Understanding the Power of Dividend Growth

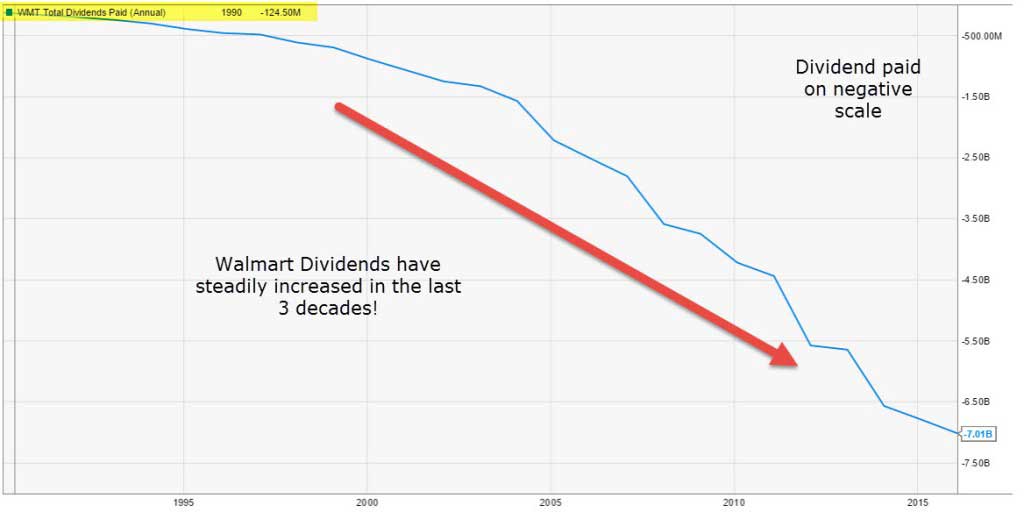

Dividend discount models (DDMs) are fundamental tools for valuing stocks. For long-term investors, dividends represent a key source of return. Consistent dividend growth signals a company’s financial strength and its ability to generate sustainable profits. Simple DDM models, however, often fall short in accurately capturing the complexities of real-world company growth. These models assume a constant dividend growth rate, an unrealistic simplification for many companies. More sophisticated approaches, like the multi-stage dividend growth model, offer superior predictability by accommodating varying growth rates over time. The multi-stage dividend growth model‘s flexibility makes it a more robust valuation tool compared to the Gordon Growth Model, which relies on a constant growth assumption. This adaptability allows for a more nuanced and realistic assessment of a company’s future prospects. The multi-stage dividend growth model considers different phases of a company’s lifecycle, each with its own unique growth rate. This approach recognizes that companies typically experience periods of rapid expansion followed by more stable growth in their mature years. Ignoring these shifts in growth patterns can lead to inaccurate valuations.

The multi-stage dividend growth model addresses the limitations of simpler models by incorporating multiple growth phases into the valuation process. This approach better reflects the reality of a company’s life cycle. A company might experience high growth initially, due to factors like new product introductions or market expansion. Over time, however, growth typically slows as the company matures and faces increased competition. The multi-stage model explicitly acknowledges this transition, assigning different growth rates to each phase. This sophisticated approach delivers improved valuation accuracy and helps avoid the pitfalls of oversimplification. Unlike the Gordon Growth Model, the multi-stage dividend growth model allows for a more realistic representation of a company’s future dividend payments. It acknowledges that dividend growth is rarely constant over the long term. This makes the multi-stage model an invaluable tool for investors seeking to make informed investment decisions. The model’s ability to capture these nuances is a key advantage over simpler models.

Incorporating the multi-stage dividend growth model into your investment strategy provides a more robust valuation framework. It allows investors to analyze companies with varying growth trajectories more accurately. By considering both high-growth and sustainable growth phases, the model offers a more comprehensive view of a company’s future potential. This nuanced approach enhances the accuracy of valuation and reduces the reliance on overly simplistic assumptions. The ability to adjust growth rates for different periods makes the multi-stage dividend growth model a valuable tool in navigating the complexities of stock valuation. Its increased accuracy offers significant advantages for investors seeking to make sound and profitable investment decisions.

Introducing the Multi-Stage Dividend Growth Model

The multi-stage dividend growth model offers a more nuanced approach to stock valuation than simpler models. Unlike the Gordon Growth Model, which assumes a constant dividend growth rate forever, the multi-stage dividend growth model acknowledges that a company’s growth trajectory changes over time. This model divides a company’s life cycle into distinct stages, each characterized by a different dividend growth rate. For example, a young, rapidly expanding company might experience a high growth phase initially, followed by a period of slower, more sustainable growth as it matures. This flexibility allows for a more realistic representation of a company’s future cash flows, leading to a potentially more accurate valuation. The multi-stage dividend growth model’s strength lies in its ability to capture this dynamic growth pattern. Understanding this makes the model superior for long-term investors.

A typical multi-stage dividend growth model might incorporate two or three stages. A high-growth phase could reflect a period of rapid expansion, driven by factors like new product launches or successful market penetration. This phase is characterized by a significantly higher dividend growth rate than subsequent stages. After this initial period, the model often transitions to a stable growth phase. In this stage, the dividend growth rate is lower and more sustainable, reflecting the company’s mature market position and potentially slower expansion. The specific number of stages and the associated growth rates are determined based on careful analysis of the company’s financial history, future prospects, and industry trends. The multi-stage dividend growth model explicitly accounts for these varying growth rates, enhancing the model’s predictive power over simpler models that assume constant growth.

To illustrate, consider a company with an initial high-growth phase of 15% for the next five years, followed by a stable growth phase of 5% indefinitely. The multi-stage dividend growth model would use different growth rates for each phase to discount the future dividend payments back to their present value. This contrasts sharply with the Gordon Growth Model, which would apply a single growth rate to all future periods. The ability to model different growth rates is a key advantage of the multi-stage dividend growth model, allowing for more accurate valuation, particularly for companies with uneven growth patterns. This sophisticated approach improves accuracy in forecasting long-term value. This makes the multi-stage dividend growth model a powerful tool for sophisticated investors. The incorporation of multiple growth stages reflects the realities of a company’s lifecycle more effectively than single-stage models.

How to Apply the Multi-Stage Dividend Growth Model: A Step-by-Step Guide

The multi-stage dividend growth model offers a sophisticated approach to stock valuation. It surpasses simpler models by acknowledging that dividend growth isn’t constant. Instead, it incorporates different growth rates for distinct periods, reflecting a company’s life cycle. To apply this model, one must follow a structured process. First, identify the distinct growth phases the company is expected to experience. Each phase will have its own growth rate. For example, a company might experience a high-growth phase initially, followed by a period of stable growth, and eventually, a terminal growth phase. Accurate determination of these phases is crucial for the model’s success.

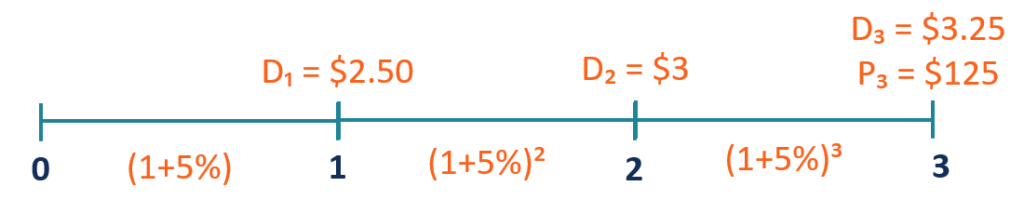

Next, estimate the dividends for each phase. This involves forecasting future dividends based on historical data, analyst projections, or industry benchmarks. Consider factors such as revenue growth, profit margins, and dividend payout ratios. Once dividend forecasts are complete, determine the appropriate discount rate, often the Weighted Average Cost of Capital (WACC). The WACC reflects the company’s cost of financing, incorporating both debt and equity. A higher WACC indicates a higher discount applied to future cash flows, resulting in a lower valuation. The formula for the multi-stage dividend growth model involves discounting each phase’s dividends back to the present value. The present value of dividends in each stage is calculated using the formula: PV = D/(1+r)^t where PV represents present value, D is the dividend, r is the discount rate (WACC), and t is the time period. For the terminal value, a perpetuity formula is often used: Terminal Value = Dn+1/(r-g), where Dn+1 is the dividend at the beginning of the terminal phase and g is the terminal growth rate.

The multi-stage dividend growth model’s accuracy hinges on the reliability of the input parameters. Estimating future dividend growth rates is inherently challenging, involving inherent uncertainty. Sensitivity analysis, testing different growth rate assumptions, should be conducted to assess the model’s robustness and the impact of changes in growth rate assumptions on the final valuation. The selection of an appropriate discount rate is also critical. A higher discount rate leads to a lower valuation, highlighting the significance of accurately estimating the WACC. By carefully considering these factors, the multi-stage dividend growth model provides a robust framework for valuing companies with varying growth profiles. The model’s flexibility in handling different growth stages makes it superior to simpler models like the Gordon Growth Model, which assumes a constant growth rate. Accurate estimation of future growth rates and appropriate discount rates is paramount for successful application of the multi-stage dividend growth model. Remember that any valuation model relies on estimations, and the multi-stage dividend growth model is no exception.

Choosing the Right Growth Rates: High-Growth vs. Sustainable Growth

Selecting appropriate growth rates for each stage of the multi-stage dividend growth model is crucial for accurate valuation. The model’s effectiveness hinges on realistic estimations of both high-growth and sustainable growth phases. High-growth periods, typically occurring early in a company’s life cycle, are characterized by rapid expansion. Factors driving this accelerated growth include successful new product introductions, aggressive market penetration strategies, and expansion into new geographic markets. These periods often feature exceptionally high dividend growth rates, reflecting the company’s strong earnings potential and reinvestment opportunities. However, these rates are rarely sustainable indefinitely.

In contrast, sustainable growth phases represent the company’s long-term, steady-state growth trajectory. This phase usually occurs once the company matures and its market share stabilizes. Factors such as industry competition, economic conditions, and the company’s own internal capacity influence sustainable growth rates. These rates are generally lower than high-growth rates and are assumed to persist into perpetuity, forming the basis for the terminal value calculation in the multi-stage dividend growth model. Accurately differentiating between these high-growth and sustainable growth periods is vital for the model’s precision. Using historical data, analyst forecasts, and industry benchmarks can provide valuable insights into potential growth rates. However, it’s important to remember that these are estimations, and the inherent uncertainty associated with future growth needs to be acknowledged.

The sensitivity of the multi-stage dividend growth model’s valuation to changes in growth rate assumptions is significant. Even small adjustments to the assumed growth rates, especially in the high-growth phase and the terminal growth rate, can substantially impact the calculated intrinsic value of the stock. Therefore, a thorough analysis of various growth rate scenarios, incorporating both optimistic and pessimistic projections, is recommended. This sensitivity analysis highlights the uncertainty inherent in forecasting future growth and underscores the importance of utilizing a range of plausible estimates rather than relying on single-point predictions. Understanding this inherent sensitivity is critical to applying the multi-stage dividend growth model responsibly and interpreting its results with caution. Remember, the model’s output is only as good as the inputs. Careful consideration of these inputs is essential for a reliable valuation.

Determining the Terminal Value: A Crucial Aspect of the Multi-Stage Dividend Growth Model

The terminal value represents the present value of all dividends expected beyond the explicit forecast period of the multi-stage dividend growth model. Accurately estimating this value is crucial, as it significantly impacts the overall valuation. The terminal value accounts for the long-term growth and stability of the company, reflecting the expected dividends after the high-growth phase ends. Ignoring this element leads to an incomplete and potentially misleading valuation.

Several methods exist for calculating the terminal value. One common approach is using the Gordon Growth Model (GGM), assuming a constant dividend growth rate indefinitely. The GGM formula, Terminal Value = (Dn+1) / (r – g), simplifies the calculation. Here, Dn+1 is the dividend at the end of the explicit forecast period, r is the discount rate (often the weighted average cost of capital, WACC), and g represents the constant long-term growth rate. This method’s simplicity makes it appealing, but its reliance on a constant growth rate limits its applicability to mature companies with stable growth prospects. The accuracy of the multi-stage dividend growth model relies heavily on this final calculation.

Alternatively, more sophisticated methods can be employed. These might involve projecting dividends for a longer explicit period or using a combination of growth rates reflecting changing market conditions and company performance. These methods are more complex, requiring detailed forecasts, but they offer greater precision, potentially leading to more robust valuations. The selection of the terminal value calculation method should consider the company’s specific characteristics and the quality of long-term growth forecasts available. Ultimately, the choice significantly influences the multi-stage dividend growth model’s final valuation, emphasizing the importance of careful consideration in this aspect of the model.

Addressing the Challenges and Limitations of the Multi-Stage Dividend Growth Model

The multi-stage dividend growth model, while a powerful tool, presents inherent challenges. Accurately predicting future dividends and growth rates is inherently difficult. Companies’ financial performance is subject to numerous unpredictable factors, including economic downturns, unexpected competition, and changes in consumer preferences. These uncertainties directly impact dividend payouts. The model’s accuracy relies heavily on the precision of these input parameters. Inaccurate estimations can lead to significantly different valuation outcomes. Therefore, careful consideration and thorough research are crucial.

Furthermore, the selection of appropriate growth rates for each stage is inherently subjective. Determining the transition point between high-growth and stable-growth phases requires considerable judgment. Analysts may employ different methodologies, leading to variations in their estimations. The sensitivity of the multi-stage dividend growth model to these growth rate assumptions underscores the importance of utilizing robust forecasting techniques and incorporating a range of plausible scenarios. The model’s reliance on assumptions about future dividends and growth rates emphasizes the need for careful and thoughtful input parameter selection. Investors should always remember that the model’s output reflects these inputs and their associated uncertainties.

Another limitation lies in the terminal value calculation. The terminal value represents the present value of all future dividends beyond the explicit forecast horizon. The accuracy of the terminal value calculation significantly impacts the overall valuation. The choice of the terminal growth rate and the discount rate used to calculate the terminal value are critical and potentially subjective. Small changes in these parameters can considerably alter the valuation. Therefore, a thorough understanding of these elements is necessary when utilizing the multi-stage dividend growth model for investment decision-making. The model’s effectiveness is directly tied to the accuracy and realism of these subjective estimates. Users should always be aware of this limitation and treat the model’s results as estimates rather than precise predictions.

Comparing the Multi-Stage Model to Other Valuation Methods

The multi-stage dividend growth model offers a powerful approach to stock valuation, but it’s not the only game in town. Discounted cash flow (DCF) models provide a broader perspective by considering all free cash flows, not just dividends. DCF analysis offers greater flexibility, accommodating companies that don’t pay dividends or have erratic dividend policies. However, accurately forecasting future free cash flows can be challenging, introducing a similar level of subjectivity as forecasting dividends in the multi-stage dividend growth model. The multi-stage dividend growth model, focused solely on dividends, offers simplicity and direct relevance for dividend-paying stocks. The choice between these methods depends on the specific company and the availability of reliable data. In situations where dividend history and future expectations are strong, the multi-stage dividend growth model provides a compelling and relatively straightforward valuation. For companies with complex capital structures or inconsistent dividend payments, a DCF analysis might be more appropriate.

Relative valuation methods, such as price-to-earnings (P/E) ratios, offer a simpler, albeit less fundamental, approach. These methods compare a company’s valuation metrics to those of its peers or industry averages. While quick and easy to apply, relative valuation techniques rely heavily on market sentiment and can be susceptible to market fluctuations. The multi-stage dividend growth model, by contrast, focuses on intrinsic value, grounded in projected future cash flows. This intrinsic valuation approach helps mitigate the influences of market sentiment. However, relative valuation methods offer a valuable benchmark against which to compare a multi-stage dividend growth model valuation. It’s often beneficial to use a combination of valuation approaches to achieve a more robust and reliable valuation. Consider the multi-stage dividend growth model as one important tool in a broader valuation toolkit.

In summary, the selection of the most suitable valuation method depends on various factors. The multi-stage dividend growth model excels when dealing with established companies with a clear history of dividend payments and predictable future growth. However, when facing companies with irregular or no dividend payments, or when seeking a rapid assessment, alternative methods like DCF analysis or relative valuation become more appropriate. Each approach has strengths and weaknesses, and experienced investors often integrate multiple methods to form a well-rounded valuation opinion. Understanding the nuances of each method allows for a more comprehensive and informed investment decision. The key is to choose the method best suited to the specific characteristics of the company being valued and the available data.

Putting it All Together: A Multi-Stage Dividend Growth Model Case Study

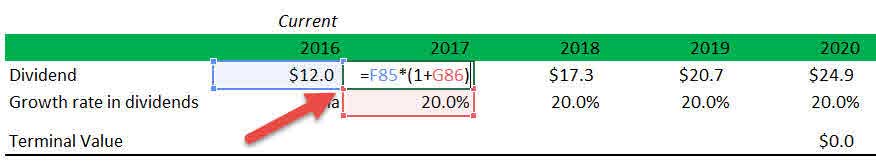

Let’s illustrate the multi-stage dividend growth model with a hypothetical company, “GrowthTech,” a technology firm experiencing rapid initial growth followed by a more sustainable expansion. GrowthTech’s current dividend is $1 per share. Analysts predict a high growth rate of 20% for the next three years, reflecting strong market penetration and new product launches. Following this initial phase, a more sustainable growth rate of 5% is anticipated, representing a mature market scenario. The company’s weighted average cost of capital (WACC) is estimated at 10%. To value GrowthTech using the multi-stage dividend growth model, we first project dividends for the high-growth period. Year 1 dividend: $1 * 1.20 = $1.20; Year 2 dividend: $1.20 * 1.20 = $1.44; Year 3 dividend: $1.44 * 1.20 = $1.73. These projections form the basis for the present value calculations. Note that the multi-stage dividend growth model’s flexibility allows for varying growth rates across different periods. This adaptability offers a more nuanced valuation compared to simpler models.

Next, we determine the terminal value. The terminal value represents the present value of all dividends beyond the explicit forecast period (three years in this case). Using the Gordon Growth Model (a constant growth model), the terminal value at the end of year 3 is calculated as: Terminal Value = (Year 4 Dividend) / (Discount Rate – Terminal Growth Rate). The year 4 dividend is projected as $1.73 * 1.05 = $1.8165. Therefore, the terminal value is $1.8165 / (0.10 – 0.05) = $36.33. This terminal value is then discounted back to the present value at the end of year 3: $36.33 / (1.10)^3 = $27.05. Now, we calculate the present value of all cash flows: PV = $1.20/(1.10) + $1.44/(1.10)^2 + $1.73/(1.10)^3 + $27.05/(1.10)^3 = $1.09 + $1.19 + $1.26 + $19.77 = $23.31. Therefore, using this multi-stage dividend growth model, the estimated intrinsic value of GrowthTech’s stock is approximately $23.31 per share. This multi-stage model offers a superior valuation approach compared to a single-stage Gordon Growth Model, because of the flexibility in accommodating changing growth phases.

It is crucial to understand that the accuracy of this valuation hinges on the accuracy of the input parameters, especially the growth rates and the discount rate. Slight alterations in these assumptions can significantly influence the final valuation. This highlights the importance of thorough research and realistic estimations when applying the multi-stage dividend growth model. Sensitivity analysis – systematically varying the input parameters to observe the impact on the final valuation – is a crucial step in mitigating the risk of relying on potentially inaccurate assumptions. Remember, the multi-stage dividend growth model, like any valuation model, provides an estimate, not a definitive value. It is but one tool in a broader financial analysis toolkit. Comparing the results with other valuation methods strengthens the overall investment decision.