Understanding the Total Face Value of Derivatives

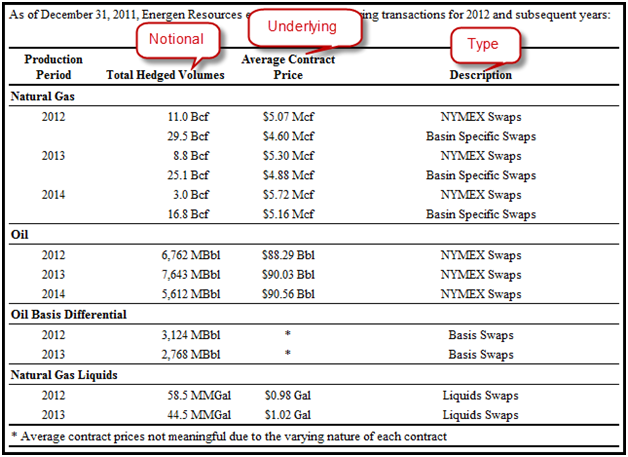

The world of finance includes various complex instruments, and understanding them is crucial for investors and anyone interested in the economy. Among these instruments, derivatives play a significant role. To grasp the magnitude and potential impact of derivatives, it’s essential to first understand the concept of the notional amount of derivative contracts. The notional amount is the underlying asset’s total value in a derivative contract and serves as a reference point for calculating payments. It is important to clarify that the notional amount of derivative contracts is not the amount of money at risk, but rather the reference value upon which the derivative’s cash flows are based.

The notional amount of derivative contracts provides a scale for the size of the derivative transaction. For instance, in an interest rate swap, two parties might agree to exchange interest payments based on a notional principal amount. This notional amount of derivative contracts might be $1 million, but the actual cash exchanged between the parties will only be the interest payments calculated on that $1 million. Similarly, in a currency future, the notional amount of derivative contracts represents the value of the currency being hedged or speculated upon. This value is used to determine the profit or loss when the future contract is settled. While the notional amount of derivative contracts is substantial, the actual risk exposure is often a fraction of this amount due to various risk mitigation strategies.

The significance of understanding the notional amount of derivative contracts lies in its ability to provide context to the overall derivatives market. It allows regulators and market participants to monitor the scale of derivative activities and assess potential systemic risks. Though the notional amount of derivative contracts can be large, it’s critical to remember it is not a direct measure of potential losses. Factors like netting agreements, collateralization, and the specific terms of the derivative contract all influence the true level of risk. Therefore, while the notional amount of derivative contracts is a key metric, it should be interpreted in conjunction with other risk measures to provide a comprehensive view of the derivative’s market and its potential impact on financial stability.

Deconstructing Derivative Contract Size: A Guide

The notional amount of derivative contracts serves as the foundation for calculating payments and understanding the scale of these financial instruments. Its application varies across different types of derivatives, influencing potential payoffs and risk exposure. Examining these variations is crucial for grasping the true impact of the notional amount of derivative contracts.

In interest rate swaps, the notional amount of derivative contracts represents the principal on which interest payments are exchanged. For instance, if two parties enter into a swap with a notional amount of $1 million, they will exchange interest payments based on this principal, even though the principal itself is not exchanged. One party might pay a fixed interest rate, while the other pays a floating rate, with the notional amount determining the magnitude of these payments. Similarly, in currency swaps, the notional amount refers to the principal in each currency that is used to calculate the interest payments. Understanding the notional amount of derivative contracts in swaps is key to evaluating the potential cash flows and hedging strategies involved.

Options contracts also utilize a notional amount, although its role differs slightly. The notional amount of derivative contracts in options represents the value of the underlying asset that the option controls. For example, a call option on 100 shares of a stock trading at $50 per share has a notional amount of $5,000 (100 shares x $50/share). The option holder has the right, but not the obligation, to buy these shares at a specified price (the strike price) before the expiration date. The potential payoff depends on the difference between the market price of the underlying asset and the strike price, multiplied by the number of shares represented by the notional amount of derivative contracts. In futures contracts, the notional amount reflects the quantity of the underlying commodity or asset being traded. A futures contract for 5,000 bushels of wheat, with wheat trading at $6 per bushel, has a notional amount of $30,000. Changes in the price of wheat will affect the value of the futures contract, impacting the potential profit or loss. The notional amount of derivative contracts thus serves as a multiplier, amplifying the effects of price fluctuations.

Why Does the Aggregate Face Value of Derivatives Matter?

Tracking the total notional amount of derivative contracts is crucial for understanding the overall health and stability of the financial system. While the notional amount of derivative contracts doesn’t represent the actual money at risk, it provides a valuable indicator of the potential scale of financial obligations and exposures. A large and rapidly growing notional amount can signal increased leverage and interconnectedness within the financial system, potentially amplifying the impact of economic shocks. This is why regulators and market participants closely monitor these figures.

The aggregate face value of derivatives matters because it offers insights into systemic risk. Systemic risk refers to the risk that the failure of one financial institution could trigger a cascade of failures throughout the system. A high notional amount of derivative contracts, particularly when concentrated among a few large institutions, can increase this risk. If a major player defaults on its obligations, the resulting losses could spread rapidly through the network of derivative contracts, leading to market volatility and potentially destabilizing the financial system. Understanding the notional amount of derivative contracts helps assess the potential for such contagion effects.

Furthermore, the total notional amount of outstanding derivative contracts is important for regulatory oversight. Regulators use this information to assess the overall level of risk in the financial system and to identify potential areas of concern. By monitoring trends in the notional amount of derivative contracts, regulators can better understand how different market participants are using derivatives and to what extent they are exposed to various risks. This allows them to develop appropriate regulations and policies to mitigate systemic risk and promote financial stability. The notional amount of derivative contracts, therefore, serves as a critical data point for ensuring a stable and resilient financial system, even though it is not a direct measure of exposure or risk, its implications are significant for overall economic impact.

How to Interpret Derivative Volume: A Practical Approach

The aggregate notional amount of derivative contracts often raises concerns due to its sheer size. However, it’s crucial to understand that this figure is not a direct indicator of market risk or potential losses. The notional amount represents the total face value of the underlying assets referenced by these contracts, not the actual money exchanged or at risk. To accurately interpret derivative volume, one must consider several key factors beyond the headline number.

Firstly, netting arrangements significantly reduce the actual exposure in the derivatives market. Netting allows counterparties to offset their obligations, meaning that only the net amount owed is ultimately at risk. This practice substantially decreases the potential for cascading defaults. Secondly, collateralization plays a vital role in mitigating counterparty risk. Derivative contracts are often collateralized, requiring parties to post assets as security against potential losses. The presence of collateral cushions the impact of defaults and reduces the overall systemic risk associated with the notional amount of derivative contracts. Furthermore, central clearinghouses employ sophisticated risk management techniques, including margin requirements and stress testing, to ensure the stability of the derivatives market. These measures provide an additional layer of protection against potential losses.

It’s important to avoid solely relying on the aggregate notional amount as a measure of market risk. A more comprehensive assessment requires analyzing factors such as the types of derivatives involved (e.g., interest rate swaps, credit default swaps), the degree of netting and collateralization, the creditworthiness of counterparties, and the overall market conditions. Understanding the nuances of these factors provides a more accurate and informed perspective on the potential implications of the notional amount of derivative contracts. Therefore, interpreting derivative volume demands a practical approach that goes beyond the surface level and delves into the underlying mechanisms that mitigate risk and maintain market stability. Focusing solely on the notional amount of derivative contracts can be misleading without considering these crucial risk-reducing elements.

Exploring the Scale of Derivative Deal Values: A Deep Dive

The global market for derivatives is vast. It dwarfs many other financial markets. Understanding its size requires examining the total notional amounts outstanding. These figures provide a sense of the scale of derivative activity. However, they must be interpreted carefully.

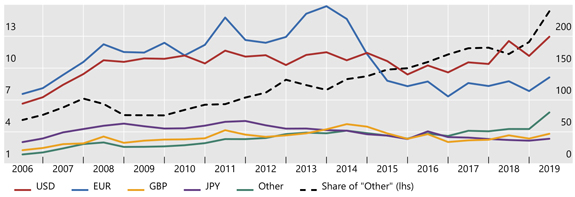

Statistics on the global derivatives market reveal impressive numbers. The total notional amount of derivative contracts often reaches hundreds of trillions of dollars. The Bank for International Settlements (BIS) regularly publishes data on these amounts. These statistics offer insights into the overall market size. When comparing the derivatives market to others, its scale becomes apparent. For example, the total notional amount of derivative contracts can exceed the combined value of global stock and bond markets. This comparison highlights the derivatives market’s significance in the financial system. The trends in the growth or decline of the notional amount of derivative contracts are important indicators. Increases in the notional amount may reflect growing economic activity or increased hedging needs. Decreases might suggest reduced risk appetite or regulatory changes impacting the use of derivatives. Analyzing these trends requires considering various economic and financial factors. Changes in interest rates, exchange rates, and regulatory policies all play a role in shaping derivative market activity. The notional amount of derivative contracts serves as a key metric. The correct interpretation of trends in notional amounts is crucial for understanding global financial dynamics.

The sheer size of the derivatives market raises important questions. How do these massive figures relate to actual risk? It’s crucial to remember that the notional amount of derivative contracts isn’t a direct measure of exposure. Factors like netting and collateralization significantly reduce the actual risk. Despite this, tracking the total notional amount remains essential for regulators and market participants. It provides a broad overview of potential systemic risk. It helps assess the potential impact of market shocks on the financial system. The notional amount of derivative contracts is, therefore, a valuable but imperfect indicator. Combining this data with other risk measures offers a more complete picture of the derivatives market. This approach is vital for informed decision-making and effective risk management. Continual monitoring and analysis are essential to navigate the complexities of the global derivatives landscape and understand the implications of the notional amount of derivative contracts.

The Role of Clearinghouses in Reducing Derivative Contract Risks

Central clearinghouses play a crucial role in mitigating the risks associated with derivative contracts. These entities act as intermediaries between buyers and sellers, effectively becoming the counterparty to both sides of a transaction. This arrangement significantly reduces counterparty risk, which is the risk that one party in a derivative contract will default on its obligations. The mechanics of clearinghouses are fundamental to understanding the overall stability of the financial system, especially considering the enormous notional amount of derivative contracts outstanding.

Clearinghouses employ several mechanisms to manage risk. Netting is a key process where they consolidate multiple trades between counterparties, reducing the total number of transactions that need to be settled. This lowers operational complexity and the overall exposure. Collateralization is another vital aspect; clearing members are required to post margin, which is essentially collateral, to cover potential losses. The amount of margin required is determined by sophisticated risk models that assess the potential volatility of the underlying assets. These practices are particularly important given the scale of the notional amount of derivative contracts and their potential to amplify market shocks. By requiring sufficient collateral, clearinghouses ensure that they can cover losses even if a member defaults.

Furthermore, clearinghouses have robust risk management frameworks that include stress testing and monitoring of members’ positions. They actively monitor market conditions and adjust margin requirements as needed to reflect changes in risk. By centralizing the clearing process, they promote transparency and standardization in the derivatives market. This transparency allows regulators to better monitor systemic risk and take appropriate action to prevent financial instability. The combined effect of netting, collateralization, and rigorous risk management helps to safeguard the financial system from the potential adverse effects associated with the large notional amount of derivative contracts.

Examining Factors Affecting Derivative Sums: A Detailed Analysis

The total notional amount of derivative contracts outstanding is not a static figure. It fluctuates based on a complex interplay of economic and regulatory forces. Understanding these drivers is crucial for interpreting trends in the derivatives market and assessing potential implications for financial stability. Several key factors exert significant influence on the aggregate notional amount of derivative contracts.

Interest rate movements are a primary driver. When interest rates are volatile, businesses often use interest rate swaps to manage their borrowing costs, thus increasing the notional amount of derivative contracts. Similarly, exchange rate volatility prompts companies engaged in international trade to hedge their currency risk using currency derivatives, impacting the overall notional amount of derivative contracts. Economic growth also plays a vital role. During periods of strong economic expansion, increased investment and business activity typically lead to greater use of derivatives for hedging and speculation, driving up the notional amount of derivative contracts. Conversely, economic slowdowns can reduce derivative activity. Furthermore, changes in regulations can have a profound impact. New rules regarding capital requirements, margin requirements, or reporting obligations can either encourage or discourage the use of derivatives, significantly affecting the total notional amount of derivative contracts outstanding. For example, regulations designed to increase transparency and reduce systemic risk may lead to a temporary decrease in the notional amount as some market participants adjust their strategies.

Beyond these broad economic and regulatory factors, specific events can also trigger shifts in the notional amount of derivative contracts. Unexpected geopolitical events, commodity price shocks, or major corporate restructurings can all create uncertainty and increase the demand for derivatives as risk management tools. The introduction of new types of derivative products can also lead to a surge in activity, particularly if these products offer innovative ways to manage specific risks. Careful analysis of these factors, combined with an understanding of the limitations of the notional amount as a risk measure, is essential for a comprehensive assessment of the derivatives market and its potential impact on the broader financial system. It’s important to remember that the notional amount of derivative contracts, while large, represents the underlying value being hedged or speculated upon, and not necessarily the actual risk exposure.

Evaluating Derivative Contract Size: Avoiding Common Misconceptions

A common misunderstanding surrounds the notional amount of derivative contracts. It’s crucial to recognize that the notional amount of derivative contracts does not represent the actual money that changes hands or the potential profit or loss. It serves as a reference point for calculating payments within the derivative agreement. Confusing the notional amount with actual exposure can lead to a distorted view of the risks involved. The total notional amount of derivative contracts outstanding gives only a partial picture of the real economic risk.

The market value of a derivative contract, which reflects its current worth based on market conditions, is different from the notional amount. The market value fluctuates constantly, reflecting changes in the underlying asset’s price or other relevant factors. Consider a simple example: a company enters a currency swap with a notional amount of $10 million. This $10 million is not exchanged initially; instead, it is used to calculate the interest payments between the parties. The market value of this swap, however, might be only $100,000, reflecting the present value of the expected future cash flows. The distinction between the notional amount and the market value is paramount for understanding the true economic substance of derivative transactions. Focus should be placed on how the notional amount of derivative contracts is used.

Actual risk exposure in derivative contracts is further mitigated by factors like netting agreements, collateralization, and the creditworthiness of the counterparties involved. Netting allows parties to offset multiple positions, reducing the overall exposure. Collateralization requires parties to pledge assets as security, minimizing potential losses if one party defaults. Credit risk mitigation techniques, such as credit default swaps, are also employed to transfer credit risk to other parties. These mechanisms demonstrate that the notional amount of derivative contracts significantly overstates the true economic risk in the market. The intelligent evaluation of derivative contract size necessitates a comprehensive understanding of these risk mitigation strategies and a move away from simply relying on the notional amount of derivative contracts as a primary indicator of risk. A proper risk assessment also requires sophisticated modeling techniques that incorporate various market scenarios and stress tests.