Understanding the True Cost of Debt: A Pre-Tax Perspective

In the world of corporate finance, debt financing plays a vital role in a company’s capital structure. However, evaluating the true cost of debt can be a complex task, especially when considering the tax implications. This is where the pre-tax cost of debt formula comes into play, providing a valuable tool for companies to assess the cost of debt financing. By understanding the pre-tax cost of debt, companies can better navigate the complexities of debt financing and optimize their financial performance. In essence, the pre-tax cost of debt formula helps companies make informed decisions about their debt financing options, taking into account the tax implications that can significantly impact their bottom line.

How to Calculate the Pre-Tax Cost of Debt: A Step-by-Step Approach

The pre-tax cost of debt formula is a fundamental concept in corporate finance, enabling companies to evaluate the true cost of debt financing. The formula is calculated as follows: pre-tax cost of debt = (interest expense / total debt) x (1 – tax rate). This formula takes into account the interest expense associated with debt financing, as well as the tax implications of debt financing. By applying this formula, companies can determine the pre-tax cost of debt, which is essential for making informed debt financing decisions.

In practice, the pre-tax cost of debt formula can be applied in various scenarios. For instance, a company may use the formula to evaluate the cost of debt financing for a specific project or to compare the cost of debt financing across different lenders. Additionally, the formula can be used to assess the impact of changes in tax rates on the cost of debt financing. By understanding how to calculate the pre-tax cost of debt, companies can optimize their debt financing strategies and make more informed decisions about their capital structure.

The Impact of Tax Rates on Debt Financing Decisions

Tax rates play a crucial role in determining the pre-tax cost of debt, and changes in tax rates can significantly impact a company’s debt financing strategy. When tax rates increase, the pre-tax cost of debt decreases, making debt financing more attractive. Conversely, when tax rates decrease, the pre-tax cost of debt increases, making debt financing less attractive. This is because the tax benefits associated with debt financing, such as interest expense deductions, are more valuable when tax rates are higher.

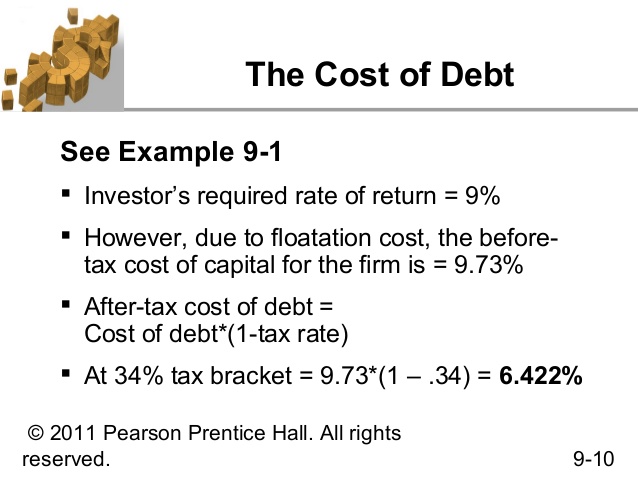

For instance, consider a company with a debt financing option that has an interest rate of 8%. If the tax rate is 25%, the pre-tax cost of debt would be 6% (8% x (1 – 0.25)). However, if the tax rate increases to 30%, the pre-tax cost of debt would decrease to 5.6% (8% x (1 – 0.30)). This reduction in the pre-tax cost of debt may lead the company to opt for debt financing over other financing options. Therefore, it is essential for companies to consider the impact of tax rates on their debt financing decisions and adjust their strategies accordingly.

In addition, changes in tax rates can also affect the pre-tax cost of debt formula. For example, if a company is considering a debt financing option with a variable interest rate, changes in tax rates can impact the pre-tax cost of debt. By understanding the relationship between tax rates and the pre-tax cost of debt, companies can make more informed decisions about their debt financing options and optimize their capital structure.

Comparing Pre-Tax and After-Tax Cost of Debt: What’s the Difference?

In corporate finance, it is essential to understand the distinction between pre-tax and after-tax cost of debt, as each metric serves a unique purpose in different contexts. The pre-tax cost of debt, calculated using the pre-tax cost of debt formula, represents the cost of debt financing before considering tax implications. On the other hand, the after-tax cost of debt takes into account the tax benefits associated with debt financing, such as interest expense deductions.

In capital budgeting, the after-tax cost of debt is often used to evaluate the feasibility of projects, as it provides a more accurate representation of the project’s true cost. In contrast, the pre-tax cost of debt is commonly used in financial analysis to assess a company’s debt financing strategy and optimize its capital structure. By understanding the difference between pre-tax and after-tax cost of debt, companies can make more informed decisions about their debt financing options and project investments.

For instance, consider a company evaluating a project with a pre-tax cost of debt of 8%. If the tax rate is 25%, the after-tax cost of debt would be 6% (8% x (1 – 0.25)). In this scenario, the company may use the after-tax cost of debt to evaluate the project’s feasibility, while also considering the pre-tax cost of debt when making debt financing decisions. By recognizing the distinction between pre-tax and after-tax cost of debt, companies can optimize their capital structure and make more informed investment decisions.

Real-World Applications of Pre-Tax Cost of Debt: Case Studies and Examples

In the real world, companies have successfully utilized the pre-tax cost of debt formula to inform their debt financing decisions. For instance, consider a company like Amazon, which has a significant debt financing strategy in place. By using the pre-tax cost of debt formula, Amazon can determine the true cost of its debt financing options and make informed decisions about its capital structure.

Another example is General Electric (GE), which has a complex debt financing structure involving multiple debt instruments. By applying the pre-tax cost of debt formula, GE can evaluate the cost of each debt instrument and optimize its debt financing strategy to minimize costs and maximize returns.

In addition, companies like Apple and Microsoft have used the pre-tax cost of debt formula to evaluate the feasibility of debt financing for specific projects. By considering the pre-tax cost of debt, these companies can determine whether debt financing is a viable option for funding their projects and make informed decisions about their capital budgeting.

The benefits of using the pre-tax cost of debt formula are numerous. By considering the true cost of debt financing, companies can avoid costly mistakes and optimize their capital structure to achieve their financial goals. However, there are also challenges associated with using the pre-tax cost of debt formula, such as accurately estimating the variables involved and considering the impact of tax rates on debt financing decisions.

Despite these challenges, the pre-tax cost of debt formula remains a powerful tool for companies seeking to optimize their debt financing strategy. By understanding the pre-tax cost of debt formula and its applications, companies can make informed decisions about their debt financing options and achieve their financial objectives.

Common Mistakes to Avoid When Calculating Pre-Tax Cost of Debt

When calculating the pre-tax cost of debt, companies often make mistakes that can lead to inaccurate results and poor debt financing decisions. One common mistake is failing to consider the impact of tax rates on the pre-tax cost of debt. This can result in an overestimation or underestimation of the true cost of debt financing.

Another mistake is using an incorrect or outdated interest rate when applying the pre-tax cost of debt formula. This can occur when companies fail to update their interest rates to reflect changes in market conditions or when they use an average interest rate that does not accurately reflect the cost of debt financing.

In addition, companies may neglect to consider the impact of debt maturity on the pre-tax cost of debt. This can lead to an inaccurate calculation of the pre-tax cost of debt, as the maturity of the debt instrument can significantly affect its cost.

To avoid these mistakes, companies should ensure that they accurately estimate the variables involved in the pre-tax cost of debt formula, including the interest rate, tax rate, and debt maturity. By doing so, companies can obtain an accurate calculation of the pre-tax cost of debt and make informed debt financing decisions.

Furthermore, companies should regularly review and update their pre-tax cost of debt calculations to reflect changes in market conditions and tax rates. This can help companies to identify opportunities to optimize their debt financing strategy and minimize costs.

By being aware of these common mistakes and taking steps to avoid them, companies can ensure that they accurately calculate the pre-tax cost of debt and make informed decisions about their debt financing options. The pre-tax cost of debt formula is a powerful tool for companies seeking to optimize their debt financing strategy, and by using it correctly, companies can achieve their financial objectives and maximize returns.

The Role of Pre-Tax Cost of Debt in Capital Structure Decisions

In determining a company’s optimal capital structure, the pre-tax cost of debt plays a crucial role. By understanding the true cost of debt financing, companies can make informed decisions about the trade-offs between debt and equity financing.

The pre-tax cost of debt formula provides a framework for evaluating the cost of debt financing, which is essential in determining the optimal mix of debt and equity. By considering the pre-tax cost of debt, companies can assess the benefits of debt financing, such as tax shields and lower costs, against the risks, such as increased leverage and potential default.

In capital structure decisions, the pre-tax cost of debt is used to evaluate the cost of debt financing relative to equity financing. By comparing the pre-tax cost of debt to the cost of equity, companies can determine the optimal capital structure that minimizes costs and maximizes returns.

For instance, if the pre-tax cost of debt is lower than the cost of equity, a company may opt for debt financing to take advantage of the tax benefits and lower costs. On the other hand, if the pre-tax cost of debt is higher than the cost of equity, a company may prefer equity financing to avoid the risks associated with debt.

The pre-tax cost of debt formula is also useful in evaluating the impact of changes in tax rates on a company’s capital structure. By considering the relationship between tax rates and the pre-tax cost of debt, companies can adjust their capital structure to optimize their debt financing strategy.

In conclusion, the pre-tax cost of debt formula is a critical component of capital structure decisions, providing a framework for evaluating the cost of debt financing and determining the optimal mix of debt and equity. By understanding the pre-tax cost of debt, companies can make informed decisions about their capital structure and achieve their financial objectives.

Conclusion: Mastering the Pre-Tax Cost of Debt Formula for Informed Decision-Making

In conclusion, understanding the pre-tax cost of debt formula is crucial for companies seeking to make informed debt financing decisions. By grasping the concept of pre-tax cost of debt and its significance in corporate finance, companies can optimize their debt financing strategy and achieve their financial objectives.

Throughout this article, we have explored the importance of considering tax implications when evaluating debt financing options, the step-by-step approach to calculating the pre-tax cost of debt, and the impact of tax rates on debt financing decisions. We have also discussed the distinction between pre-tax and after-tax cost of debt, real-world applications of the pre-tax cost of debt formula, and common mistakes to avoid when calculating the pre-tax cost of debt.

Furthermore, we have examined the role of pre-tax cost of debt in determining a company’s optimal capital structure, including the trade-offs between debt and equity financing. By mastering the pre-tax cost of debt formula, companies can make informed decisions about their capital structure and debt financing strategy, ultimately leading to improved financial performance and competitiveness.

In today’s complex and dynamic business environment, companies must stay ahead of the curve by leveraging the power of financial analysis and decision-making tools. The pre-tax cost of debt formula is a critical component of this toolkit, providing a framework for evaluating the cost of debt financing and determining the optimal debt financing strategy.

By applying the concepts and principles outlined in this article, companies can unlock the secrets of debt financing and achieve their full potential in the marketplace. Remember, understanding the pre-tax cost of debt formula is key to making informed debt financing decisions and driving business success.