What is an Overnight Index Swap?

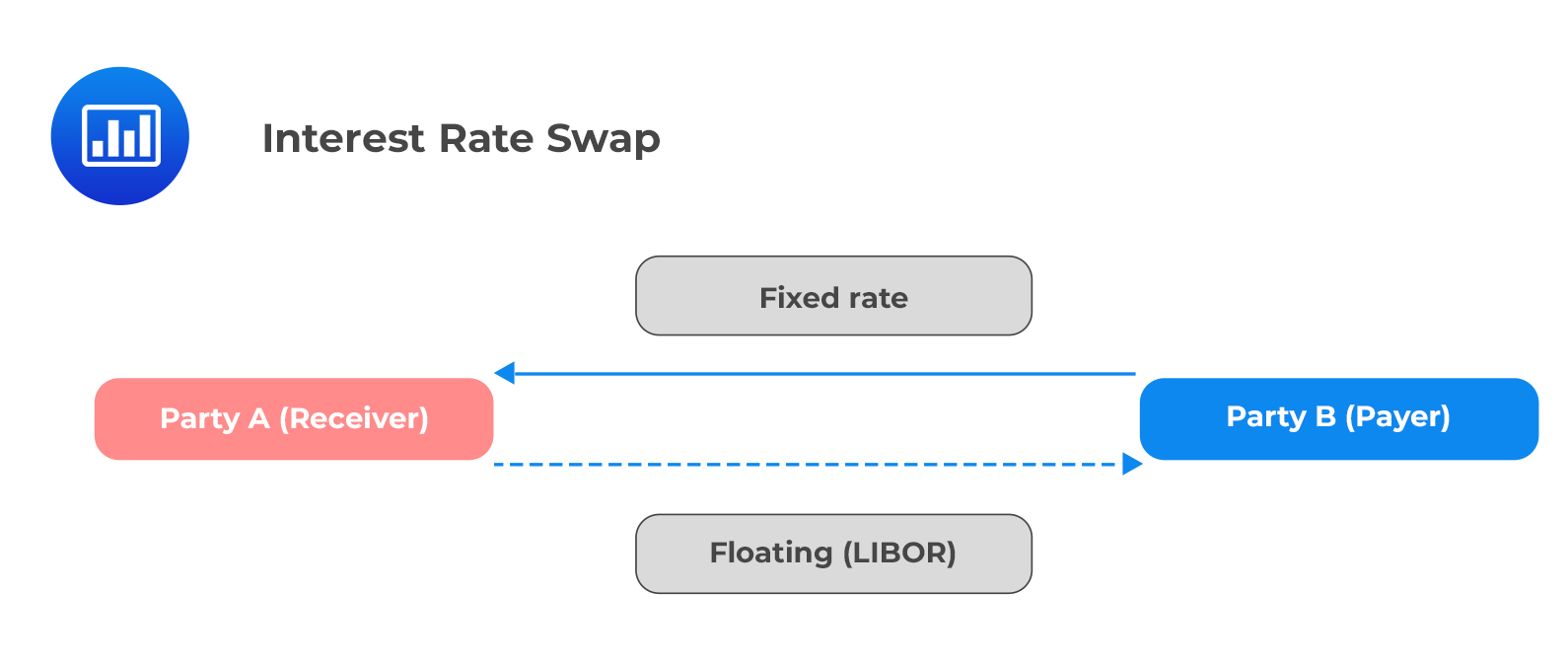

An overnight index swap (OIS) is a type of financial derivative that enables parties to exchange fixed and floating interest payments based on a notional amount. The floating leg of the swap is typically tied to a short-term interest rate, such as the federal funds rate or the euro overnight index average (EONIA). OIS rates are used to hedge against interest rate risks and to speculate on future interest rate movements. In essence, OIS rates reflect the market’s expectations of future central bank policy decisions and their impact on the economy.

The primary purpose of an OIS is to provide a means for financial institutions to manage their interest rate exposure and to take advantage of arbitrage opportunities. For instance, a bank may use an OIS to hedge against a potential increase in short-term interest rates, thereby reducing its exposure to interest rate risk. OIS rates are also used as a benchmark for other financial instruments, such as floating-rate notes and collateralized debt obligations.

OIS rates differ from other types of swaps, such as basis swaps and cross-currency swaps, in that they are specifically designed to capture the overnight interest rate risk. This makes OIS rates a key indicator of market sentiment and a valuable tool for investors seeking to understand the direction of interest rates. Central banks, in particular, play a crucial role in shaping OIS rates through their monetary policy decisions and communication strategies. As a result, OIS rates have a significant impact on the financial market, influencing everything from bond yields to currency exchange rates. In today’s market, understanding overnight index swap rates today is essential for making informed investment decisions.

How to Understand Overnight Index Swap Rates

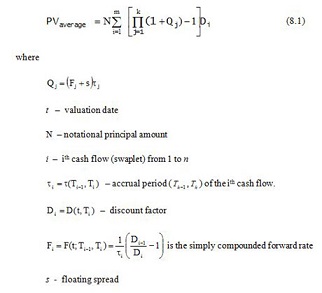

To grasp the intricacies of overnight index swap (OIS) rates, it’s essential to understand how they are calculated and the factors that influence them. OIS rates are typically calculated as a weighted average of expected future overnight interest rates, with the weights based on the probability of each rate scenario. This complex calculation involves analyzing various economic indicators, such as GDP growth, inflation rates, and employment numbers, as well as monetary policy decisions and market sentiment.

Interpreting OIS rates requires a deep understanding of the underlying factors that drive them. For instance, a rise in OIS rates may indicate a tightening of monetary policy, while a decline may suggest a more accommodative stance. Investors can use OIS rates to inform their investment decisions, such as adjusting their bond portfolios or currency positions in response to changes in OIS rates. To stay ahead of the curve, investors should monitor economic indicators, follow central bank announcements, and stay up-to-date with financial news and analysis.

In today’s market, understanding overnight index swap rates today is crucial for making informed investment decisions. By recognizing the factors that influence OIS rates and staying informed about changes in the market, investors can navigate the complex world of overnight index swaps and make more informed investment decisions.

The Current State of Overnight Index Swap Rates

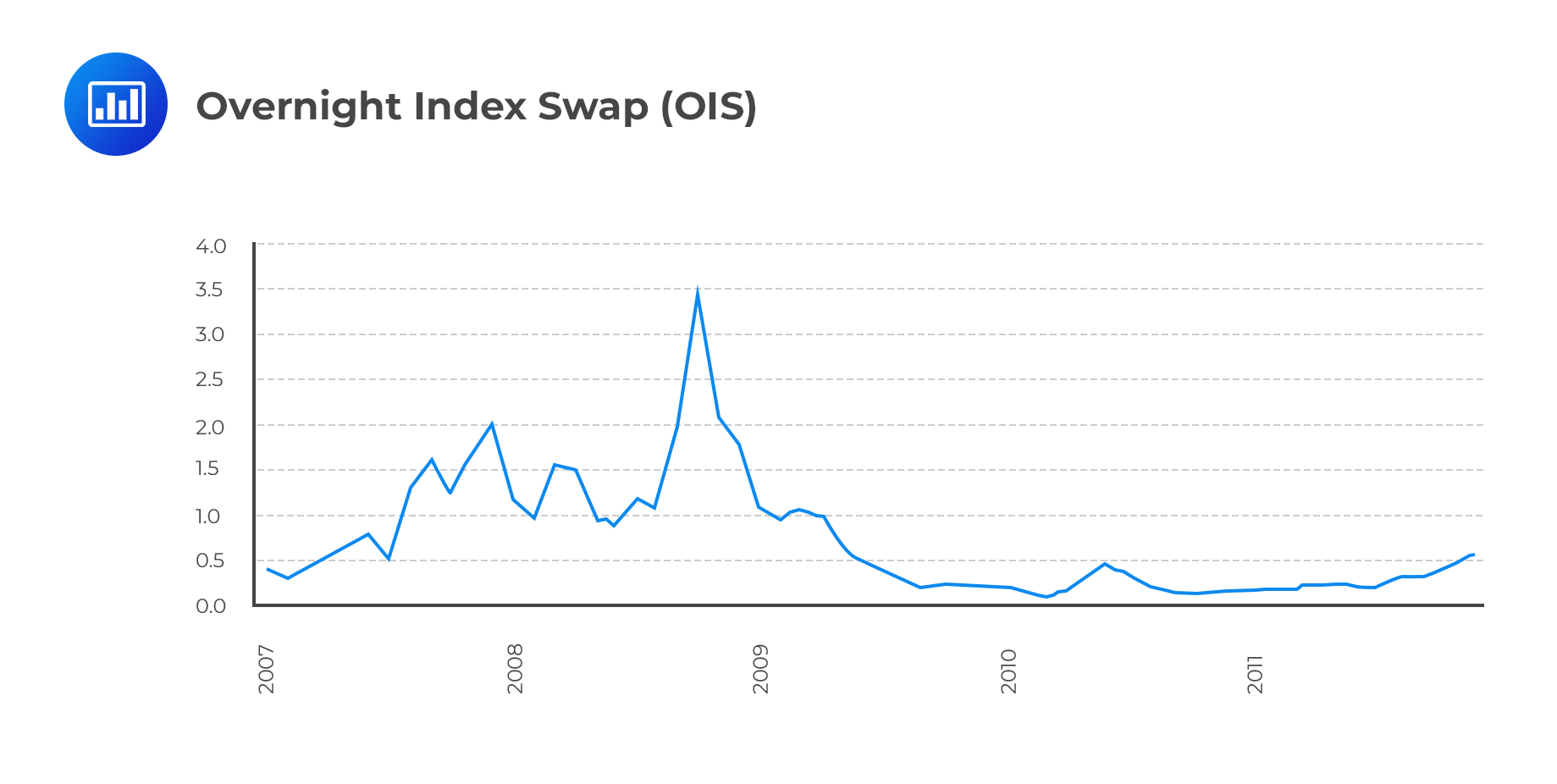

The current state of overnight index swap (OIS) rates is characterized by a high degree of volatility, driven by shifting market sentiment and central bank policies. In recent months, OIS rates have experienced significant fluctuations, with some markets witnessing a tightening of monetary policy and others seeing a more accommodative stance. For instance, the overnight index swap rate today in the US has risen in response to the Federal Reserve’s hawkish tone, while in Europe, OIS rates have remained relatively stable amidst the European Central Bank’s dovish stance.

These changes in OIS rates have had a profound impact on the economy and financial institutions. For example, the rise in OIS rates in the US has led to a strengthening of the US dollar, making exports more expensive and contributing to a slowdown in economic growth. In contrast, the stability of OIS rates in Europe has helped to support the region’s fragile economic recovery. Financial institutions, such as banks and hedge funds, have also been affected by the changes in OIS rates, with some experiencing significant losses or gains depending on their positioning.

Understanding the current state of OIS rates is crucial for investors seeking to navigate the complex world of overnight index swaps. By analyzing the trends and fluctuations in OIS rates, investors can gain valuable insights into the direction of interest rates and the overall health of the economy. This knowledge can be used to inform investment decisions, such as adjusting bond portfolios or currency positions in response to changes in OIS rates. In today’s market, staying informed about overnight index swap rates today is essential for making informed investment decisions.

What Drives Overnight Index Swap Rate Volatility

Overnight index swap (OIS) rate volatility is driven by a complex array of factors, including changes in central bank policies, economic indicators, and geopolitical events. Central banks, in particular, play a crucial role in shaping OIS rates through their monetary policy decisions and communication strategies. For instance, a hawkish tone from a central bank can lead to a rise in OIS rates, while a dovish stance can result in a decline.

Economic indicators, such as GDP growth, inflation rates, and employment numbers, also have a significant impact on OIS rates. A strong economy with low unemployment and rising inflation may lead to higher OIS rates, while a slowing economy with high unemployment and low inflation may result in lower OIS rates. Additionally, geopolitical events, such as trade wars, elections, and natural disasters, can also influence OIS rates by affecting market sentiment and economic growth.

The interaction between these factors can lead to significant volatility in OIS rates. For example, a change in central bank policy may be influenced by economic indicators, which in turn may be affected by geopolitical events. Understanding these complex relationships is essential for investors seeking to navigate the volatile world of overnight index swaps. By staying informed about the factors that drive OIS rate volatility, investors can better anticipate changes in the overnight index swap rate today and make more informed investment decisions.

The Role of Central Banks in Shaping Overnight Index Swap Rates

Central banks play a crucial role in shaping overnight index swap (OIS) rates through their monetary policy decisions and communication strategies. By setting interest rates and implementing quantitative easing or tightening measures, central banks can influence the direction of OIS rates. For instance, a central bank may raise interest rates to combat inflation, leading to an increase in OIS rates, or lower interest rates to stimulate economic growth, resulting in a decline in OIS rates.

Central banks also use OIS rates as a tool to influence the economy and financial markets. By setting OIS rates, central banks can affect the cost of borrowing, the value of currencies, and the overall direction of asset prices. For example, a central bank may use OIS rates to manage inflation expectations, stabilize financial markets, or stimulate economic growth. By understanding the role of central banks in shaping OIS rates, investors can better anticipate changes in the overnight index swap rate today and make more informed investment decisions.

In addition, central banks’ communication strategies also play a significant role in shaping OIS rates. Forward guidance, for instance, can influence market expectations and shape OIS rates. Central banks may use forward guidance to signal future policy changes, which can lead to changes in OIS rates. By paying close attention to central banks’ communication strategies, investors can gain valuable insights into the direction of OIS rates and make more informed investment decisions.

Implications of Overnight Index Swap Rates for Investors

Overnight index swap (OIS) rates have significant implications for investors, as they can affect bond yields, currency markets, and asset prices. Understanding the impact of OIS rates on these markets is crucial for investors seeking to make informed investment decisions. For instance, a rise in OIS rates can lead to an increase in bond yields, making borrowing more expensive and potentially reducing the attractiveness of fixed-income investments. Conversely, a decline in OIS rates can lead to lower bond yields, making borrowing cheaper and potentially increasing the appeal of fixed-income investments.

In currency markets, OIS rates can influence exchange rates and currency valuations. A country with higher OIS rates may attract foreign investment, causing its currency to appreciate, while a country with lower OIS rates may experience a depreciation of its currency. Investors should consider the impact of OIS rates on currency markets when making investment decisions, particularly in foreign exchange markets.

Asset prices, including stocks and commodities, can also be affected by OIS rates. A rise in OIS rates can lead to a decrease in asset prices, as higher borrowing costs can reduce demand for assets. Conversely, a decline in OIS rates can lead to an increase in asset prices, as lower borrowing costs can increase demand for assets. By understanding the implications of OIS rates on asset prices, investors can make more informed investment decisions and adjust their portfolios accordingly.

To navigate the complex landscape of OIS rates, investors should stay informed about the overnight index swap rate today and its implications for various markets. By monitoring OIS rates and their impact on bond yields, currency markets, and asset prices, investors can make more informed investment decisions and optimize their portfolios for success.

Comparing Overnight Index Swap Rates Across Markets

Overnight index swap (OIS) rates vary across different markets, reflecting the unique economic conditions and monetary policies of each region. Comparing OIS rates across markets can provide valuable insights into the global economy and financial markets. In this section, we will compare OIS rates across the US, Europe, and Asia, analyzing the similarities and differences in OIS rates across regions and their implications for global financial markets.

In the US, OIS rates are influenced by the Federal Reserve’s monetary policy decisions, with the federal funds rate serving as a benchmark for OIS rates. In Europe, OIS rates are influenced by the European Central Bank’s (ECB) monetary policy decisions, with the eurozone’s main refinancing rate serving as a benchmark. In Asia, OIS rates are influenced by the monetary policy decisions of individual countries, such as Japan and China, with their respective central banks’ interest rates serving as benchmarks.

Despite these differences, OIS rates across markets share some similarities. For instance, OIS rates in all three regions are influenced by economic indicators, such as GDP growth and inflation rates. Additionally, OIS rates in all three regions are affected by changes in central bank policies, with shifts in monetary policy stances influencing OIS rates. However, there are also significant differences in OIS rates across markets, reflecting the unique economic conditions and monetary policies of each region.

For example, OIS rates in the US have been higher than those in Europe and Asia in recent years, reflecting the Federal Reserve’s tighter monetary policy stance. In contrast, OIS rates in Europe have been lower than those in the US and Asia, reflecting the ECB’s more accommodative monetary policy stance. These differences in OIS rates across markets have significant implications for global financial markets, influencing the flow of capital and the value of currencies.

By comparing OIS rates across markets, investors can gain a better understanding of the global economy and financial markets. By monitoring the overnight index swap rate today and its implications for different markets, investors can make more informed investment decisions and optimize their portfolios for success.

Staying Ahead of Overnight Index Swap Rate Changes

To stay informed about overnight index swap (OIS) rate changes, it is essential to monitor economic indicators, follow central bank announcements, and utilize financial news and analysis sources. By doing so, investors can stay ahead of OIS rate changes and make informed investment decisions.

One key strategy is to monitor economic indicators, such as GDP growth, inflation rates, and employment numbers, which can influence OIS rates. By tracking these indicators, investors can anticipate potential changes in OIS rates and adjust their investment portfolios accordingly.

Following central bank announcements is also crucial, as central banks play a significant role in shaping OIS rates through their monetary policy decisions. By staying up-to-date with central bank announcements and statements, investors can gain insights into potential changes in OIS rates and adjust their investment strategies accordingly.

Utilizing financial news and analysis sources, such as Bloomberg or Reuters, can also provide investors with valuable insights into OIS rate changes. These sources often provide real-time data and analysis on OIS rates, allowing investors to stay informed and make timely investment decisions.

In addition, investors can use technical analysis tools, such as charts and graphs, to identify trends and patterns in OIS rates. By analyzing these trends and patterns, investors can anticipate potential changes in OIS rates and adjust their investment portfolios accordingly.

By staying informed about OIS rate changes, investors can optimize their investment portfolios and minimize potential losses. It is essential to stay up-to-date with the overnight index swap rate today and its implications for the financial market. By doing so, investors can make informed investment decisions and achieve their financial goals.

:max_bytes(150000):strip_icc()/overnightindexswap.asp-final-216af61ba0f84575815b62a83457d7b9.jpg)