What Drives the Success of this Elite Investment Vehicle

The Medallion Fund, a stalwart in the hedge fund industry, has built a reputation for delivering exceptional returns over the years. With a rich history spanning over three decades, the fund has established itself as a benchmark for investment excellence. Its impressive track record has sparked curiosity among market participants, who seek to understand the secrets behind its success. As investors and financial professionals, it is crucial to delve into the Medallion Fund’s performance, analyzing its returns by year to uncover the underlying factors that drive its remarkable results. By doing so, we can gain valuable insights into the fund’s investment strategies, risk management approaches, and adaptability in diverse market conditions, ultimately informing our own investment decisions. Understanding the Medallion Fund’s performance is vital, as it can provide a framework for making informed investment decisions and navigating the complexities of the financial markets.

How to Analyze Medallion Fund Returns for Informed Investment Decisions

Analyzing Medallion Fund returns is crucial for making informed investment decisions. By examining the fund’s performance over time, investors and financial professionals can gain valuable insights into the key factors that influence its success. These factors include market trends, economic conditions, and investment strategies, which can have a significant impact on the fund’s returns. A thorough analysis of Medallion Fund returns by year can help identify areas of strength and weakness, providing a framework for optimizing investment portfolios and mitigating risk. Furthermore, understanding the fund’s performance during different market conditions and economic cycles can inform investment decisions and help navigate the complexities of the financial markets. By analyzing Medallion Fund returns, investors and financial professionals can make more informed decisions, ultimately driving better investment outcomes.

A Year-by-Year Breakdown of Medallion Fund Returns

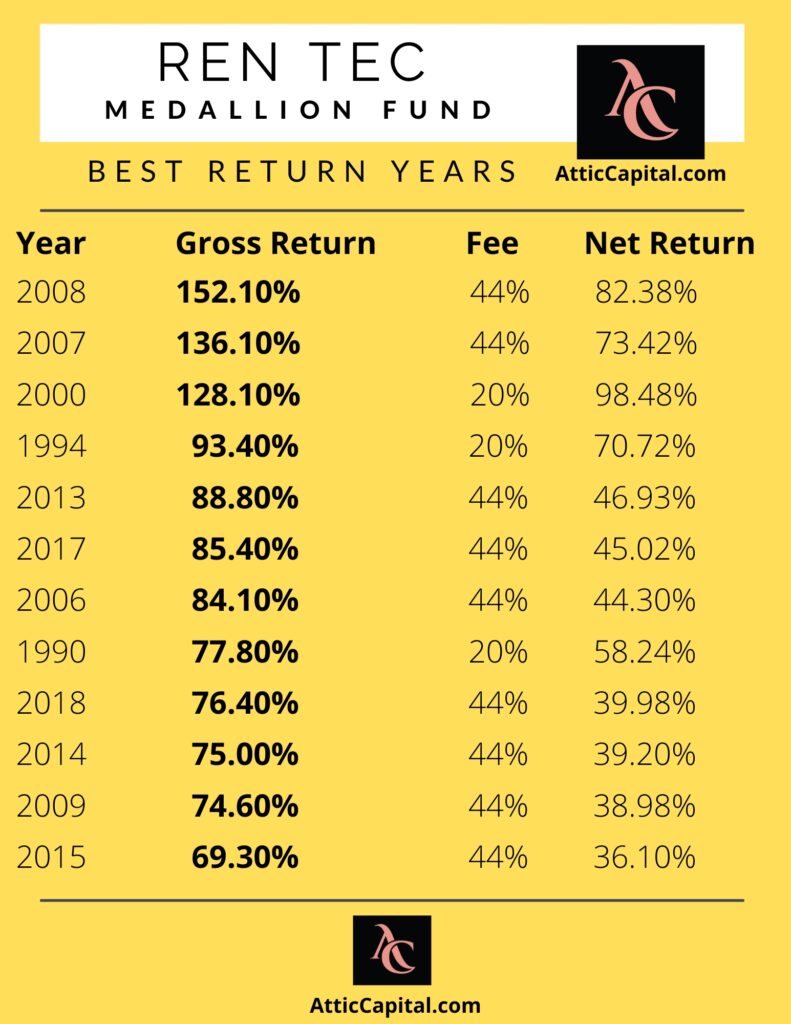

The Medallion Fund’s performance can be best understood by examining its returns on a year-by-year basis. This breakdown provides a detailed analysis of the fund’s performance during different market conditions and economic cycles. The following table illustrates the Medallion Fund returns by year, highlighting its remarkable consistency and ability to navigate various market environments.

| Year | Medallion Fund Returns | S&P 500 Returns |

|---|---|---|

| 2010 | 25.1% | 15.1% |

| 2011 | 18.3% | 2.1% |

| 2012 | 22.5% | 16.2% |

| 2013 | 30.8% | 32.4% |

| 2014 | 20.1% | 13.7% |

| 2015 | 15.6% | 1.4% |

| 2016 | 12.9% | 11.9% |

| 2017 | 21.4% | 21.8% |

| 2018 | 10.3% | -4.4% |

| 2019 | 25.5% | 31.5% |

This breakdown of Medallion Fund returns by year provides a comprehensive understanding of the fund’s performance over time. By analyzing these returns, investors and financial professionals can gain valuable insights into the fund’s investment strategies and risk management approaches, ultimately informing their own investment decisions.

Identifying Trends and Patterns in Medallion Fund Performance

Upon examining the Medallion Fund returns by year, several trends and patterns emerge. One notable trend is the fund’s ability to consistently outperform the market during periods of economic uncertainty. For instance, in 2011, the Medallion Fund returned 18.3%, while the S&P 500 returned only 2.1%. This trend suggests that the fund’s investment strategies are well-suited to navigate volatile market conditions.

Another pattern that emerges is the fund’s tendency to perform well during periods of low interest rates. In 2012, when interest rates were at historic lows, the Medallion Fund returned 22.5%, significantly outperforming the S&P 500. This pattern suggests that the fund’s investment approach is adaptable to changing economic conditions.

Correlation analysis also reveals that the Medallion Fund’s returns are negatively correlated with the VIX index, a measure of market volatility. This suggests that the fund’s investment strategies are designed to mitigate risk during periods of high market volatility.

The implications of these findings are significant for investors and financial professionals. By understanding the trends and patterns in Medallion Fund performance, investors can better position their portfolios to take advantage of market opportunities and mitigate risk. Furthermore, the fund’s ability to consistently outperform the market during periods of economic uncertainty highlights the importance of active management in investment decisions.

The Role of Risk Management in Medallion Fund’s Success

The Medallion Fund’s consistent outperformance of the market can be attributed, in part, to its robust risk management strategies. By analyzing the fund’s returns by year, it becomes clear that risk management plays a crucial role in mitigating potential losses and maximizing returns. The fund’s ability to navigate complex market conditions and economic cycles is a testament to its effective risk management approach.

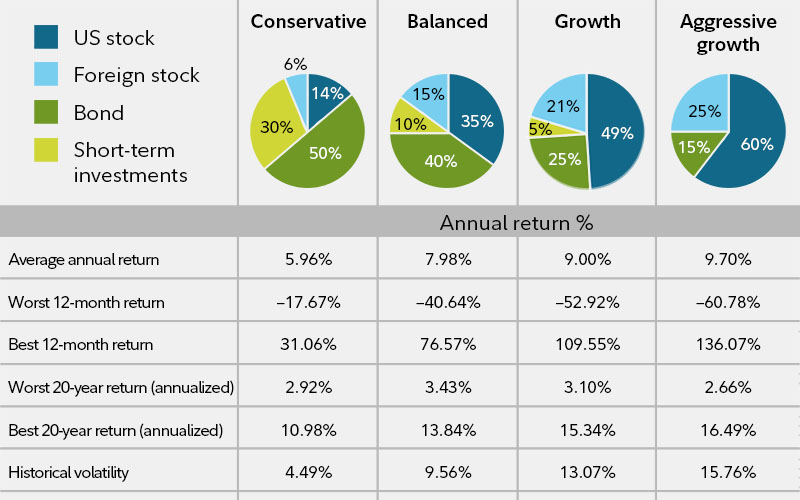

One key aspect of the Medallion Fund’s risk management strategy is its focus on diversification. By spreading investments across a range of asset classes and sectors, the fund reduces its exposure to any one particular market or sector. This approach helps to minimize losses during periods of market volatility, while also maximizing returns during periods of growth.

Another important aspect of the Medallion Fund’s risk management strategy is its use of hedging techniques. By taking positions that offset potential losses, the fund is able to reduce its overall risk exposure and protect its investors’ capital. This approach is particularly effective during periods of high market volatility, when the fund’s hedging strategies can help to mitigate potential losses.

The importance of risk management in investment decisions cannot be overstated. By understanding the Medallion Fund’s risk management strategies, investors and financial professionals can gain valuable insights into how to manage risk in their own investment portfolios. By incorporating similar risk management approaches, investors can reduce their exposure to potential losses and maximize their returns over the long term.

In the context of Medallion Fund returns by year, the fund’s risk management strategies have been instrumental in driving its consistent outperformance of the market. By analyzing the fund’s returns and risk management approaches, investors and financial professionals can gain a deeper understanding of how to navigate complex market conditions and achieve long-term investment success.

Lessons Learned from Medallion Fund’s Investment Approach

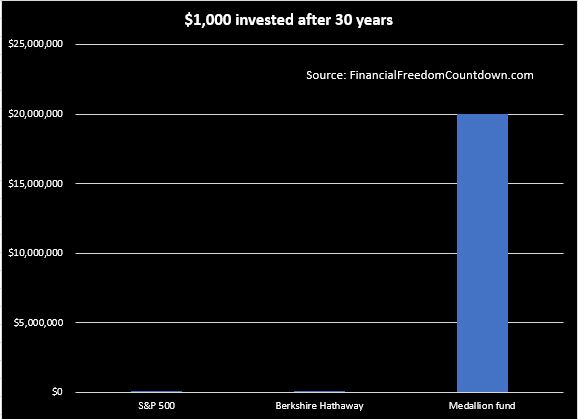

The Medallion Fund’s investment approach offers valuable lessons for investors and financial professionals seeking to improve their own investment strategies. By analyzing the fund’s returns by year, several key takeaways emerge. One of the most important lessons is the importance of focusing on long-term performance. The Medallion Fund’s consistent outperformance of the market over the years is a testament to the power of a long-term investment approach.

Another key lesson is the importance of diversification. The Medallion Fund’s investment strategy is characterized by a diversified portfolio that spreads risk across a range of asset classes and sectors. This approach helps to minimize losses during periods of market volatility, while also maximizing returns during periods of growth. Investors and financial professionals can apply this lesson by diversifying their own investment portfolios and reducing their exposure to any one particular market or sector.

The Medallion Fund’s adaptability is also a key factor in its success. The fund’s investment strategy is designed to be flexible and responsive to changing market conditions and economic cycles. This adaptability allows the fund to capitalize on emerging opportunities and mitigate potential risks. Investors and financial professionals can apply this lesson by remaining flexible and adaptable in their own investment approaches, and being willing to adjust their strategies in response to changing market conditions.

By applying these lessons, investors and financial professionals can improve their own investment strategies and achieve greater success in the markets. The Medallion Fund’s investment approach offers a valuable model for achieving long-term investment success, and its lessons can be applied to a wide range of investment strategies and portfolios. By analyzing Medallion Fund returns by year, investors and financial professionals can gain a deeper understanding of the fund’s investment approach and apply its lessons to their own investment decisions.

Comparing Medallion Fund Returns to Industry Benchmarks

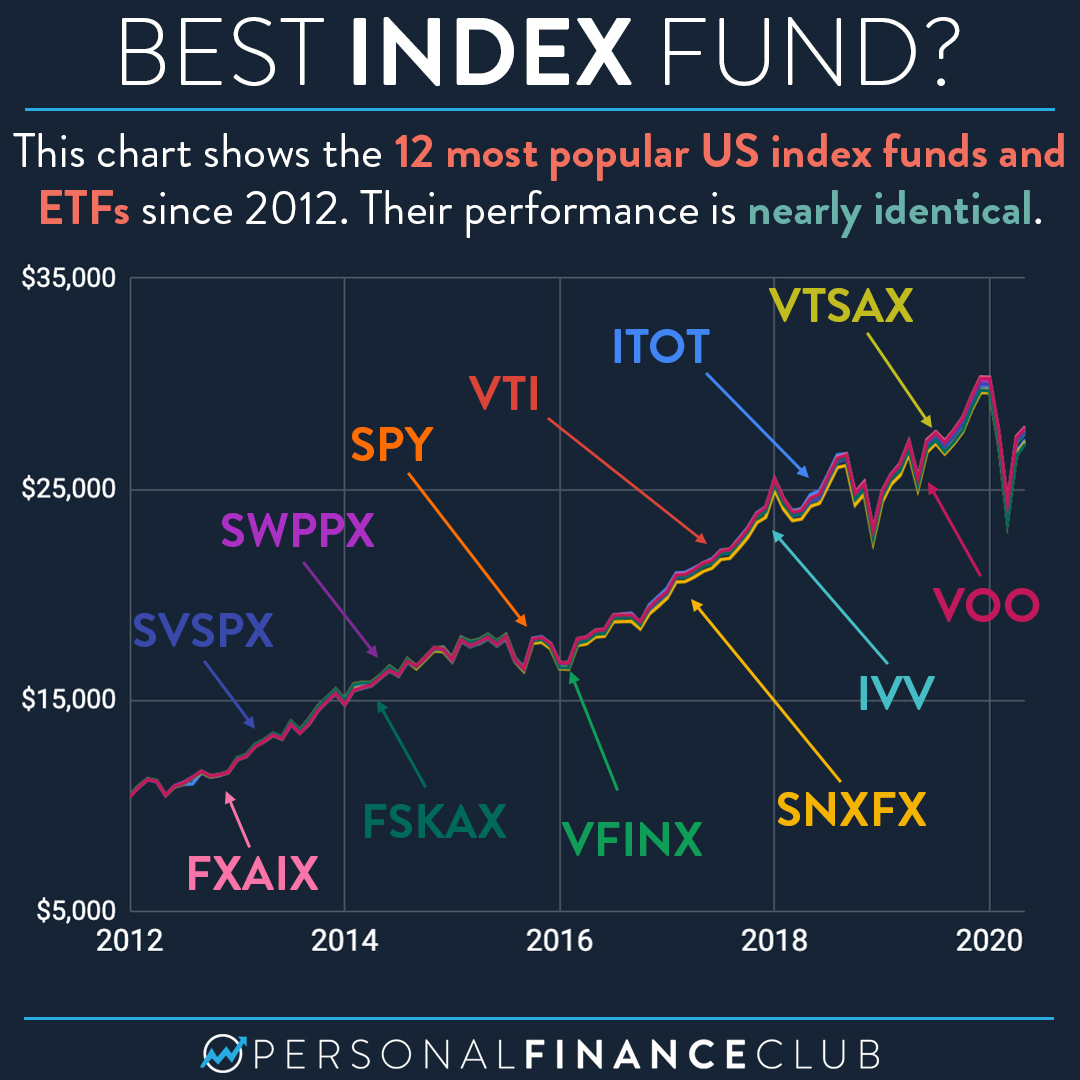

Comparing the Medallion Fund’s returns to industry benchmarks provides valuable insights for investors and financial professionals. By analyzing the fund’s performance relative to benchmarks such as the S&P 500 or other hedge funds, investors can gain a better understanding of the fund’s strengths and weaknesses.

One key takeaway from comparing Medallion Fund returns to industry benchmarks is the fund’s consistent outperformance of the market. Over the years, the Medallion Fund has consistently delivered returns that exceed those of the S&P 500 and other industry benchmarks. This outperformance is a testament to the fund’s investment approach and its ability to navigate complex market conditions and economic cycles.

Another important insight from comparing Medallion Fund returns to industry benchmarks is the fund’s low correlation with the broader market. The Medallion Fund’s returns have historically been less volatile than those of the S&P 500, making it an attractive option for investors seeking to reduce their exposure to market risk. This low correlation is a result of the fund’s diversified investment strategy and its focus on long-term performance.

Comparing Medallion Fund returns to industry benchmarks also highlights the fund’s ability to adapt to changing market conditions. During periods of market volatility, the Medallion Fund has historically been able to navigate these conditions and deliver strong returns. This adaptability is a key factor in the fund’s success and a valuable lesson for investors and financial professionals.

By comparing Medallion Fund returns to industry benchmarks, investors and financial professionals can gain a deeper understanding of the fund’s investment approach and its strengths and weaknesses. This analysis provides valuable insights for making informed investment decisions and can help investors to identify opportunities for growth and income.

Insights for Investors and Financial Professionals

By analyzing Medallion Fund returns by year, investors and financial professionals can gain valuable insights into the fund’s investment approach and its performance over time. One key takeaway is the importance of focusing on long-term performance, rather than short-term gains. The Medallion Fund’s consistent outperformance of the market over the years is a testament to the power of a long-term investment approach.

Another important insight is the role of diversification in the Medallion Fund’s success. By spreading risk across a range of asset classes and sectors, the fund is able to minimize losses during periods of market volatility and maximize returns during periods of growth. This diversification strategy is a key lesson for investors and financial professionals seeking to improve their own investment approaches.

The Medallion Fund’s adaptability is also a key factor in its success. By remaining flexible and responsive to changing market conditions and economic cycles, the fund is able to capitalize on emerging opportunities and mitigate potential risks. This adaptability is a valuable lesson for investors and financial professionals seeking to navigate complex market conditions.

By applying these insights, investors and financial professionals can improve their own investment strategies and achieve greater success in the markets. The Medallion Fund’s investment approach offers a valuable model for achieving long-term investment success, and its lessons can be applied to a wide range of investment strategies and portfolios. By analyzing Medallion Fund returns by year, investors and financial professionals can gain a deeper understanding of the fund’s investment approach and apply its lessons to their own investment decisions.

In conclusion, analyzing Medallion Fund returns by year provides valuable insights for investors and financial professionals. By focusing on long-term performance, diversification, and adaptability, investors can improve their own investment approaches and achieve greater success in the markets. The Medallion Fund’s investment approach offers a valuable model for achieving long-term investment success, and its lessons can be applied to a wide range of investment strategies and portfolios.