Deciphering Advance Decline Data: A Comprehensive Guide

Understanding market trends is crucial for informed investment decisions. One valuable tool for this is advance-decline data. It serves as a key indicator of market breadth. Market breadth reflects the participation level of stocks in an overall market move. The advance-decline data represents the number of stocks that are advancing versus the number that are declining in price on a given day. Analyzing nyse advance decline historical data provides insights into the overall health and sentiment of the stock market, specifically the NYSE. This article will explore how to understand and utilize this data effectively. The nyse advance decline historical data is a fundamental tool. It helps investors gauge market sentiment and potential turning points.

The advance-decline data offers a broad perspective on market strength. It goes beyond simply looking at the major market indices. A healthy market typically sees a large number of stocks participating in an upward trend. This is reflected in a high number of advancing stocks compared to declining stocks. Conversely, a weak market might show more declining stocks than advancing ones. Even if the major indices are still rising, divergences can occur. These divergences between the indices and the advance-decline data can provide early warnings of potential market weakness. Investors can use nyse advance decline historical data to assess the validity of market rallies. They can also anticipate potential corrections.

Analyzing nyse advance decline historical data involves tracking the daily advances and declines. It also requires understanding how this data is compiled into indicators like the Advance-Decline Line. The Advance-Decline Line, which we will explore later, provides a visual representation of cumulative market breadth. By studying the trends and patterns in the advance-decline data, investors can gain a deeper understanding of the underlying forces driving market movements. This knowledge can be invaluable in making more informed investment decisions. Ultimately, using the nyse advance decline historical data is a responsible way to improve investing success.

How to Track Historical Market Breadth Indicators

Accessing historical advance-decline data is crucial for analyzing market trends. This data, specifically the nyse advance decline historical data, provides insights into the overall health and direction of the stock market. Several reliable resources are available for tracking this information. Financial websites, data providers, and charting platforms are primary sources.

To find nyse advance decline historical data, start with reputable financial websites. Many offer historical data sections where you can search for market breadth indicators. Look for sections dedicated to market statistics or indices. Navigate to the NYSE data and locate the advance-decline figures. Data providers, such as Bloomberg or Refinitiv, offer comprehensive datasets. These often require a subscription but provide more detailed and granular information. Charting platforms like TradingView are also useful. They typically include advance-decline lines as overlays on stock charts. This allows for visual analysis of market breadth in relation to price movements. When extracting data, pay attention to the format. Ensure it’s suitable for your analysis tools, such as spreadsheets or statistical software. Download the data in a compatible format, such as CSV or Excel.

Specifically, you can find the nyse advance decline historical data on the New York Stock Exchange’s official website, although it might require some digging through their market data resources. Major financial news outlets like Yahoo Finance, Google Finance, and MarketWatch compile and present this data in an accessible format. These sites often provide charts and tables that visualize the advance-decline line over different time periods. When using these resources, verify the data’s accuracy and ensure it aligns with your analysis objectives. Consistently tracking and updating your nyse advance decline historical data will enhance your understanding of market dynamics and improve investment decisions. Analyzing nyse advance decline historical data is an important technique.

Understanding the Significance of Advance-Decline Line

The Advance-Decline Line is a crucial tool for interpreting market breadth, particularly when analyzing nyse advance decline historical data. It visually represents the cumulative difference between the number of stocks advancing and the number of stocks declining in a specific market, such as the New York Stock Exchange (NYSE). This line is calculated by starting with an arbitrary base value and adding the net difference between advances and declines each day. For instance, if 1,800 stocks advance and 1,200 stocks decline, the net advance is 600. This number is then added to the previous day’s value on the Advance-Decline Line.

The importance of the Advance-Decline Line lies in its ability to act as a leading indicator of market trends. It offers insights into the underlying strength or weakness of a market that might not be immediately apparent from price indices alone. A rising Advance-Decline Line suggests broad market participation in an uptrend, indicating a healthy and sustainable bullish market. Conversely, a declining Advance-Decline Line indicates that more stocks are declining than advancing, signaling potential weakness and a possible bearish trend. Analyzing nyse advance decline historical data through the lens of the Advance-Decline Line provides a valuable perspective on market sentiment.

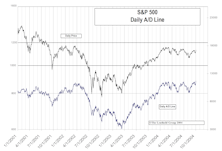

Divergences between the Advance-Decline Line and the price action of a major market index, such as the S&P 500, can be particularly informative. For example, if the S&P 500 is making new highs, but the Advance-Decline Line is not confirming those highs and instead is trending sideways or downward, this is a bearish divergence. It suggests that fewer stocks are participating in the rally, and the market’s strength may be waning. This divergence could foreshadow a potential market correction. Conversely, a bullish divergence occurs when the market index is making new lows, but the Advance-Decline Line is trending higher, indicating underlying strength and a possible upcoming rally. Monitoring nyse advance decline historical data and its relationship to price indices is essential for informed investment decisions. The consistent analysis of nyse advance decline historical data will help you to anticipate any market moves.

Interpreting NYSE Breadth Data for Investment Decisions

Interpreting NYSE advance-decline historical data requires careful observation and analysis. The advance-decline line, representing the cumulative difference between advancing and declining stocks, offers valuable insights into market sentiment. A rising advance-decline line typically indicates a healthy market, where a broad range of stocks participate in the upward trend. Conversely, a declining line suggests weakening market breadth, with more stocks declining than advancing. This could signal underlying weakness even if major market indices are still rising.

One crucial aspect of interpreting NYSE advance decline historical data is recognizing divergences. A bearish divergence occurs when the market index, such as the S&P 500, makes new highs, but the advance-decline line fails to follow suit. This suggests that fewer stocks are participating in the rally, potentially foreshadowing a market correction. Conversely, a bullish divergence arises when the market index makes new lows, but the advance-decline line starts to rise. This indicates that selling pressure is diminishing and a potential reversal might be underway. Understanding these divergences in the NYSE advance decline historical data can provide early warning signals for investment decisions. Bullish signals are observed when the advance-decline line is trending up, supporting the overall market trend. Bearish signals appear when the advance-decline line trends down or diverges negatively from the price index.

To effectively use NYSE advance decline historical data, investors should also consider the magnitude and duration of the trends. A sharp, short-term divergence might be less significant than a prolonged divergence that persists over several weeks or months. Furthermore, it is important to analyze the advance-decline line in conjunction with other technical indicators and fundamental analysis. No single indicator should be relied upon in isolation. By combining the insights from NYSE advance decline historical data with other tools, investors can make more informed and well-rounded investment decisions, increasing the probability of successful outcomes. Using NYSE advance decline historical data in conjunction with other indicators helps confirm trends and identify potential turning points more accurately.

Using Breadth Indicators in Conjunction with Other Technical Analysis Tools

Advance-decline data offers valuable insights, but it should not be the sole basis for investment decisions. A more comprehensive understanding of market conditions arises when used alongside other technical analysis tools. Integrating the analysis of nyse advance decline historical data with other indicators can lead to more informed and potentially profitable investment strategies.

Moving averages, for example, can help to confirm the trends suggested by the advance-decline line. A rising advance-decline line coupled with the market index trading above its 50-day or 200-day moving average strengthens the bullish signal. Conversely, a falling advance-decline line and the index trading below its moving averages can signal a bearish trend. Volume analysis is another powerful tool to combine with nyse advance decline historical data. Ideally, rising prices should be accompanied by increasing volume, confirming strong buying interest. If the advance-decline line is rising but volume is weak, it may suggest a lack of conviction in the rally, potentially indicating a short-term correction. The Relative Strength Index (RSI) measures the speed and change of price movements. When the RSI and the advance-decline line both point in the same direction, it reinforces the signal. A divergence between the RSI and the advance-decline line could indicate a potential trend reversal. For instance, if the advance-decline line is making new highs, but the RSI is showing overbought conditions and begins to decline, it could foreshadow a market correction. Using stochastics oscillators in conjunction with nyse advance decline historical data can also help identify overbought or oversold conditions. The combination of these indicators with the analysis of nyse advance decline historical data, provides a more robust and nuanced view of market sentiment. Another useful combination involves analyzing nyse advance decline historical data with the McClellan Oscillator or the Arms Index (TRIN), both breadth indicators that provide further confirmation or divergence signals.

Effective combinations might include observing a bullish divergence in the advance-decline line alongside a golden cross (50-day moving average crossing above the 200-day moving average) in the S&P 500. This convergence strengthens the bullish outlook. Conversely, a death cross (50-day moving average crossing below the 200-day moving average) occurring alongside a bearish divergence in the advance-decline line could signal a significant market downturn. Analyzing nyse advance decline historical data with Fibonacci retracement levels can help identify potential support and resistance levels, providing traders with possible entry and exit points. Combining these tools enhances the reliability of signals derived from nyse advance decline historical data, fostering better-informed investment decisions and minimizing the risk of false signals.

Limitations and Considerations When Analyzing Market Breadth

While NYSE advance decline historical data offers valuable insights into market sentiment, it is crucial to acknowledge its limitations. One potential bias arises from the influence of large-capitalization stocks on overall market indices like the S&P 500 or Dow Jones. A few mega-cap companies experiencing significant gains can mask underlying weakness in the broader market, leading to a divergence between the index and the advance-decline line. This means that the index might be trending upward while the number of advancing stocks is actually decreasing.

Furthermore, the NYSE advance decline historical data can sometimes generate false signals. A temporary surge in advancing stocks, for instance, might be driven by short-covering rallies or sector-specific news, rather than a genuine improvement in market breadth. Relying solely on this indicator without considering other factors could lead to premature or inaccurate investment decisions. It’s vital to remember that no single indicator provides a foolproof prediction of future market movements. The savvy investor incorporates a range of tools and perspectives to build a balanced strategy. Fundamental analysis, examining company financials and economic indicators, should always complement technical analysis derived from NYSE advance decline historical data.

In addition to the advance-decline line, other market breadth indicators can provide a more complete picture. The McClellan Oscillator and Summation Index, for example, offer different perspectives on the relationship between advancing and declining stocks. New highs versus new lows is another useful indicator, measuring the number of stocks reaching their 52-week highs compared to those hitting 52-week lows. Analyzing these various indicators in conjunction with NYSE advance decline historical data and fundamental research can provide a more robust and reliable assessment of market conditions. Using the NYSE advance decline historical data appropriately, can yield outstanding results, but it must be within a wider study of indicators to limit errors.

Case Studies: Examining Historical Market Movements and Advance-Decline Data

Examining historical market movements in conjunction with nyse advance decline historical data offers valuable insights. These insights can illuminate the predictive power of market breadth. A classic example is the market crash of 2008. Leading up to the crash, the S&P 500 continued to reach new highs. However, the Advance-Decline Line began to diverge, failing to confirm these highs. This divergence suggested that fewer stocks were participating in the rally, indicating weakening market breadth. This early warning signal, derived from nyse advance decline historical data, foretold the impending downturn.

Conversely, consider the bull market that followed the 2008 crisis. As the S&P 500 recovered, the Advance-Decline Line consistently made new highs alongside the index. This confirmation signaled broad participation and underlying strength. Reviewing nyse advance decline historical data from this period reveals a healthy market environment. Another compelling case study involves the dot-com bubble of the late 1990s. While technology stocks soared, the Advance-Decline Line showed signs of weakening well before the bubble burst. This again highlighted a divergence, with a smaller and smaller group of stocks holding up the market. By analyzing charts that visualize this historical data, investors can identify similar patterns. These patterns help to anticipate potential market corrections or the continuation of existing trends.

Another example of nyse advance decline historical data providing valuable information is during specific sector rotations. If the market indices are trending upwards but the advance decline line is flat or declining, this could signal that only a few sectors are driving the gains. This scenario indicates a potential shift in market leadership. Investors can dig deeper to identify which sectors are advancing versus declining. They can then adjust their portfolios accordingly. Understanding how the Advance-Decline Line has behaved during various economic cycles and market events is essential. Essential for any investor looking to incorporate market breadth into their analysis. Recognizing these historical patterns can improve decision-making and risk management.

Building a Market Breadth Analysis Strategy for Long-Term Investing

This article has explored the nuances of market breadth analysis, with a focus on the advance-decline data. Integrating this data into a long-term investment strategy requires a systematic approach. A key element involves consistently tracking nyse advance decline historical data to identify prevailing market trends. Begin by establishing a routine for accessing and recording this data from reliable sources. Financial websites and charting platforms offer the necessary historical information. This ensures the availability of the nyse advance decline historical data needed for ongoing analysis.

Develop a framework for interpreting the nyse advance decline historical data. Focus on identifying divergences between the advance-decline line and major market indices. A bearish divergence, where the market index rises while the advance-decline line stagnates or declines, can signal caution. Conversely, a bullish divergence suggests underlying strength, even if the market index is lagging. Combining this with other technical indicators enhances the reliability of signals. For example, confirm potential reversals indicated by advance-decline data with RSI or moving average crossovers. Remember that no single indicator is foolproof. Employing multiple tools provides a more balanced perspective. Analyzing nyse advance decline historical data offers insights that improve investment decisions. This leads to a more informed and strategic approach.

Long-term investing requires adapting to evolving market dynamics. Continuously refine the market breadth analysis strategy. Regularly backtest strategies using nyse advance decline historical data to assess their effectiveness across different market cycles. Pay attention to how the advance-decline line behaved during past bull and bear markets. This historical context can provide valuable lessons for navigating future market conditions. Also, remain aware of the limitations of advance-decline data. Consider fundamental factors and macroeconomic trends. This holistic approach avoids over-reliance on any single indicator. By consistently applying these principles and adapting to new information, one can effectively integrate market breadth analysis into their long-term investment strategy. The goal is to improve risk-adjusted returns over the long run.

:max_bytes(150000):strip_icc()/Dmi_sketch_final-ec92e99e2a524f8c8dd40dbdb813853b.png)