Unveiling the Mystery: The Stated Annual Rate

The world of finance often presents numbers that appear straightforward, but understanding their true meaning requires a deeper look. One such number is the nominal interest rate. This rate, also known as the stated annual interest rate, is the percentage typically quoted in loan agreements or investment products. It represents the basic interest charged or earned over a year, without considering the effects of compounding. The nominal vs effective interest rate is the core of financial literacy.

At first glance, the nominal interest rate seems simple enough. If a loan has a nominal interest rate of 5%, it appears that you would pay 5% of the principal in interest over the course of a year. However, this isn’t always the case. The simplicity of the nominal rate can be misleading, especially when compounding comes into play. Compounding refers to the process where the interest earned in one period is added to the principal, and then the next period’s interest is calculated on this new, larger principal. The nominal vs effective interest rate is a key concept in finance.

To illustrate, consider a loan with a 5% nominal interest rate, compounded monthly. While the stated annual rate is 5%, the actual interest paid over the year will be higher due to the monthly compounding. Each month, interest is calculated on the outstanding balance, including the previously accrued interest. This means you’re earning interest on your interest, leading to a higher overall return than the nominal rate suggests. Therefore, while the nominal rate provides a starting point, it’s crucial to understand the compounding frequency to determine the true cost of borrowing or the actual return on an investment. The difference between nominal vs effective interest rate can significantly impact financial decisions.

The True Price: Calculating the Impact of Compounding

Transitioning from the stated annual rate, it is crucial to understand the effective interest rate. The effective interest rate reveals the true cost of borrowing. It accounts for the effects of compounding, offering a more accurate representation of the interest paid over a year. While the nominal interest rate provides a simple figure, it often hides the real financial burden. The difference between the nominal vs effective interest rate is the impact of compounding.

Compounding frequency significantly influences the actual interest accrued. Interest can compound annually, semi-annually, quarterly, monthly, or even daily. The more frequently interest compounds, the higher the effective interest rate becomes, compared to the nominal rate. This difference arises because interest earned in one period starts earning interest in the subsequent period. This accelerating effect increases the total interest paid over the loan’s term. Therefore, focusing solely on the nominal interest rate can be misleading, especially when comparing loans with different compounding schedules. Understanding nominal vs effective interest rate is key to compare loan options.

For instance, a loan with a 5% nominal interest rate compounded monthly will have a higher effective interest rate than a loan with the same nominal rate compounded annually. The effective interest rate provides a standardized measure. It allows borrowers to directly compare the true cost of different loan products. Ignoring the impact of compounding can lead to underestimating the actual cost of borrowing. The effective interest rate is essential for making informed financial decisions. Accurately comparing nominal vs effective interest rate ensures transparency in lending practices. This ultimately empowers borrowers to choose the most suitable option for their needs.

How to Calculate the Real Cost of a Loan

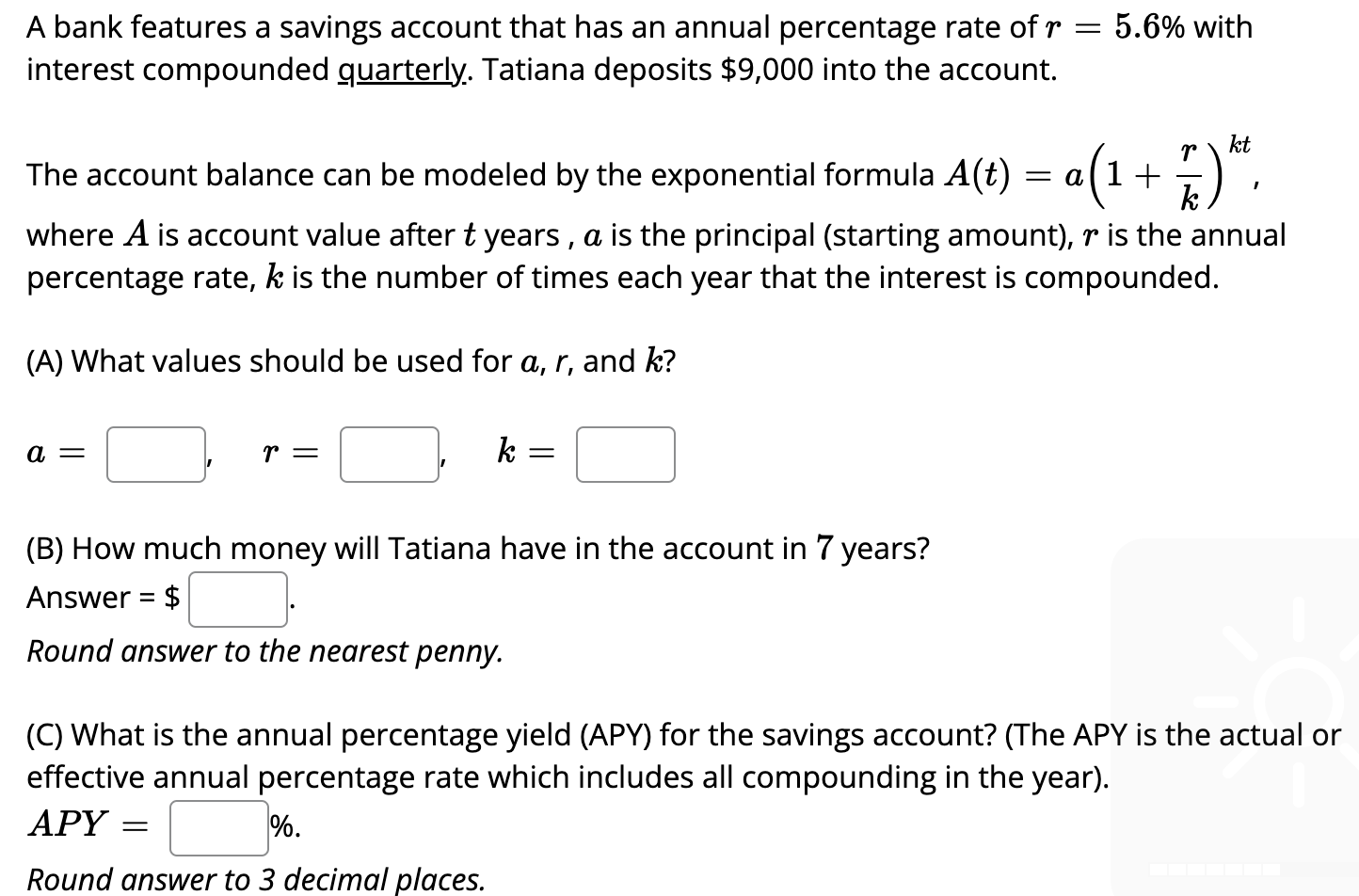

Understanding the difference between nominal vs effective interest rate is crucial for making informed borrowing decisions. The effective interest rate reveals the true cost of borrowing, considering the impact of compounding. It’s calculated using a formula that takes into account the nominal interest rate and the compounding frequency. The formula is: Effective Interest Rate = (1 + (Nominal Rate / Number of Compounding Periods)) ^ (Number of Compounding Periods) – 1. The nominal rate is the stated annual interest rate. The number of compounding periods indicates how often interest is calculated and added to the principal during a year (e.g., monthly compounding means 12 periods).

Let’s illustrate with an example. Suppose a loan has a nominal interest rate of 12% per year, compounded monthly. To find the effective interest rate, we substitute the values into the formula: Effective Interest Rate = (1 + (0.12 / 12)) ^ 12 – 1. This simplifies to (1 + 0.01)^12 – 1, which equals approximately 0.1268 or 12.68%. Notice the difference! The effective interest rate (12.68%) is higher than the nominal rate (12%). This is because the interest earned each month also earns interest in subsequent months – this is the effect of compounding. The more frequently interest compounds (daily, weekly, etc.), the greater the difference between the nominal and effective interest rate will be. When comparing loan offers, always look at the effective interest rate to understand the true cost of borrowing, as the nominal vs effective interest rate can differ significantly.

Calculating the effective interest rate empowers borrowers to compare loan offers accurately. The effective interest rate provides a standardized measure for comparing loans with different compounding frequencies and nominal rates. Remember, higher compounding frequency leads to a larger difference between the nominal and the effective interest rate. This difference is especially significant for high-interest loans or those with frequent compounding periods, highlighting the importance of understanding the nominal vs effective interest rate. This calculation helps consumers make smarter financial decisions and avoid unexpected costs. It allows for accurate comparisons, enabling borrowers to select the loan option that truly offers the lowest cost.

Annual Percentage Yield (APY) as Effective Rate

While the effective interest rate provides the true cost of borrowing for loans, the Annual Percentage Yield (APY) serves a similar purpose for savings accounts and investments. APY represents the total amount of interest earned in a year, accounting for the effects of compounding. It’s the effective annual interest rate, reflecting the actual return on an investment after considering the compounding frequency. Understanding the difference between nominal vs effective interest rate is crucial here. Banks often prefer to advertise APY because it presents a clearer picture of the actual return compared to the nominal interest rate. The nominal rate simply states the annual interest without considering how frequently the interest is compounded. This difference becomes particularly important for high-yield savings accounts or investments with frequent compounding periods.

The APY calculation mirrors that of the effective interest rate. It takes into account the nominal interest rate and the number of compounding periods within the year. This means understanding APY helps consumers make informed decisions about where to deposit their savings. By comparing APYs from different financial institutions, savers can choose the option that maximizes their returns. The use of APY provides transparency and allows for easier comparison between competing offers. This helps savers to make more effective financial decisions. It’s a simple yet effective way to understand the real return on investment, rather than just the stated annual rate.

In essence, APY and the effective interest rate are two sides of the same coin. Both help consumers understand the true cost of borrowing or the actual return on investment, considering the effects of compounding. While one applies to loans and the other to savings, both are essential for navigating the complexities of personal finance and making informed choices. When comparing loan offers, always look beyond the nominal vs effective interest rate – consider the APY or effective interest rate to make sound financial decisions. This crucial understanding ensures consumers are fully aware of the true financial implications, avoiding any misleading interpretations of interest rates.

Compare Offers: Navigating Loan Options Effectively

When comparing loan offers, focusing solely on the nominal interest rate can be misleading. The nominal vs effective interest rate comparison is critical. Understanding the effective interest rate empowers borrowers to make informed financial choices. Different lenders may present attractive nominal rates, but the true cost lies in the effective rate, which accounts for compounding frequency and associated fees.

To effectively compare loan options, calculate or request the Annual Percentage Rate (APR) or the effective interest rate. The APR includes not only the nominal interest rate but also any mandatory fees associated with the loan, such as origination fees, application fees, or insurance costs. By considering the APR, borrowers gain a clearer picture of the total cost of borrowing. A lower nominal rate might seem appealing initially, but if it comes with substantial fees, the effective interest rate could be higher than a loan with a slightly higher nominal rate but fewer fees. It’s essential to request a detailed breakdown of all fees and understand how they impact the overall cost. When evaluating different loan offers, create a spreadsheet or use an online calculator to compare the effective interest rates and the total repayment amount over the loan term. This allows for a side-by-side comparison that reveals the most cost-effective option.

Always inquire about all associated costs and the compounding frequency before making a decision. Be aware of potential prepayment penalties, which can significantly impact the total cost if you decide to pay off the loan early. Remember that the nominal vs effective interest rate can vary significantly based on the loan type and the lender’s policies. By carefully analyzing all aspects of the loan agreement and focusing on the effective interest rate, borrowers can confidently choose the option that best aligns with their financial goals and minimizes the overall cost of borrowing. Scrutinize the fine print to avoid any hidden costs. Remember, comparing the nominal vs effective interest rate is key to securing the most favorable loan terms.

When Does Compounding Really Matter?

The difference between the nominal vs effective interest rate becomes especially pronounced under specific conditions. The impact of compounding on the nominal vs effective interest rate is more significant when dealing with high-interest loans or investments. This is because the more frequently interest is compounded, the faster the actual return or cost increases relative to the stated annual rate. For instance, a payday loan with a high nominal interest rate compounded daily will accrue significantly more interest than a loan with the same nominal rate compounded annually. Conversely, when interest rates are low, and compounding occurs less frequently, the nominal vs effective interest rate will be closer.

Consider a scenario where someone invests in a high-yield bond. If the bond’s nominal interest rate is, say, 10% and it compounds monthly, the effective interest rate will be noticeably higher than 10%. However, if the nominal interest rate is only 1% and it compounds annually, the difference between the nominal vs effective interest rate will be minimal. Similarly, for large sums of money, even small differences between the nominal vs effective interest rate can translate to substantial amounts over time. Therefore, it’s crucial to understand the compounding frequency and its implications, especially when dealing with considerable financial transactions.

Furthermore, the perceived impact of compounding also depends on the duration of the loan or investment. Over shorter periods, the effect of compounding may seem negligible. However, over several years or decades, the cumulative effect of compounding can be substantial. For example, in a long-term investment account, even a slightly higher effective interest rate due to compounding can lead to significantly greater wealth accumulation compared to an account with a lower rate and less frequent compounding. Thus, borrowers and investors need to evaluate the timeframe involved and assess whether the difference between the nominal vs effective interest rate warrants closer attention.

Real-World Examples: Mortgages vs. Credit Cards

To fully grasp the difference between the nominal vs effective interest rate, examining real-world examples is beneficial. Mortgages and credit cards, common financial products, illustrate how compounding frequency impacts the overall cost of borrowing. Understanding the nominal vs effective interest rate is crucial for smart financial planning.

Consider a mortgage with a stated annual interest rate (nominal rate) of 6%, compounded monthly. While 6% appears to be the interest rate, the effective interest rate, which accounts for monthly compounding, will be slightly higher. The borrower effectively earns interest on the interest each month. Over the life of a 30-year mortgage, this difference, although seemingly small, can translate into thousands of dollars in additional interest paid. Financial institutions are legally required to disclose the Annual Percentage Rate (APR) for mortgages, which is designed to reflect the total cost of the loan, including fees and the effect of compounding. The APR is a tool for borrowers to compare nominal vs effective interest rate.

Credit cards, on the other hand, often compound interest daily. If a credit card has a nominal interest rate of 18%, the effective interest rate will be significantly higher than 18% due to the power of daily compounding. This means that unpaid balances accrue interest very quickly. The impact of compounding is far more pronounced with credit cards because of the higher nominal interest rates and the frequent compounding schedule. This makes understanding the nominal vs effective interest rate indispensable. Furthermore, credit card companies may also charge various fees. Those fees can drastically increase the overall cost of borrowing. Therefore, it is essential to look beyond the stated annual rate and consider the effective interest rate, along with any applicable fees, when evaluating credit card offers. Ignoring the distinction between nominal vs effective interest rate can lead to unexpected debt accumulation. Scrutinizing the terms and conditions to determine the effective interest rate offers a clearer picture of the true cost of borrowing, empowering consumers to make sound financial choices.

Making Informed Decisions: Financial Literacy for Borrowers

Understanding the nuances of interest rates is crucial for responsible financial management. Borrowers must recognize the difference between the stated annual rate and the actual cost of borrowing, represented by the effective interest rate. Grasping this distinction empowers individuals to make sound financial choices and avoid potentially costly pitfalls. The difference between the nominal vs effective interest rate can be significant.

A crucial step toward financial literacy is understanding how compounding impacts the overall cost of a loan or the return on an investment. When evaluating financial products, such as loans or savings accounts, consumers should prioritize obtaining complete information. Inquire specifically about the Annual Percentage Yield (APY) or the effective interest rate. These metrics provide a clearer picture of the true cost or benefit, taking into account the effects of compounding. The concept of nominal vs effective interest rate is vital in financial planning.

Always ask about the APY or effective rate when considering loans or investments. Comparing nominal vs effective interest rate allows individuals to assess the true cost of borrowing or the real return on investments. Equipped with this knowledge, consumers are better positioned to navigate the complexities of the financial landscape and make decisions aligned with their financial goals. This heightened awareness fosters financial well-being and promotes responsible borrowing habits.