset that provides value to the business over time.

The Asset Advantage: How Prepaid Expenses Benefit Your Business

Treating prepaid expenses as assets can have a significant impact on a company’s financial management and accounting. By recognizing prepaid expenses as assets, businesses can unlock a range of benefits that improve their overall financial health. Prepaid expenses are an asset because they represent a future benefit to the business, providing value over time.

One of the primary advantages of treating prepaid expenses as assets is improved cash flow management. By accurately accounting for prepaid expenses, businesses can better understand their cash flow and make informed decisions about investments and funding. This, in turn, can reduce financial risk and enhance financial reporting.

Additionally, recognizing prepaid expenses as assets can provide a more accurate picture of a company’s financial position. This is because prepaid expenses are not immediately expensed, but rather amortized over time. This approach provides a more nuanced understanding of a company’s financial performance, allowing for more informed decision-making.

Furthermore, treating prepaid expenses as assets can also enhance financial reporting. By accurately accounting for prepaid expenses, businesses can provide stakeholders with a clearer understanding of their financial position and performance. This, in turn, can increase transparency and build trust with investors and other stakeholders.

How to Identify and Record Prepaid Expenses Correctly

Identifying and recording prepaid expenses accurately is crucial for effective financial management and accounting. Prepaid expenses are an asset because they represent a future benefit to the business, providing value over time. To ensure accurate accounting, it’s essential to understand what constitutes a prepaid expense and how to record them correctly.

Common examples of prepaid expenses include rent, insurance, subscriptions, and utility deposits. These expenses are paid in advance of receiving the goods or services, and as such, they should be treated as assets. Other examples of prepaid expenses may include prepaid interest, taxes, and royalties.

When recording prepaid expenses, it’s essential to accurately classify them as assets on the balance sheet. This involves creating a prepaid expense account, which is then amortized over the relevant period. For example, if a business pays an annual insurance premium in advance, the expense would be recorded as a prepaid asset and then amortized over the 12-month period.

Accurate recording and accounting for prepaid expenses are critical because they can significantly impact a company’s financial statements. Misclassifying prepaid expenses as liabilities or failing to account for them properly can lead to inaccurate financial reporting and poor business decision-making. By correctly identifying and recording prepaid expenses, businesses can ensure a more accurate picture of their financial position and performance.

The Role of Prepaid Expenses in Financial Statements

Prepaid expenses play a crucial role in financial statements, providing stakeholders with a clear understanding of a company’s financial position and performance. When accurately recorded and accounted for, prepaid expenses can have a significant impact on key financial metrics such as assets, liabilities, and equity.

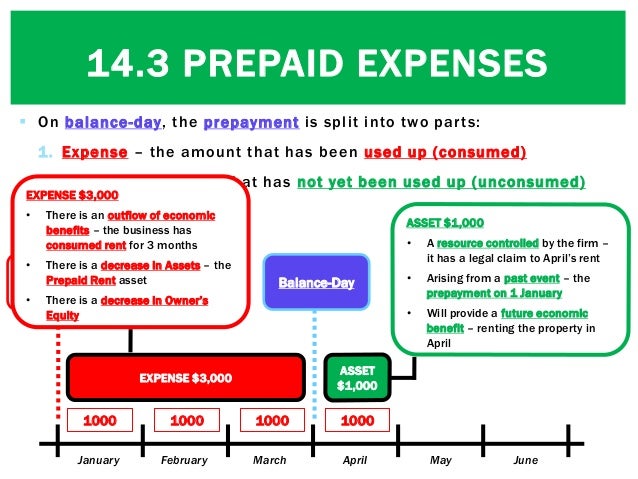

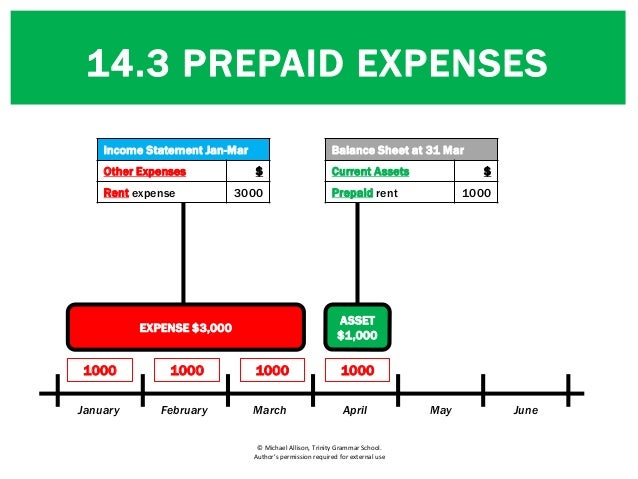

On the balance sheet, prepaid expenses are typically recorded as a current asset, representing the amount of expenses paid in advance. This is because prepaid expenses are an asset, providing a future benefit to the business. As the prepaid expense is amortized over time, it is gradually reduced on the balance sheet, and the corresponding expense is recorded on the income statement.

The income statement is also affected by prepaid expenses, as the amortized expense is recorded as a cost of doing business. This can have a significant impact on a company’s net income, as prepaid expenses can represent a significant portion of total expenses. Accurate accounting for prepaid expenses is essential to ensure that the income statement accurately reflects a company’s financial performance.

Prepaid expenses can also impact a company’s cash flow statement, as the initial payment is recorded as a cash outflow. However, as the prepaid expense is amortized, it does not affect cash flow, providing a more accurate picture of a company’s cash flow position.

By accurately presenting prepaid expenses in financial statements, businesses can provide stakeholders with a clear understanding of their financial position and performance. This, in turn, can lead to better business decision-making and improved financial outcomes. Remember, prepaid expenses are an asset, and accurate accounting for them is essential for effective financial management and reporting.

Managing Prepaid Expenses for Maximum Efficiency

Effective management of prepaid expenses is crucial for businesses to reap the benefits of treating them as assets. By implementing efficient strategies for tracking, monitoring, and optimizing prepaid expenses, businesses can improve their financial performance and make informed decisions.

One key strategy for managing prepaid expenses is to establish a centralized system for tracking and recording these expenses. This can be achieved through the use of accounting software or spreadsheets that allow for easy tracking and analysis of prepaid expenses. By having a clear and accurate picture of prepaid expenses, businesses can identify areas for optimization and make informed decisions about future expenses.

Another important strategy is to regularly review and analyze prepaid expenses to ensure they are being utilized efficiently. This involves identifying prepaid expenses that are not being fully utilized and finding ways to optimize their use. For example, a business may find that it is paying for a subscription service that is not being fully utilized, and therefore, can be cancelled or reduced.

Additionally, businesses can implement a system for amortizing prepaid expenses over time, ensuring that the expense is accurately reflected on the financial statements. This can be achieved through the use of accounting software or by establishing a manual system for tracking and amortizing prepaid expenses.

By implementing these strategies, businesses can ensure that their prepaid expenses are being managed efficiently and effectively, providing a clear picture of their financial position and performance. Remember, prepaid expenses are an asset, and effective management of these expenses is crucial for achieving financial success.

Furthermore, businesses can also consider implementing a prepaid expense policy that outlines the procedures for managing prepaid expenses. This policy can include guidelines for identifying and recording prepaid expenses, as well as procedures for reviewing and optimizing these expenses.

By taking a proactive approach to managing prepaid expenses, businesses can unlock the full potential of these expenses and achieve greater financial efficiency and success.

Common Mistakes to Avoid When Dealing with Prepaid Expenses

When it comes to managing prepaid expenses, businesses often make mistakes that can have a significant impact on their financial performance. By understanding these common mistakes, businesses can avoid them and ensure that their prepaid expenses are accurately accounted for and effectively managed.

One of the most common mistakes businesses make is misclassifying prepaid expenses as liabilities. This can lead to inaccurate financial reporting and a distorted view of a company’s financial position. Remember, prepaid expenses are an asset, and they should be treated as such on the balance sheet.

Another mistake businesses make is failing to account for prepaid expenses properly. This can include failing to record prepaid expenses in the correct period, or failing to amortize them over time. This can lead to inaccurate financial reporting and a lack of transparency in financial statements.

Additionally, businesses may fail to regularly review and analyze their prepaid expenses, leading to inefficiencies and waste. By regularly reviewing prepaid expenses, businesses can identify areas for optimization and make informed decisions about future expenses.

Furthermore, businesses may not have a clear policy in place for managing prepaid expenses, leading to confusion and inconsistencies in accounting practices. By establishing a clear policy, businesses can ensure that prepaid expenses are managed consistently and accurately.

By avoiding these common mistakes, businesses can ensure that their prepaid expenses are accurately accounted for and effectively managed. This can lead to improved financial performance, better decision-making, and a competitive edge in the market.

It is essential for businesses to recognize the importance of prepaid expenses and to manage them effectively. By doing so, businesses can unlock the full potential of prepaid expenses and achieve greater financial success.

The Impact of Prepaid Expenses on Business Decision-Making

Accurate accounting for prepaid expenses is crucial for informed business decision-making. By recognizing prepaid expenses as assets, businesses can gain a clearer understanding of their financial position and make better decisions about investments, funding, and strategic planning.

Prepaid expenses can inform business decisions in several ways. For instance, a business may use prepaid expenses to determine the feasibility of a new project or investment. By accurately accounting for prepaid expenses, businesses can get a more accurate picture of their cash flow and make informed decisions about resource allocation.

Furthermore, prepaid expenses can impact funding decisions. By recognizing prepaid expenses as assets, businesses can demonstrate a stronger financial position to lenders and investors, potentially securing better funding terms. Additionally, accurate accounting for prepaid expenses can help businesses identify areas for cost reduction and optimization, leading to improved profitability.

Strategic planning is another area where prepaid expenses can have a significant impact. By accurately accounting for prepaid expenses, businesses can identify trends and patterns in their expenses, informing decisions about future investments and resource allocation. This can lead to more effective strategic planning and improved business outcomes.

Remember, prepaid expenses are an asset, and accurate accounting for these expenses is essential for informed business decision-making. By recognizing the importance of prepaid expenses, businesses can unlock the full potential of these expenses and achieve greater financial success.

In conclusion, prepaid expenses play a critical role in business decision-making. By accurately accounting for these expenses, businesses can gain a clearer understanding of their financial position, make informed decisions, and achieve better business outcomes.

Conclusion: Unlocking the Full Potential of Prepaid Expenses

In conclusion, prepaid expenses are an asset that can have a significant impact on a business’s financial performance and decision-making. By recognizing prepaid expenses as assets, businesses can improve their cash flow management, reduce financial risk, and enhance their financial reporting.

Effective prepaid expense management is crucial for businesses to unlock the full potential of these expenses. This includes accurately identifying and recording prepaid expenses, presenting them correctly in financial statements, and managing them efficiently. By doing so, businesses can make informed decisions, optimize their resources, and achieve better business outcomes.

Remember, prepaid expenses are an asset, and treating them as such can lead to improved financial performance and competitiveness. By incorporating prepaid expenses into their financial management and accounting practices, businesses can gain a competitive edge and achieve long-term success.

In today’s fast-paced business environment, it is essential for businesses to stay ahead of the curve by leveraging the power of prepaid expenses. By doing so, businesses can unlock the full potential of these expenses and achieve greater financial success.